公司簡介

| IQM CAPITAL評論摘要 | |

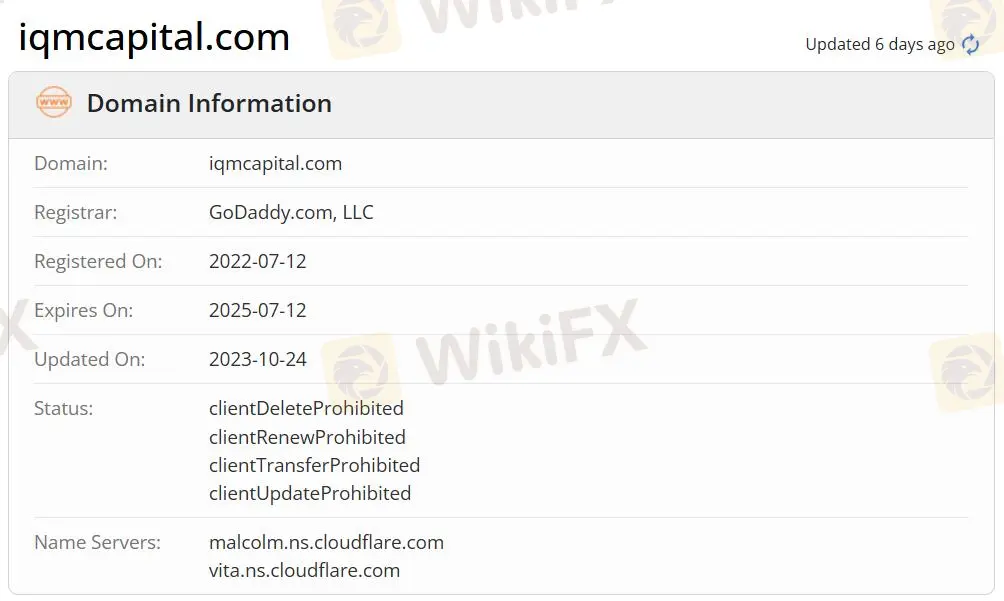

| 成立日期 | 2022-07-12 |

| 註冊國家/地區 | 聖文森特和格林納丁斯 |

| 監管 | 未受監管 |

| 市場工具 | 外匯/貴金屬/指數/差價合約/股票/加密貨幣 |

| 模擬帳戶 | ✅ |

| 槓桿 | 最高可達1:500 |

| 點差 | 最低為0.0點 |

| 交易平台 | CTrader(桌面版(Windows)/移動版(iOS/Android)/Web) |

| 最低存款 | $100 |

| 客戶支援 | 電話:+971 4 5823377 |

| 電郵:support@iqmcapital.com | |

| 電郵:info@iqmcapital.com | |

| 在線聊天 | |

| Facebook/YouTube/Instagram/LinkedIn/TikTok/Telegram/WhatsApp | |

IQM CAPITAL 資訊

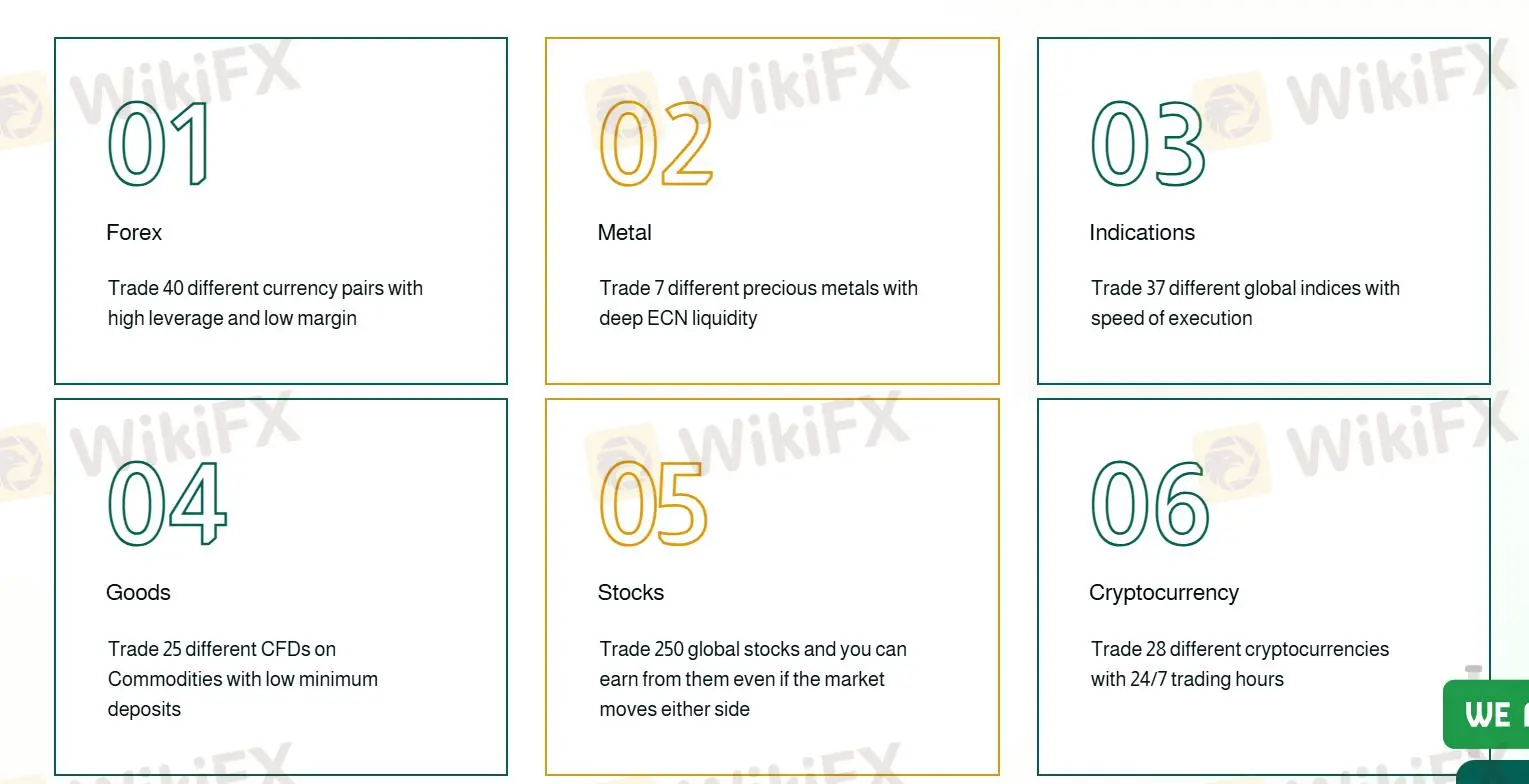

IQM CAPITAL 是一家提供個人和企業客戶多種交易方法、24/7支援和諮詢服務的ECN(外匯)經紀公司。可交易的工具包括40種貨幣對、7種貴金屬、37種指數、25種差價合約、250種股票和28種加密貨幣。該經紀商還提供三種帳戶,最高槓桿為1:500。最低點差為0.0點,最低存款為$100。由於其未受監管的狀態以及有關提款困難的負面評論,IQM CAPITAL 仍然存在風險。

