ryad22

1-2年

Can I trust ChaoShang as a reliable and secure broker for my trading activities?

From my own experience as an independent trader, evaluating a broker like ChaoShang requires careful attention to both its regulatory status and the scope of its services. ChaoShang has been operating from Hong Kong since 2004 and is regulated by the Hong Kong Securities and Futures Commission (SFC), specifically holding a license for dealing in futures contracts. Regulation by the SFC is typically a positive sign, as it means the broker is subject to oversight and required to follow certain compliance standards, which is vital for safeguarding client interests.

However, my caution is raised by the mention of a "suspicious scope of business" and "suspicious overrun," as well as a "medium potential risk" flag. These are not to be taken lightly in my view, especially when my long-term financial security is at stake. While the broker has a reasonably long history and offers trading in regulated products like securities, futures, and options, its product range is narrow—there's no forex or cryptocurrency, for example—which may or may not suit individual preferences.

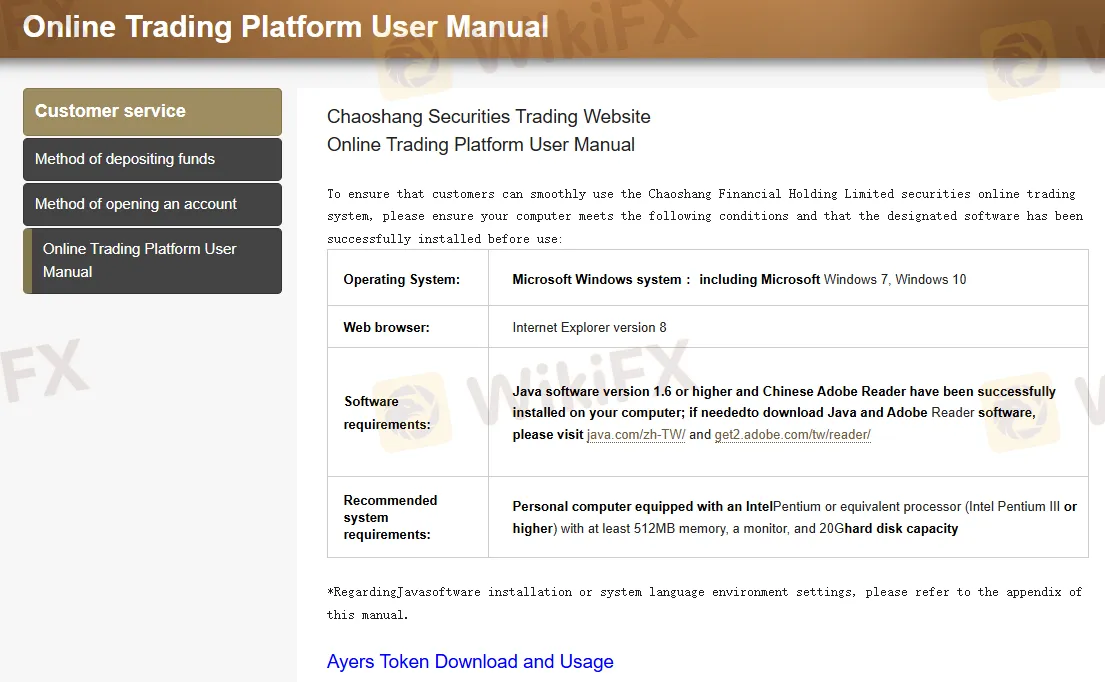

Another important consideration for me is the lack of clarity around fee structures and the fact that the platforms offered are proprietary rather than widely recognized ones. The support options do seem standard, but I found that the transparency and straightforwardness of the broker's business practices matter greatly to me in deciding who to trust with my funds.

Given these factors, while ChaoShang appears legitimate from a regulatory standpoint, I remain conservative. I suggest anyone considering them proceed with careful due diligence and avoid assuming regulatory registration alone guarantees comprehensive safety or reliability. For me, only after independently verifying all relevant details and understanding all risks would I consider engaging with any broker, including ChaoShang.

Moshiheya

1-2年

Is it possible to deposit funds into my ChaoShang account using cryptocurrencies such as Bitcoin or USDT?

