Profil perusahaan

| BitMart Ringkasan Ulasan | |

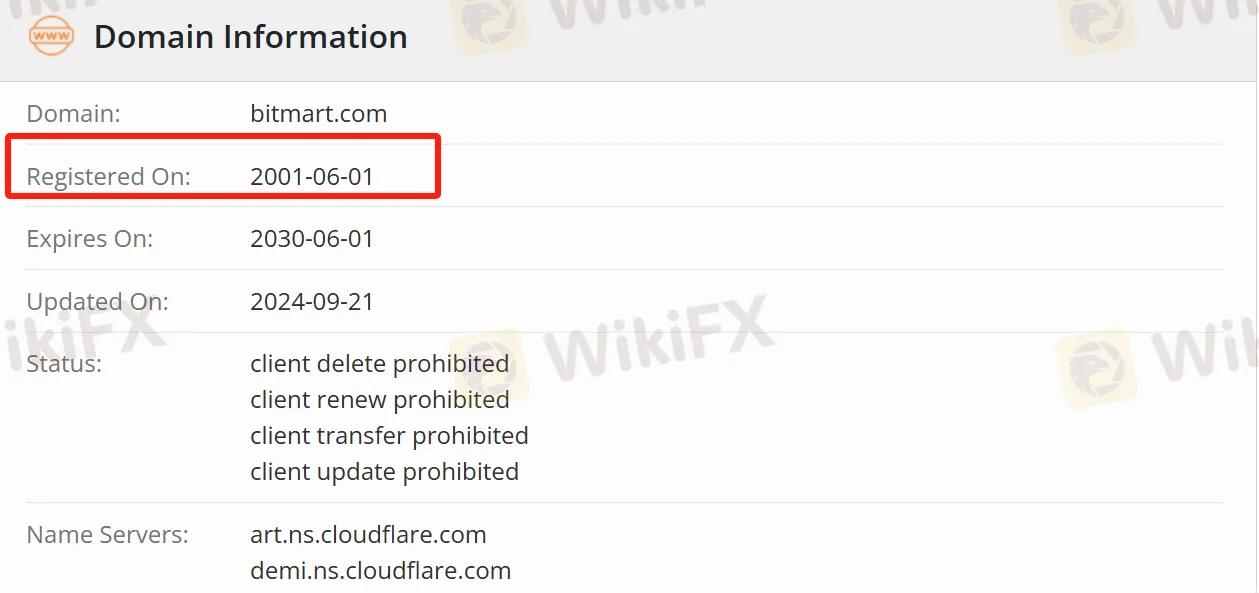

| Teregistrasi Pada | 2001-06-01 |

| Negara/Daerah Terdaftar | Selandia Baru |

| Regulasi | Ditarik |

| Instrumen Pasar | 1.700 mata uang kripto, futures |

| Perdagangan Simulasi | ✅ |

| Daya Ungkit | / |

| Spread | / |

| Platform Perdagangan | BitMart (web dan mobile) |

| Deposit Minimum | / |

| Dukungan Pelanggan | Twitter, Telegram, Facebook, Instagram, YouTube, LinkedIn, TikTok, dll. |

