회사 소개

| ChaoShang 리뷰 요약 | |

| 설립 연도 | 2004 |

| 등록 국가/지역 | 홍콩 |

| 규제 | SFC |

| 거래 상품 | 증권, 선물 및 옵션 |

| 데모 계정 | / |

| 거래 플랫폼 | Chaoshang Securities (Ayers) 모바일 앱 및 Chaoshang Securities 거래 웹사이트 |

| 최소 입금액 | / |

| 고객 지원 | 전화: (852) 2152 0878; (852) 3899 2599 |

| 이메일: cs@chaoshangsec.com | |

| 홍콩 완차이 하얀 건물 하얀로 26호 2206-10호 | |

ChaoShang 정보

ChaoShang은 2004년에 설립된 홍콩 기반의 중개업체로 SFC에 의해 규제를 받고 있습니다. 자체 모바일 및 웹 플랫폼을 통해 증권, 선물 및 옵션 거래를 제공합니다.

장단점

| 장점 | 단점 |

| 역사가 길다 | 수수료 구조 불명확 |

| SFC 규제 |

ChaoShang이 신뢰할 만한가요?

ChaoShang은 "선물 계약 거래" 라이선스 유형으로 홍콩 증권 및 선물 위원회 (SFC)에 의해 규제를 받고 있습니다. 라이선스 번호는 BGH629입니다.

ChaoShang에서 무엇을 거래할 수 있나요?

ChaoShang은 증권, 선물 및 옵션 세 가지 주요 거래 상품을 제공합니다.

| 거래 가능한 상품 | 지원 |

| 증권 | ✔ |

| 선물 | ✔ |

| 옵션 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| ETFs | ❌ |

거래 플랫폼

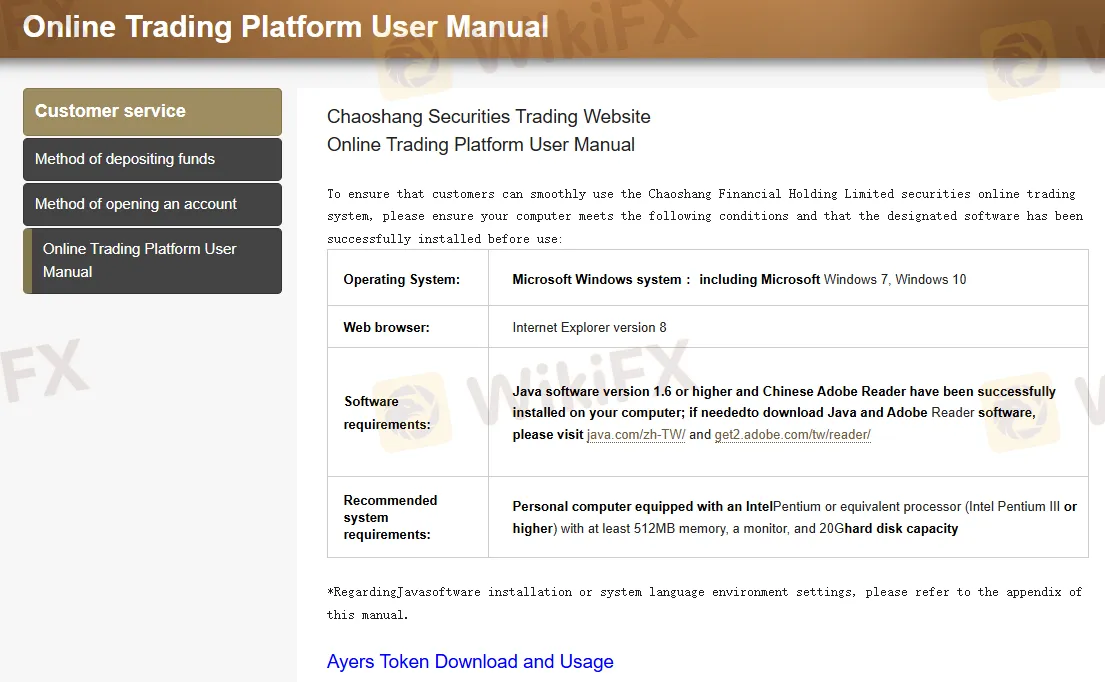

ChaoShang은 고유한 모바일 거래 플랫폼인 Chaoshang Securities (Ayers) Mobile App을 제공하며 안드로이드 및 iOS 시스템을 지원합니다. 또한 웹 기반 거래 플랫폼인 Chaoshang Securities Trading Website도 제공합니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| Chaoshang Securities (Ayers) Mobile App | ✔ | iOS, Android |

