公司簡介

| SBI Securities Review Summary | |

| 成立年份 | 1999 |

| 註冊國家/地區 | 日本 |

| 監管機構 | FSA |

| 市場工具 | 外匯、股票、債券、ETF、共同基金、差價合約、黃金/白金、NISA、iDeCo |

| 模擬帳戶 | 可用 |

| 槓桿 | 最高1:25(外匯) |

| 點差 | 外匯對從1點起(CFD為0.5點) |

| 交易平台 | 專有的網絡和移動平台,HYPER SBI |

| 最低存款 | ¥10,000 |

| 客戶支援 | 電話:0120-104-214 |

| 電郵:contact@sbisec.co.jp | |

| 24/7 在線聊天:否 | |

| 實體地址:日本 | |

SBI Securities 資訊

SBI Securities 成立於1999年,總部位於日本,受FSA監管。它提供外匯、股票、債券、ETF、共同基金等多種市場工具,外匯交易槓桿可達1:25。該平台提供專有的網絡和移動交易系統,包括HYPER SBI,最低存款為¥10,000。

優點與缺點

| 優點 | 缺點 |

| 超過150種金融產品和服務 | 外匯槓桿有限(最高1:25) |

| 提供NISA和iDeCo帳戶以享受稅收優惠 | 無24/7客戶支援 |

| 受FSA監管 |

SBI Securities 是否合法?

