公司簡介

| CFE 評論摘要 | |

| 成立年份 | 1945 |

| 註冊國家/地區 | 英國 |

| 監管機構 | FCA |

| 產品或服務 | 投資銀行、股票、固定收益、股票研究、資產管理、首席經紀、現金管理 |

| 客戶支援 | 電子郵件:hari.chandra@cantor.com |

| 電話:+44 207 894 8741 | |

CFE 資訊

Cantor Fitzgerald Europe (CFE) 是一家成立已久且受FCA監管的金融機構,總部位於英國。憑藉超過80年的運營經驗和強大的全球影響力,CFE 為機構和高資產客戶提供專業服務。它是僅有的25家美國主要經銷商之一,提供多元化的投資銀行、股票和資產管理解決方案。

優點和缺點

| 優點 | 缺點 |

| 受FCA監管,具有市場製造商許可證 | 沒有零售投資者產品 |

| 超過80年的業務經驗 | 沒有交易平台的信息 |

| 廣泛的機構產品範圍和美國國債 | 沒有有關費用或槓桿的公開信息 |

CFE 是否合法?

Cantor Fitzgerald Europe (CFE) 是一家合法且受監管的機構,獲得英國金融行為監管局(FCA)授權,許可證號為149380。

CFE 可以交易什麼?

Cantor Fitzgerald Europe (CFE) 專為機構和高資產客戶設計,提供多元化的交易機會和金融服務。他們的產品包括投資銀行、股票、固定收益、股票研究、資產管理和首席服務。

