Unternehmensprofil

| Ces Futures Überprüfungszusammenfassung | |

| Gegründet | 2010 |

| Registriertes Land/Region | China |

| Regulierung | CFFE (Reguliert) |

| Marktinstrument | Futures |

| Demo-Konto | ✅ |

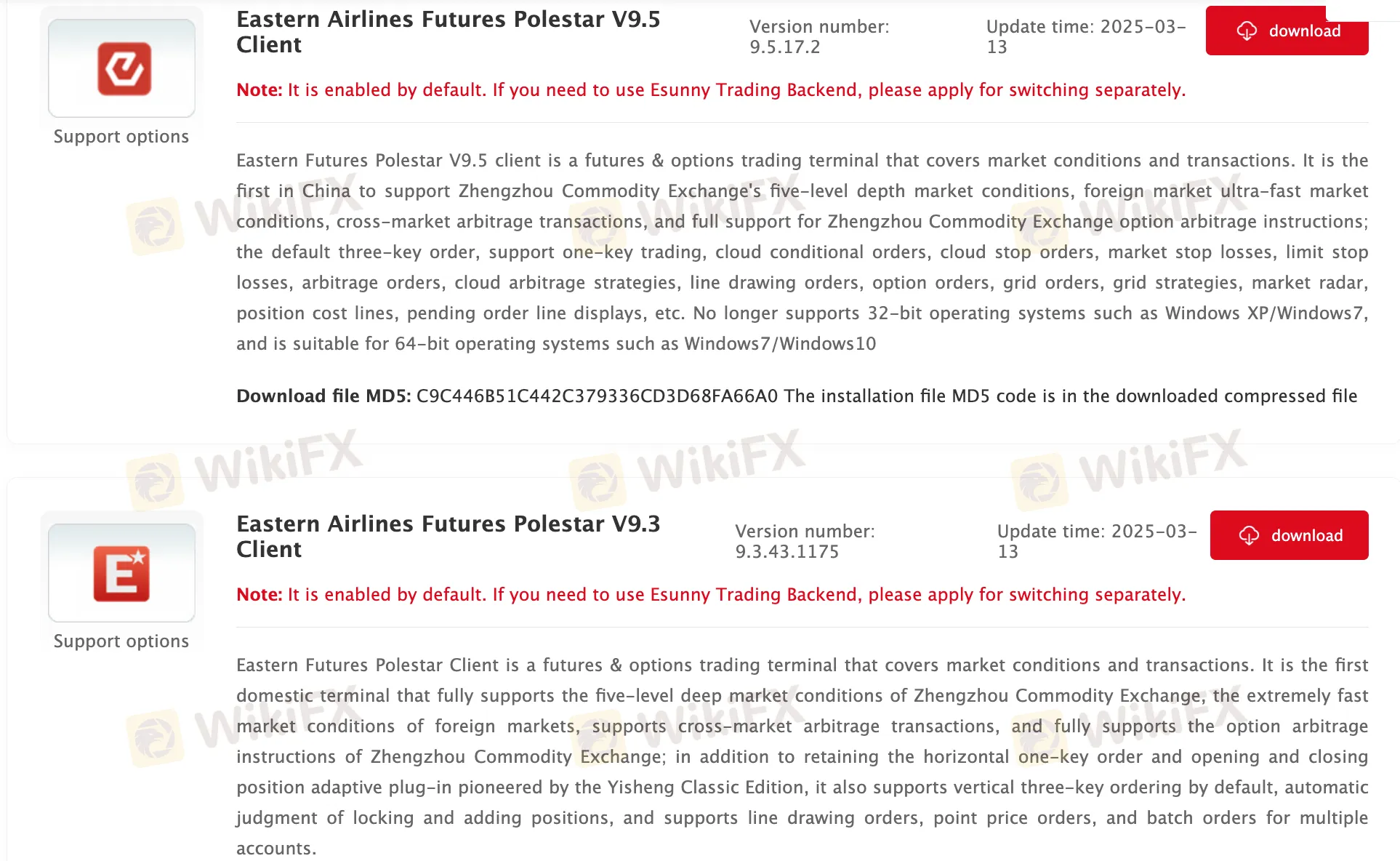

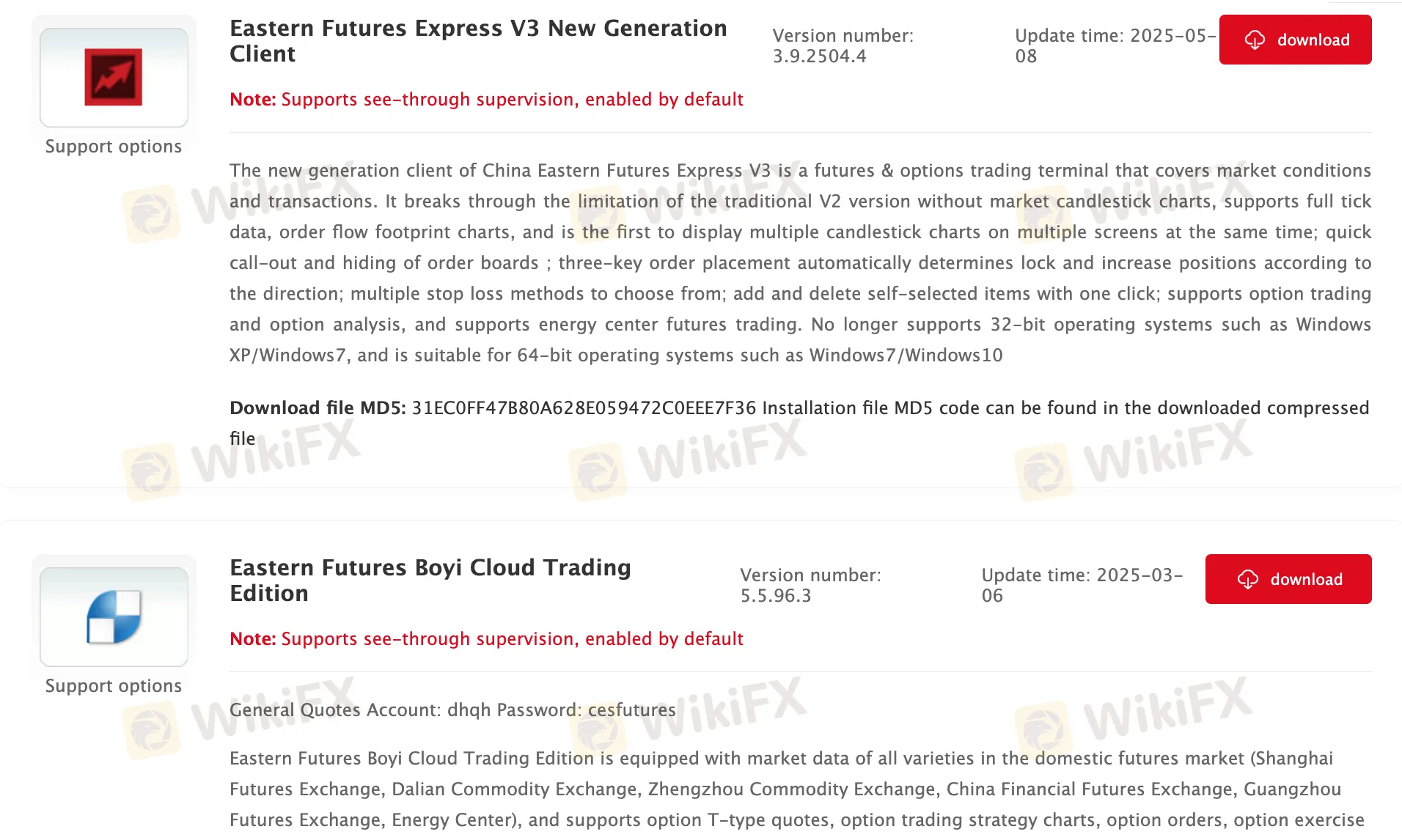

| Handelsplattform | Eastern Futures APP, China Eastern Easy Star (Android-Version), China Eastern Easy Star (IOS-Version), China Eastern Express APP, Eastern Airlines Futures Polestar V9.5 Client, Eastern Airlines Futures Polestar V9.3 Client, Eastern Futures Express V3 New Generation Client, Eastern Futures Boyi Cloud Trading Edition, Eastern Airlines Futures Market Software Winshun Edition (Wenhua WH6), Eastern Futures Express V2 Client, Eastern Futures Trading Pioneer Terminal, Eastern Futures Yisheng Polestar V8.5 Client, Eastern Futures Yisheng Classic Client V8.3, Kuaiqi V2 Trading Terminal (Nationale Geheimversion), Eastern Airlines Futures Boyi Cloud (Nationale Vertraulichkeitsversion), usw. |

| Kundenbetreuung | Live-Chat |

| Tel: 4008-889-889 | |

| Wechat, tiktok | |

| E-Mail: service@kiiik.com | |

Ces Futures Informationen

Ces Futures ist ein regulierter Broker, der den Handel mit Futures auf verschiedenen Handelsplattformen anbietet.

