Présentation de l'entreprise

| BitMart Résumé de l'examen | |

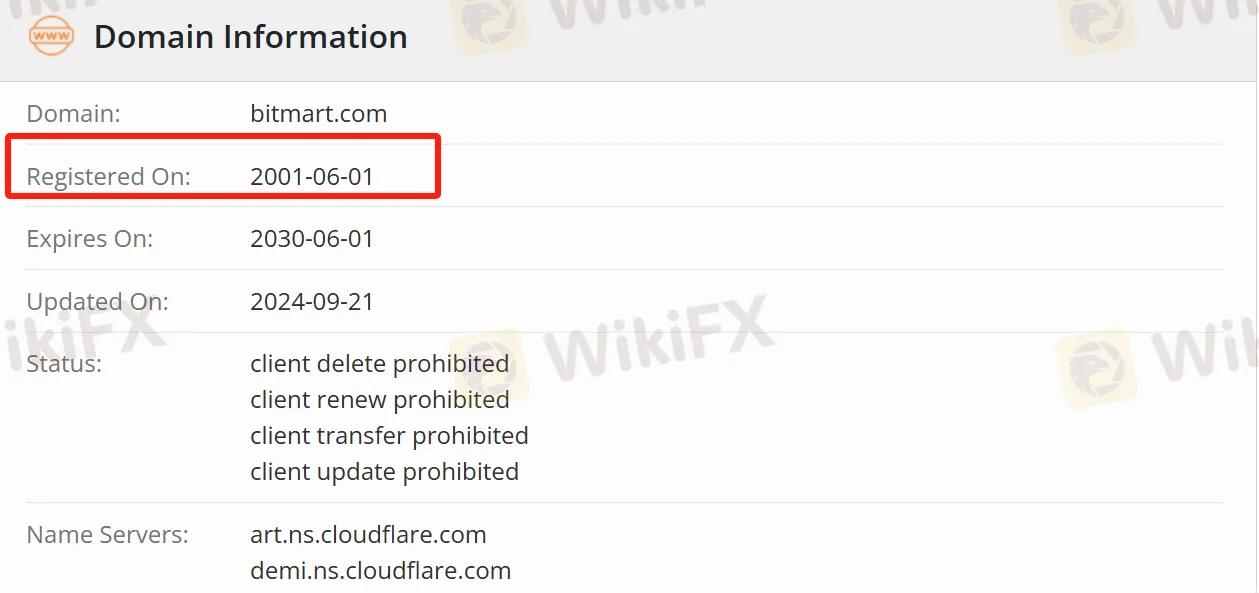

| Inscrit le | 2001-06-01 |

| Pays/Région d'inscription | Nouvelle-Zélande |

| Régulation | Révoquée |

| Instruments de marché | 1 700 cryptomonnaies, contrats à terme |

| Trading de simulation | ✅ |

| Effet de levier | / |

| Spread | / |

| Plateforme de trading | BitMart (web et mobile) |

| Dépôt minimum | / |

| Support client | Twitter, Telegram, Facebook, Instagram, YouTube, LinkedIn, TikTok, etc. |

