Allan777

1-2年

Does Barings offer investor protection?

Barings, being regulated by the SFC, is required to maintain high standards of transparency and protect client funds. Regulation ensures that client funds are segregated from the firm’s operational funds, providing a layer of security in case of financial difficulties. However, it's important to remember that investor protection doesn’t eliminate market risks, especially in volatile markets like futures and stock options. As with any investment service, it’s crucial to be aware of the inherent risks and carefully assess your investment strategy, especially when making Barings investments.

Tomas

1-2年

Can I access Barings’ services if I’m not an institutional investor?

Barings primarily serves institutional clients and high-net-worth individuals, offering sophisticated investment solutions like global private finance, real estate, and capital solutions. However, some of their services might be accessible to qualified individual investors who meet certain criteria. If you are not an institutional investor but are still interested in Barings investment services, it’s a good idea to contact them directly. They may offer tailored solutions or advice based on your financial profile.

Broker Issues

Instruments

Platform

Account

Leverage

Five8

1-2年

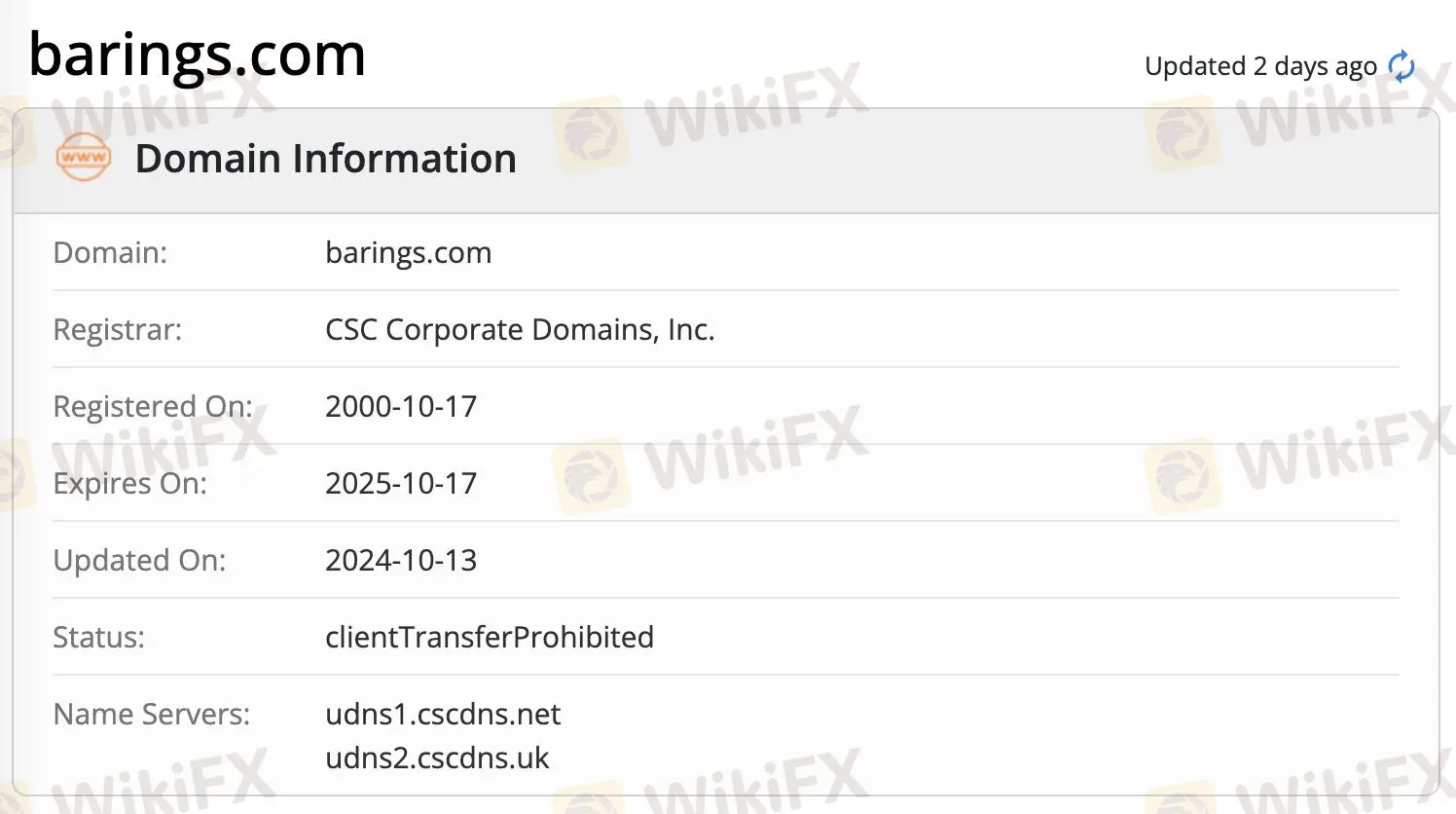

Is Barings safe and legit for trading?

Yes, Barings is a legitimate and safe broker for trading, regulated by the SFC. This regulation enhances the legitimacy of Barings investment services, ensuring that the firm adheres to compliance requirements that protect traders and investors. The firm’s diverse product offerings, such as private finance, real estate, and diversified equity, make it a solid choice for institutional investors and high-net-worth individuals. However, traders must still be aware of the risks involved in complex investment products like futures and alternative equity. Always review Barings reviews and do thorough research before making Barings investments.

Aman A

1-2年

What are the cons of trading with Barings?

Despite its strengths, one of the major cons of trading with Barings is the lack of transparency regarding fees, which can be frustrating for traders looking for clear and upfront cost structures. Barings investment services offer sophisticated solutions but without detailed information on pricing, it may be difficult for retail traders to evaluate costs effectively. Additionally, since Barings primarily caters to institutional clients, it might not offer as much flexibility for individual retail traders. This could make it less appealing for those who prefer straightforward, low-cost trading services.