Giới thiệu doanh nghiệp

| ChaoShang Tóm tắt đánh giá | |

| Thành lập | 2004 |

| Quốc gia/Vùng lãnh thổ đăng ký | Hồng Kông |

| Quy định | SFC |

| Sản phẩm giao dịch | Chứng khoán, hợp đồng tương lai và tùy chọn |

| Tài khoản Demo | / |

| Nền tảng giao dịch | Ứng dụng di động Chaoshang Securities (Ayers) và Trang web giao dịch Chaoshang Securities |

| Yêu cầu tối thiểu về tiền gửi | / |

| Hỗ trợ khách hàng | Điện thoại: (852) 2152 0878; (852) 3899 2599 |

| Email: cs@chaoshangsec.com | |

| Tòa nhà Harbin, Đường Harbin, Wan Chai, Hồng Kông Phòng 2206-10 | |

Thông tin về ChaoShang

ChaoShang là một nhà môi giới có trụ sở tại Hồng Kông được thành lập vào năm 2004 và được quy định bởi SFC. Công ty cung cấp dịch vụ giao dịch chứng khoán, hợp đồng tương lai và tùy chọn thông qua các nền tảng di động và web của riêng mình.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Lịch sử dài | Cấu trúc phí không rõ ràng |

| Được quy định bởi SFC |

ChaoShang Có Uy tín không?

ChaoShang được quy định bởi Ủy ban Chứng khoán và Hợp đồng Tương lai Hồng Kông (SFC) với loại giấy phép "Giao dịch hợp đồng tương lai," số giấy phép BGH629.

Tôi có thể giao dịch gì trên ChaoShang?

ChaoShang cung cấp ba sản phẩm giao dịch chính: chứng khoán, hợp đồng tương lai và tùy chọn.

| Công cụ có thể giao dịch | Hỗ trợ |

| Chứng khoán | ✔ |

| Hợp đồng tương lai | ✔ |

| Tùy chọn | ✔ |

| Forex | ❌ |

| Hàng hóa | ❌ |

| Chỉ số | ❌ |

| Tiền điện tử | ❌ |

| Trái phiếu | ❌ |

| ETFs | ❌ |

Nền tảng giao dịch

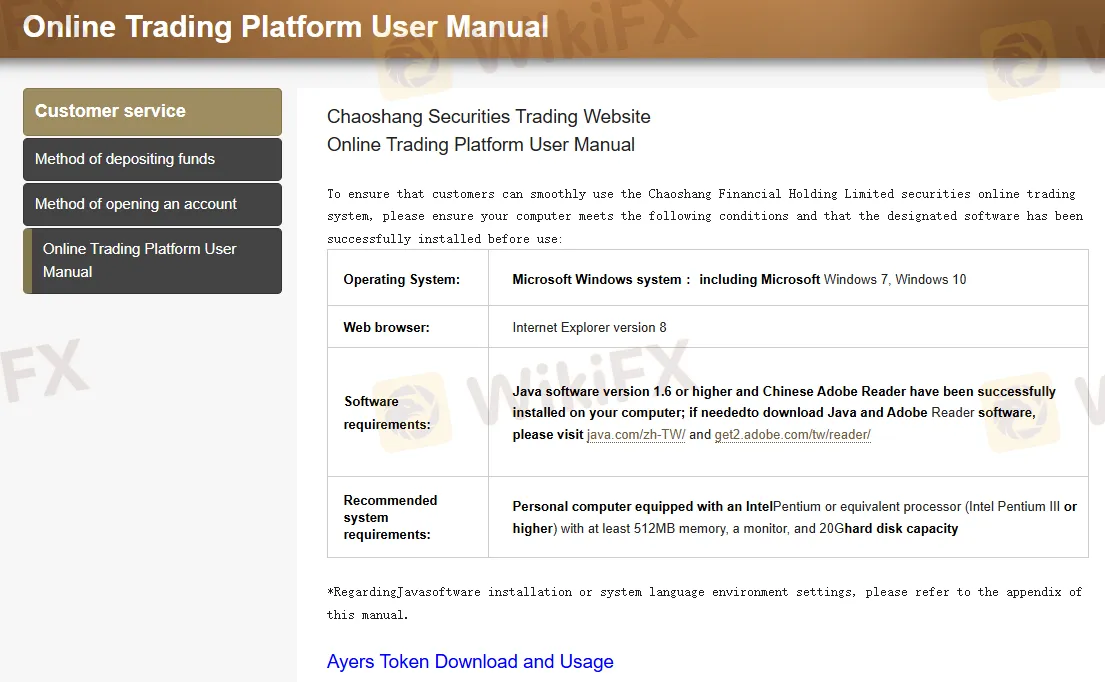

ChaoShang cung cấp một nền tảng giao dịch di động độc quyền - Ứng dụng di động Chaoshang Securities (Ayers) - hỗ trợ cả hệ điều hành Android và iOS. Ngoài ra, nó cũng cung cấp một nền tảng giao dịch dựa trên web - Trang web giao dịch Chaoshang Securities.

