Resumo da empresa

| ChaoShang Resumo da Revisão | |

| Fundação | 2004 |

| País/Região Registrada | Hong Kong |

| Regulação | SFC |

| Produtos de Negociação | Ações, futuros e opções |

| Conta Demonstrativa | / |

| Plataforma de Negociação | Aplicativo Móvel Chaoshang Securities (Ayers) e Site de Negociação da Chaoshang Securities |

| Depósito Mínimo | / |

| Suporte ao Cliente | Telefone: (852) 2152 0878; (852) 3899 2599 |

| E-mail: cs@chaoshangsec.com | |

| 26 Edifício Harbin, Estrada Harbin, Wan Chai, Hong Kong Sala 2206-10 | |

Informações sobre ChaoShang

ChaoShang é uma corretora sediada em Hong Kong, fundada em 2004 e regulamentada pela SFC. Oferece negociação de ações, futuros e opções por meio de suas plataformas móveis e web proprietárias.

Prós e Contras

| Prós | Contras |

| Histórico longo | Estrutura de taxas pouco clara |

| Regulamentado pela SFC |

ChaoShang é Legítimo?

ChaoShang é regulado pela Comissão de Valores Mobiliários e Futuros de Hong Kong (SFC) com um tipo de licença "Negociação de contratos futuros", número de licença BGH629.

O Que Posso Negociar na ChaoShang?

ChaoShang oferece três principais produtos de negociação: ações, futuros e opções.

| Instrumentos Negociáveis | Suportado |

| Ações | ✔ |

| Futuros | ✔ |

| Opções | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Criptomoedas | ❌ |

| Obrigações | ❌ |

| ETFs | ❌ |

Plataforma de Negociação

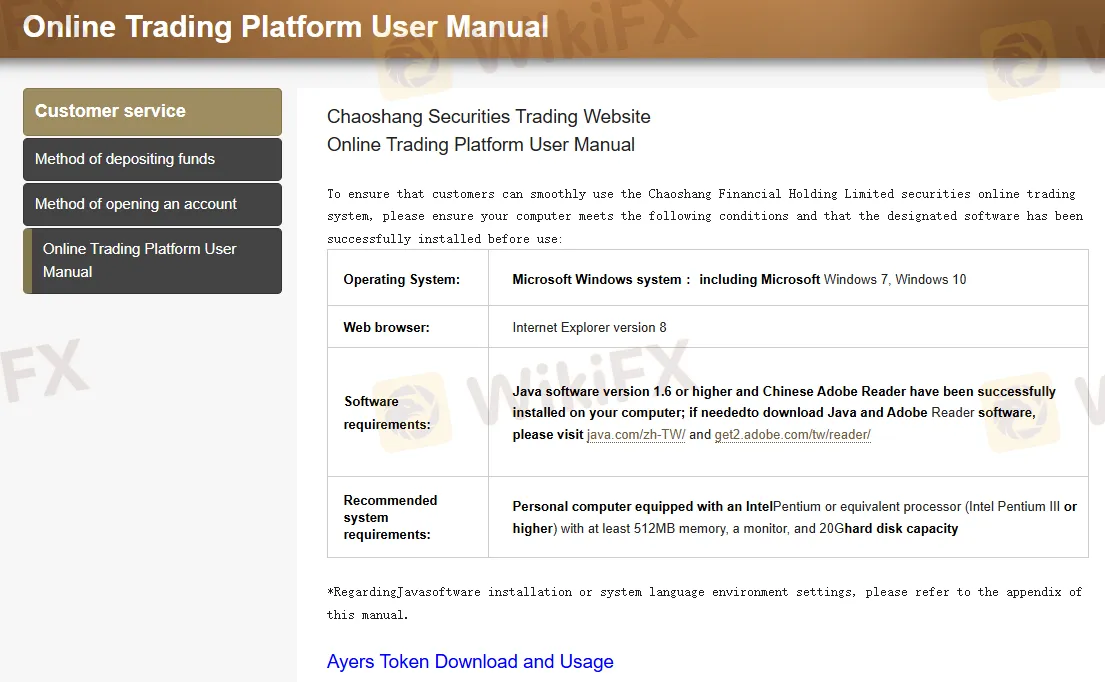

ChaoShang oferece uma plataforma de negociação móvel proprietária - Chaoshang Securities (Ayers) Mobile App - que suporta sistemas Android e iOS. Além disso, também oferece uma plataforma de negociação baseada na web - Chaoshang Securities Trading Website.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis |

