公司簡介

| BitMart 審查摘要 | |

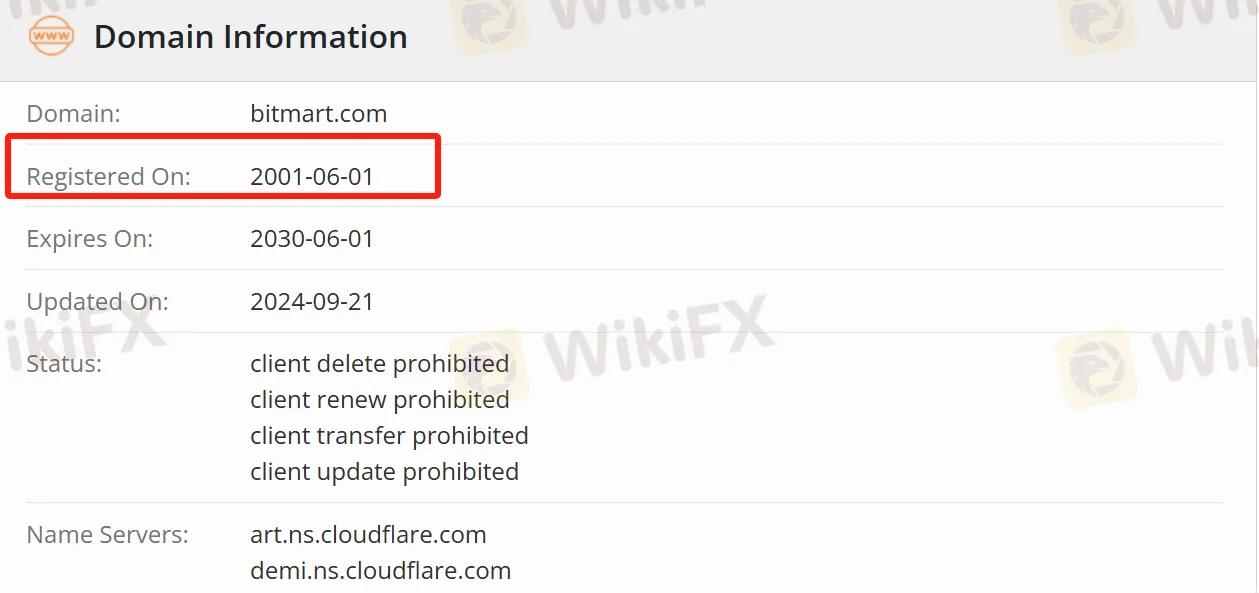

| 註冊日期 | 2001-06-01 |

| 註冊國家/地區 | 紐西蘭 |

| 監管 | 已撤銷 |

| 市場工具 | 1,700種加密貨幣、期貨 |

| 模擬交易 | ✅ |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | BitMart(網頁和手機) |

| 最低存款 | / |

| 客戶支援 | Twitter、Telegram、Facebook、Instagram、YouTube、LinkedIn、TikTok等 |

BitMart 資訊

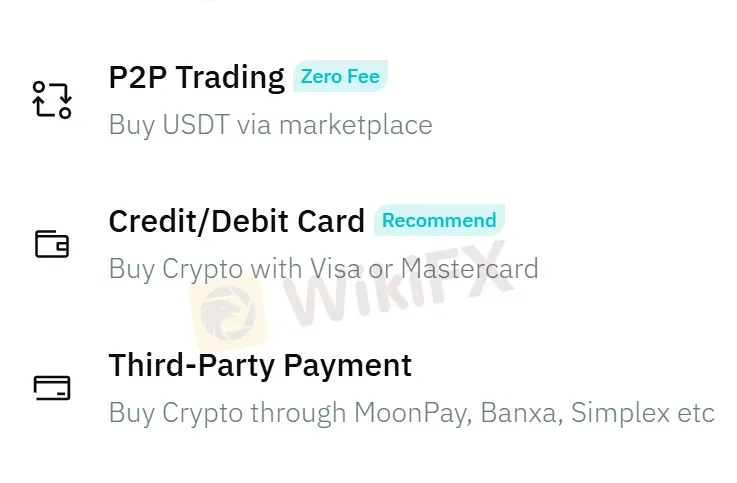

BitMart 是一個針對全球用戶的加密貨幣交易平台,支援超過1,700種加密貨幣,提供各種交易類型,如現貨交易、保證金交易和期貨。它還支持使用法定貨幣購買加密貨幣,讓用戶可以通過Google Pay、Apple Pay、信用卡/借記卡、MoonPay、Banxa和Simplex等第三方支付方式方便地購買硬幣,並提供全天候7x24小時支援,隨時回應需求。