Informasi BitMart

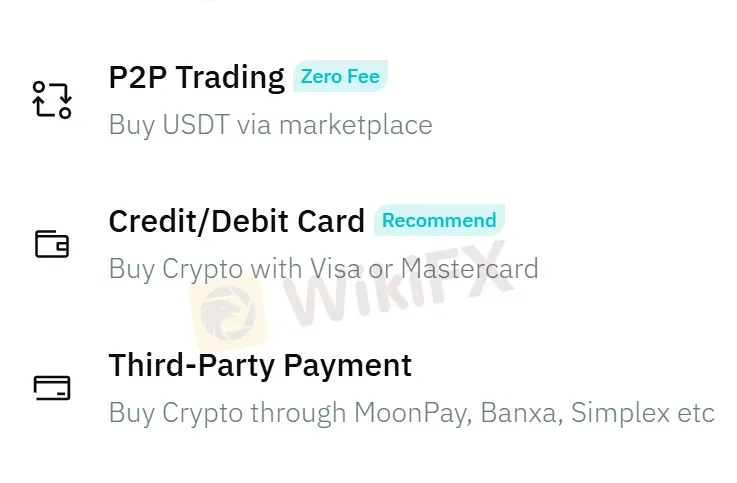

BitMart adalah platform perdagangan kripto untuk pengguna global, mendukung lebih dari 1.700 mata uang kripto dan menawarkan berbagai jenis perdagangan seperti perdagangan spot, perdagangan marjin, dan futures. Juga mendukung pembelian mata uang kripto dengan mata uang fiat, memungkinkan pengguna untuk membeli koin dengan mudah melalui metode pembayaran pihak ketiga seperti Google Pay, Apple Pay, kartu kredit/debit, MoonPay, Banxa, dan Simplex, dengan dukungan 7×24 jam untuk merespons kebutuhan kapan saja.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Lebih dari 1.700 mata uang kripto | Tidak Diatur |

| Tersedia perdagangan salin | Informasi biaya yang tidak spesifik |

| Hadiah aktivitas yang murah hati | Informasi akun yang tidak jelas |

| Diskon biaya perdagangan 50% (untuk VIP) |

Apakah BitMart Legal?

BitMart telah beroperasi di bidang perdagangan kripto selama bertahun-tahun, namun tidak diatur. Disarankan agar para trader memberikan prioritas kepada pialang yang diatur oleh lembaga regulasi yang berwenang.

Apa yang Dapat Saya Perdagangkan di BitMart?

Di BitMart, trader dapat melakukan berbagai jenis transaksi. Untuk perdagangan spot, terdapat lebih dari 1.700 mata uang kripto yang dapat dipilih; perdagangan futures mendukung lebih dari 100 pasangan mata uang kripto.

Biaya BitMart

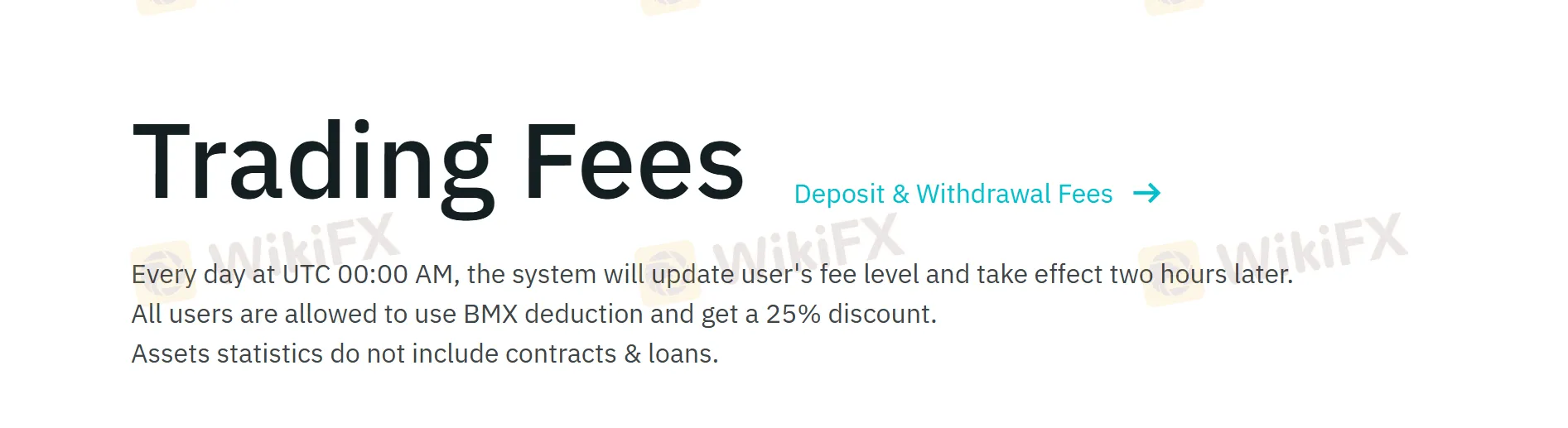

Pada pukul 00:00 UTC setiap hari, sistem akan memperbarui tingkat biaya transaksi pengguna, yang akan berlaku dua jam kemudian. Semua trader dapat menggunakan BMX untuk potongan dan menikmati diskon 25%.

Daya Ungkit

Dalam perdagangan berjangka, BitMart menawarkan leverage hingga 100x, sehingga cocok untuk investor dengan pengetahuan pasar yang mendalam dan toleransi risiko yang tinggi.

