Buod ng kumpanya

| BitMart Buod ng Pagsusuri | |

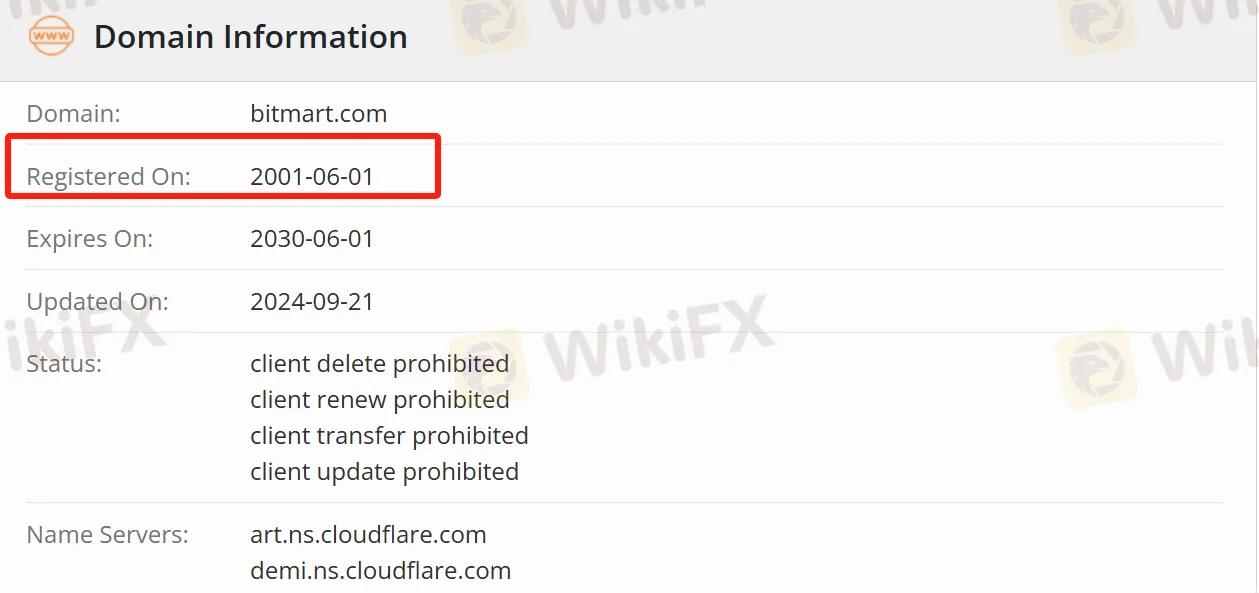

| Nakarehistro Noong | 2001-06-01 |

| Nakarehistrong Bansa/Rehiyon | New Zealand |

| Regulasyon | Ibinasura |

| Mga Kasangkapang Pang-Merkado | 1,700 cryptocurrencies, futures |

| Simulasyon ng Paghahalal | ✅ |

| Leverage | / |

| Spread | / |

| Platform ng Paghahalal | BitMart (web at mobile) |

| Min Deposit | / |

| Suporta sa Kustomer | Twitter, Telegram, Facebook, Instagram, YouTube, LinkedIn, TikTok, at iba pa. |

