Unternehmensprofil

| BitMart Überprüfungszusammenfassung | |

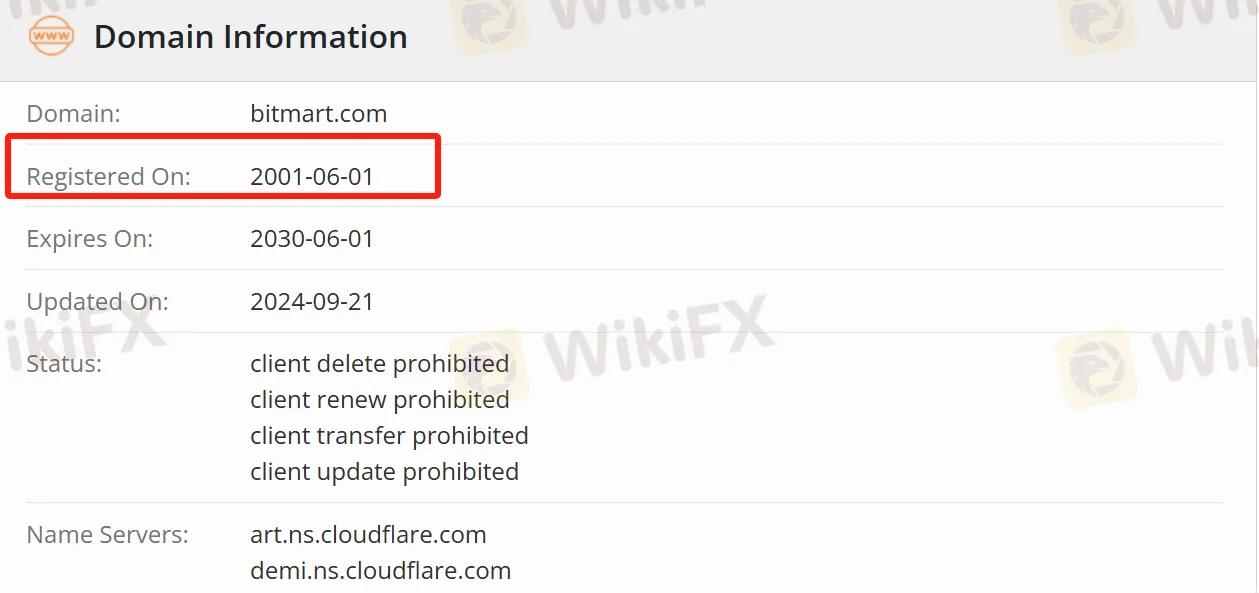

| Registriert am | 2001-06-01 |

| Registriertes Land/Region | Neuseeland |

| Regulierung | Widerrufen |

| Marktinstrumente | 1.700 Kryptowährungen, Futures |

| Simulationshandel | ✅ |

| Hebel | / |

| Spread | / |

| Handelsplattform | BitMart (Web und Mobil) |

| Mindesteinzahlung | / |

| Kundenbetreuung | Twitter, Telegram, Facebook, Instagram, YouTube, LinkedIn, TikTok, etc. |

BitMart Informationen

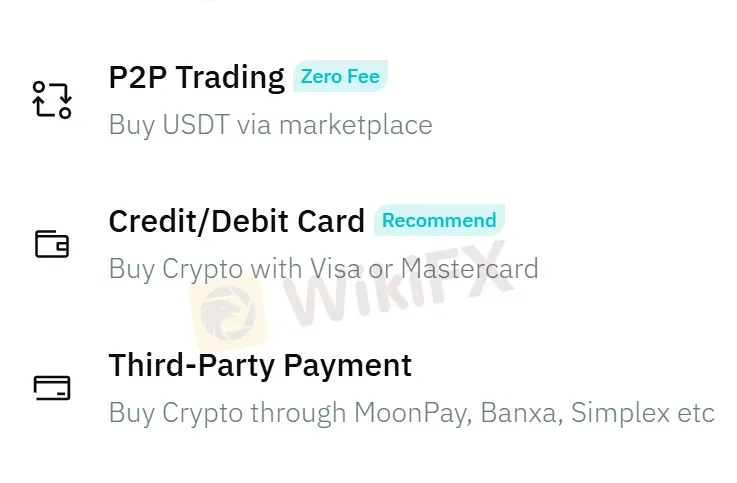

BitMart ist eine Kryptowährungs-Handelsplattform für globale Benutzer, die über 1.700 Kryptowährungen unterstützt und verschiedene Handelstypen wie Spot-Handel, Margin-Handel und Futures anbietet. Es unterstützt auch den Kauf von Kryptowährungen mit Fiat-Währung, sodass Benutzer bequem Münzen über Drittanbieter-Zahlungsmethoden wie Google Pay, Apple Pay, Kredit-/Debitkarten, MoonPay, Banxa und Simplex kaufen können, mit einem 7×24-Stunden-Support, um jederzeit auf Bedürfnisse zu reagieren.

