公司簡介

| RRR Capital 檢討摘要 | |

| 註冊 | 2017 |

| 註冊國家/地區 | 毛里裘斯 |

| 監管 | 無監管 |

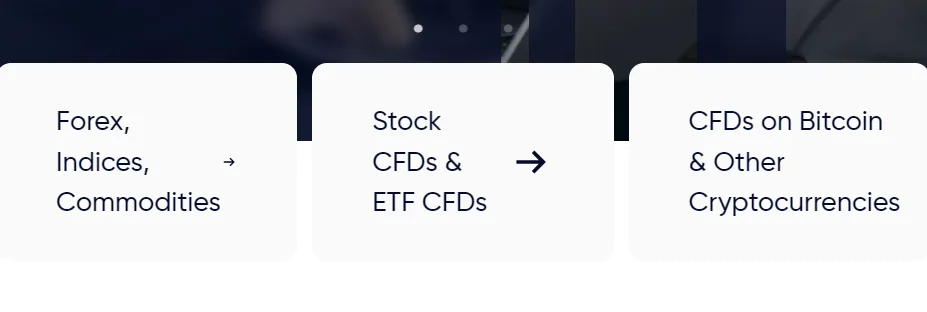

| 市場工具 | 外匯、指數、股票、加密貨幣、金屬和能源 |

| 模擬帳戶 | ✅ |

| 槓桿 | 最高達1:500 |

| 點差 | 從1.5點起(標準) |

| 交易平台 | MT5 |

| 最低存款 | $100 |

| 複製交易 | ✅ |

| 客戶支援 | support@rrrcapital.com |

| +23052970901 | |

| 聯絡表格 | |

| Facebook、Instagram | |

| 區域限制 | 美國、日本、北韓 |

RRR Capital 資訊

RRR Capital 是一家為零售和機構客戶提供衍生交易服務的全球經紀商,包括外匯、商品、指數、股票差價合約和加密貨幣。該平台提供多種帳戶類型以適應和複製交易功能,並通過MT5交易平台協助進行交易。

優缺點

| 優點 | 缺點 |

| 多樣化的交易工具 | 無監管 |

| 靈活的帳戶類型 | 嚴格的區域限制 |

| 提供MT5 | 僅接受加密貨幣付款 |

| 點差低至0.2點 | |

| 提供複製交易 |

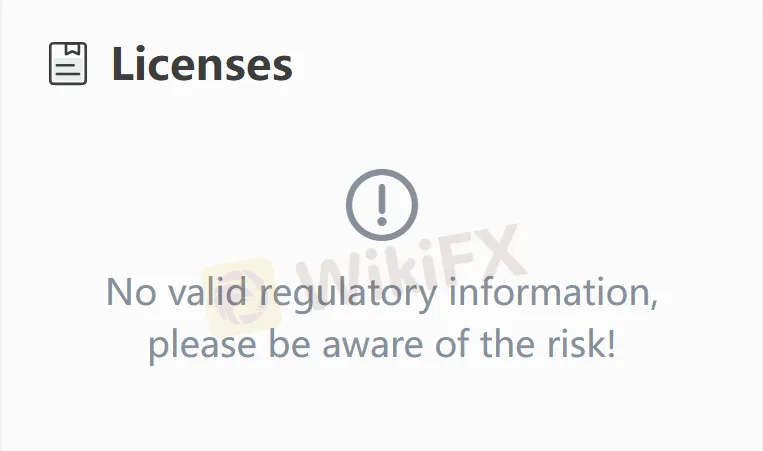

RRR Capital 是否合法?

RRR Capital 未受監管。儘管該平台聲稱持有由毛里裘斯金融服務委員會(FSC)頒發的金融牌照(牌照號碼:GB23202044),交易者可以前往監管機構的官方網站進行進一步驗證。

我可以在RRR Capital上交易什麼?

