公司簡介

| 安聯投資 檢討摘要 | |

| 成立年份 | 1998 |

| 註冊地區/國家 | 香港 |

| 監管機構 | SFC |

| 金融服務 | 機構投資者、保險資產管理、零售基金、退休服務。 |

| 客戶支援 | (852) 2238 8888, (852) 2238 8000 |

| hkenquiry@allianzgi.com | |

安聯投資 資訊

安聯投資 於1998年在香港成立,是一家專注於資產管理的企業,受SFC監管,提供多項金融服務,包括為機構投資者提供解決方案、為保險資產管理提供量身定制的策略、多元化的零售基金和利用其全球專業知識的退休服務。

優缺點

| 優點 | 缺點 |

|

|

|

|

安聯投資 是否合法?

安聯投資 持有由香港證券及期貨事務監察委員會(SFC)監管的「從事期貨合約交易」牌照,牌照號碼為BFE699。

產品與服務

- 機構投資者:安聯投資 為機構投資者提供集中和分離策略,包括國家/地區股票、全球股票、新興市場股票、主題和行業策略,以及總回報和多資產解決方案。他們的機構客戶包括主權基金、養老金計劃、慈善機構等。

- 保險資產管理:安聯投資 為全球保險公司提供量身定制的投資策略和解決方案,包括人壽保險、財產與意外保險以及健康保險,以應對監管和低利率挑戰。

- 零售基金:安聯投資 為零售投資者提供不同投資策略的多元化基金,包括在全球市場追求長期資本增值的股票基金、提供穩定收入的債券基金,以及為資本增長和多元化而設的多資產基金。這些基金可通過其世界級投資平台進行交易。