Informations sur BitMart

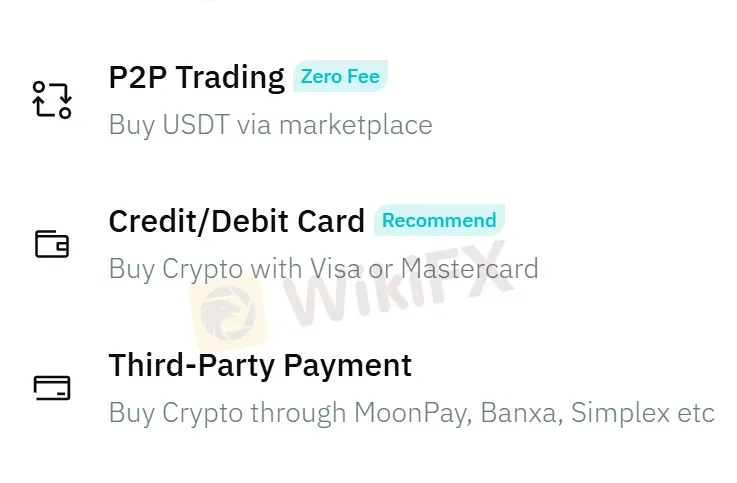

BitMart est une plateforme de trading de cryptomonnaies pour les utilisateurs du monde entier, prenant en charge plus de 1 700 cryptomonnaies et offrant divers types de trading tels que le trading au comptant, le trading avec marge et les contrats à terme. Elle prend également en charge l'achat de cryptomonnaies avec des devises fiduciaires, permettant aux utilisateurs d'acheter facilement des pièces via des méthodes de paiement tierces telles que Google Pay, Apple Pay, cartes de crédit/débit, MoonPay, Banxa et Simplex, avec un support 24h/24 et 7j/7 pour répondre aux besoins à tout moment.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Plus de 1 700 cryptomonnaies | Non réglementé |

| Trading par copie disponible | Informations sur les frais non spécifiques |

| Récompenses d'activité généreuses | Informations de compte peu claires |

| Réduction de 50% sur les frais de trading (pour les VIP) |

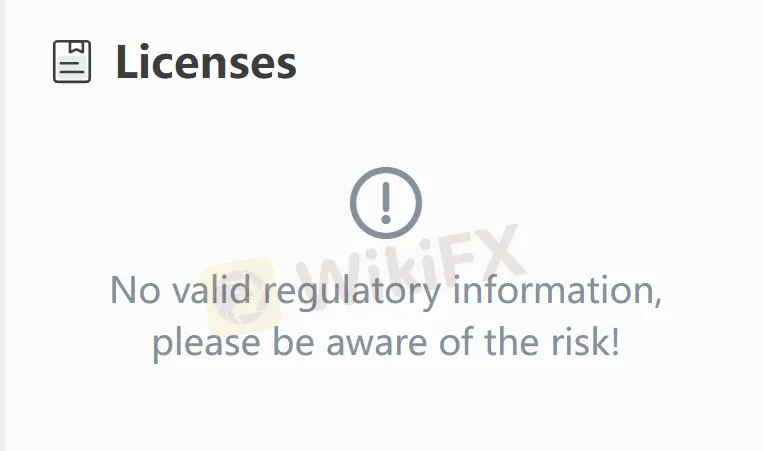

BitMart Est-il Légitime ?

BitMart opère dans le domaine du trading de cryptomonnaies depuis de nombreuses années, mais n'est pas réglementé. Il est recommandé aux traders de privilégier les courtiers réglementés par des organismes de réglementation compétents.

Que Puis-je Trader sur BitMart ?

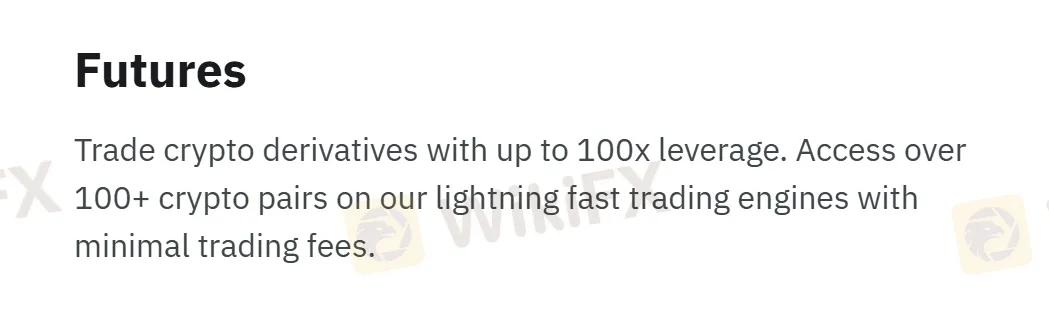

Sur BitMart, les traders peuvent effectuer différents types de transactions. Pour le trading au comptant, il y a plus de 1 700 cryptomonnaies parmi lesquelles choisir ; le trading de contrats à terme prend en charge plus de 100 paires de cryptomonnaies.

Frais de BitMart

À 00:00 UTC chaque jour, le système mettra à jour les paliers de frais de transaction des utilisateurs, qui prendront effet deux heures plus tard. Tous les traders peuvent utiliser le BMX pour la déduction et bénéficier d'une réduction de 25%.

Effet de Levier

Dans le trading de contrats à terme, BitMart propose un effet de levier allant jusqu'à 100x, le rendant adapté aux investisseurs ayant une connaissance approfondie du marché et une tolérance élevée au risque.