| Chaoshang Securities (Ayers) Mobile App | ✔ | iOS, Android |

| Chaoshang Securities Trading Website | ✔ | Web |

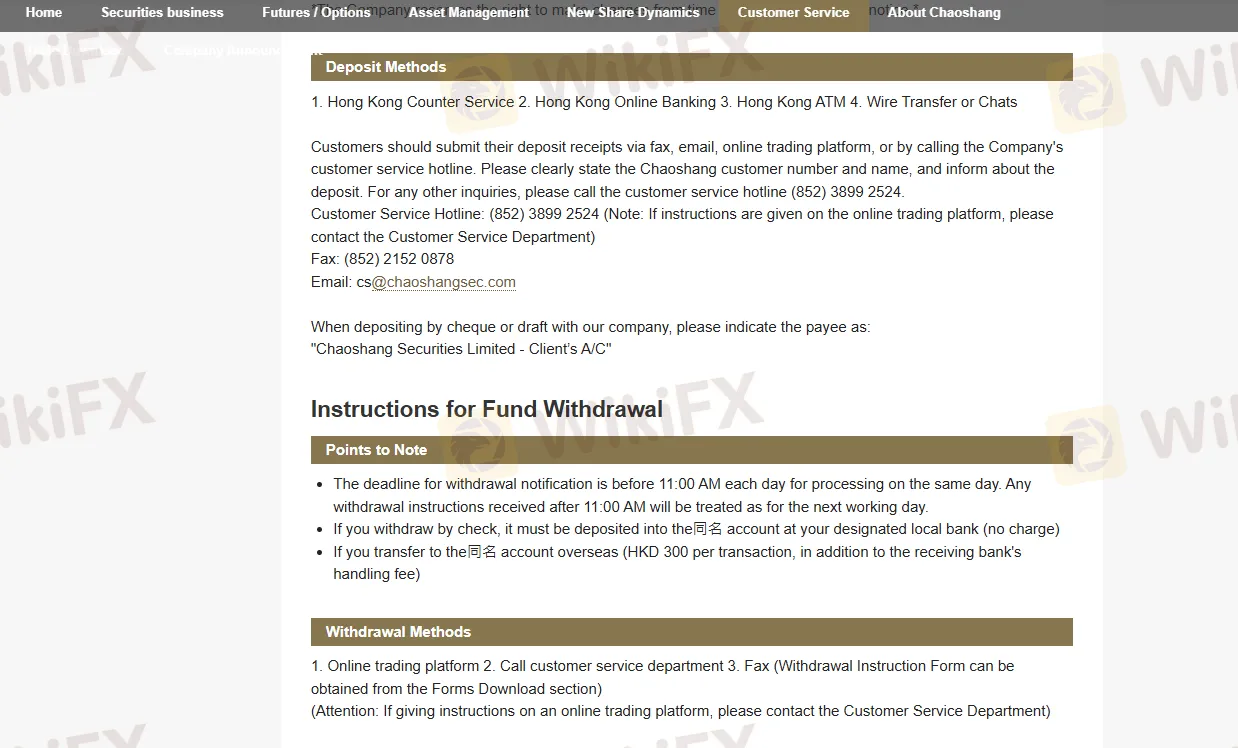

Depósito e Retirada

Os métodos de depósito do ChaoShang incluem transferências bancárias (Bank of Communications, Chong Hing Bank, Hang Seng Bank, Bank of China), serviços de balcão, internet banking, depósitos em cheque e transferências telegráficas ou o Sistema de Pagamento Mais Rápido (FPS).

Os métodos de retirada incluem instruções enviadas via plataforma de negociação online, telefone ou fax.