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 指數 | ✔ |

| 股票 | ✔ |

| 加密貨幣 | ✔ |

| 金屬 | ✔ |

| 能源 | ✔ |

| ETF | ❌ |

| 債券 | ❌ |

| 共同基金 | ❌ |

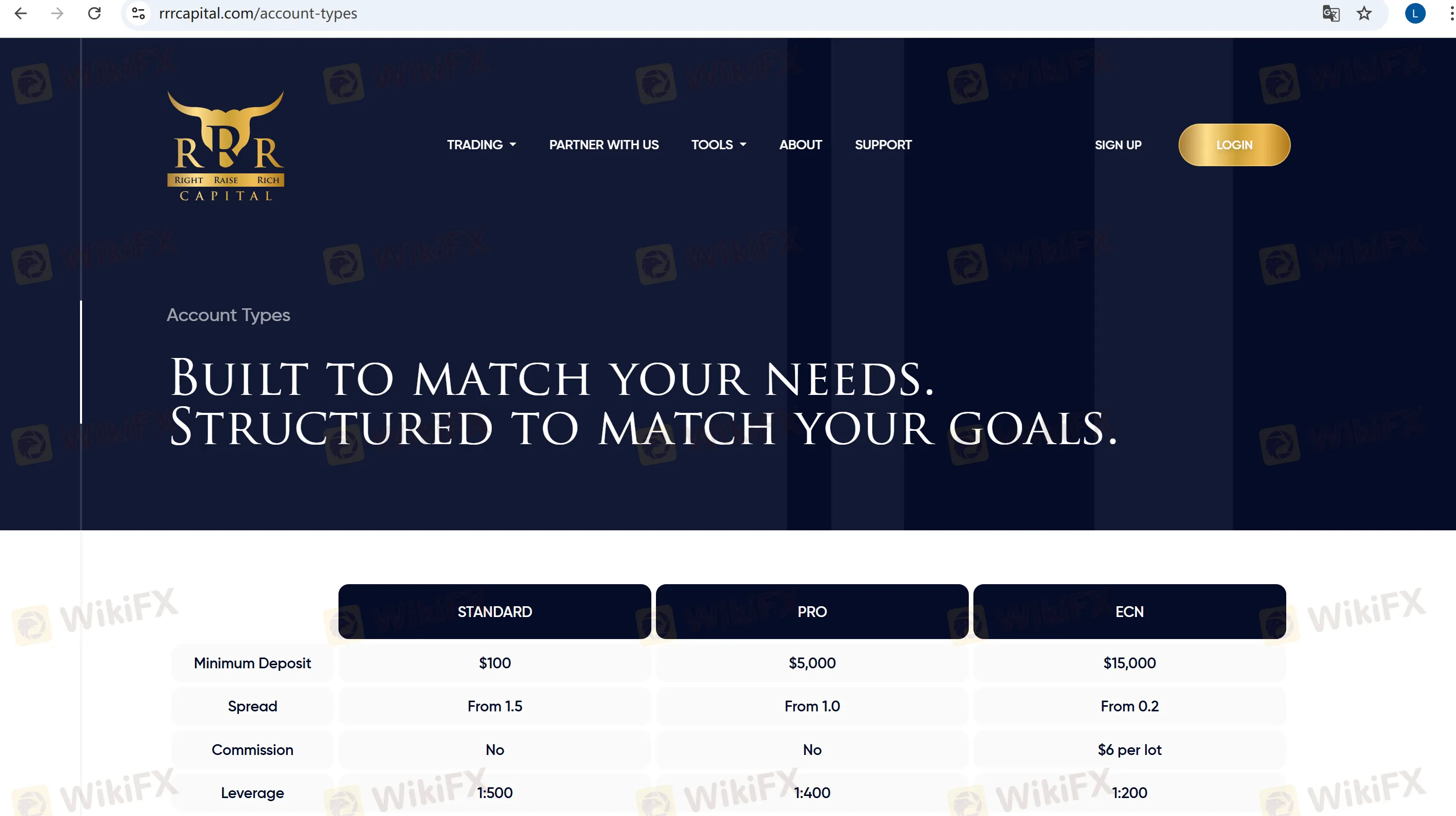

帳戶類型

該平台提供三種核心帳戶類型。標準帳戶適合初學者,ECN帳戶具有最低點差但需要支付佣金,VIP帳戶平衡了成本和槓桿。

| 帳戶類型 | 標準 | 專業 | ECN |

| 最低存款 | $100 | $5,000 | $15,000 |

| 點差 | 從1.5點 | 從1.0點 | 從0.2點 |

| 佣金 | 無 | 無 | $6每手 |

| 槓桿 | 1:500 | 1:400 | 1:200 |

| 免息交換 | 10天 | 10天 | 免費 |

槓桿

RRR Capital 提供高達1:500的槓桿,適合風險承受能力強的經驗豐富的交易者。

RRR Capital 費用

RRR Capital 提供低至0.2點的點差,適用於ECN帳戶,但每手需額外支付$6的佣金。其他帳戶則無需支付佣金。此外,標準/VIP帳戶提供10天免息交換,而ECN帳戶則永久免息交換。