| 產品 | 支援 |

| 投資銀行 | ✔ |

| 股票(包括美國國債) | ✔ |

| 固定收益 | ✔ |

| 股票研究 | ✔ |

| 資產管理 | ✔ |

| 首席經紀服務 | ✔ |

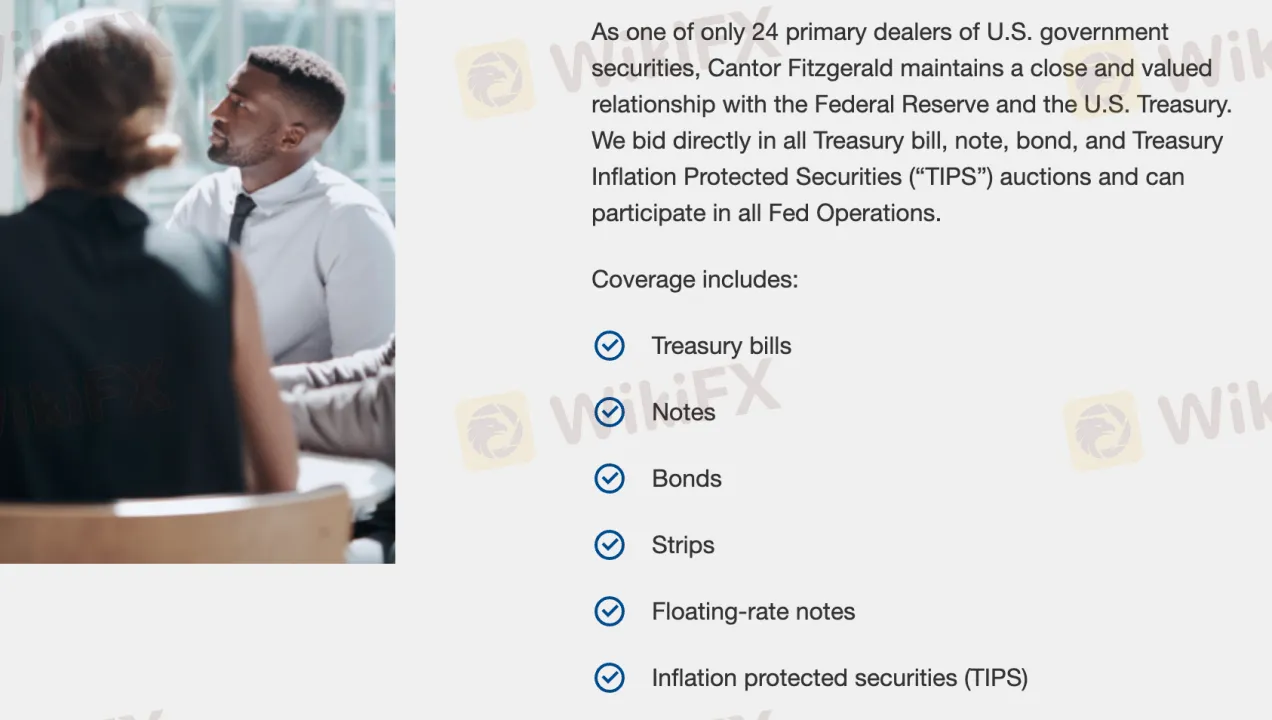

現金管理

作為美國政府證券僅有的24家主要經銷商之一,Cantor Fitzgerald Europe (CFE) 也提供強大的現金管理服務。CFE 通過直接參與美聯儲操作和美國財政部拍賣,為組織提供了全方位的現金和流動性工具。

| 現金管理 | 支援 |

| 國庫券 | ✔ |

| 國庫票據 | ✔ |

| 國庫債券 | ✔ |

| 國庫STRIPS | ✔ |

| 浮動利率票據 | ✔ |

| 通脹保護國庫證券 | ✔ |

公司統計數據

Cantor Fitzgerald Europe (CFE) 在全球60多個辦事處運營,是一家私人持有的金融公司,已經運營超過80年。作為美國僅有的25家主要經銷商之一,自2016年以來已完成超過700筆投資銀行交易,並提供對全球450多家企業的股票研究。