優缺點

| 優點 | 缺點 |

| 超過1,700種加密貨幣 | 未受監管 |

| 可進行複製交易 | 未提供具體的費用信息 |

| 豐厚的活動獎勵 | 帳戶信息不清晰 |

| 50%交易手續費折扣(對VIP會員) |

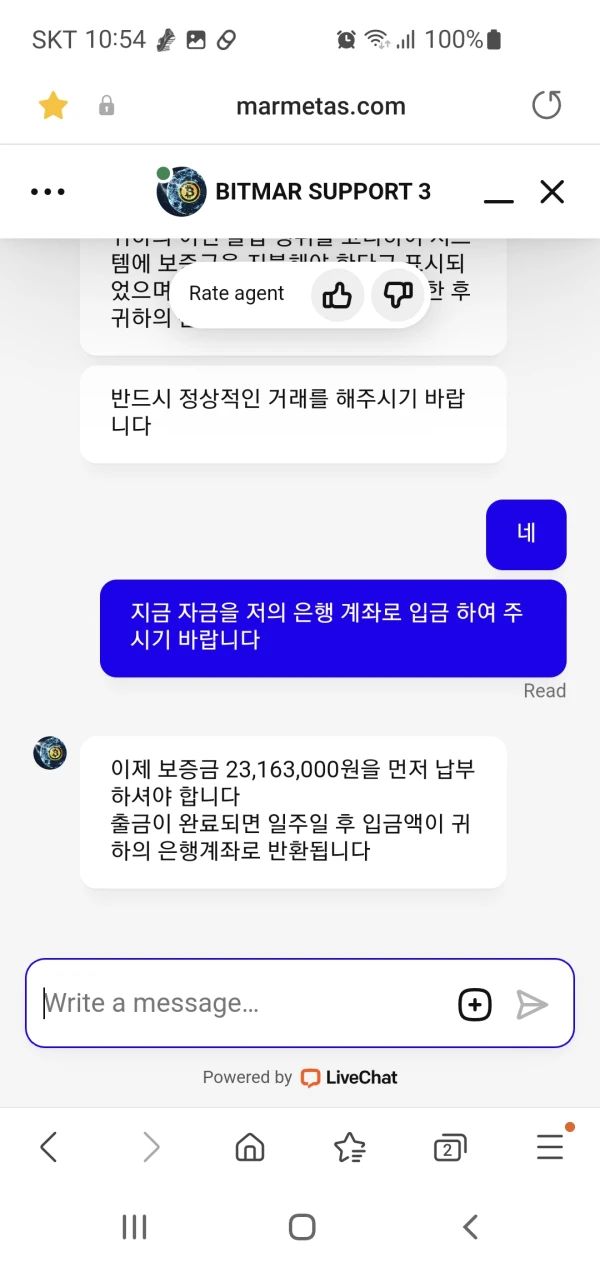

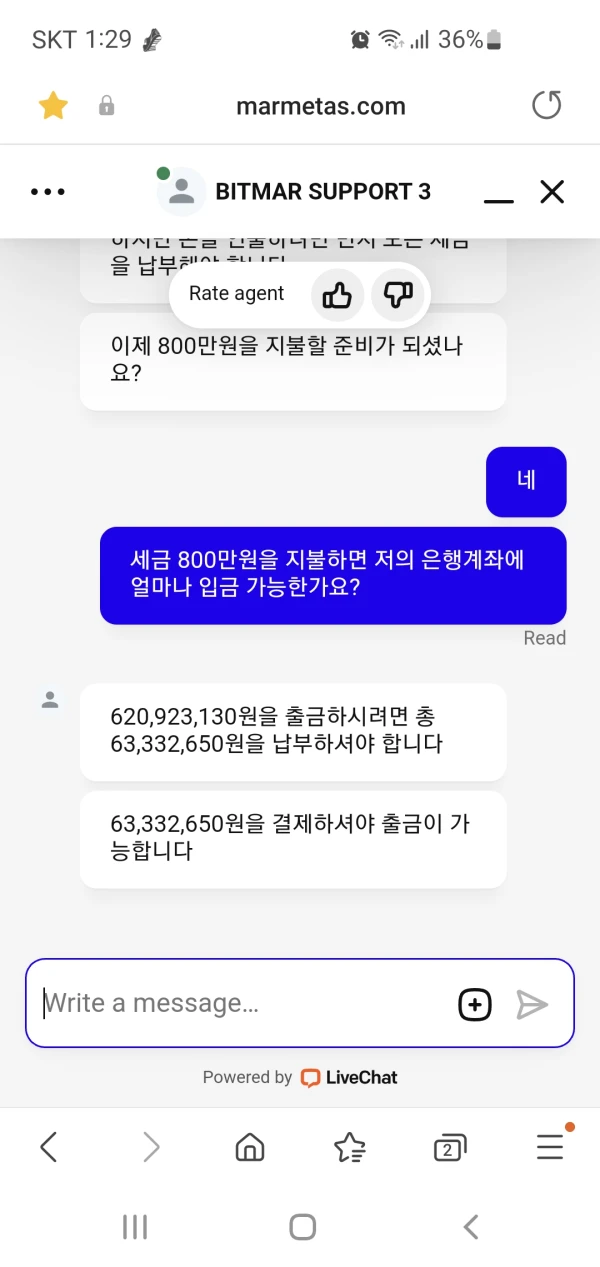

BitMart 是否合法?

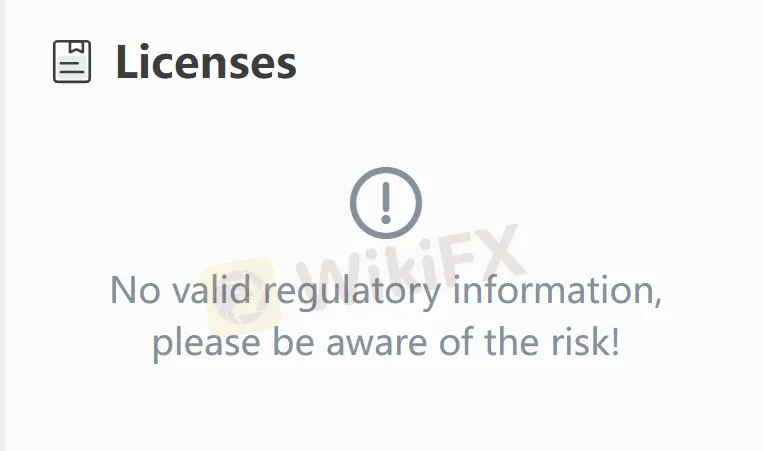

BitMart 在加密貨幣交易領域經營多年,但未受監管。建議交易者優先考慮由權威監管機構監管的經紀商。

我可以在 BitMart 交易什麼?

