公司簡介

| ABX檢討摘要 | |

| 註冊日期 | 1999-02-26 |

| 註冊國家/地區 | 澳洲 |

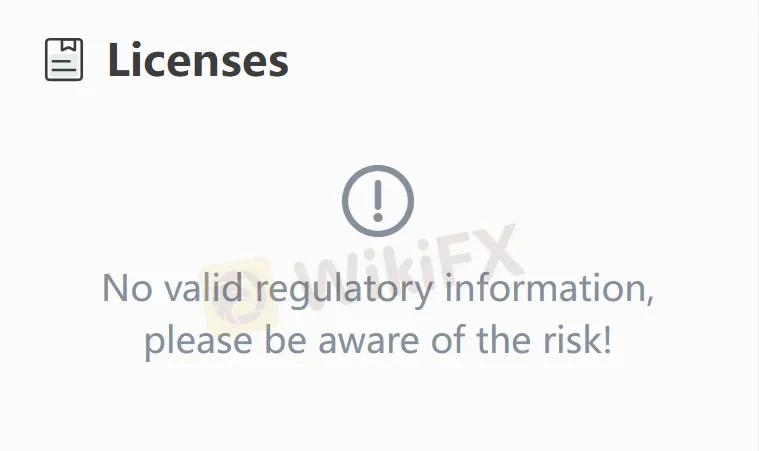

| 監管 | 未受監管 |

| 市場工具 | 黃金、白銀和鉑金 |

| 交易平台 | MetalDesk |

| 客戶支援 | 電話:+61 7 3211 5007(澳洲) |

| 電話:+66 (0)2 231 8171(泰國) | |

| 電話:+852 3956 7193(香港) | |

| 電話:+357 25262656(塞浦路斯) | |

| 傳真:+61 7 3236 1106(澳洲) | |

| 傳真:+852 3956 7100(香港) | |

| 傳真:+357 25560815(塞浦路斯) | |

| 電郵:info@abx.com | |

| LinkedIn、Facebook、Twitter | |

ABX 資訊

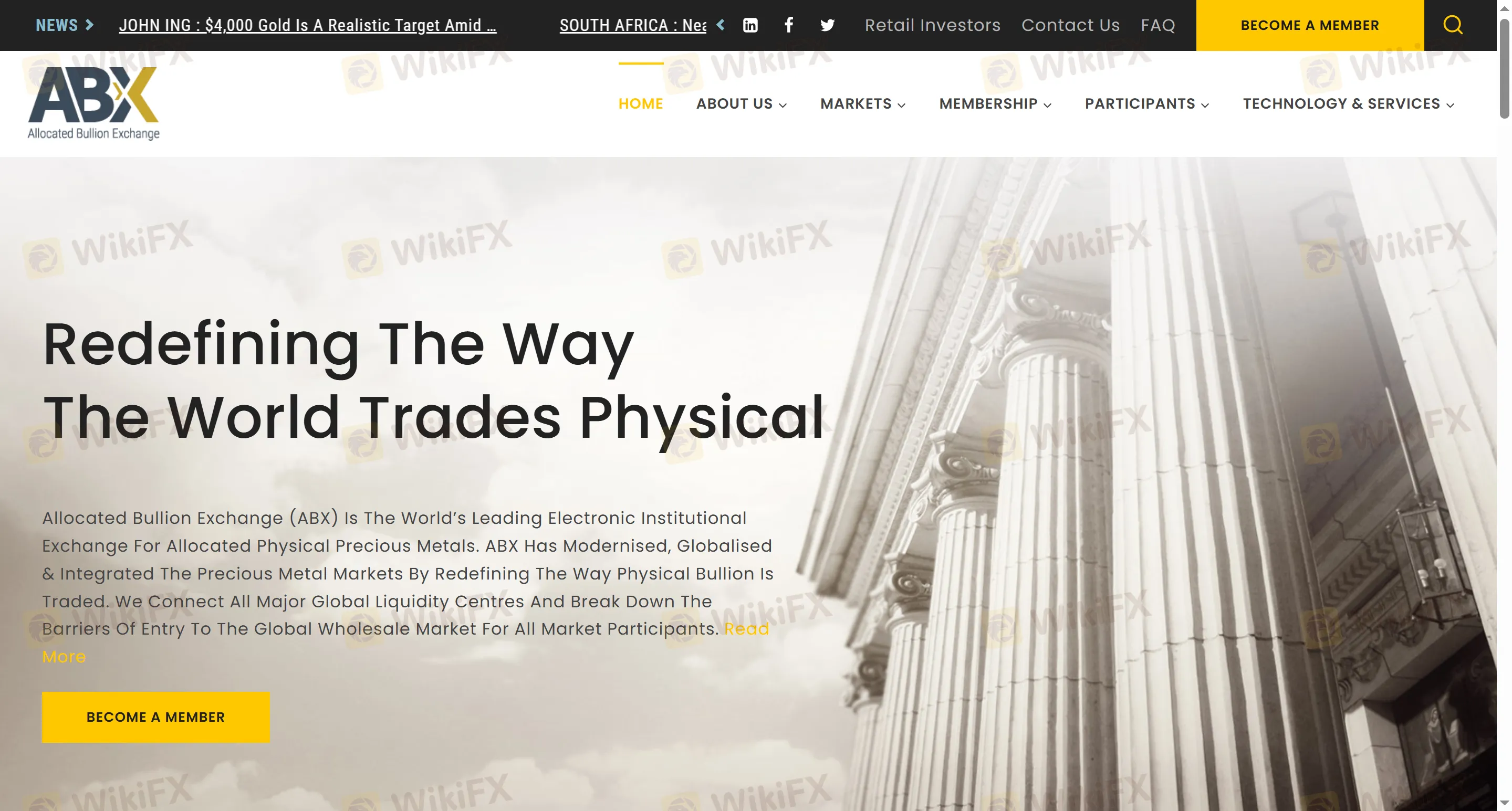

Allocated Bullion Exchange (ABX) 是一個全球電子交易所,專門交易實物貴金屬。透過其自行開發的MetalDesk平台,ABX 將七個主要的全球交易中心連接起來,提供黃金、白銀和鉑金等實物貴金屬的交易服務。該平台為整個行業鏈上的參與者提供高效的交易解決方案,從礦工到投資者。

優缺點

| 優點 | 缺點 |

| 全球交易多元化的黃金、白銀和鉑金 | 未受監管僅限於貴金屬 |

| 對於某些產品存在高進入門檻(例如,最低交易單位為25,000盎司的白銀) |

ABX 是否合法?

ASIC 監管 ABX,但實際上並非如此。建議交易者向ASIC監管機構核實此主張的真實性。

ABX 可以交易什麼?

在 ABX 平台上,投資者可以交易各種實物貴金屬產品,包括黃金、白銀和鉑金。