優點和缺點

| 優點 | 缺點 |

| 最高槓桿可達1:500 | 未受監管 |

| 24/7客戶支援 | MT4/MT5不可用 |

| 多種可交易工具 | 有關提款困難的負面評論 |

| 點差最低為0.0點 | 沒有提款處理信息 |

| 提供模擬帳戶 |

IQM CAPITAL 是否合法?

IQM CAPITAL 未受監管,即使它聲稱受聖露西亞監管。然而,未受監管的經紀商不像受監管的經紀商那樣安全。

IQM CAPITAL 可以交易什麼?

IQM CAPITAL 提供多種市場工具,包括40種貨幣對、7種貴金屬、37種指數、25種差價合約、250種股票和28種加密貨幣。

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 指數 | ✔ |

| 差價合約 | ✔ |

| 貴金屬 | ✔ |

| 股票 | ✔ |

| 加密貨幣 | ✔ |

| 股份 | ❌ |

| 商品 | ❌ |

| ETF | ❌ |

| 債券 | ❌ |

| 共同基金 | ❌ |

帳戶類型

IQM CAPITAL 提供三種帳戶類型:VIP、標準和ZERO。希望低槓桿的交易者可以選擇VIP帳戶,而預算較小的交易者可以開設標準帳戶。此外,模擬帳戶主要用於讓交易者熟悉交易平台和教育目的。每個人還可以通過複製頂級交易者的成功來賺錢。穆斯林可以開設無掉期的伊斯蘭帳戶。