Impormasyon Tungkol sa BitMart

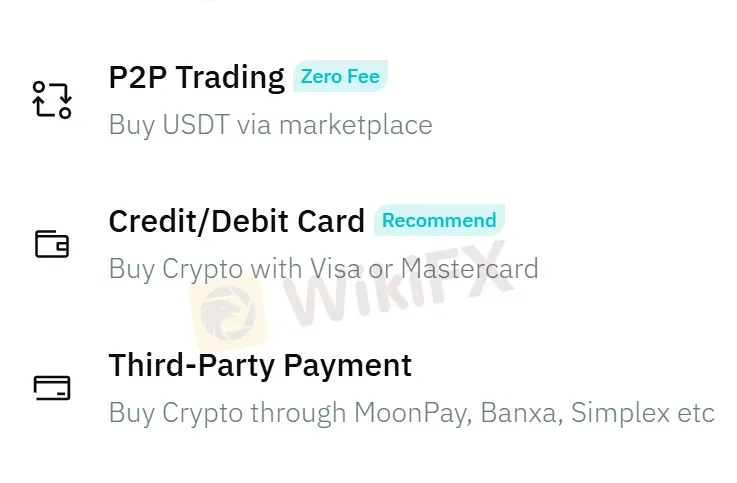

Ang BitMart ay isang plataporma ng pagtetrading ng cryptocurrency para sa global na mga gumagamit, sumusuporta sa higit sa 1,700 cryptocurrencies at nag-aalok ng iba't ibang uri ng trading tulad ng spot trading, margin trading, at futures. Sumusuporta rin ito sa pagbili ng cryptocurrencies gamit ang fiat currency, pinapayagan ang mga gumagamit na madaling bumili ng mga coins sa pamamagitan ng third-party payment methods tulad ng Google Pay, Apple Pay, credit/debit cards, MoonPay, Banxa, at Simplex, na may 7×24-hour support upang tugunan ang mga pangangailangan sa anumang oras.

Mga Benepisyo at Kons

| Mga Benepisyo | Kons |

| Higit sa 1,700 cryptocurrencies | Hindi Regulado |

| Available ang Copy trading | Hindi Tiyak ang impormasyon sa bayad |

| Generous activity rewards | Hindi Malinaw ang impormasyon ng account |

| 50% diskwento sa bayad sa trading (para sa VIPs) |

Tunay ba ang BitMart?

Ang BitMart ay nag-operate sa larangan ng cryptocurrency trading sa loob ng maraming taon, ngunit ito ay hindi regulado. Inirerekomenda na bigyang prayoridad ng mga trader ang mga brokers na regulado ng mga awtorisadong ahensya ng regulasyon.

Ano ang Maaari Kong Itrade sa BitMart?

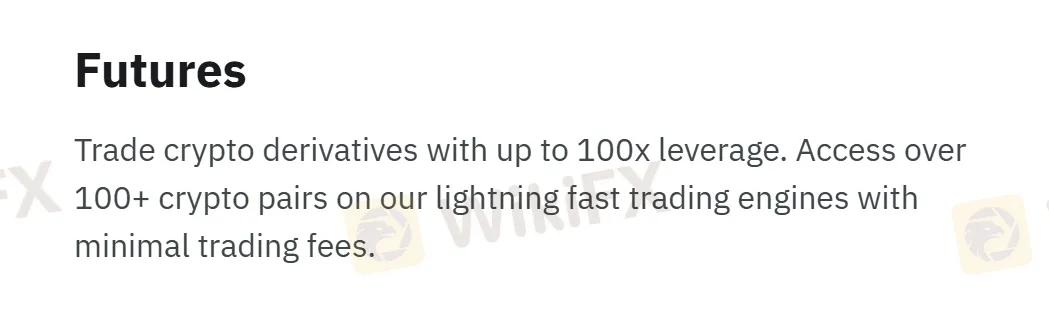

Sa BitMart, maaaring magconduct ng iba't ibang uri ng transaksyon ang mga trader. Para sa spot trading, may higit sa 1,700 cryptocurrencies na maaaring pagpilian; ang futures trading naman ay sumusuporta sa higit sa 100 cryptocurrency pairs.

Mga Bayad sa BitMart

Sa 00:00 UTC araw-araw, ia-update ng sistema ang mga transaction fee tiers ng mga users, na magiging epektibo dalawang oras pagkatapos. Lahat ng mga trader ay maaaring gumamit ng BMX para sa diskwento at mag-enjoy ng 25% na discount.

Leverage

Sa kalakalan ng hinaharap, nag-aalok ang BitMart ng leverage na hanggang 100x, na ginagawang angkop ito para sa mga mamumuhunan na may malalim na kaalaman sa merkado at mataas na toleransiya sa panganib.

Platform ng Kalakalan

Ang platform ng kalakalan ng BitMart ay sumusuporta sa multi-terminal access, kasama ang web-based at mobile devices.