- 退休服務:安聯投資 提供退休服務,利用其全球投資和研究專業知識靈活管理財富,通過其退休產品提供幫助個人規劃和確保其財務未來。

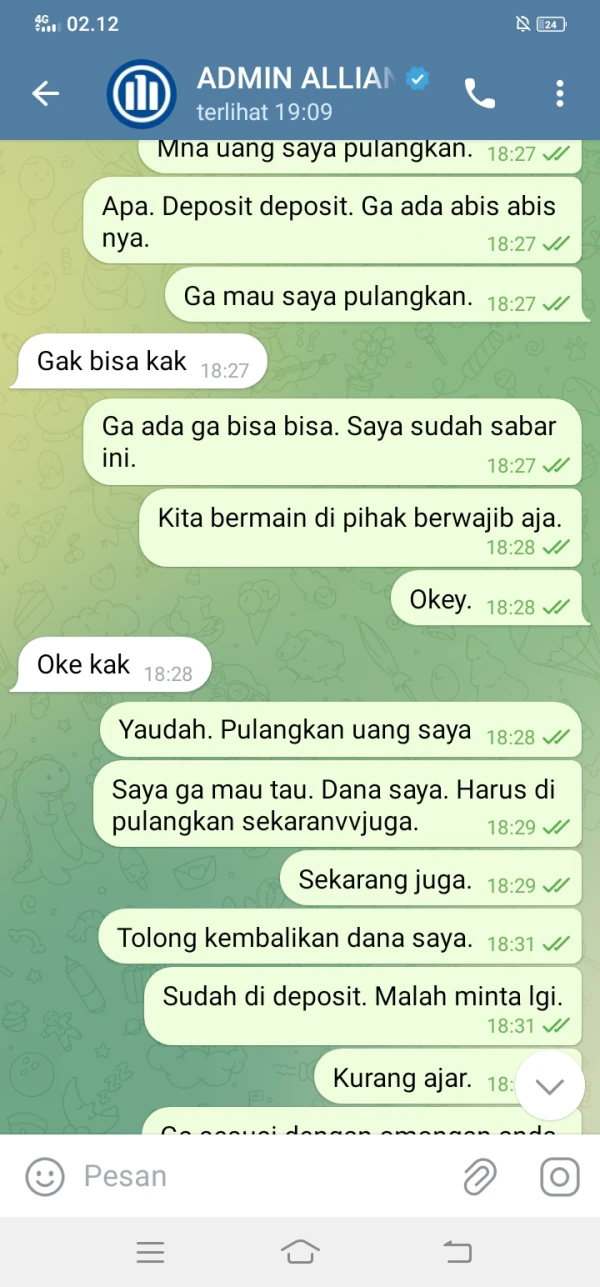

sunshine62137

韓國

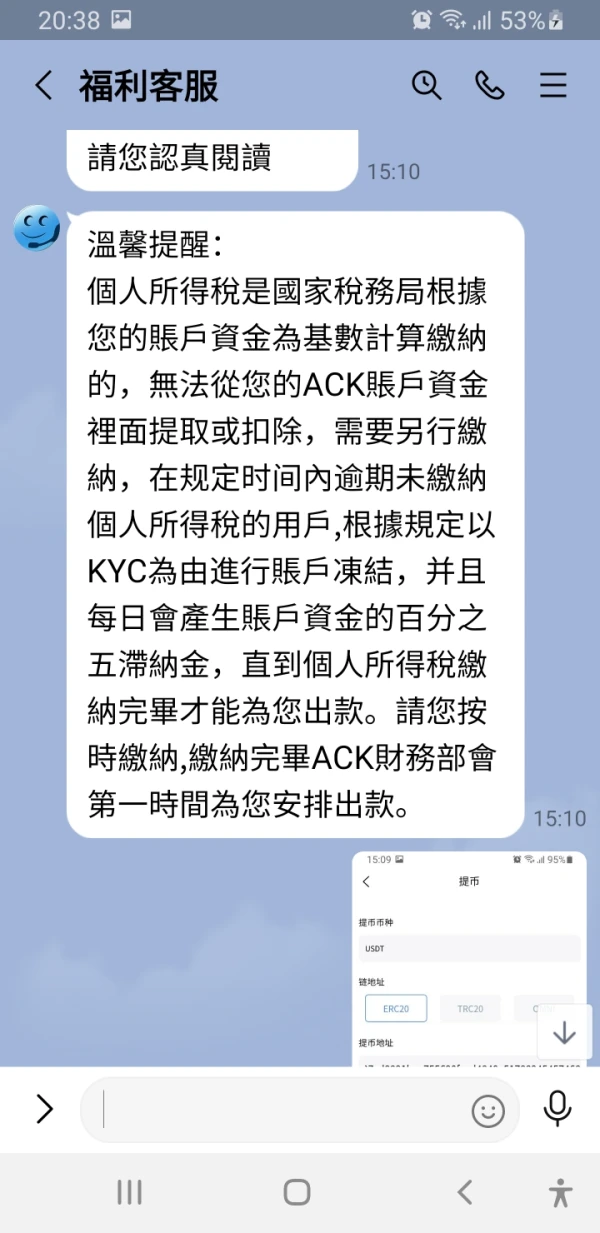