在 BitMart 上,交易者可以進行各種類型的交易。對於現貨交易,有超過1,700種加密貨幣可供選擇;期貨交易支持100多種加密貨幣交易對。

BitMart 費用

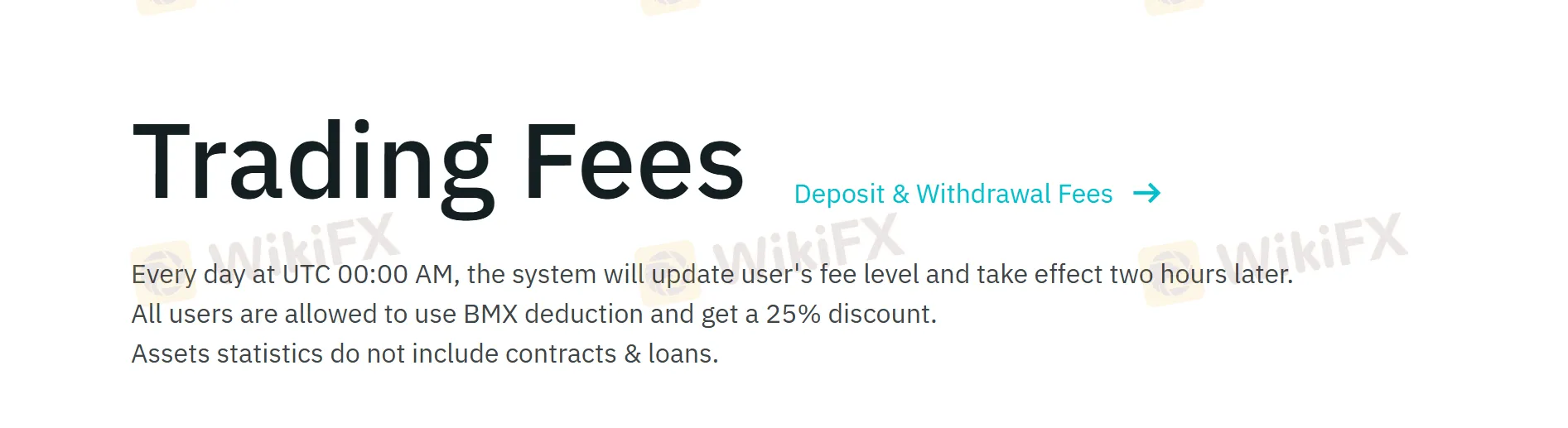

每天UTC時間00:00,系統將更新用戶的交易手續費分層,兩小時後生效。所有交易者均可使用BMX進行抵扣,並享受25%折扣。

槓桿

在期貨交易中,BitMart 提供高達100倍的槓桿,適合具有深入市場知識和高風險承受能力的投資者。

交易平台

BitMart 交易平台支持多終端訪問,包括基於網頁和移動設備。

存款和提款

交易者可以通過信用卡/借記卡和第三方支付方式(如MoonPay、Banxa、Simplex、Visa和Mastercard)購買加密貨幣。