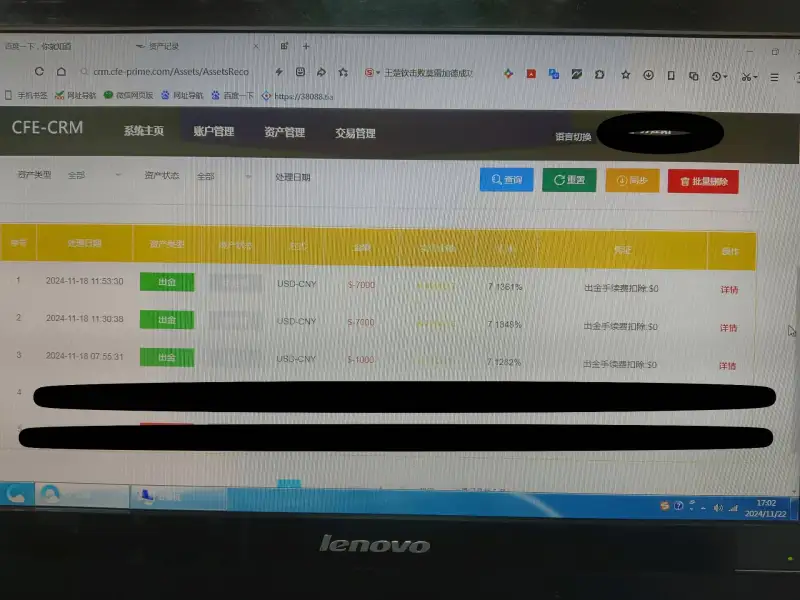

道一4256

香港

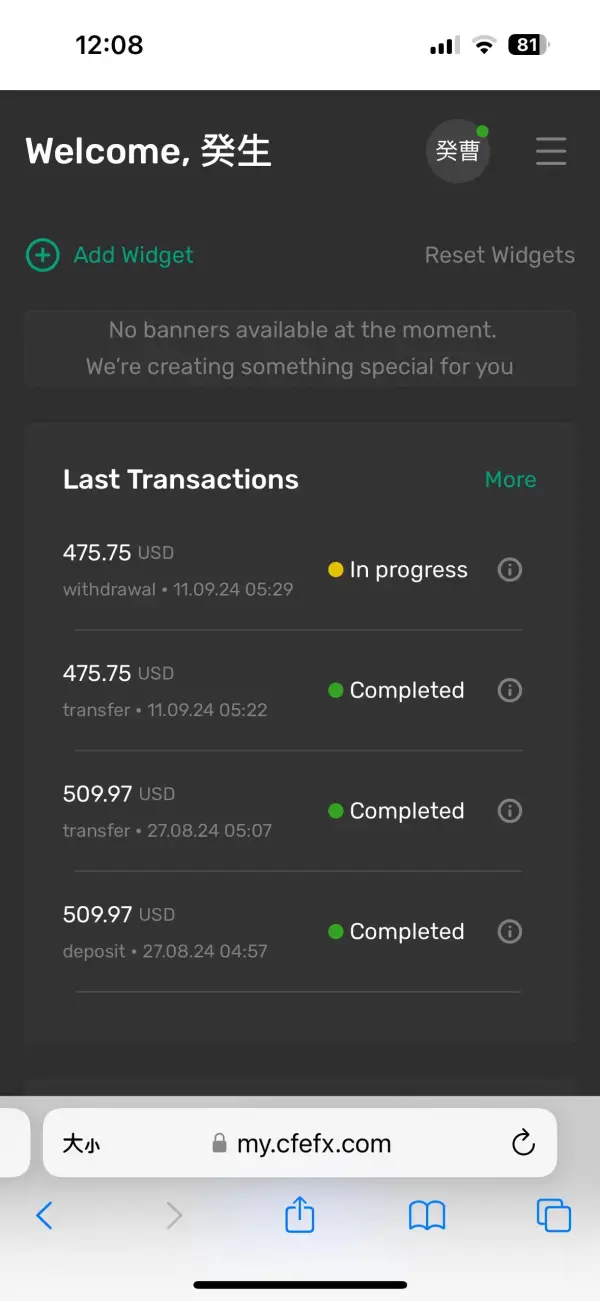

11月18日申请出出,今天23日,已经一周了,没有收到出金款,工单也没有回复

爆料

道一4256

