Perfil de la compañía

| Fulbright Financial Group Resumen de la reseña | |

| Establecido | 1999 |

| Región Registrada | Hong Kong |

| Regulación | SFC |

| Instrumentos de Mercado | Valores, Futuros, Opciones (HK, EE. UU., Global) |

| Cuenta Demo | ❌ |

| Plataformas de Trading | Fulbright App (Móvil), Fulbright Terminal (PC), Plataforma Web de Fulbright, Terminal Pro de Fulbright, Fulbright Speed Trader |

| Soporte al Cliente | Teléfono: +852 3108 3333, 4001-200-899 (Continente) |

| Email: cis@fulbright.com.hk | |

| Wechat: hkfuchang | |

Información de Fulbright Financial Group

Fulbright Financial Group, fundado en 1999 y con sede en Hong Kong, es una institución financiera con licencia regulada por la Comisión de Valores y Futuros de Hong Kong, con solo su empresa de trading de futuros actualmente con licencia. Ofrece trading de valores, futuros y opciones en Hong Kong, Estados Unidos y otros mercados globales, así como diferentes plataformas de trading, sin embargo, no ofrece cuenta demo ni revela claramente el depósito mínimo.

Pros y Contras

| Pros | Contras |

| Regulado por SFC de Hong Kong | No hay cuentas demo disponibles |

| Ofrece acceso a múltiples mercados | Depósito mínimo no claramente divulgado |

| Múltiples plataformas de trading | Información limitada sobre tipos de cuentas |

¿Es Fulbright Financial Group Legítimo?

Sí, Fulbright Financial Group es una organización con licencia. Sin embargo, solo Fulbright Futures Limited mantiene actualmente una licencia activa (regulada) para el trading de contratos de futuros de la SFC de Hong Kong. Las licencias de las otras dos entidades han caducado, por lo que ya no son válidas.

| Entidad con Licencia | Tipo de Licencia | N.º de Licencia | Fecha Efectiva | Estado Actual | Regulado por |

| Fulbright Futures Limited | Operaciones en contratos de futuros | AME963 | 2005/12/5 | Regulado | SFC Hong Kong |

| Fulbright Securities Limited | Operaciones en valores | AFB820 | 2004/11/30 | Excedido | SFC Hong Kong |

| Fulbright Asset Management Limited | Gestión de activos | AYQ254 | 2012/3/22 | Excedido | SFC Hong Kong |

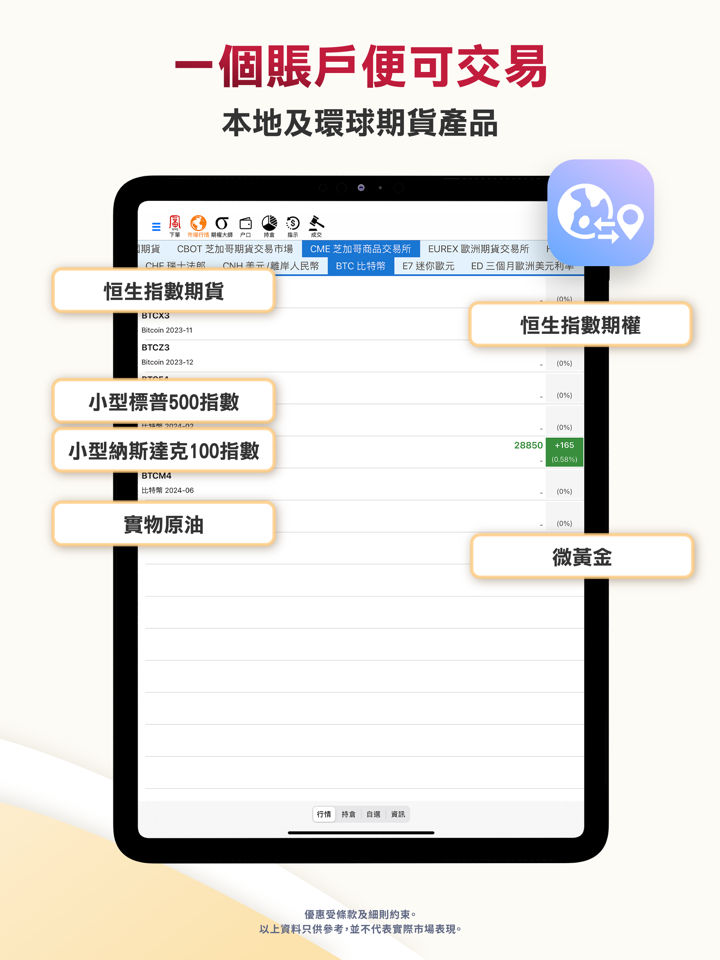

¿Qué puedo negociar en Fulbright Financial Group?