Vor- und Nachteile

| Vorteile | Nachteile |

| Über 1.700 Kryptowährungen | Unreguliert |

| Copy-Trading verfügbar | Unspezifische Gebühreninformationen |

| Großzügige Aktivitätsbelohnungen | Unklare Kontoinformationen |

| 50% Handelsgebührenrabatt (für VIPs) |

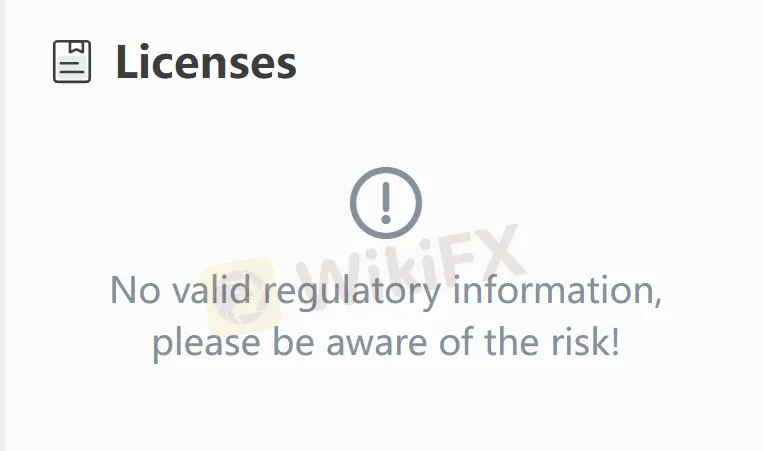

Ist BitMart legitim?

BitMart ist seit vielen Jahren im Bereich des Kryptowährungshandels tätig, jedoch unreguliert. Es wird empfohlen, dass Trader Broker priorisieren, die von autoritativen Regulierungsbehörden reguliert werden.

Was kann ich auf BitMart handeln?

Auf BitMart können Trader verschiedene Arten von Transaktionen durchführen. Für den Spot-Handel stehen über 1.700 Kryptowährungen zur Auswahl; der Futures-Handel unterstützt mehr als 100 Kryptowährungspaare.

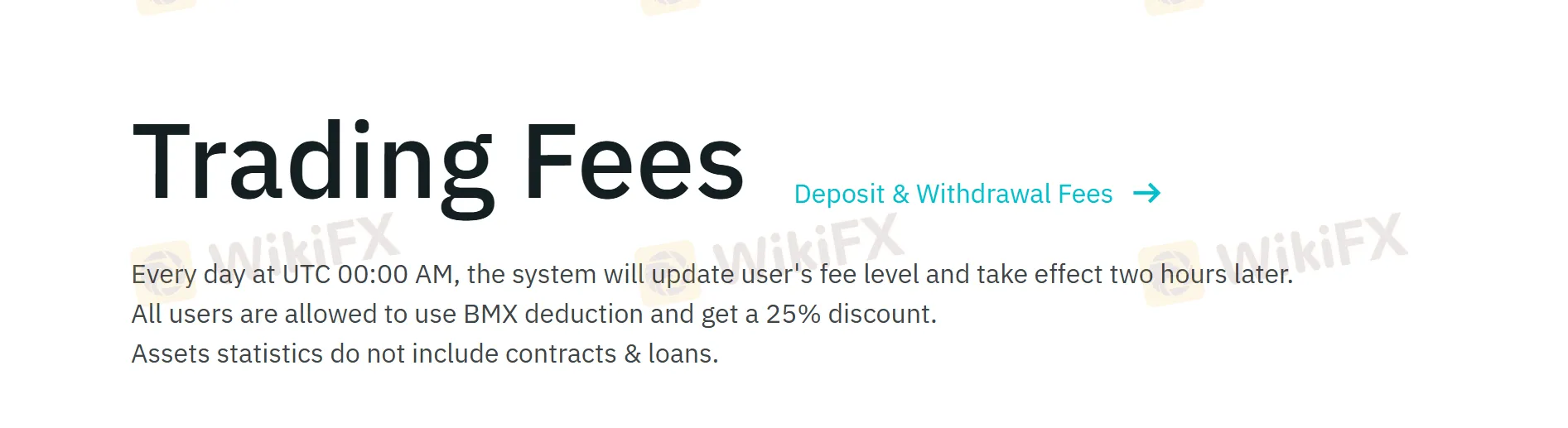

BitMart Gebühren

Um 00:00 UTC jeden Tag aktualisiert das System die Transaktionsgebührenstufen der Benutzer, die zwei Stunden später in Kraft treten. Alle Trader können BMX zur Abrechnung verwenden und einen 25% Rabatt genießen.