香港

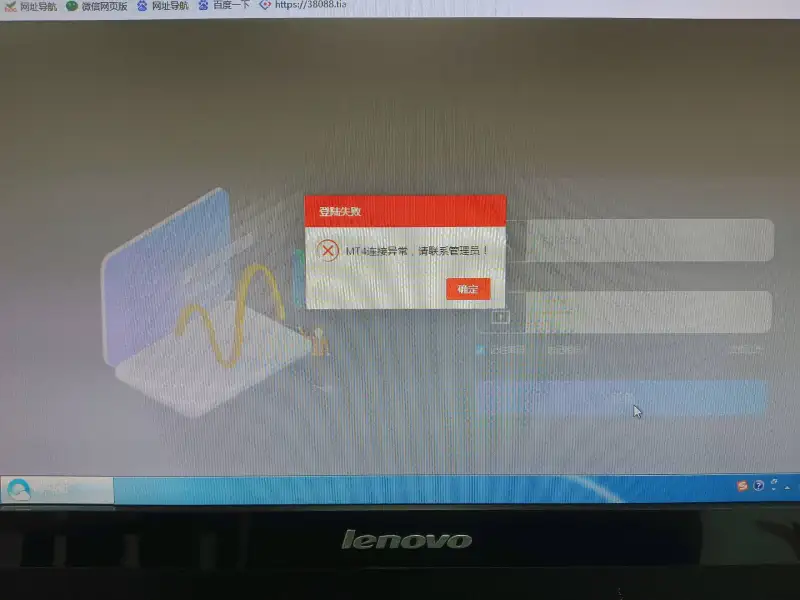

我是一名中国投资客,2024年11月18日申请出金,21日没有收到投资款,也登录不上账户

爆料

WQ

香港

现在都不能出金,等了那么久了,都不能提现

爆料

小螺号9404