Plateforme de Trading

La plateforme de trading de BitMart prend en charge l'accès multi-terminal, y compris sur le web et les appareils mobiles.

Dépôt et Retrait

Les traders peuvent acheter des cryptomonnaies via des cartes de crédit/débit et des méthodes de paiement tierces telles que MoonPay, Banxa, Simplex, Visa et Mastercard.

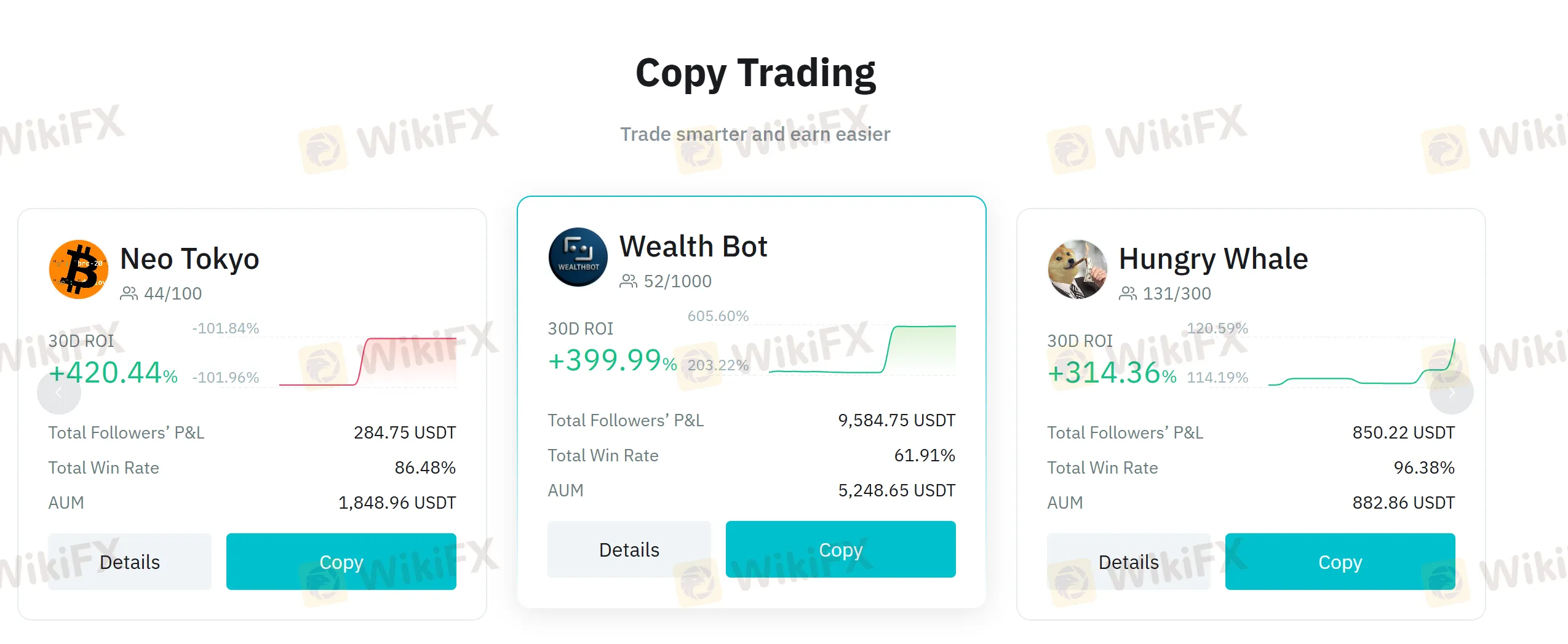

Trading Copié

Le trading copié est une fonctionnalité clé de BitMart. Le système dispose d'un mécanisme de protection par défaut contre le glissement de 0,5 %. Lorsque les fluctuations du marché font dépasser cette valeur de glissement, le trading copié est automatiquement mis en pause, le rendant adapté aux investisseurs qui manquent d'expérience ou de temps de trading.