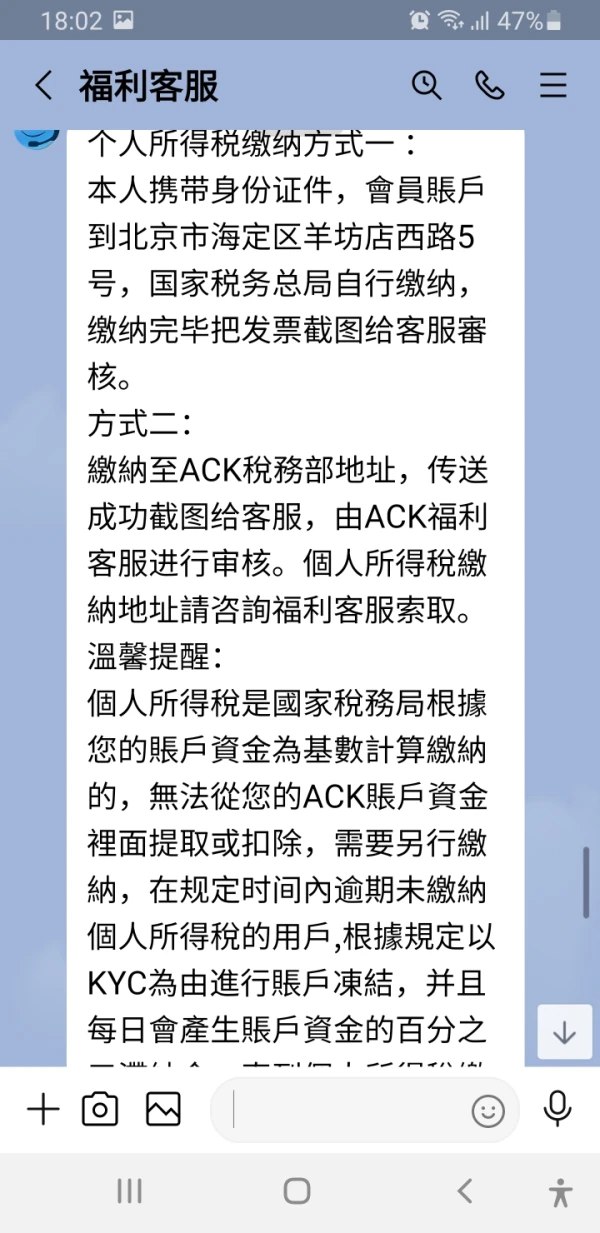

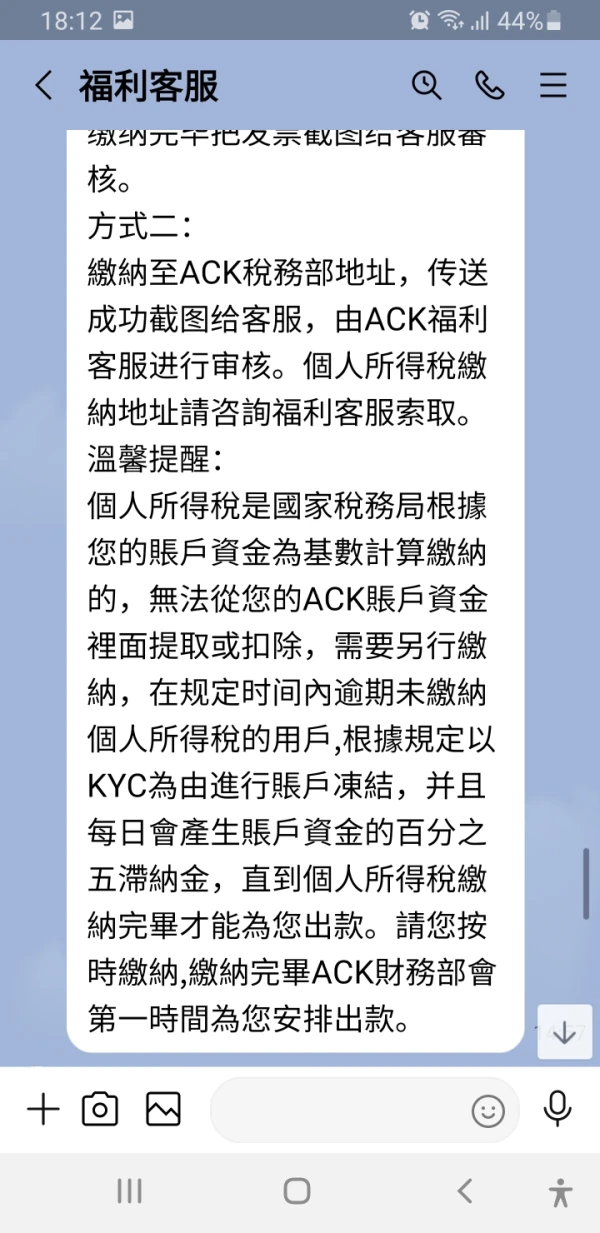

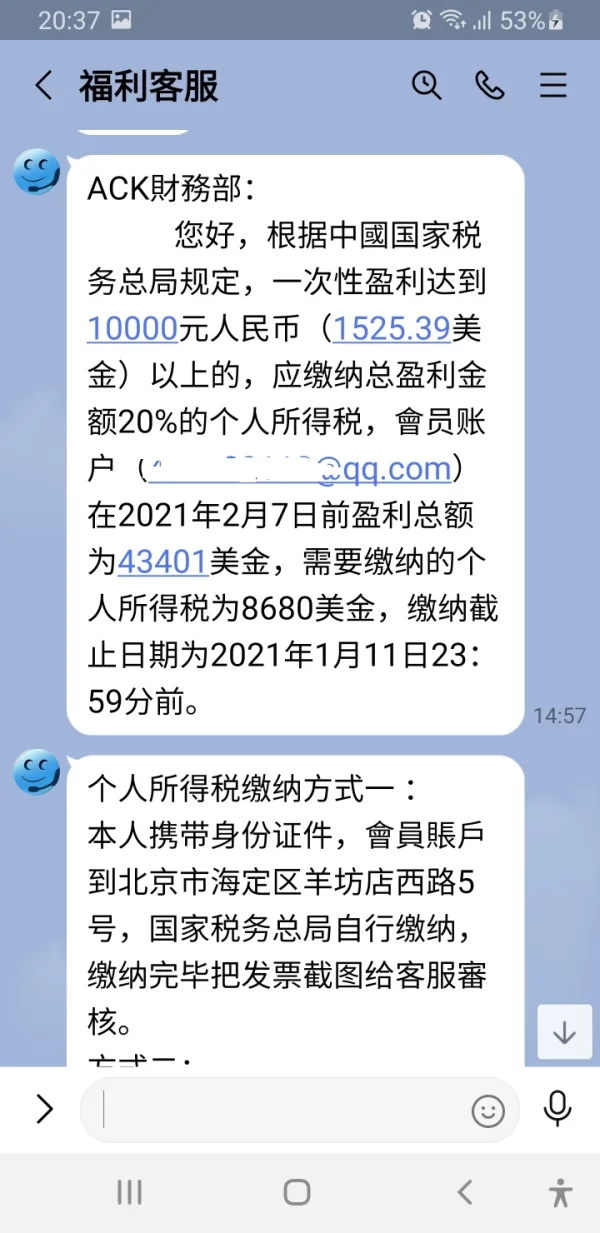

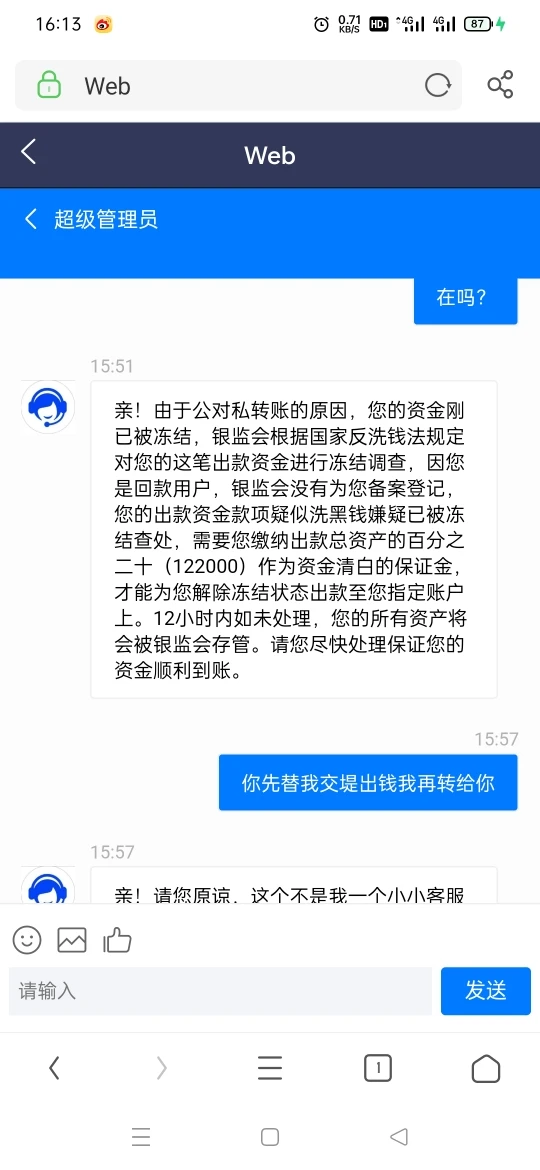

香港ACK外汇管理有限公司,一直让充值。要么就是缴纳税金,反正以各种理由不让提现