香港

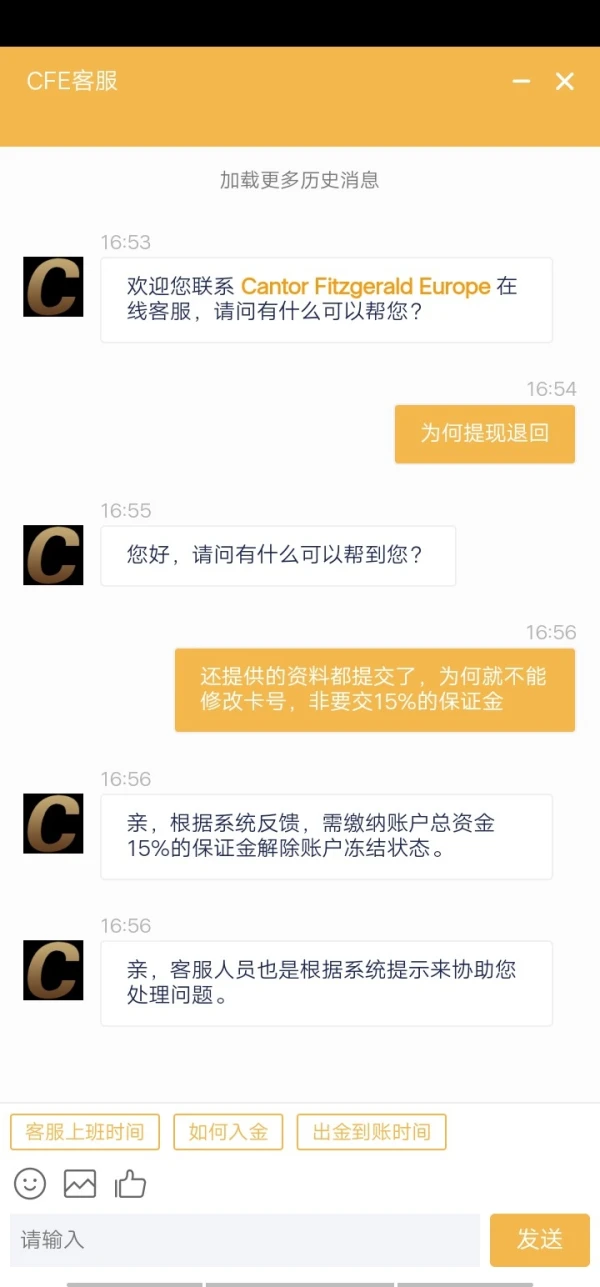

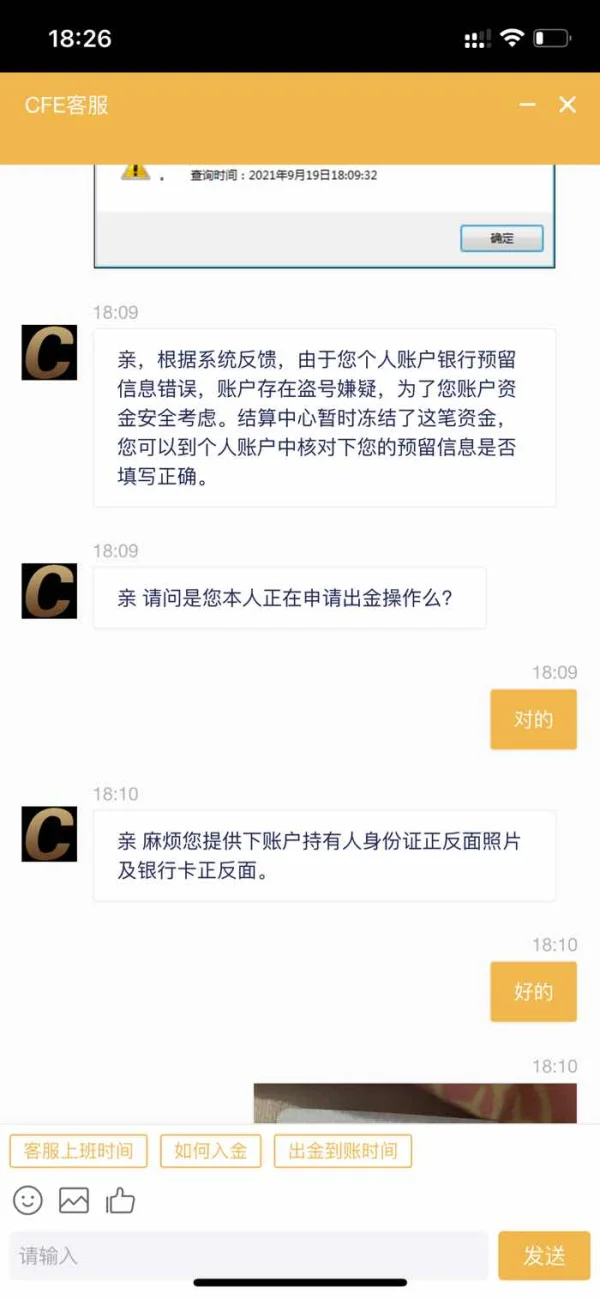

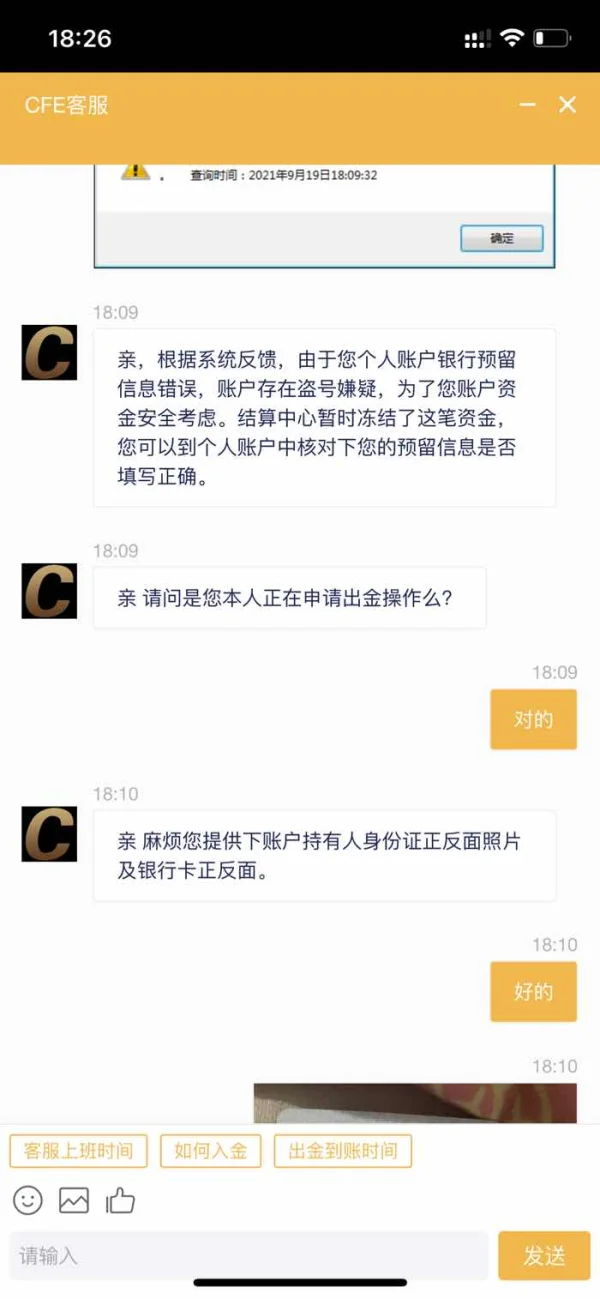