| 當前狀態 | 受監管 |

| 許可證類型 | 零售外匯許可證 |

| 監管機構 | 日本 |

| 許可證號碼 | 関東財務局長(金商)第44号 |

| 許可證機構 | 株式会社SBI証券 |

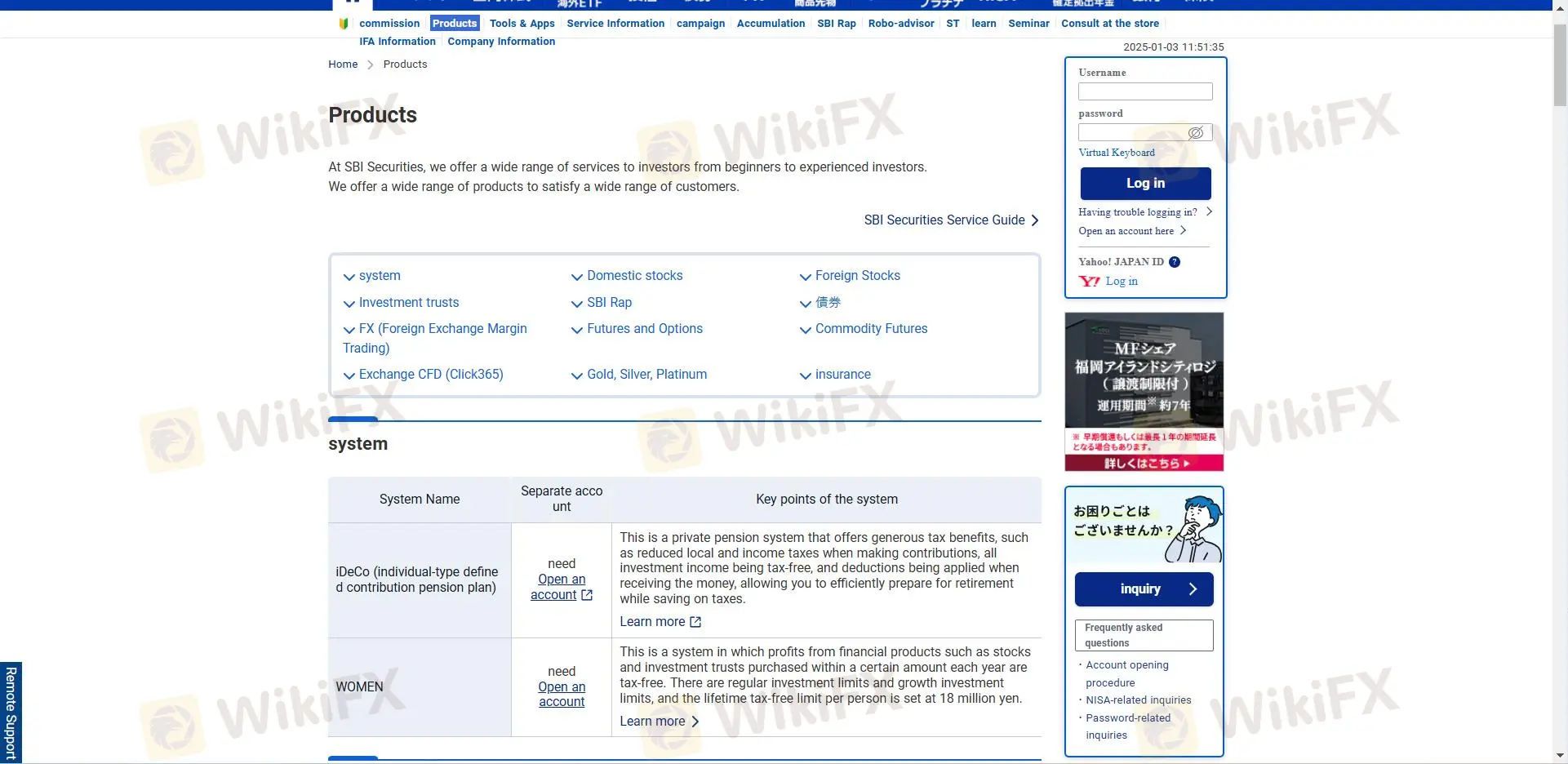

我可以在 SBI Securities 上交易什麼?

