公司簡介

| Akatsuki 評論摘要 | |

| 成立年份 | 1997 |

| 註冊國家/地區 | 日本 |

| 監管 | FSA |

| 市場工具 | 投資信託、股票、債券 |

| 模擬帳戶 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客戶支援 | 聯絡表格 |

| 電話:0120-753-960 | |

| 地址:東京都中央區日本橋小網町17-10 日本橋小網町廣場大樓5樓 | |

Akatsuki 資訊

Akatsuki 是一家成立於1997年的日本經紀商,受FSA監管。提供投資信託、股票和債券服務。

優缺點

| 優點 | 缺點 |

| 受FSA監管 | 交易信息有限 |

| 實體辦公室證實 | 收取各種費用 |

| 悠久的運營歷史 |

Akatsuki 是否合法?

Akatsuki 受日本金融廳(FSA)監管。請注意風險!

| 監管狀態 | 監管機構 | 牌照機構 | 牌照類型 | 牌照號碼 |

| 受監管 | 日本金融廳(FSA) | Akatsuki株式会社 | 零售外匯牌照 | 関東財務局長(金商)第67号 |

WikiFX 實地調查

WikiFX 的實地調查團隊訪問了 Akatsuki 的地址在日本,我們在現場找到了該公司的辦公室,這意味著該公司有實際辦公室運作。

我可以在 Akatsuki 交易什麼?