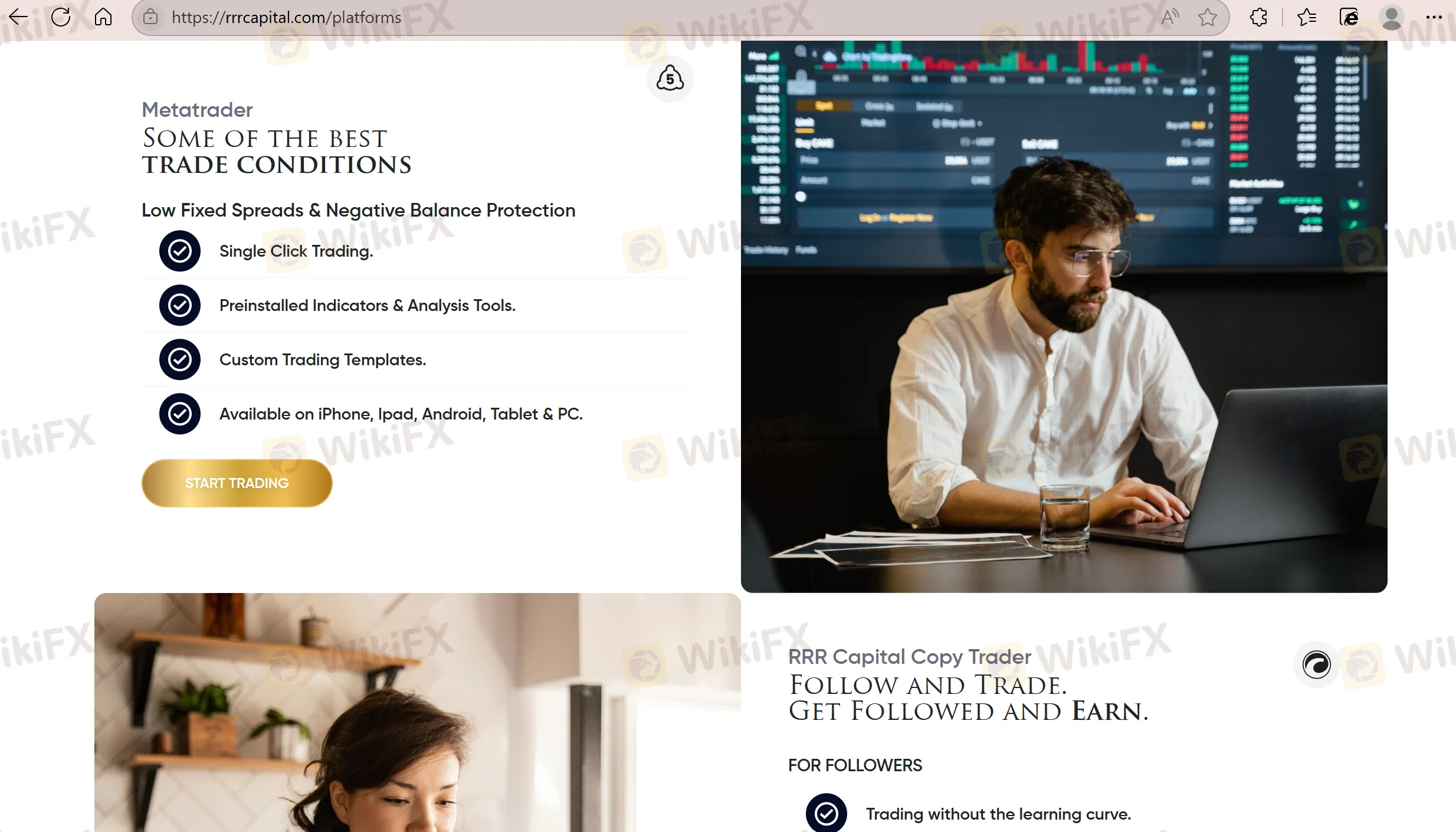

交易平台

RRR Capital 提供主要平台 MetaTrader 5,支援跨 PC、手機和平板電腦的多端同步。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| MetaTrader 5 | ✔ | PC、手機和平板電腦 | 經驗豐富的交易者 |