Fulbright Financial Group ofrece una amplia gama de servicios financieros, incluido el comercio de valores, futuros y opciones en Hong Kong y en todo el mundo.

| Instrumentos de Trading | Soportado |

| Valores | ✔ |

| Futuros | ✔ |

| Opciones | ✔ |

| Forex | ❌ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| ETFs | ❌ |

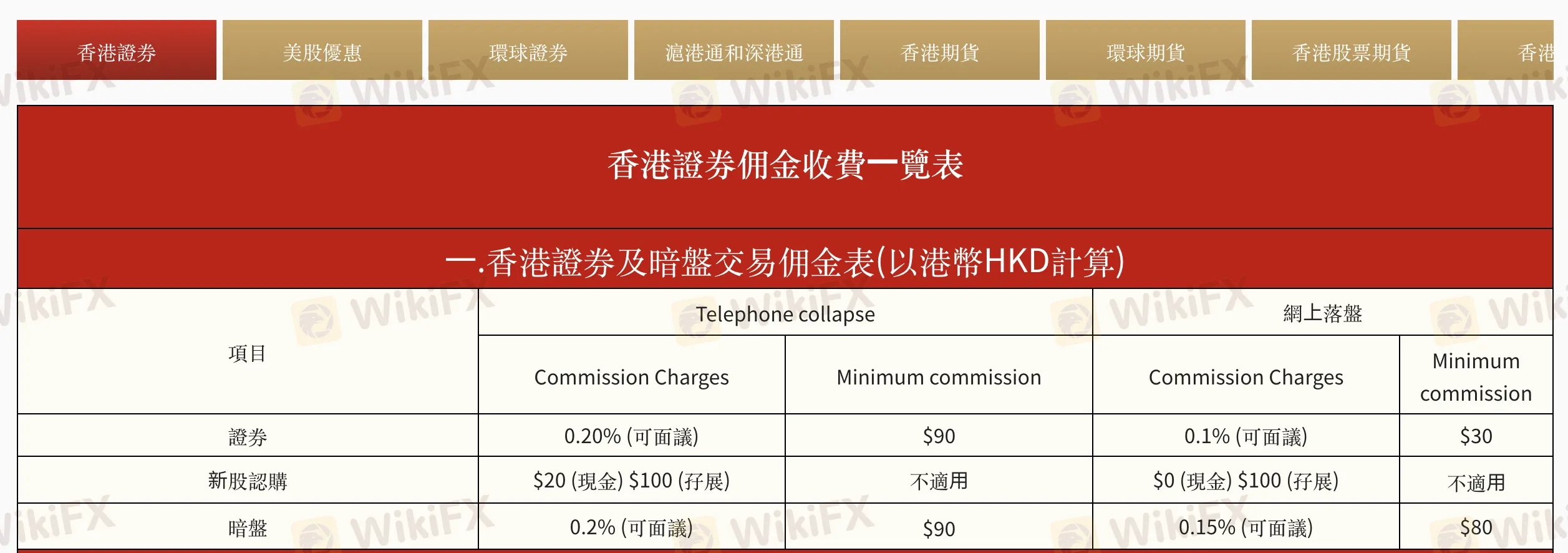

Tarifas de Fulbright Financial Group

Fulbright Financial Group cobra costos ligeramente más bajos que la norma de la industria, especialmente para el comercio en línea. Algunos cargos, como las tarifas de gestión y los intereses de financiamiento, varían según el perfil del cliente y son negociables, como es práctica comercial común.

| Categoría | Servicio/Ítem | Comisión (HKD) | Observaciones |

| Comisiones de Trading | Valores de Hong Kong (Teléfono) | 0.20% (mín $90) | Negociable |

| Valores de Hong Kong (En línea) | 0.10% (mín $30) | Negociable | |

| Suscripción a IPO (Efectivo/Margen) | $20 / $100 | Efectivo en línea: Gratis | |

| Mercado Gris (Teléfono/En línea) | 0.20% / 0.15% (mín $90 / $80) | ||

| Cargos Regulatorios | Impuesto de Timbre | 0.10% | Mín $1 |

| Impuesto de Transacción de la SFC | 0.00% | ||

| Comisión de Bolsa (HKEx) | 0.01% | ||

| Comisión de Compensación (HKSCC) | 0.005% (mín $5, máx $200) | ||

| Comisión de Transacción de la FRC | 0.00% | ||

| Cargos de Interés | Cuenta de Margen / Interés de Cuenta en Efectivo | P+1.8% o ~7.05% | Basado en la Tasa Prime de HSBC |

| Servicios de Custodia y Agente | Transferencia de Acciones (SI/ISI) | Gratis (depósito), $5/lote (retiro, mín $500) | Se aplican tarifas de HKSCC |

| Retiro de Acciones (Físico) | $5/lote | Incl. tarifa de $3.5 de HKSCC | |

| Cobro de Dividendos | 0.5% (mín $20, máx $10,000) | Incl. tarifa de HKSCC 0.12% | |

| Acciones de Bonificación / Suscripción de Derechos | Gratis / $100 + $0.80/lote | Máx $10,000 | |