| 帳戶類型 | VIP | 標準 | ZERO |

| 槓桿 | 最高1:200 | 最高1:400 | 最高1:500 |

| 最低存款 | $20000 | $100 | $500 |

| 佣金 | 免費 | 免費 | $8 |

| 伊斯蘭帳戶 | 是 | 是 | 是 |

IQM CAPITAL 費用

點差從0.0點起,佣金從0起。點差越低,流動性越快。

槓桿

最高槓桿為1:500,意味著利潤和損失放大500倍。

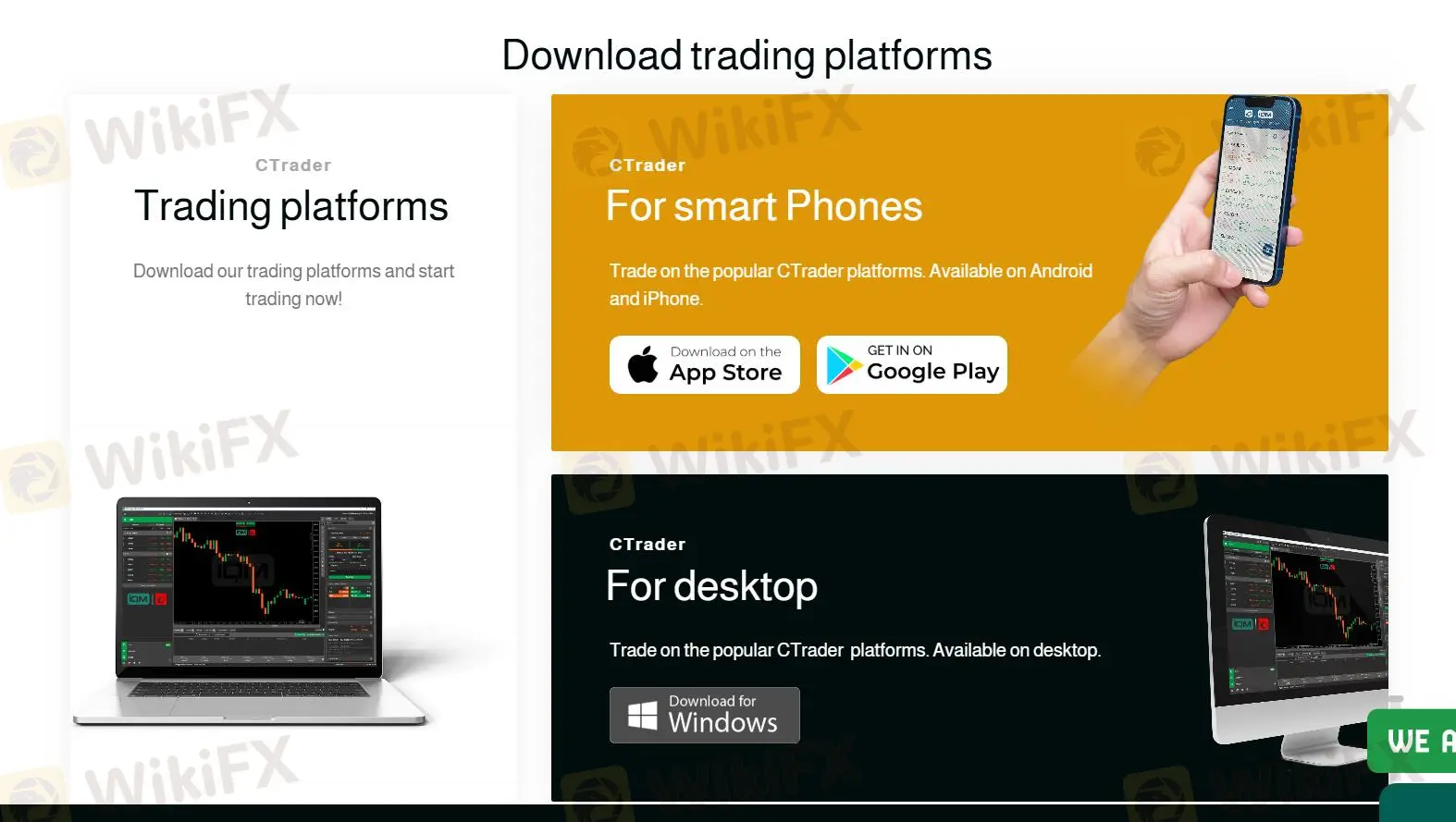

交易平台

IQM CAPITAL 提供專有的CTrader交易平台,可在桌面(Windows)和移動設備(iOS和Android)上使用,而不是成熟的MT4/MT5平台,具備成熟的分析工具和EA智能系統。

| 交易平台 | 支援 | 可用設備 |

| CTrader | ✔ | 桌面(Windows)/移動設備(iOS/Android)/Web |

存款和提款

首次存款金額必須為$100或以上。IQM CAPITAL接受本地轉帳、泰達幣、簽證、完美支付、Skrill和Neteller進行存款和提款。然而,轉帳處理時間和相關費用尚不清楚。