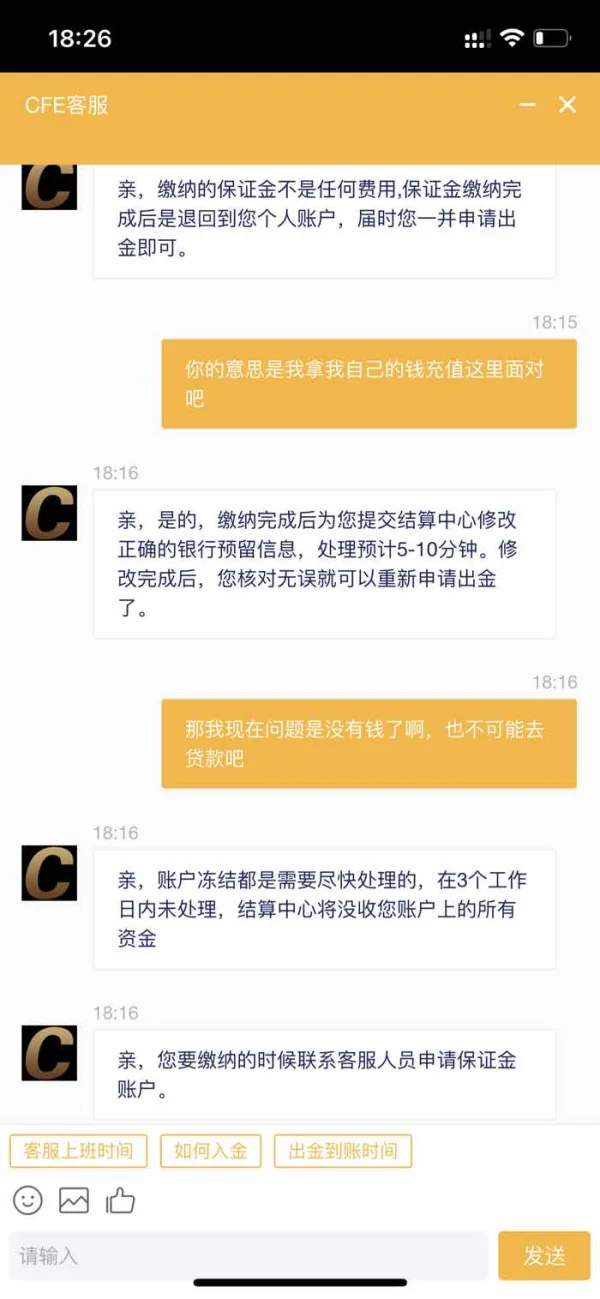

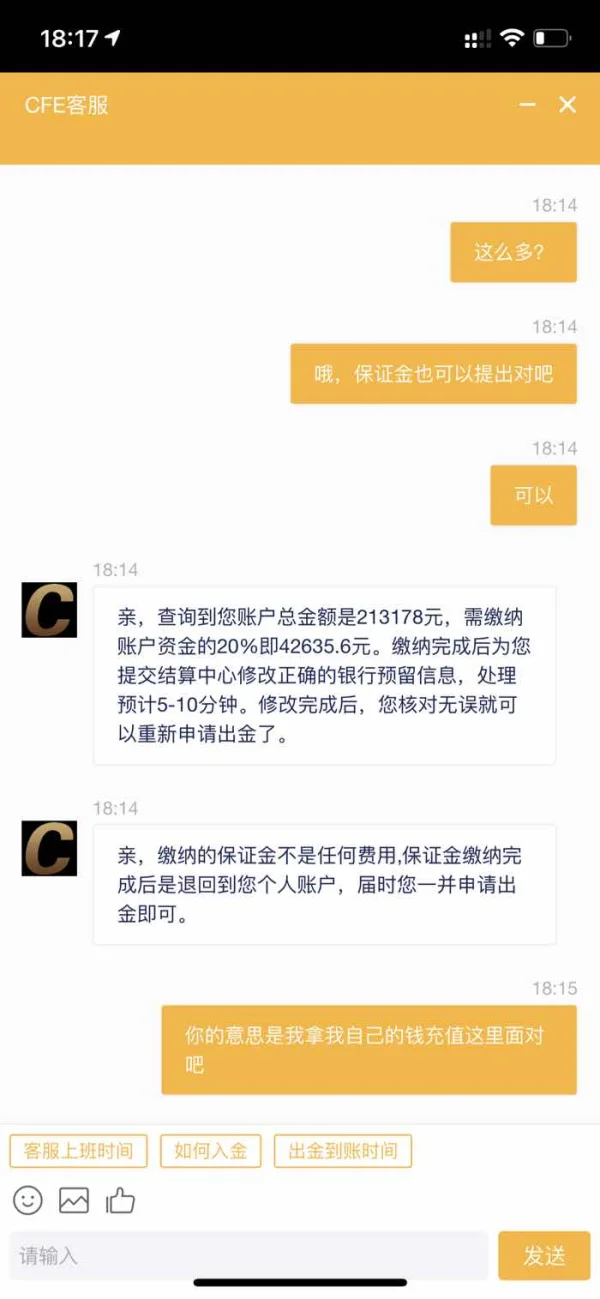

提现后退回冻结,说我卡号输错了,这么大笔巨款不核对十遍至少也得核对五遍才提交,怎么可能输错,资料全提供了,非得交15%保证金,是何道理

爆料

長樂