Platform Perdagangan

Platform perdagangan BitMart mendukung akses multi-terminal, termasuk berbasis web dan perangkat seluler.

Deposit dan Penarikan

Pedagang dapat membeli cryptocurrency melalui kartu kredit/debit dan metode pembayaran pihak ketiga seperti MoonPay, Banxa, Simplex, Visa, dan Mastercard.

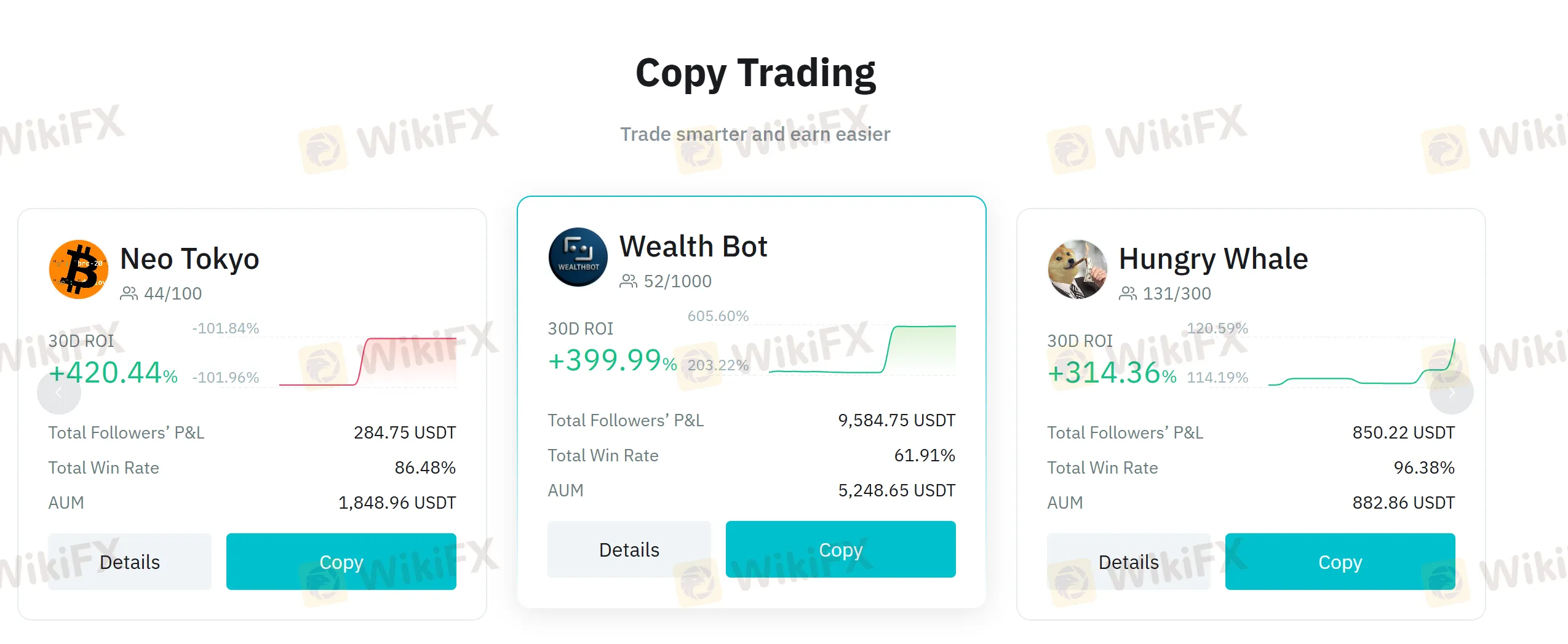

Copy Trading

Copy trading adalah fitur utama dari BitMart. Sistem ini memiliki mekanisme perlindungan slippage default sebesar 0,5%. Ketika fluktuasi pasar menyebabkan slippage melebihi nilai ini, copy trading akan secara otomatis dijeda, sehingga cocok untuk investor yang kurang memiliki pengalaman atau waktu dalam trading.