| Chaoshang Securities Trading Website | ✔ | 웹 |

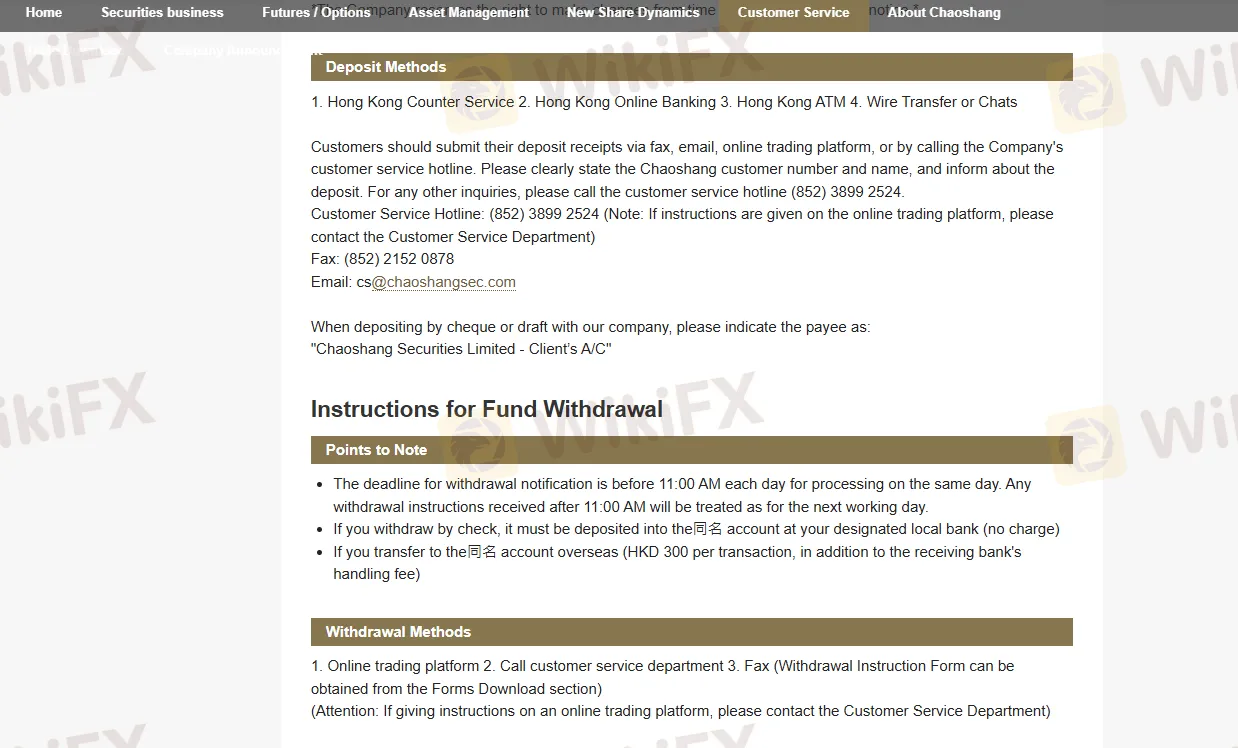

입출금

ChaoShang의 입금 방법에는 은행 송금(통신은행, 중흥은행, 항생은행, 중국은행), 계좌 서비스, 온라인 뱅킹, 수표 입금, 전신 송금 또는 빠른 지불 시스템(FPS)이 포함됩니다.

출금 방법에는 온라인 거래 플랫폼, 전화 또는 팩스를 통해 제출된 지시가 포함됩니다.