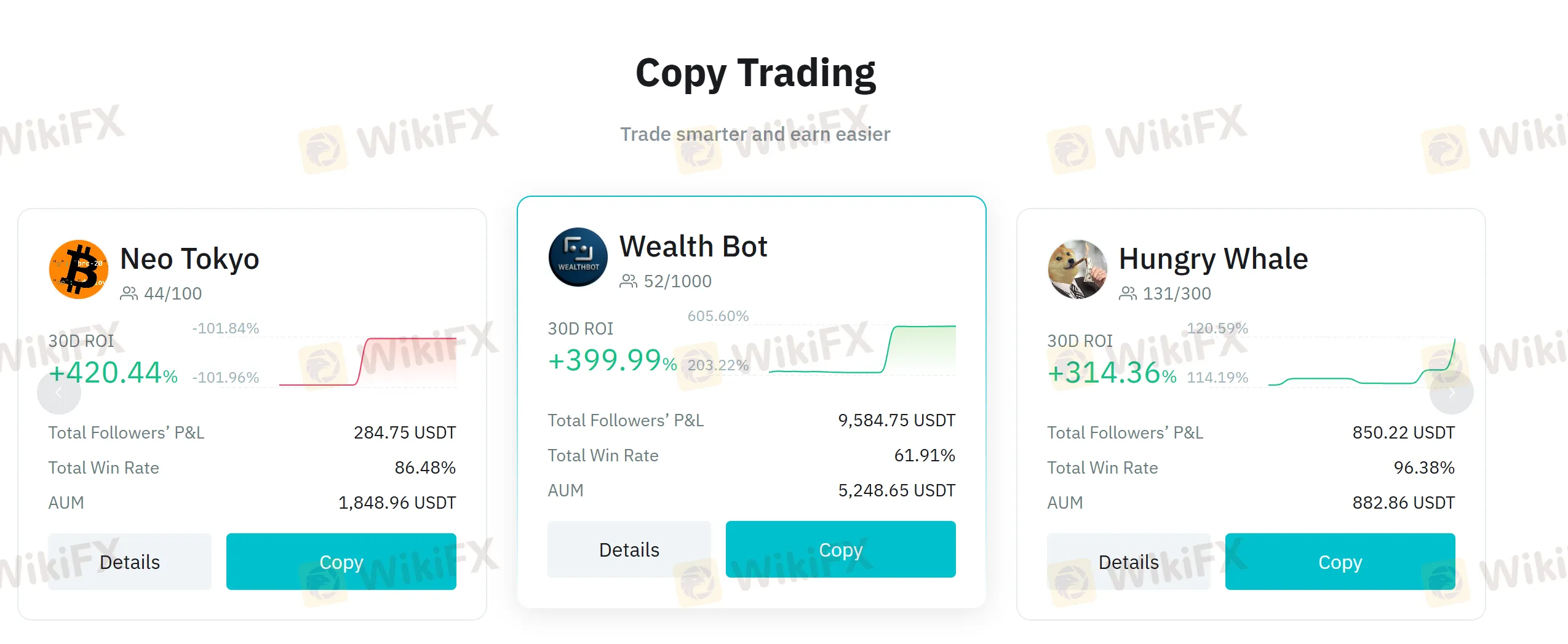

複製交易

複製交易是BitMart的一個重要功能。系統具有默認的0.5%滑點保護機制。當市場波動導致滑點超過此值時,複製交易將自動暫停,適合缺乏交易經驗或時間的投資者。

獎金

該平台提供各種有獎活動,目前為北美用戶提供獨家的加密貨幣購買比賽。從2025年5月23日UTC時間00:00:00至2025年5月29日UTC時間23:59:59期間,使用美元和加幣等法定貨幣購買加密貨幣的前100名北美用戶將分享總值3,000 USDT的獎池。

| 排名 | 總獎勵(USDT) |

| 第1名 | 288 |

| 2 - 10名 | 792 |

| 11 - 30名 | 870 |

| 31 - 100名 | 1,050 |