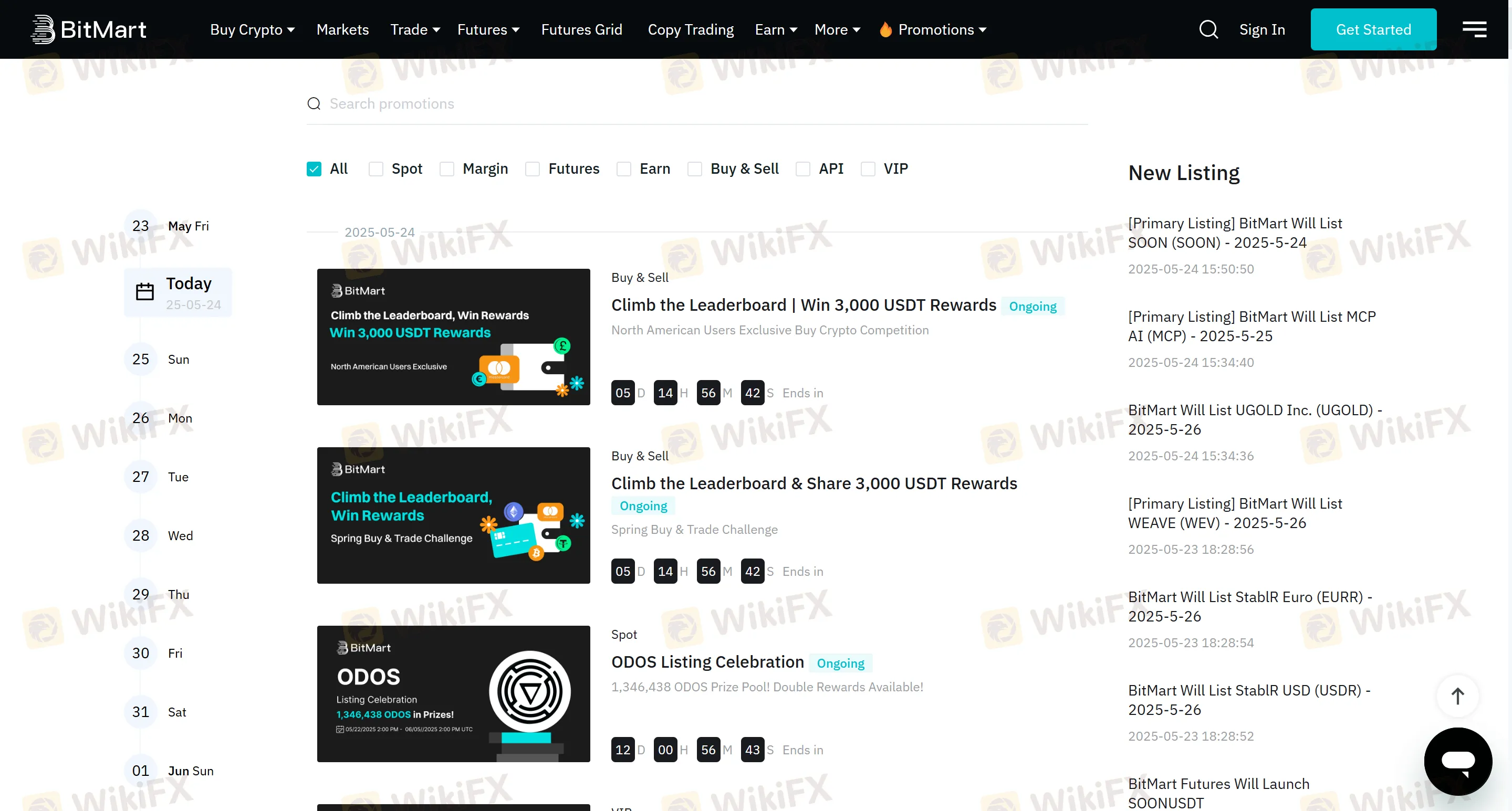

Bonus

Platform ini menawarkan berbagai kegiatan yang memberikan hadiah, dan saat ini terdapat kontes pembelian crypto eksklusif untuk pengguna Amerika Utara. Selama periode dari 00:00:00 UTC pada 23 Mei 2025, hingga 23:59:59 UTC pada 29 Mei 2025, 100 pengguna Amerika Utara teratas yang membeli cryptocurrency dengan mata uang fiat seperti USD dan CAD akan membagi hadiah sebesar 3.000 USDT.

| Peringkat | Total Hadiah (USDT) |

| Top 1 | 288 |

| 2 - 10 | 792 |

| 11 - 30 | 870 |

| 31 - 100 | 1.050 |