爆料

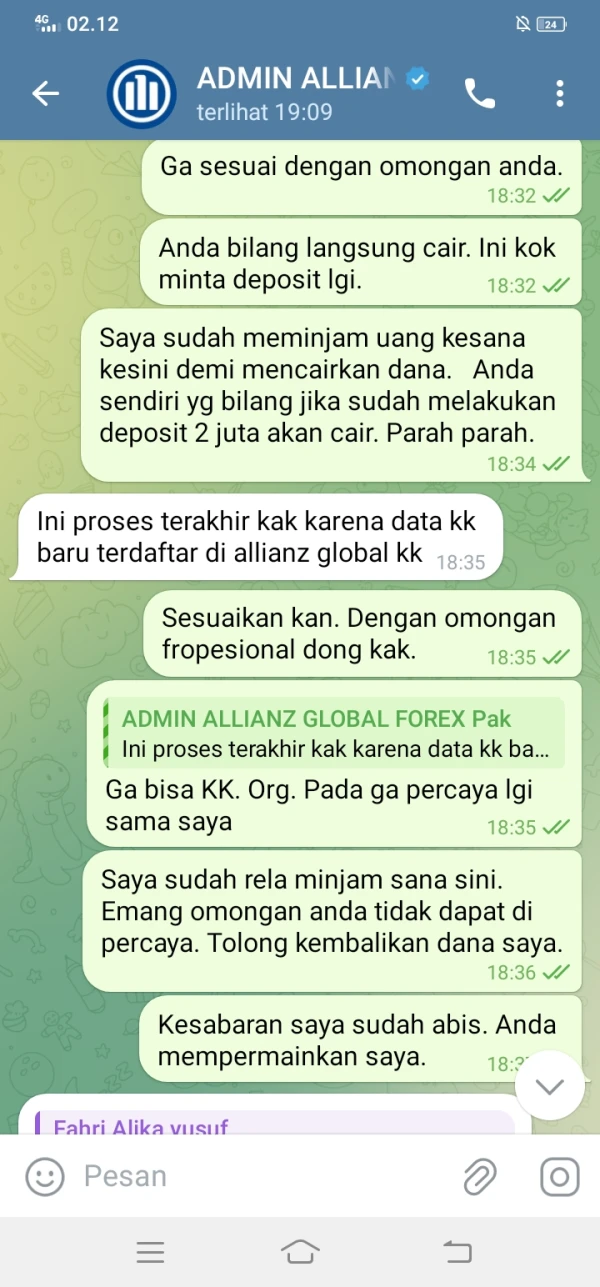

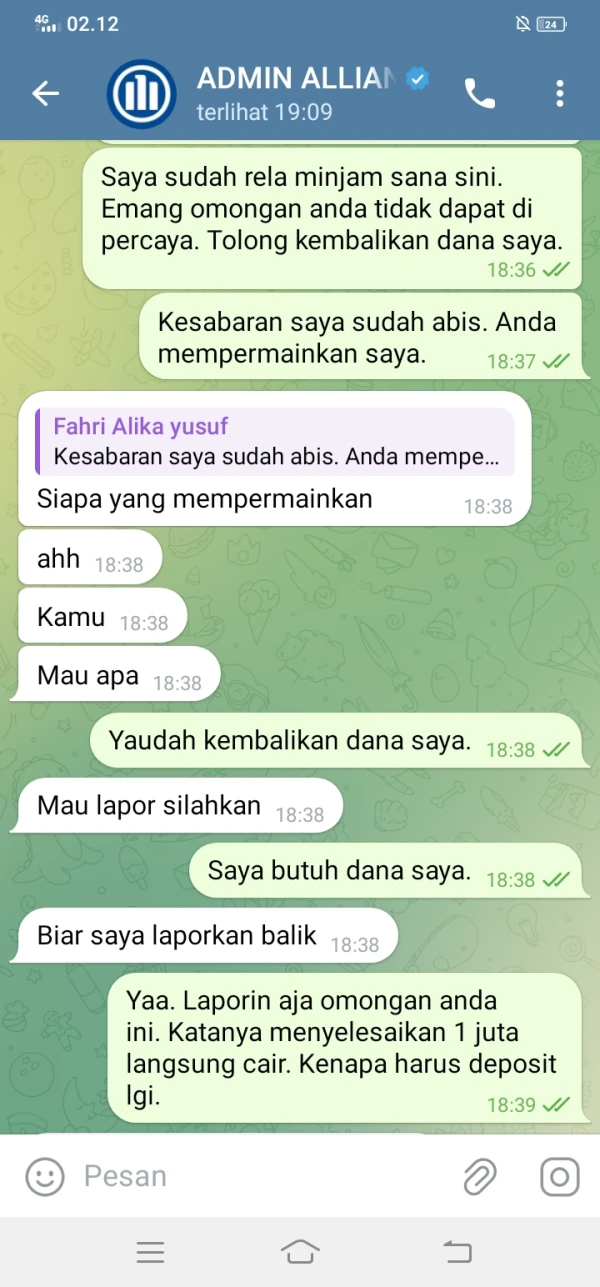

风之语8559

香港

骗子平台冒充客服让你入这个平台然后一步步骗你的保证金

爆料

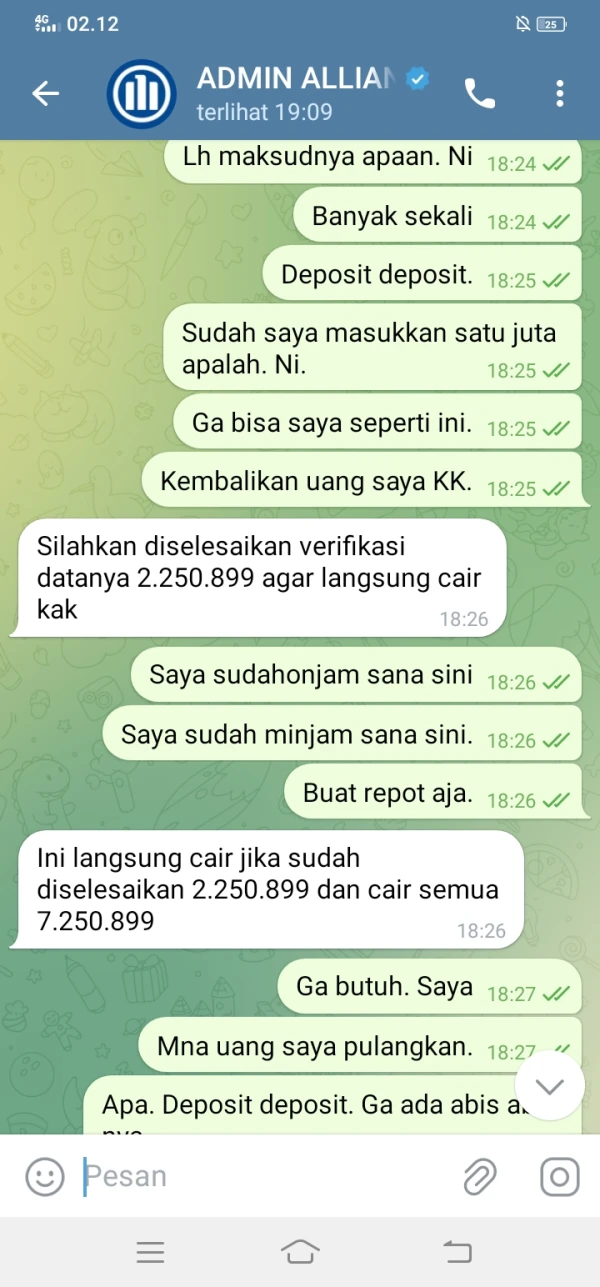