Vor- und Nachteile

| Vorteile | Nachteile |

| Verschiedene Handelsplattformen | Beschränkte Arten von Handelsprodukten |

| Demo-Konten | Gebühren für den Umtausch und die Marge werden erhoben |

| Gut reguliert | |

| Live-Chat-Support | |

| Lange Betriebszeiten |

Ist Ces Futures legitim?

Ja. Ces Futures ist von der CFFEX lizenziert, um Dienstleistungen anzubieten.

| Reguliertes Land | Regulierungsbehörde | Aktueller Status | Reguliertes Unternehmen | Lizenztyp | Lizenznummer |

| China Financial Futures Exchange | Reguliert | Ces Futures有限责任公司 | Futures-Lizenz | 0153 |

Was kann ich auf Ces Futures handeln?

Ces Futures bietet den Handel mit Futures an.

| Handelbare Instrumente | Unterstützt |

| Futures | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Indizes | ❌ |

| Aktien | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

Kontotyp

Der Broker hat die von ihm angebotenen Kontotypen nicht klar angegeben. Kunden können Demokonten eröffnen, um mit dem Handel von Futures zu beginnen.

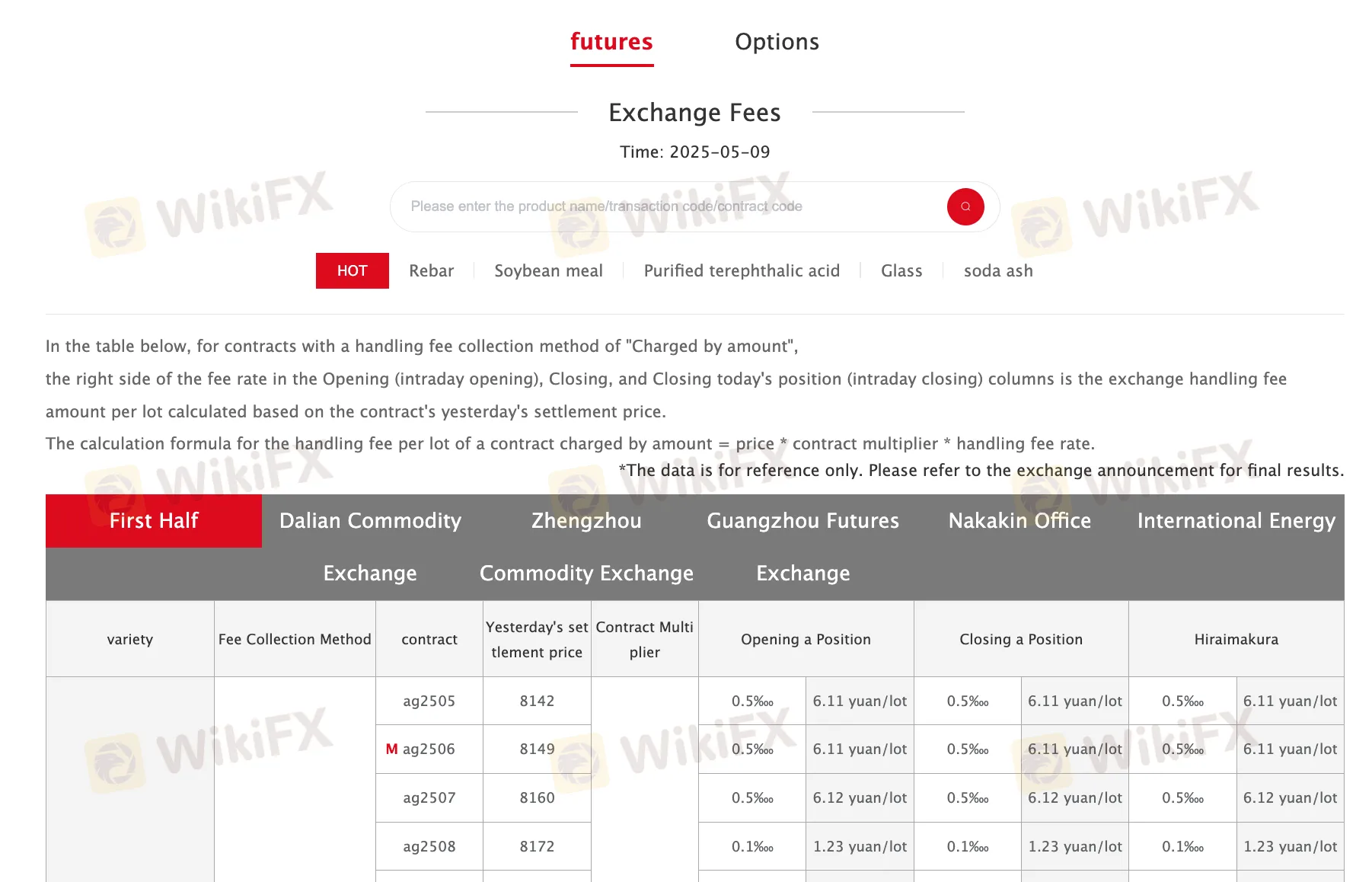

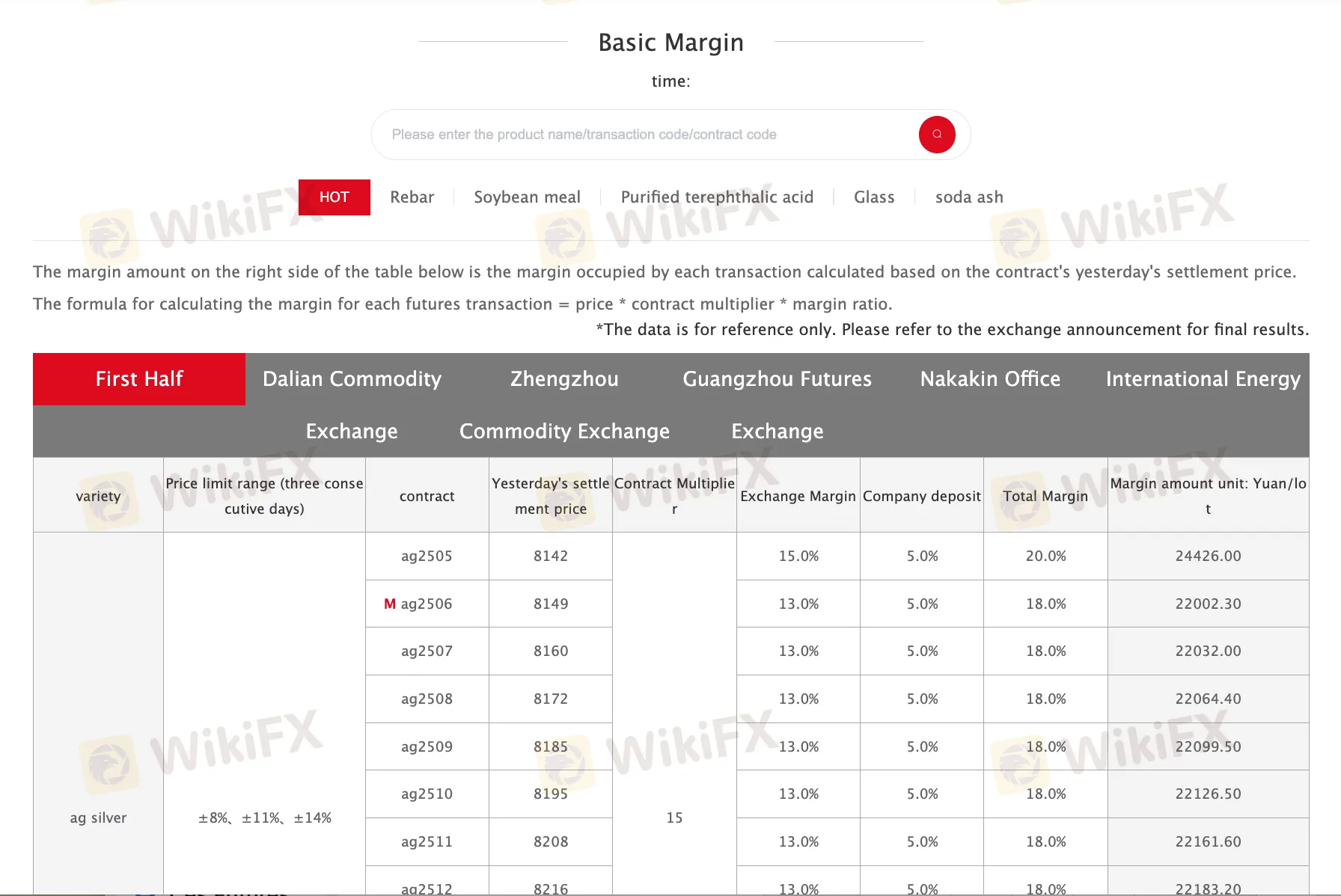

Ces Futures Gebühren

Der Broker erhebt Umtauschgebühren und Margin-Gebühren für verschiedene Arten von Handelsinstrumenten.