香港

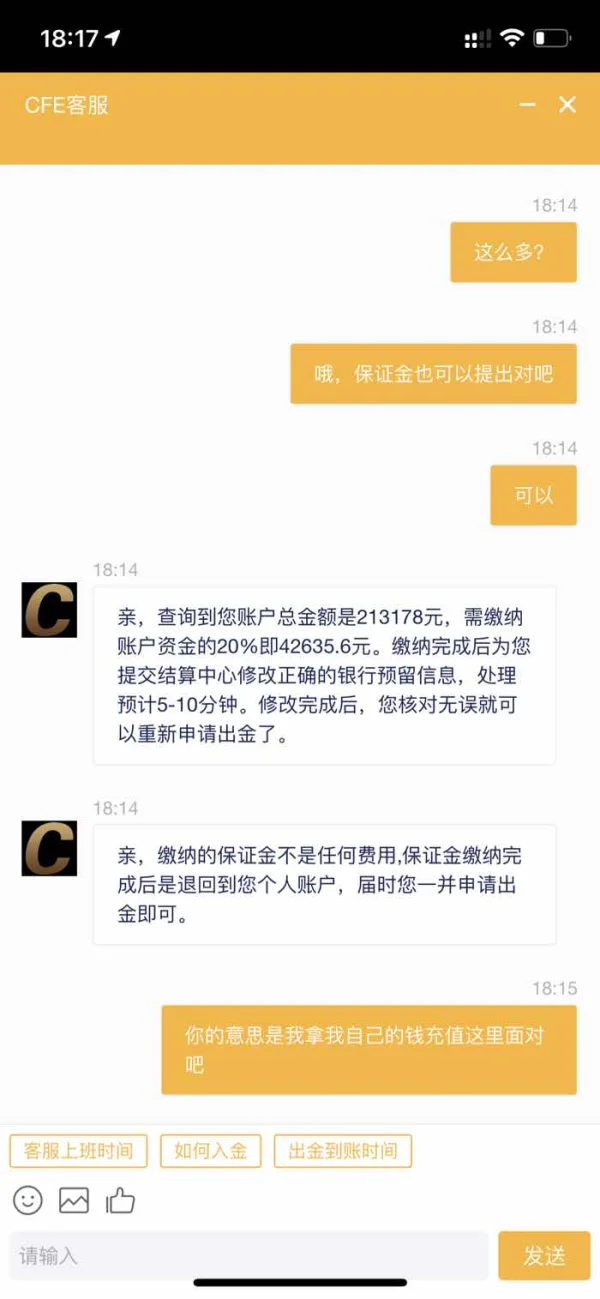

我就把银行卡号输反2位,找客服修改银行卡,他不修改还要我在充值百分之二十才给修改

爆料

長樂

香港

我就把银行卡号输反2位,找客服修改银行卡,他不修改还要我在充值百分之二十才给修改

爆料