مقدمة عن الشركة

| ChaoShang ملخص المراجعة | |

| تأسست | ٢٠٠٤ |

| البلد/المنطقة المسجلة | هونغ كونغ |

| التنظيم | SFC |

| منتجات التداول | الأوراق المالية، العقود الآجلة، والخيارات |

| حساب تجريبي | / |

| منصة التداول | تطبيق Chaoshang Securities (Ayers) النقال وموقع تداول Chaoshang Securities |

| الحد الأدنى للإيداع | / |

| دعم العملاء | الهاتف: (852) 2152 0878؛ (852) 3899 2599 |

| البريد الإلكتروني: cs@chaoshangsec.com | |

| 26 مبنى هاربين، شارع هاربين، وان تشاي، هونغ كونغ، غرفة 2206-10 | |

معلومات ChaoShang

ChaoShang هو وسيط مقره في هونغ كونغ تأسس في عام ٢٠٠٤ ويخضع لتنظيم SFC. يقدم تداول الأوراق المالية والعقود الآجلة والخيارات من خلال منصاته المحمولة وعبر الويب الخاصة به.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| تاريخ طويل | هيكل رسوم غير واضح |

| منظم بواسطة SFC |

هل ChaoShang شرعي؟

ChaoShang مُنظم بواسطة لجنة هونغ كونغ للأوراق المالية والعقود الآجلة (SFC) بنوع ترخيص "التعامل في عقود الآجلة"، رقم الترخيص BGH629.

ما الذي يمكنني التداول به على ChaoShang؟

ChaoShang يقدم ثلاث منتجات تداول رئيسية: الأوراق المالية والعقود الآجلة والخيارات.

| الأدوات التجارية | مدعوم |

| الأوراق المالية | ✔ |

| العقود الآجلة | ✔ |

| الخيارات | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

منصة التداول

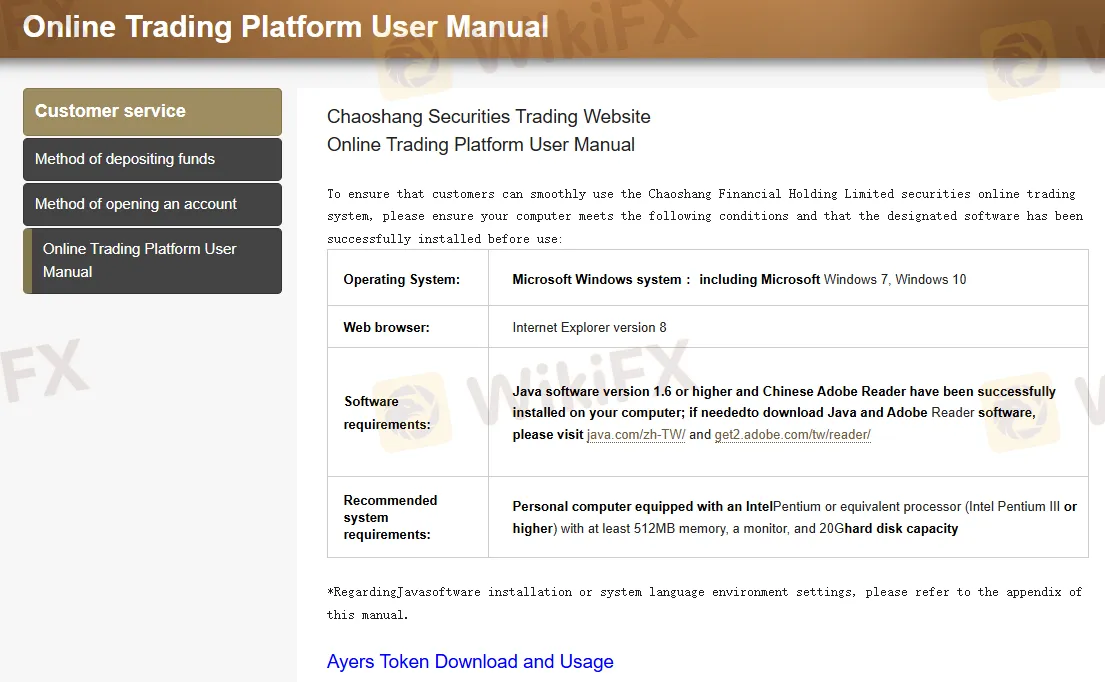

ChaoShang تقدم منصة تداول محمولة مميزة - تطبيق Chaoshang Securities (Ayers) Mobile App - الذي يدعم نظامي Android و iOS. بالإضافة إلى ذلك، تقدم أيضًا منصة تداول عبر الويب - موقع تداول Chaoshang Securities.