SBI Securities 提供150多種股票、30多種貨幣對以及各種ETF、共同基金和債券。

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 股票(海外和日本股票) | ✔ |

| ETF(海外) | ✔ |

| 共同基金 | ✔ |

| 債券 | ✔ |

| 商品 | ✔ |

| 期權 | ✔ |

| 加密貨幣 | ❌ |

槓桿

SBI Securities 只提供外匯對的1:25槓桿。

帳戶類型

SBI Securities 提供多種帳戶類型:常規投資帳戶、NISA帳戶和iDeCo養老金帳戶。

也提供模擬帳戶。

| 帳戶類型 | 最低存款 | 特點 |

| 常規帳戶 | ¥10,000 | 可訪問所有產品和服務 |

| NISA帳戶 | ¥0 | 享受稅收優惠的投資 |

| iDeCo養老金帳戶 | 可變 | 養老金專用稅收優惠 |

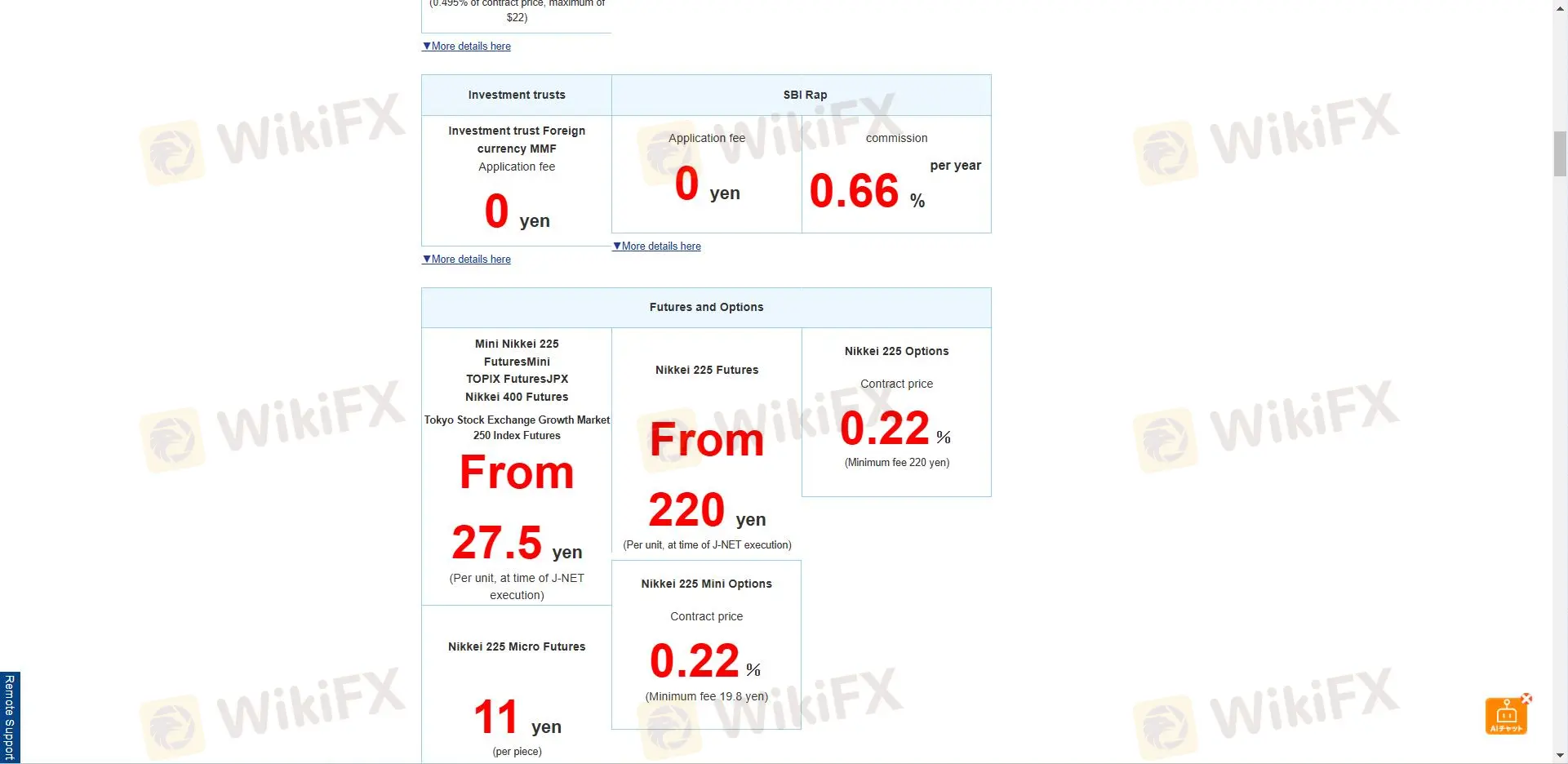

SBI Securities 費用

SBI Securities 提供指定費用的國內股票轉移(不同名稱)和 ¥3,300 的投資信託轉移,並提供免費的帳戶管理、存款、提款和大部分轉移。

交易費用

| 服務 | 費用 |

| 國內股票 | 每筆交易起始 ¥99 |

| 投資信託 | 根據基金不同(需支付管理費) |

| 外匯(FX) | 僅限於1點差價 |

| ETF/ETN | 根據發行人不同 |

| REITs | 根據發行人不同 |

| 債券 | 根據債券類型 |

| 差價合約(CFDs) | 僅限於0.5點差價 |

非交易費用

| 服務 | 費用 |

| 開戶和管理 | 免費 |

| 銀行轉帳存款 | 由客戶支付轉帳費用 |

| 即時存款/實時存款 | 免費 |

| 提款 | 免費 |

| 國內股票轉移 | 免費(同名) |

| 國內股票轉移(不同名稱) | 每個品牌 ¥2,200(含稅) |

| 投資信託轉移 | 免費(同名)/ 每個品牌 ¥3,300(含稅) |

| 國外股票轉移 | 免費(同名)/ 每個品牌 ¥2,200(含稅) |

付費服務(可選)