| Nền tảng Giao dịch | Hỗ trợ | Thiết bị Khả dụng |

| Ứng dụng di động Chaoshang Securities (Ayers) | ✔ | iOS, Android |

| Trang web giao dịch Chaoshang Securities | ✔ | Web |

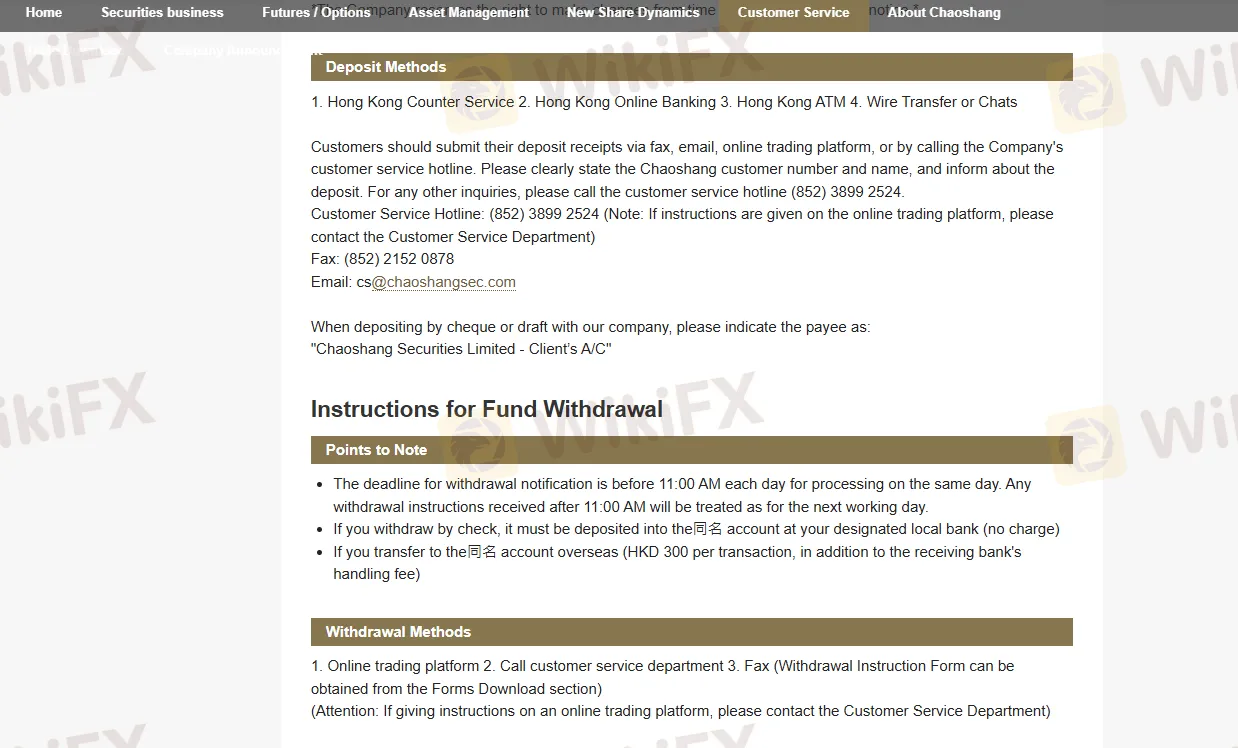

Nạp và Rút tiền

Phương thức nạp tiền của ChaoShang bao gồm chuyển khoản ngân hàng (Ngân hàng Thương mại, Ngân hàng Chong Hing, Ngân hàng Hang Seng, Ngân hàng Trung Quốc), dịch vụ quầy, ngân hàng trực tuyến, nộp tiền bằng séc và chuyển khoản điện hoặc Hệ thống Thanh toán Nhanh (FPS).

Phương thức rút tiền bao gồm hướng dẫn được gửi qua nền tảng giao dịch trực tuyến, điện thoại hoặc fax.