| منصة التداول | الدعم | الأجهزة المتاحة |

| تطبيق Chaoshang Securities (Ayers) Mobile App | ✔ | iOS، Android |

| موقع تداول Chaoshang Securities | ✔ | ويب |

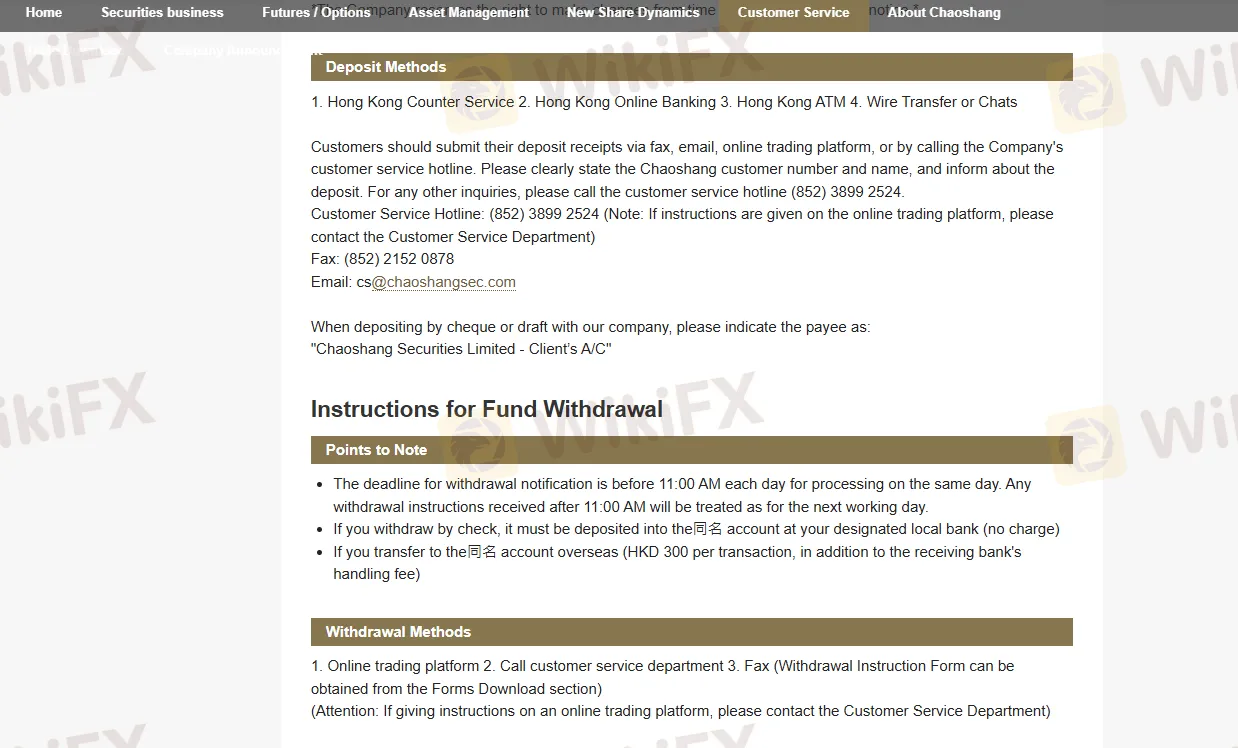

الإيداع والسحب

طرق إيداع ChaoShang تشمل تحويلات بنكية (بنك الاتصالات، بنك تشونغ هينج، بنك هانغ سنغ، بنك الصين)، خدمات الصرافة، الخدمات المصرفية عبر الإنترنت، إيداع الشيكات، وتحويلات البرقية أو نظام الدفع السريع (FPS).

تشمل طرق السحب التعليمات المقدمة عبر منصة التداول عبر الإنترنت، الهاتف، أو الفاكس.