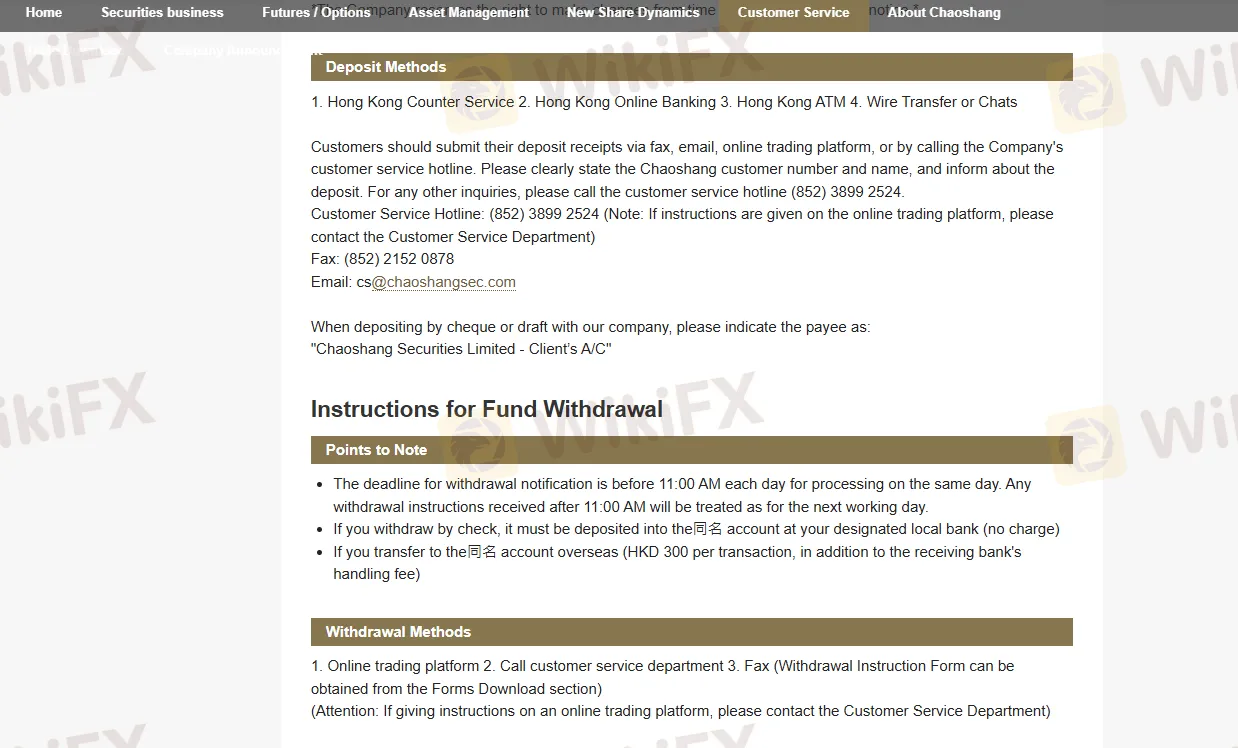

In my experience as a trader, I always pay close attention to a broker's deposit and withdrawal methods because it directly affects my ability to move funds safely and efficiently. When considering ChaoShang, I reviewed their available funding options in detail. What I found is that ChaoShang permits deposits through bank transfers with several major banks, counter services, online banking, cheque deposits, as well as telegraphic transfers and the Faster Payment System (FPS). However, there is no indication that ChaoShang supports cryptocurrencies such as Bitcoin or USDT for deposits.

For me, the absence of crypto payment options signals that ChaoShang maintains a more traditional and regulated stance, likely because they are under the supervision of Hong Kong's SFC, which tends to enforce strict operational standards. From a risk management perspective, using classic banking channels can offer an extra layer of traceability and regulatory recourse, which may reassure some traders, though it limits flexibility for those who prefer transacting with digital assets. Based on my knowledge and the available facts, I would not expect to be able to deposit Bitcoin or USDT into a ChaoShang account. If the ability to fund with crypto is a core requirement, I would recommend seeking a broker that explicitly supports this feature and verifying their regulatory status carefully.

Broker Issues

Withdrawal

Deposit

Bhavani Durga K

1-2年

How do the different account types provided by ChaoShang differ from one another?

Based on my experience as a trader researching ChaoShang, I found that the broker’s structure is fairly straightforward: there is no mention of differentiated account types for retail traders on their platform. Instead, ChaoShang appears to offer access to trading in securities, futures, and options through its own proprietary mobile and web platforms. This setup is typical for some Asian brokers, particularly those focusing more on traditional financial instruments rather than the multi-tiered forex accounts commonly seen elsewhere.

For me, this lack of overt account categories means the offering might not cater to traders seeking specialized conditions such as ECN, standard, micro, or other account distinctions. I could not locate details about minimum deposit requirements, tiered spreads, or leverage—information that is usually essential when weighing which account type to choose. This can be a point of caution, as transparency about account features is critical to building trust and managing risk. In my view, the absence of clarity regarding account variety and fee structure requires prospective clients to reach out to their customer service for tailored information before making any financial commitment. For those, like myself, who prioritize transparency and predefined options, this is something to consider carefully when evaluating ChaoShang as a trading venue.

Broker Issues

Leverage

Platform

Account

Instruments

Interbank Trader

1-2年

What documents do I generally need to provide in order to complete my initial withdrawal from ChaoShang?

Based on my experience with brokers regulated in Hong Kong, such as ChaoShang, I had to be especially attentive to verification procedures before making an initial withdrawal. Because ChaoShang is regulated by the Hong Kong Securities and Futures Commission (SFC), I found their compliance requirements to be reasonably strict—this is typical for SFC-licensed institutions. Although ChaoShang's WikiFX profile doesn't list withdrawal documents explicitly, it's common for such brokers to require proof of identity (usually a passport or government-issued ID) and proof of address (for example, a recent utility bill or bank statement) to satisfy anti-money laundering regulations.

In my case, I made sure that my name and details on the bank account matched those on my trading account. The process usually included uploading these documents through the broker’s mobile or web platform, and sometimes ChaoShang’s team verified details by contacting me directly, especially for the first withdrawal. I exercised extra caution ensuring the documents were up-to-date and clearly legible, as incomplete submissions could delay processing. Given the local regulatory environment and typical industry practices, I wouldn’t expect a withdrawal to be processed if this step wasn’t completed thoroughly. My advice is to prepare these documents in advance, and be mindful that requirements may change at the broker’s discretion or due to regulatory updates.

Broker Issues

Deposit

Withdrawal