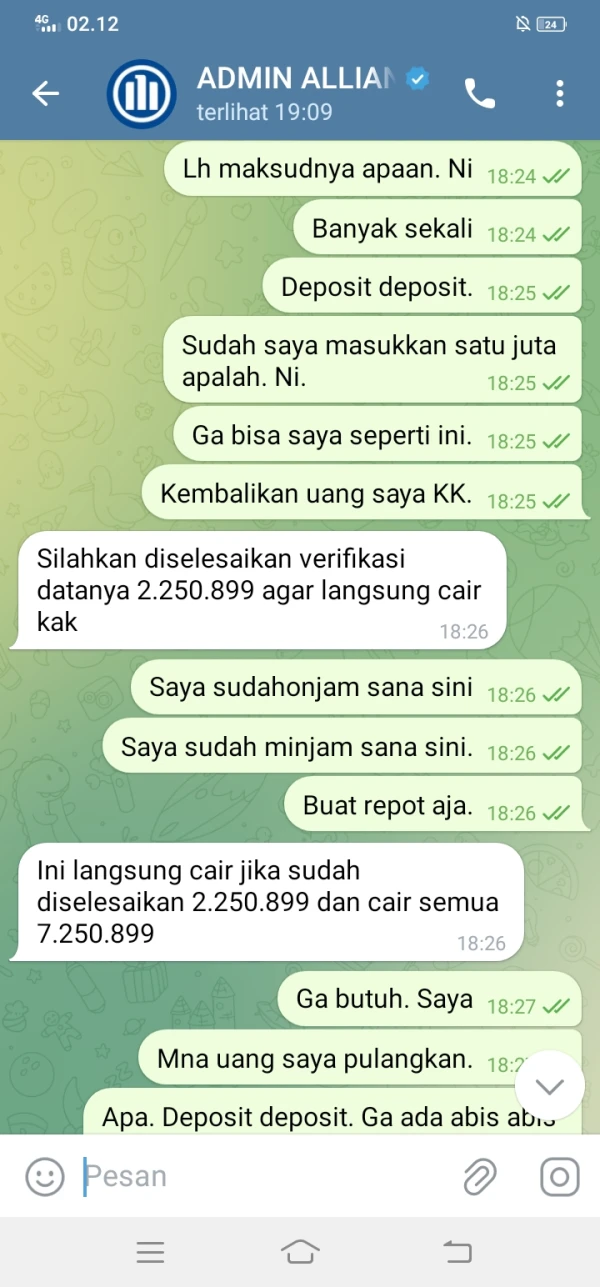

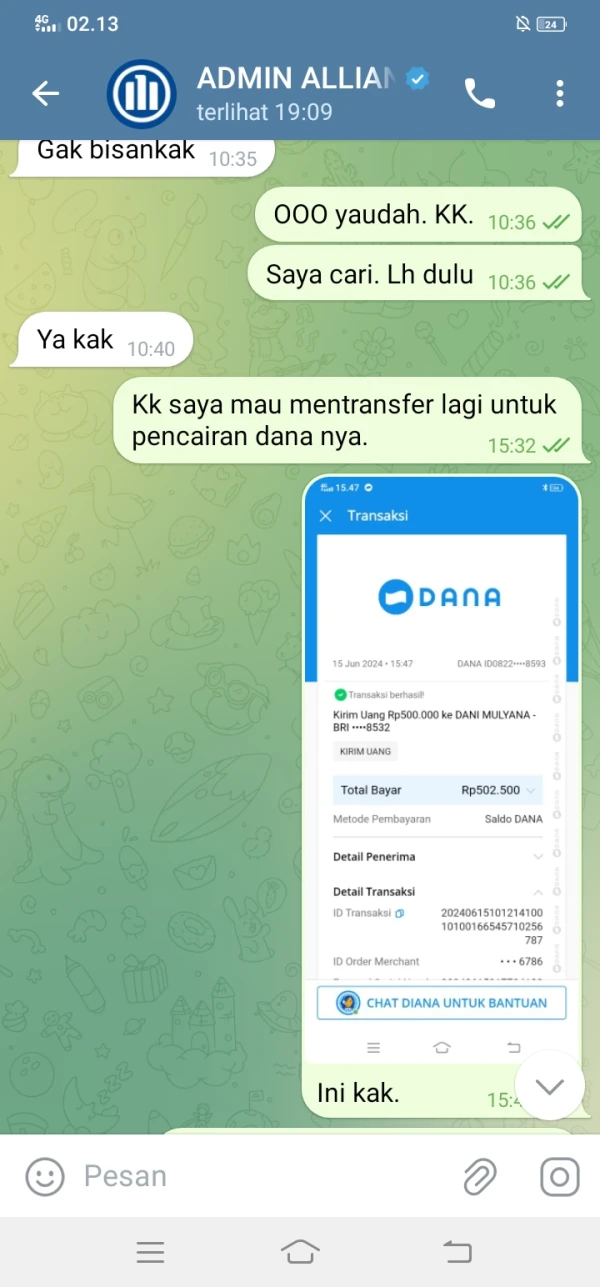

mabra1744

印尼

我的資金有1,000,000。請歸還它們。

爆料

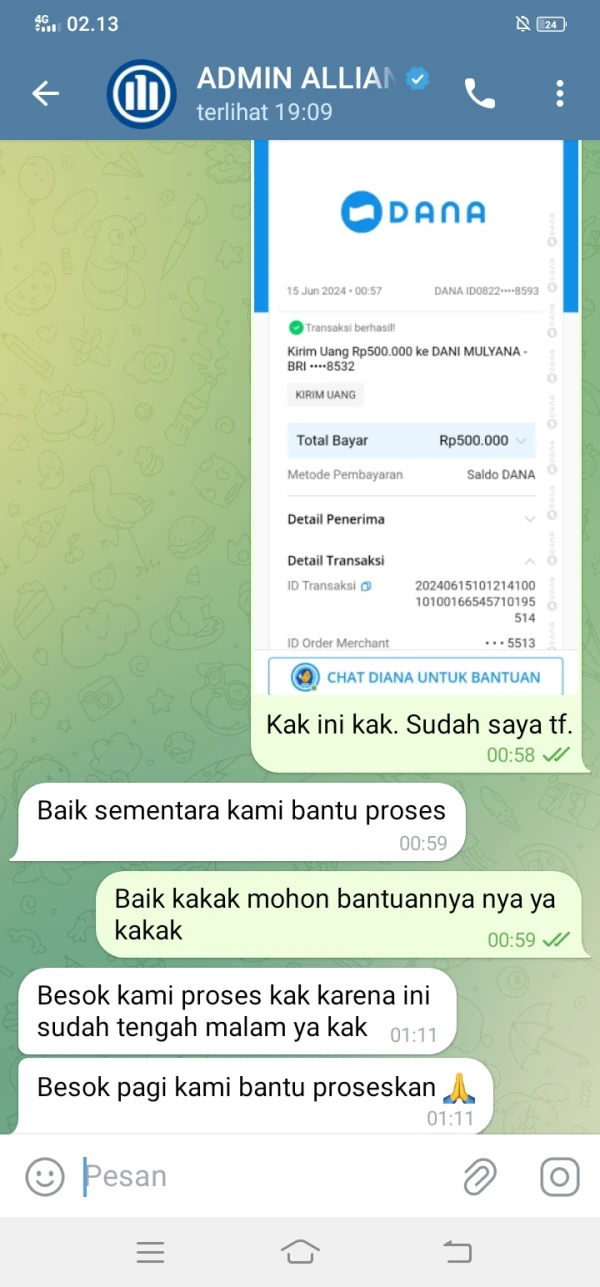

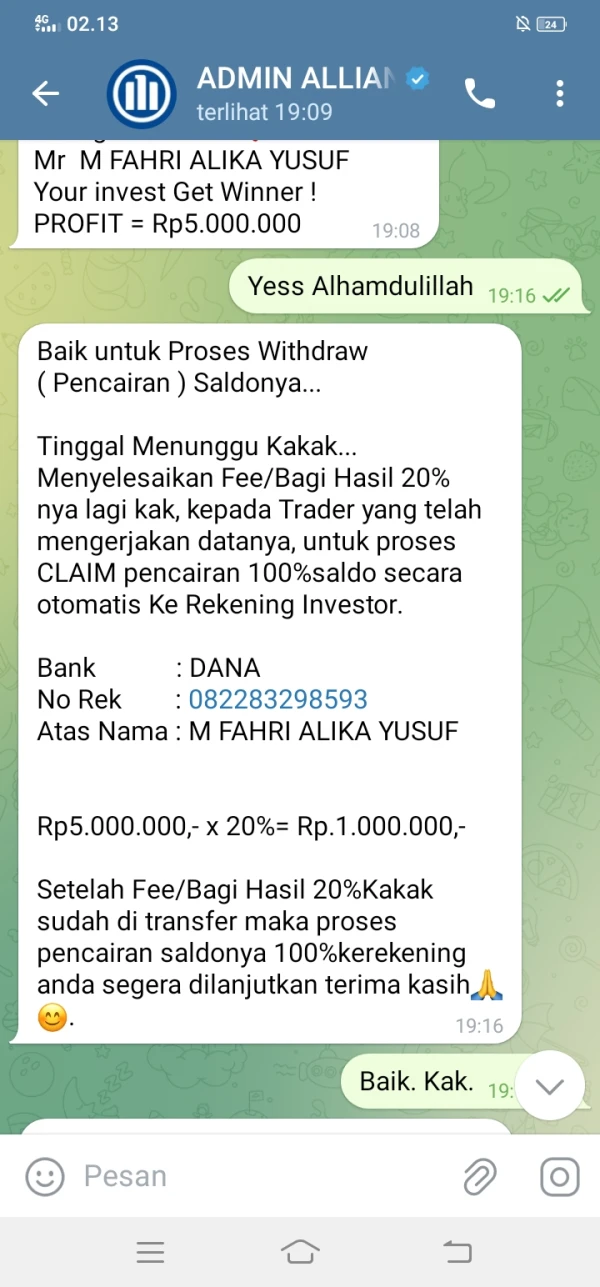