Hebel

Im Futures-Handel bietet BitMart eine Hebelwirkung von bis zu 100x, was es für Anleger mit fundierten Marktkenntnissen und hoher Risikotoleranz geeignet macht.

Handelsplattform

Die Handelsplattform von BitMart unterstützt den Zugriff über mehrere Terminals, einschließlich webbasierter und mobiler Geräte.

Ein- und Auszahlung

Händler können Kryptowährungen über Kredit-/Debitkarten und Drittanbieter-Zahlungsmethoden wie MoonPay, Banxa, Simplex, Visa und Mastercard erwerben.

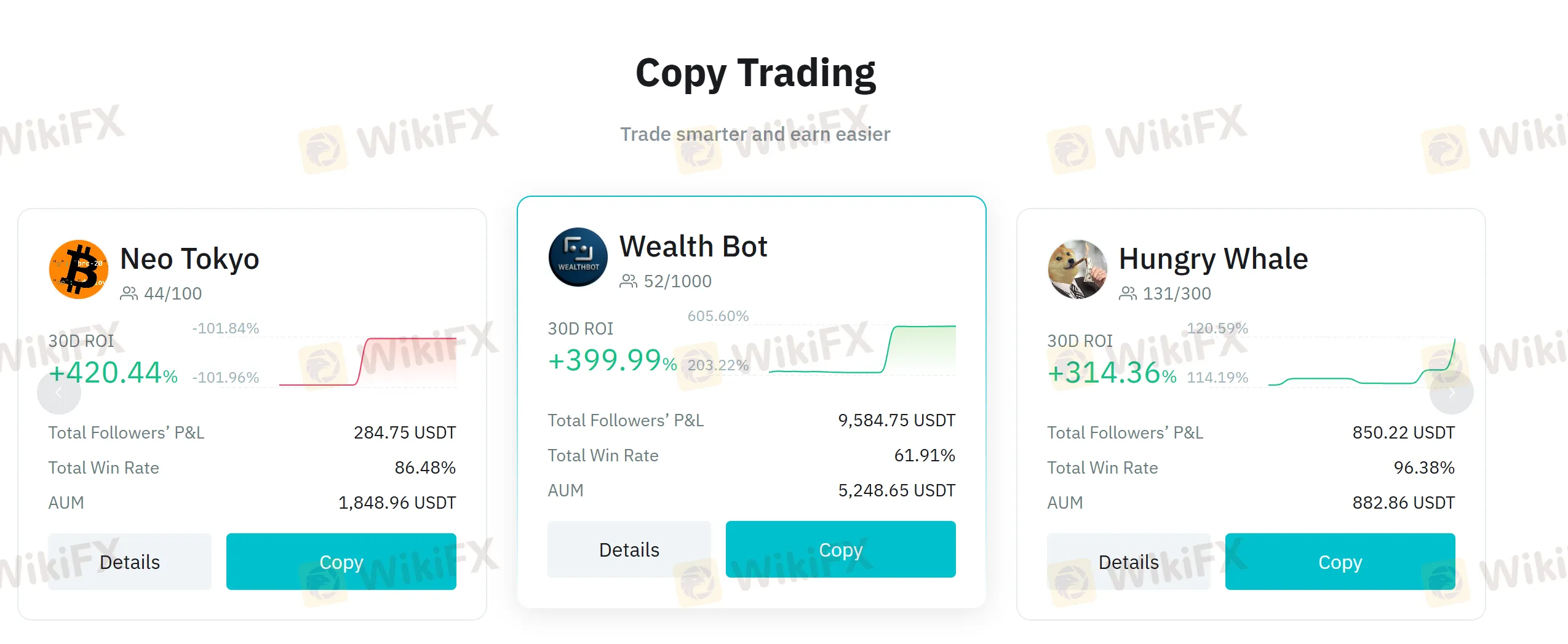

Copy Trading

Copy Trading ist eine Schlüsselfunktion von BitMart. Das System verfügt über einen standardmäßigen 0,5%igen Slippage-Schutzmechanismus. Wenn Marktschwankungen dazu führen, dass der Slippage diesen Wert überschreitet, wird das Copy Trading automatisch pausiert, was es für Anleger ohne Handelserfahrung oder Zeit geeignet macht.