| 可交易工具 | 支援 |

| 債券 | ✔ |

| 股票 | ✔ |

| 投資信託 | ✔ |

| 外匯 | ❌ |

| 商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| 交易所交易基金 | ❌ |

| 期貨 | ❌ |

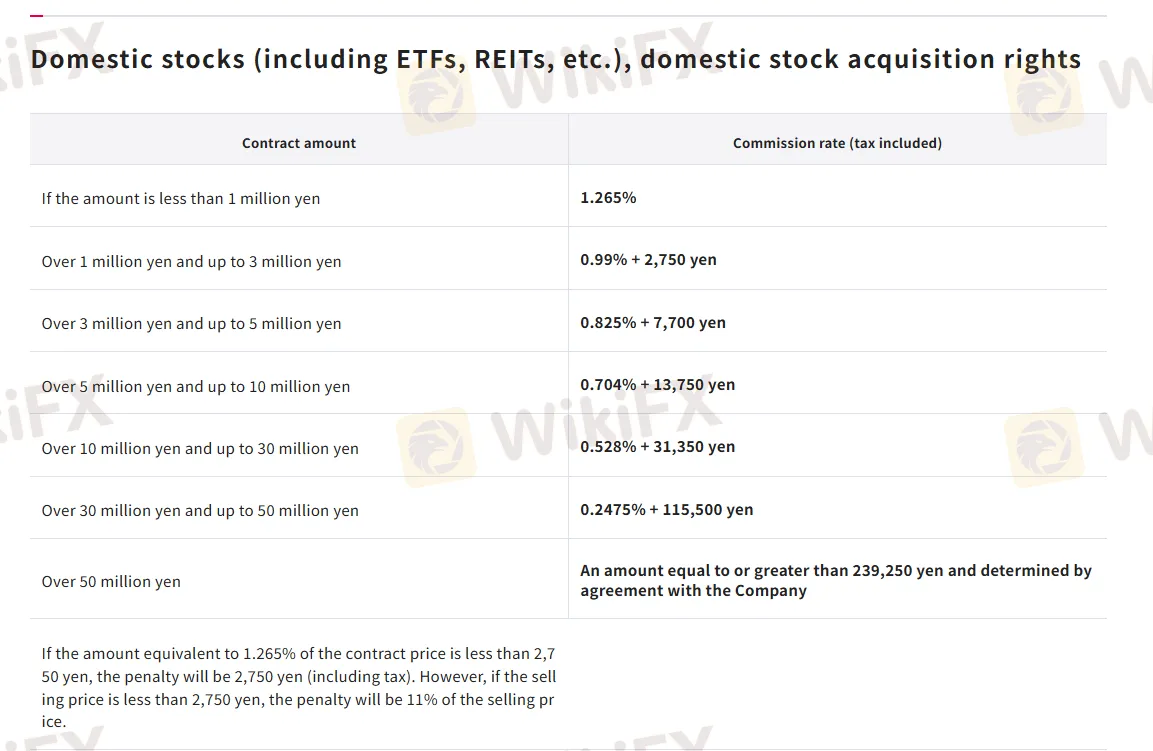

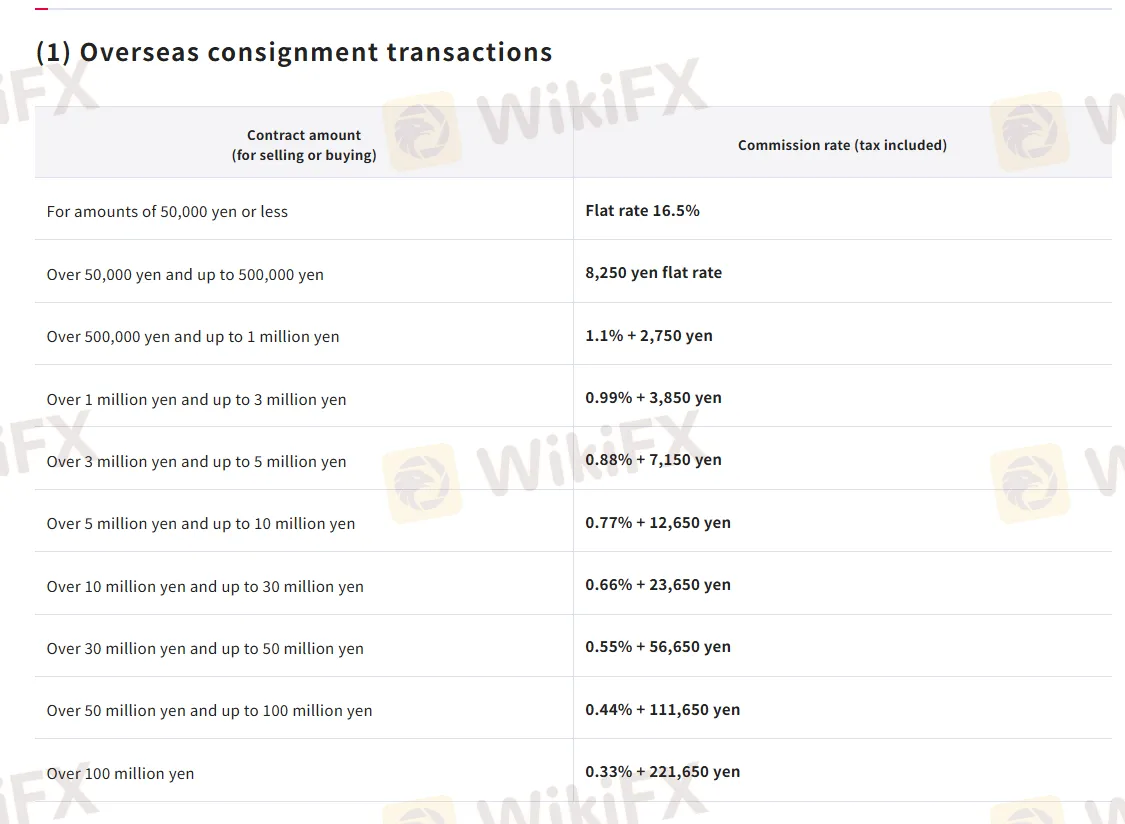

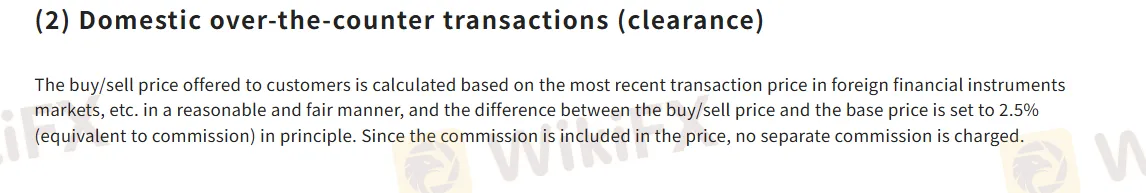

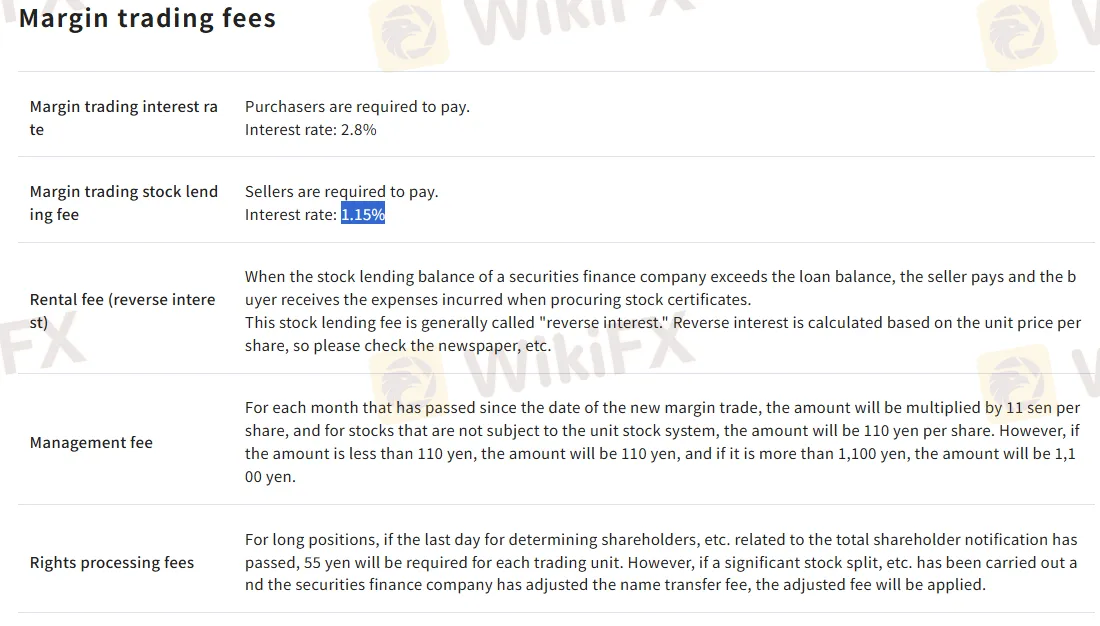

Akatsuki 費用

| 服務類型 | 基本費用 |

| 國內股票佣金率 | 0.2475% - 1.265% |

| 外國股票佣金率 | 0.33% - 16.5% |

| 國內場外交易 | 2.5% |

| 進出 | 1,100 日元 |

| 保證金交易費用 | 1.15% - 2.8% |