| MetaTrader 4 | ❌ | / | 初學者 |

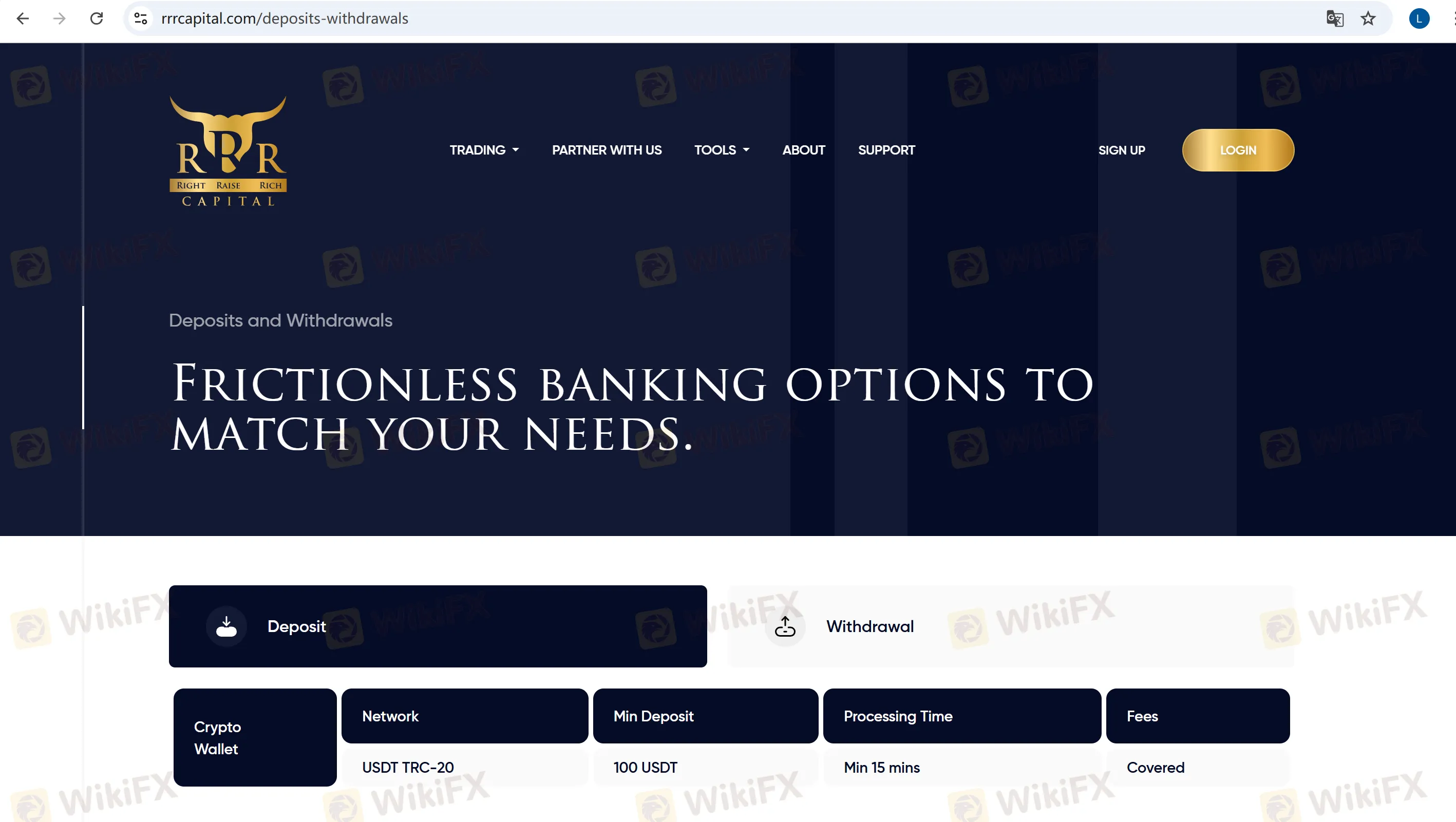

存款和提款

存款

RRR Capital 支援 USDT TRC-20 等加密貨幣錢包(最低 100 USDT,15 分鐘內入賬,平台支付手續費)。此外,還提供本地銀行轉帳和國際電匯。

提款

透過 USD TRC-20 加密貨幣錢包提款(最低 100 美元)將在 24 小時內處理。加密貨幣存款必須透過原路提款;超過存款金額的部分可以通過其他方式提款(優先順序:加密貨幣 → 本地存款 → 網上銀行)。國際電匯和加密貨幣錢包的手續費由用戶承擔(例如,Binance 美元轉帳費為 1%)。

複製交易

跟隨者可以從 15 美元的最低存款開始跟隨大師並自動複製交易,而交易大師需要存入 100 美元以啟動其帳戶並設定利潤分配比率。

Mohamed Lewaa

越南

市場覆蓋範圍廣泛,流動性足夠深厚,適合所有風險偏好的交易者。

好評

Giorgos Lazos

新西蘭

PRP Capital的MetaTrader平台速度緩慢,有時候還會停止運作。這很令人煩惱,因為當它不工作時,我無法進行交易。設計很好,但使用起來並不像我想像的那麼容易。

中評

FX9030956552

法國

RRR Capital 擁有一個用戶友好且設計良好的交易平台。搜索功能簡單易用。界面高度可定制,並有清晰的費用報告。雖然如果您是交易新手,您可能會發現理解這些術語有點困難,但他們的優點是他們擁有出色的客戶支持,可以幫助您做到最好。

好評

FX1127340201

荷蘭

我對 RRR Capital 感到 100% 滿意。當然,您知道客戶支持非常重要。我與他們的客戶支持體驗是 100% 完美的。對我來說難以置信的好。

好評

chao

美國

標準賬戶的點差比我想像的要高,歐元兌美元有時會達到 5-10 點,除此之外,沒有什麼大問題。提款基本上沒問題。

中評