| Manejo de IPO (Efectivo/Margen) | $20 / $100 | ||

| Otros Cargos | Reemisión / Envío Mensual de Estados de Cuenta | $50/mes cada uno | La tarifa de envío por correo es efectiva desde sep de 2023 |

| Solicitud de la Sección 329 de la SFO | $4,000 por caso |

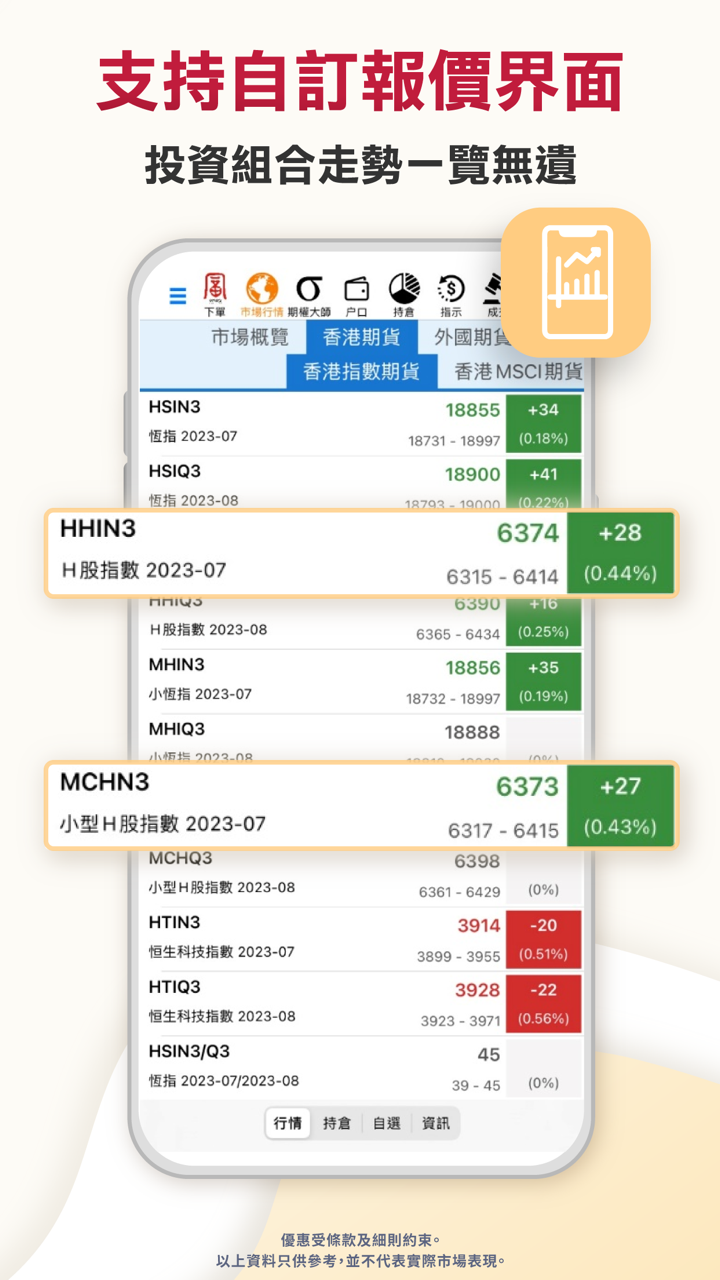

Plataforma de Trading

| Nombre de la Plataforma | Compatible | Dispositivos Disponibles | Adecuado para |

| Aplicación Fulbright (Móvil) | ✔ | Móvil | Traders Principiantes a Intermedios |

| Terminal Fulbright (PC) | ✔ | PC | Traders Intermedios |

| Plataforma Web Fulbright | ✔ | Navegador Web | Traders Intermedios |

| Terminal Pro Fulbright | ✔ | Descarga de Escritorio | Traders Profesionales |

| Trader de Velocidad Fulbright | ✔ | Descarga de Escritorio | Traders de Alta Frecuencia de HK |

Depósito y Retiro

Fulbright Financial Group no cobra ninguna tarifa por depósitos o retiros, aunque los bancos pueden aplicar cargos según el método utilizado. No menciona un monto mínimo de depósito.

Opciones de Depósito

| Método de Depósito | Comisiones de Depósito | Tiempo de Depósito |

| Depósito Rápido eDDA | ❌ | Instantáneo |

| FPS (Sistema de Pagos Más Rápidos) | ~2 horas (9:00 – 17:00 en días hábiles)* | |

| Transferencia Bancaria en Línea | 1–3 días laborables | |

| Cheque o Giro Bancario | 2+ días laborables |

Opciones de Retiro

| Método de Retiro | Comisiones de Retiro | Tiempo de Retiro |

| Transferencia Bancaria | ❌ | Procesado el mismo día si se envía de 9:00 a 13:00; de lo contrario, al siguiente día laborable |

| Cheque | Emisión el mismo día si se realiza dentro del horario de procesamiento |