| 服務 | 費用 |

| 高級新聞 | 每月 ¥37,125(含稅) |

| 即時美股價格 | 每月 ¥550(含稅) |

| BroadNewsStreet | 每月 ¥330(含稅) |

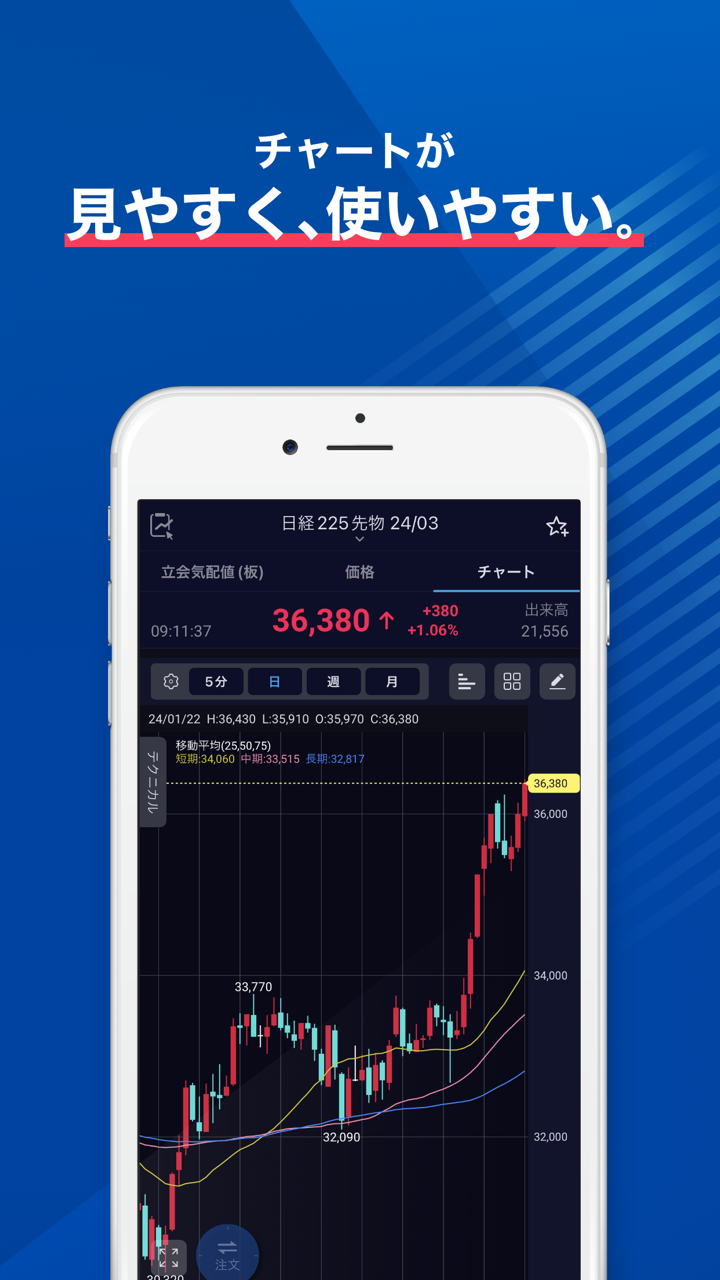

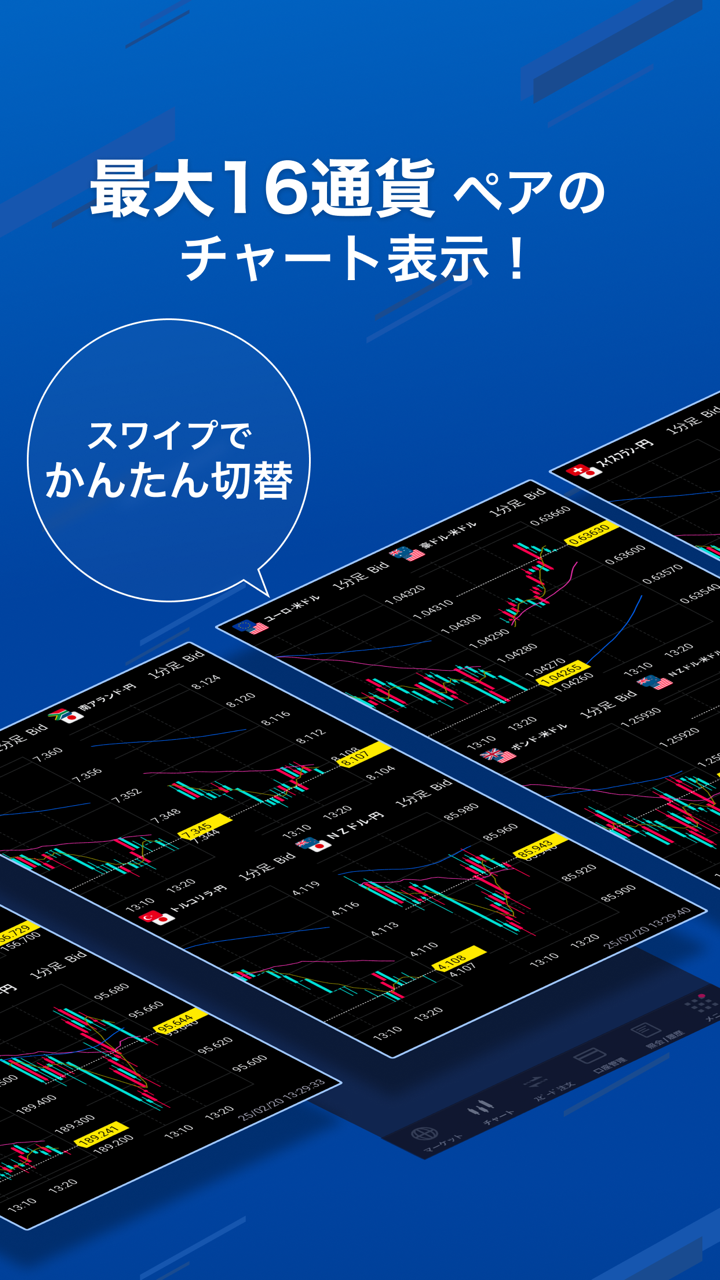

交易平台

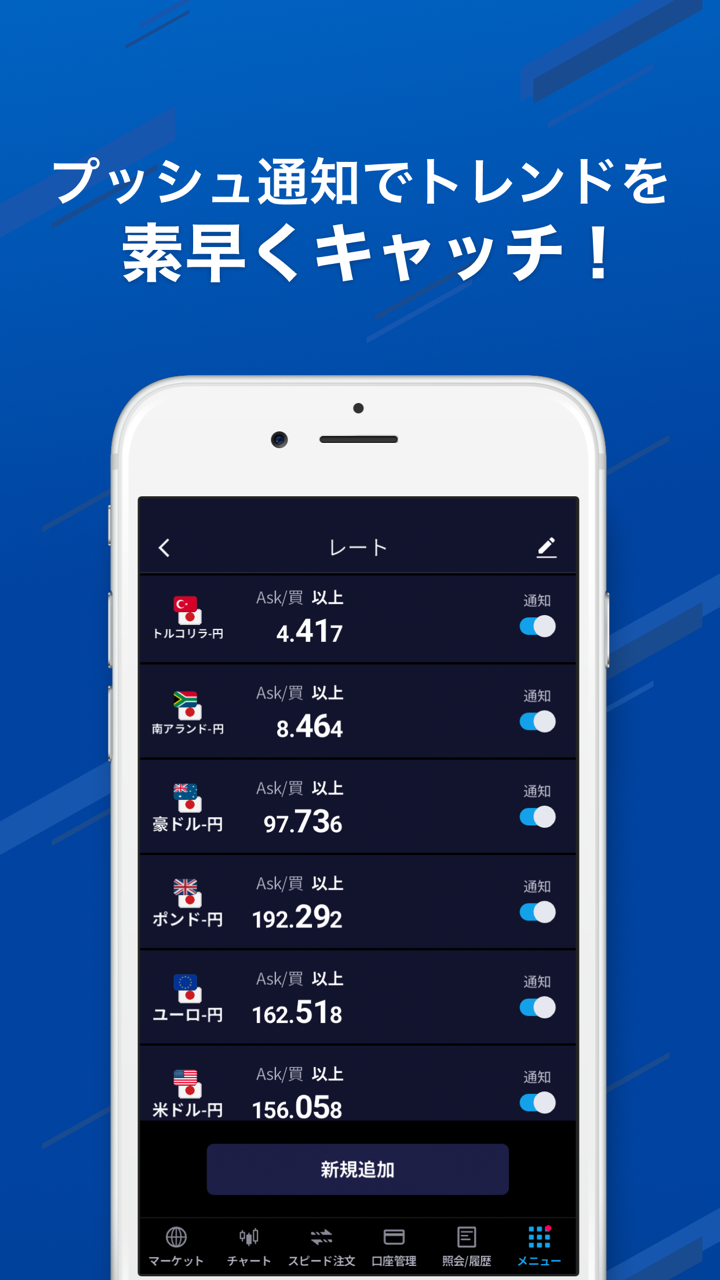

SBI 提供不同的應用程式供不同的產品使用。

| 交易平台 | 支援 | 可用設備 | 適用對象 |

| HYPER SBI | ✔ | Windows、macOS | 股票交易者 |

| SBI 手機應用程式 | ✔ | iOS、Android | 隨時隨地進行交易 |

| 不同產品的獨立應用程式(SBI 股票應用程式、國內股票智能手機網站等) | ✔ | Web | 一般和零售交易者 |

存款和提款

SBI Securities 不收取提款或存款費用。帳戶類型決定最低存款金額,標準帳戶為 ¥10,000 起。