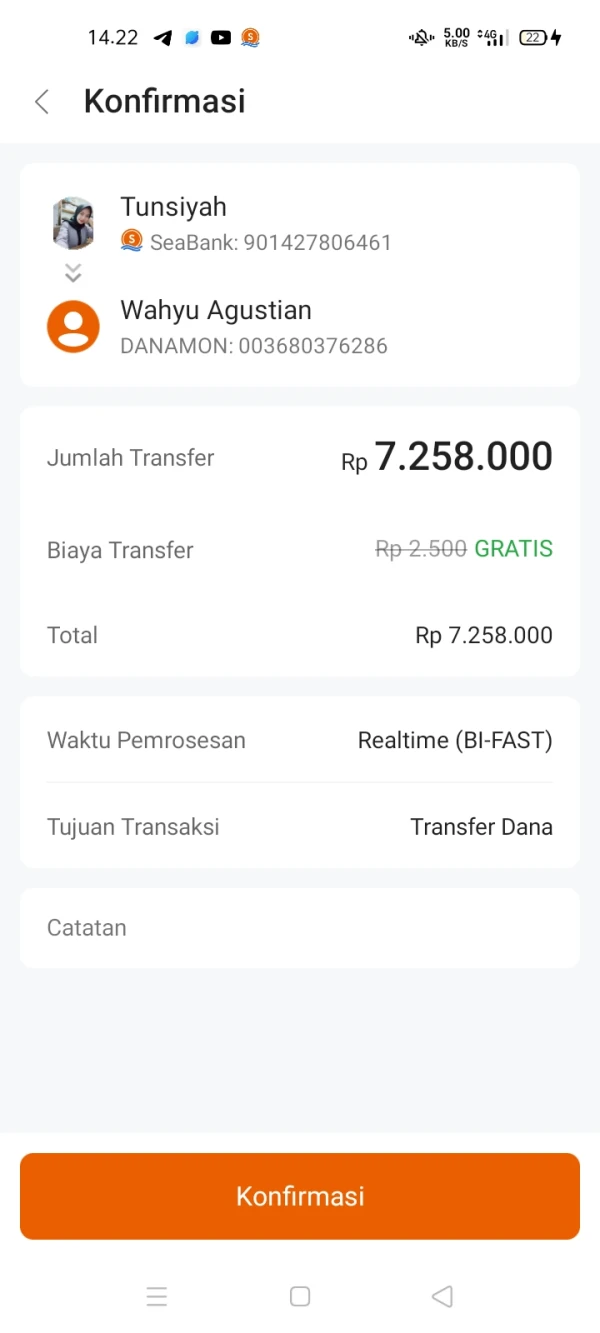

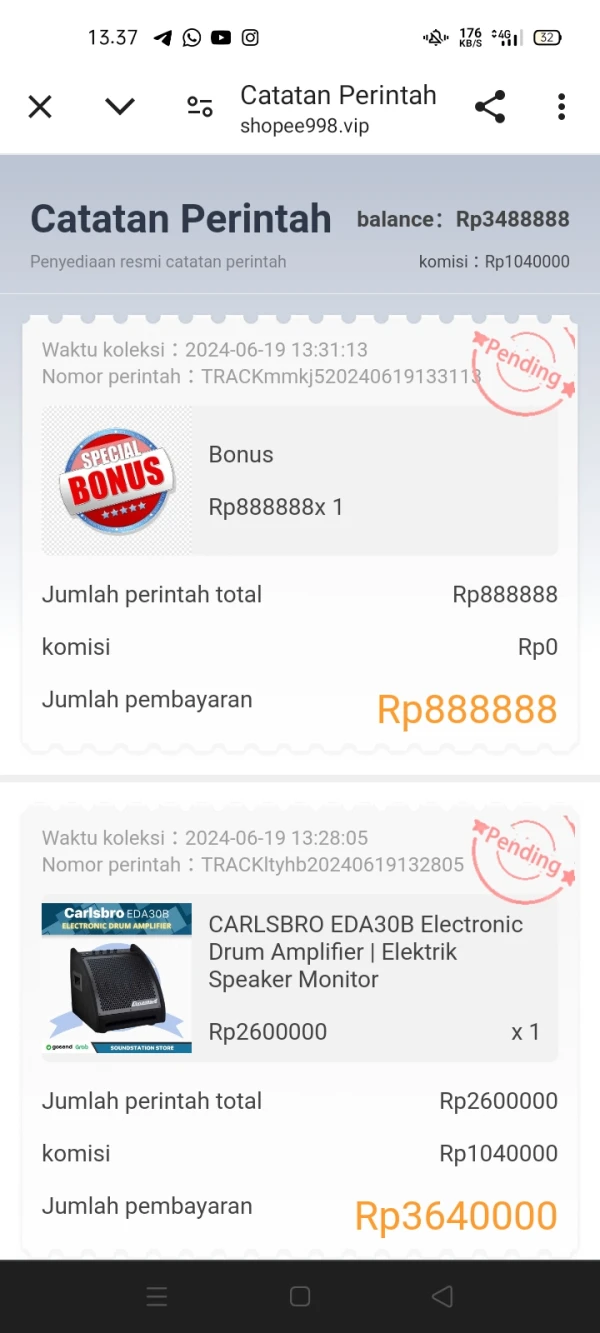

tunsiyah

印尼

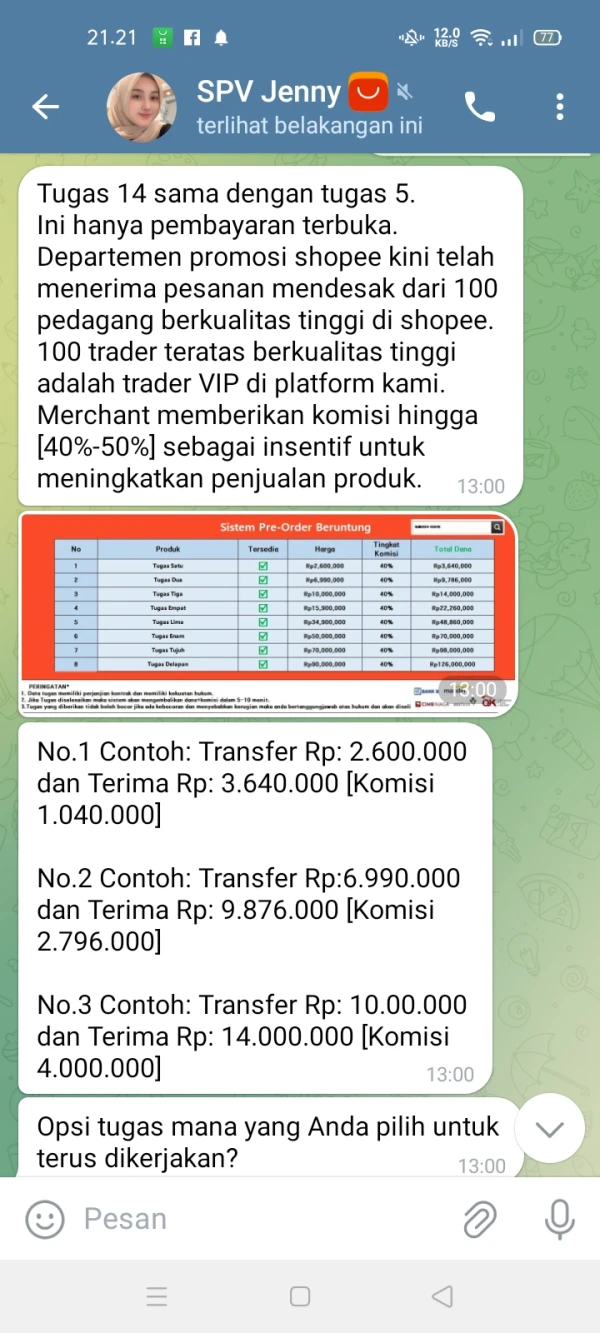

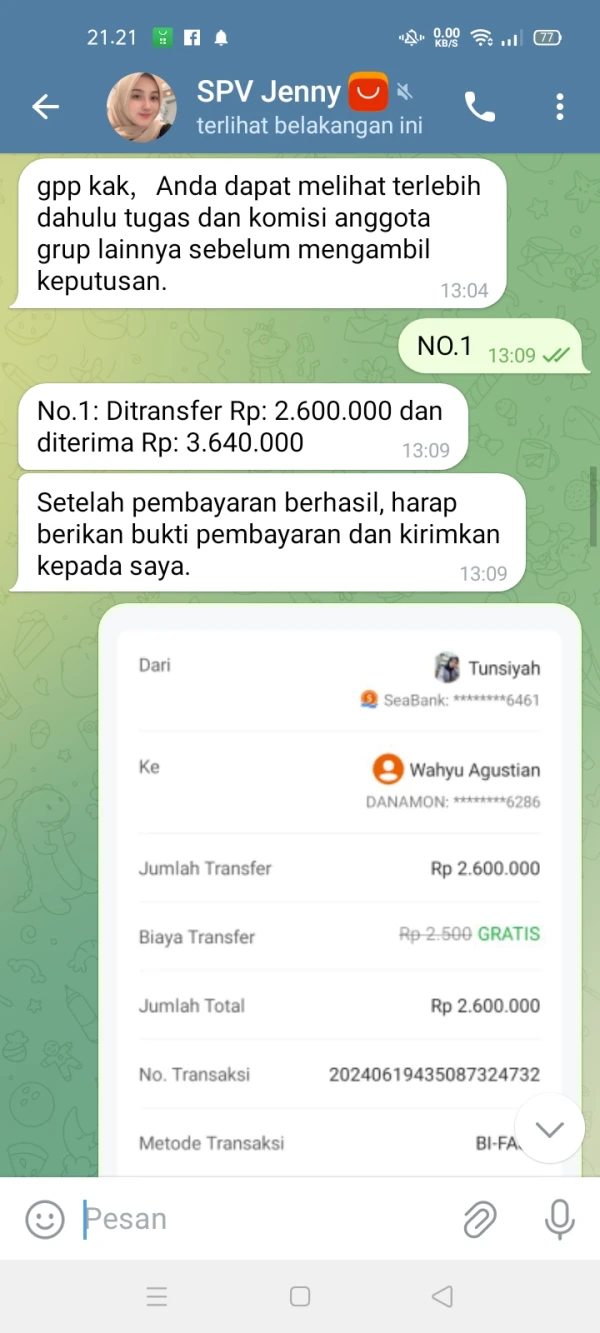