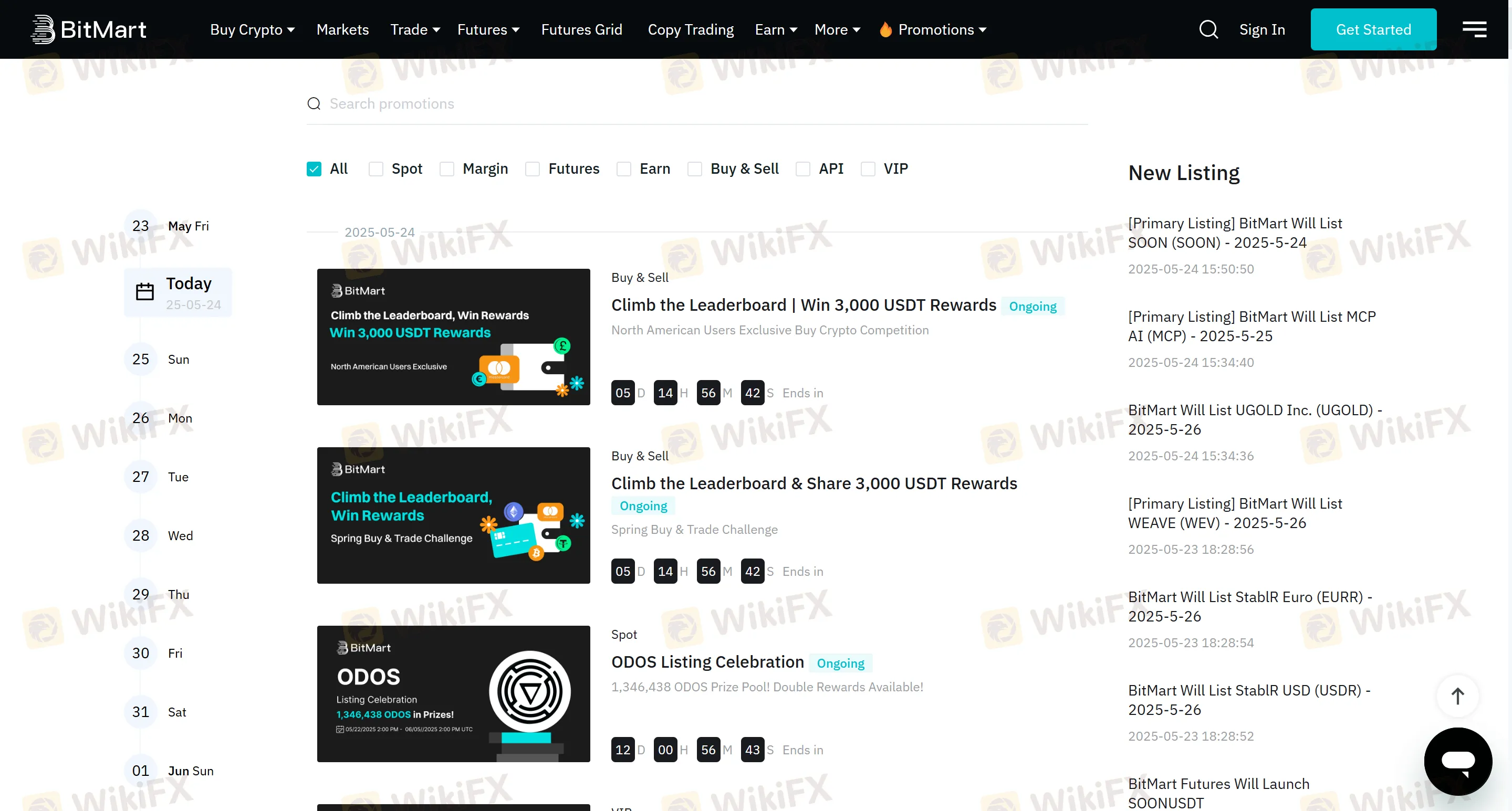

Bonus

Die Plattform bietet verschiedene belohnende Aktivitäten an, und derzeit gibt es einen exklusiven Krypto-Kaufwettbewerb für nordamerikanische Benutzer. Während des Zeitraums von 00:00:00 UTC am 23. Mai 2025 bis 23:59:59 UTC am 29. Mai 2025 teilen die Top 100 nordamerikanischen Benutzer, die Kryptowährungen mit Fiatwährungen wie USD und CAD kaufen, einen Preispool von 3.000 USDT.

| Platzierung | Gesamtbetrag (USDT) |

| Top 1 | 288 |

| 2 - 10 | 792 |

| 11 - 30 | 870 |

| 31 - 100 | 1.050 |