Handelsplattform

Der Broker bietet verschiedene Handelsplattformen an, darunter Eastern Futures APP, China Eastern Easy Star (Android-Version), China Eastern Easy Star (IOS-Version), China Eastern Express APP, Eastern Airlines Futures Polestar V9.5 Client, Eastern Airlines Futures Polestar V9.3 Client, Eastern Futures Express V3 New Generation Client, Eastern Futures Boyi Cloud Trading Edition, Eastern Airlines Futures Market Software Winshun Edition (Wenhua WH6), Eastern Futures Express V2 Client, Eastern Futures Trading Pioneer Terminal, Eastern Futures Yisheng Polestar V8.5 Client, Eastern Futures Yisheng Classic Client V8.3, Kuaiqi V2 Trading Terminal (National Secret Version) und Eastern Airlines Futures Boyi Cloud (National Confidential Version).

Verfügbare Geräte: Desktop und Mobilgeräte (IOS, Android).

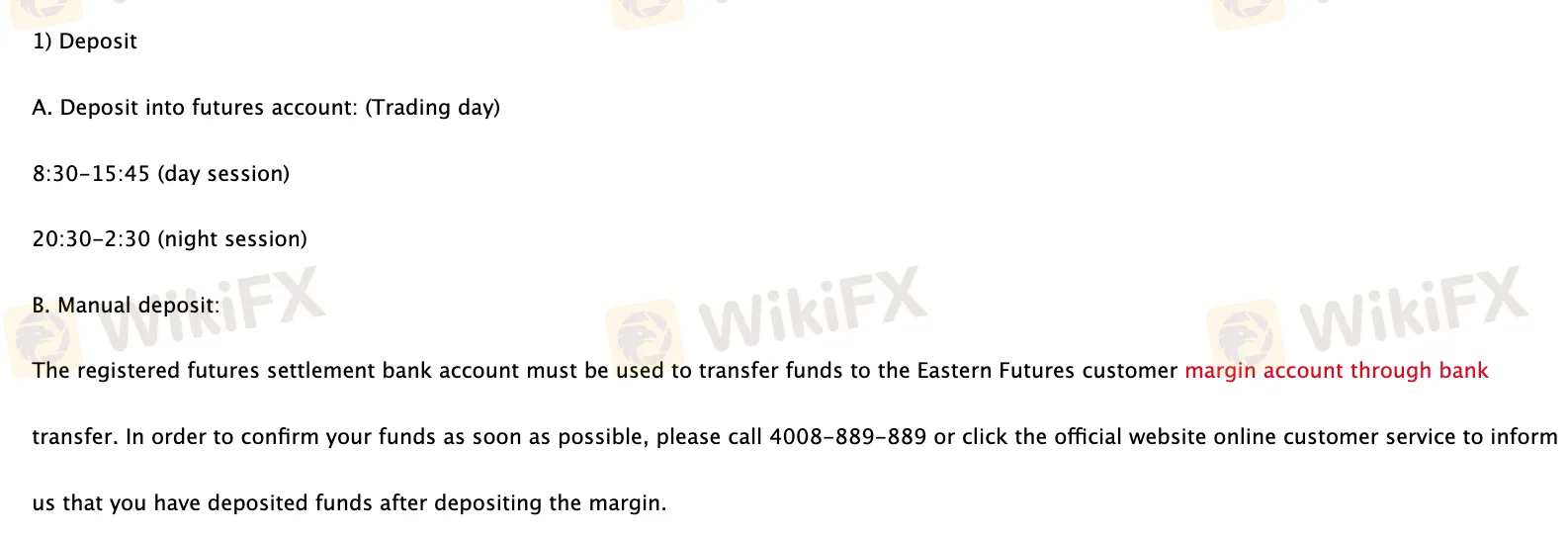

Einzahlung und Auszahlung

Kein Mindesteinzahlungs- oder Auszahlungsbetrag festgelegt und keine Gebühren oder Kosten angegeben. Die Website zeigt nur die Ein- und Auszahlungszeiten an.