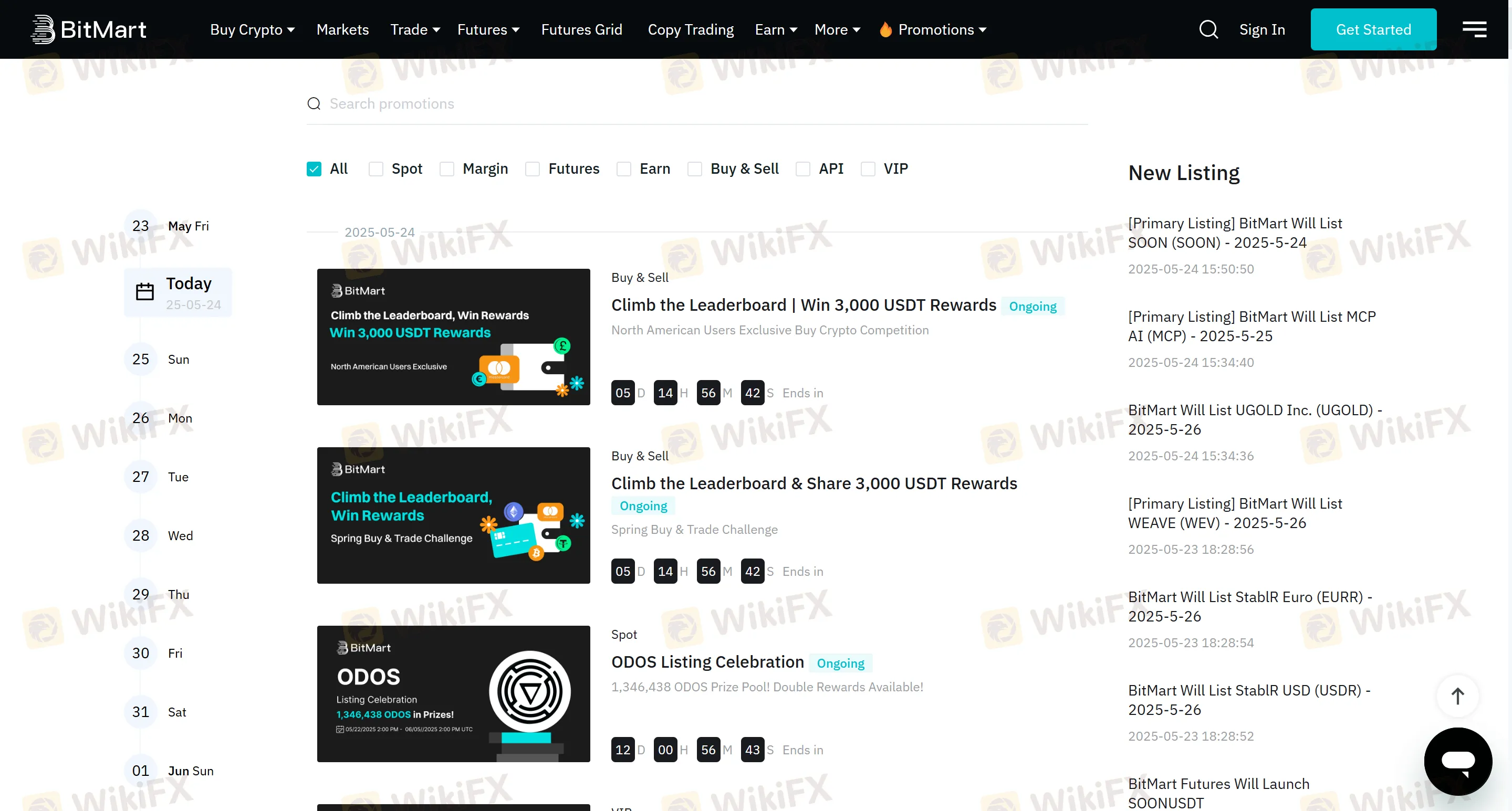

Bonus

La plateforme propose diverses activités de récompense, et actuellement, il y a un concours exclusif d'achat de cryptomonnaies pour les utilisateurs nord-américains. Pendant la période allant de 00:00:00 UTC le 23 mai 2025 à 23:59:59 UTC le 29 mai 2025, les 100 meilleurs utilisateurs nord-américains qui achètent des cryptomonnaies avec des devises fiduciaires telles que USD et CAD se partageront une cagnotte de 3 000 USDT.

| Classement | Récompense Totale (USDT) |

| Top 1 | 288 |

| 2 - 10 | 792 |

| 11 - 30 | 870 |

| 31 - 100 | 1,050 |