zr1

香港

SBI Securities作为一家有着15-20年历史的日本监管下的全球展业公司,在零售外汇领域表现稳定。优点是其悠久的历史和良好的监管背景,给投资者带来一定的信任感。然而,缺点可能包括服务的地域限制和可能存在的手续费较高问题,这些因素可能影响部分客户的投资体验。总体而言,SBI Securities是一家值得信赖但有改进空间的证券公司

中評

zr2

香港

优点:这个平台提供了全面的在线交易服务,支持实时行情、交易执行和市场分析。系统稳定,资金安全,用户可以快速开始交易。客服响应迅速,能够及时解决问题,并支持多种语言,使用起来非常方便 不足:与其他平台相比,佣金略高。量化策略编辑器等专业工具的掌握难度较大,交易效率可能受到影响。中文版研究报告有时会出现延迟,部分合约缺乏详细的中文版本

中評

a

香港

优点:这个平台提供了全面的在线交易服务,支持实时行情、交易执行和市场分析。系统稳定,资金安全,用户可以快速开始交易。客服响应迅速,能够及时解决问题,并支持多种语言,使用起来非常方便。 不足:与其他平台相比,佣金略高。量化策略编辑器等专业工具的掌握难度较大,交易效率可能受到影响。中文版研究报告有时会出现延迟,部分合约缺乏详细的中文版本

中評

好运连连55

香港

SBI提供的服务总体上令人满意,最重要的是,这是一家安全的公司,不会欺骗投资者。

好評

FX1243896738

英國

這家公司好像很安全,可惜我不是日本人。一方面,我無法閱讀他們的網站。另一方面,我擔心在交易和聯繫客服時會遇到問題。

中評

虎头蛇尾

香港

只在這個平臺上交易過外匯貨幣對,點差還不錯蠻窄的,交易環境也能不錯,就是杠桿有點保守,不適合剝頭皮交易者和專業的交易者。沒有實時的客服支持也是一個缺點。

中評

哦哦URL魔图

秘魯

SBI 提供的服務總體上令人滿意。最重要的是,這是一家安全的公司,不會騙您的錢。

好評

十指丶紧扣°

香港

SBI Securities的官方網站太複雜了,我不太容易找到我想要的。儘管許多投資者更喜歡這家經紀商,但我寧願不投資它。

中評

夏35216

香港

我已經存入初始資金。迫不及待地想看看會發生什麼!

好評