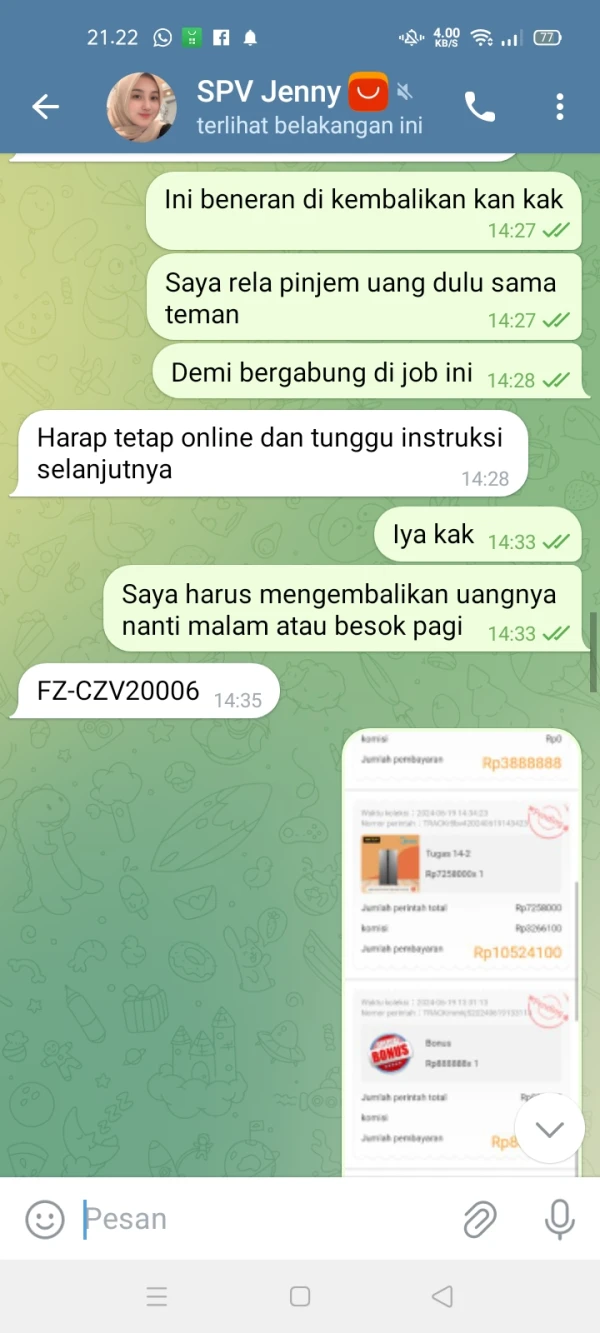

請幫忙。我損失了IDR 9,858,000,接近1000萬盧比。我是兼職工作詐騙的受害者。起初,我被分配了一項低額購買任務,我的錢和獎金一起退還。然後,我又被分配了3個購買任務,理由是必須完成所有三個任務,才能將錢和佣金一起退還。我已經轉帳了IDR 2,600,000用於第一個任務,並轉帳了IDR 7,258,000用於第二個任務。當我得到第三個任務時,我才意識到自己是詐騙的受害者。請幫助我。我使用的錢是借來的。請退還它。😭

爆料

林婷

美國

我不願意與 Allianz 進行交易,因為他們沒有任何監管許可。知道我的投資受到知名機構的保護和監督對我來說很重要。沒有執照,我不能確定安聯是否值得信賴。所以,再見了,安聯!

好評