Pag-iimbak at Pag-withdraw

Ang mga mangangalakal ay maaaring bumili ng mga cryptocurrencies sa pamamagitan ng credit/debit cards at third-party payment methods tulad ng MoonPay, Banxa, Simplex, Visa, at Mastercard.

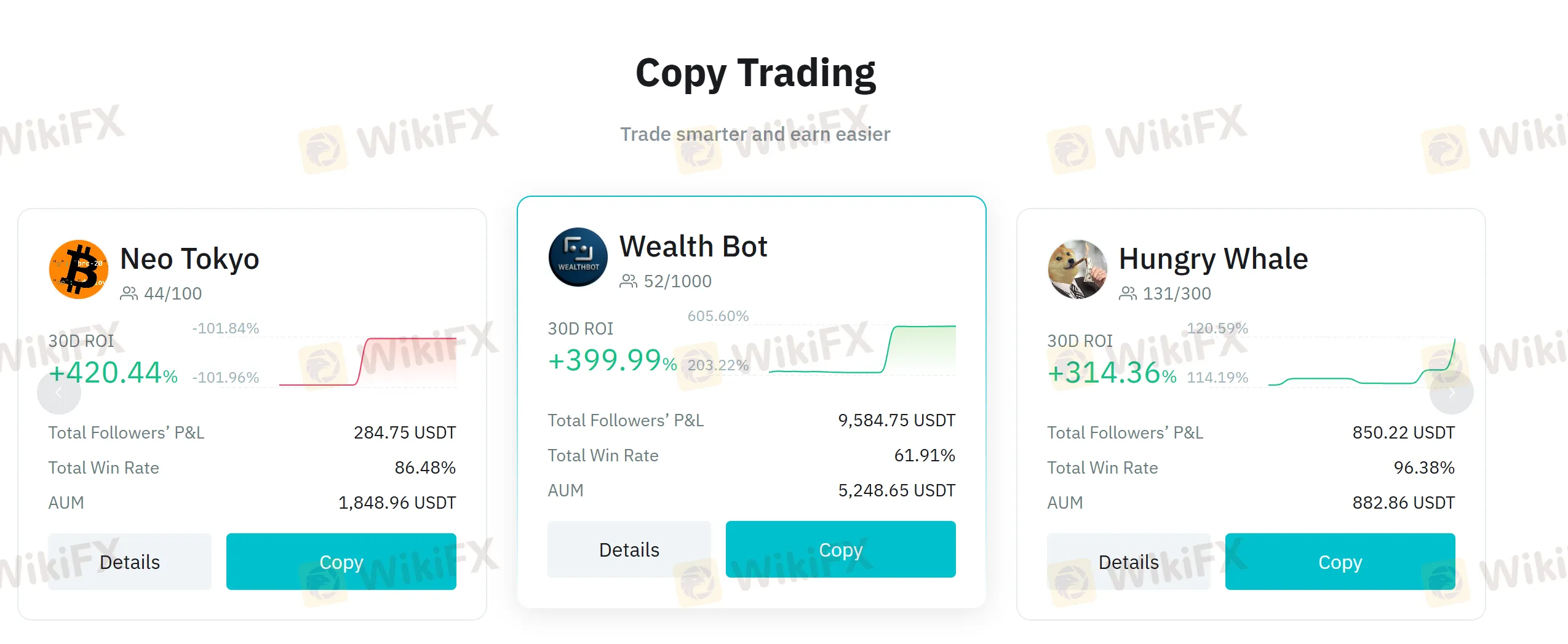

Copy Trading

Ang copy trading ay isang pangunahing tampok ng BitMart. Mayroon itong default na 0.5% slippage protection mechanism. Kapag ang mga pagbabago sa merkado ay nagdulot ng paglipat na lampas sa halagang ito, ang copy trading ay awtomatikong titigil, na ginagawang angkop ito para sa mga mamumuhunan na kulang sa karanasan sa kalakalan o oras.

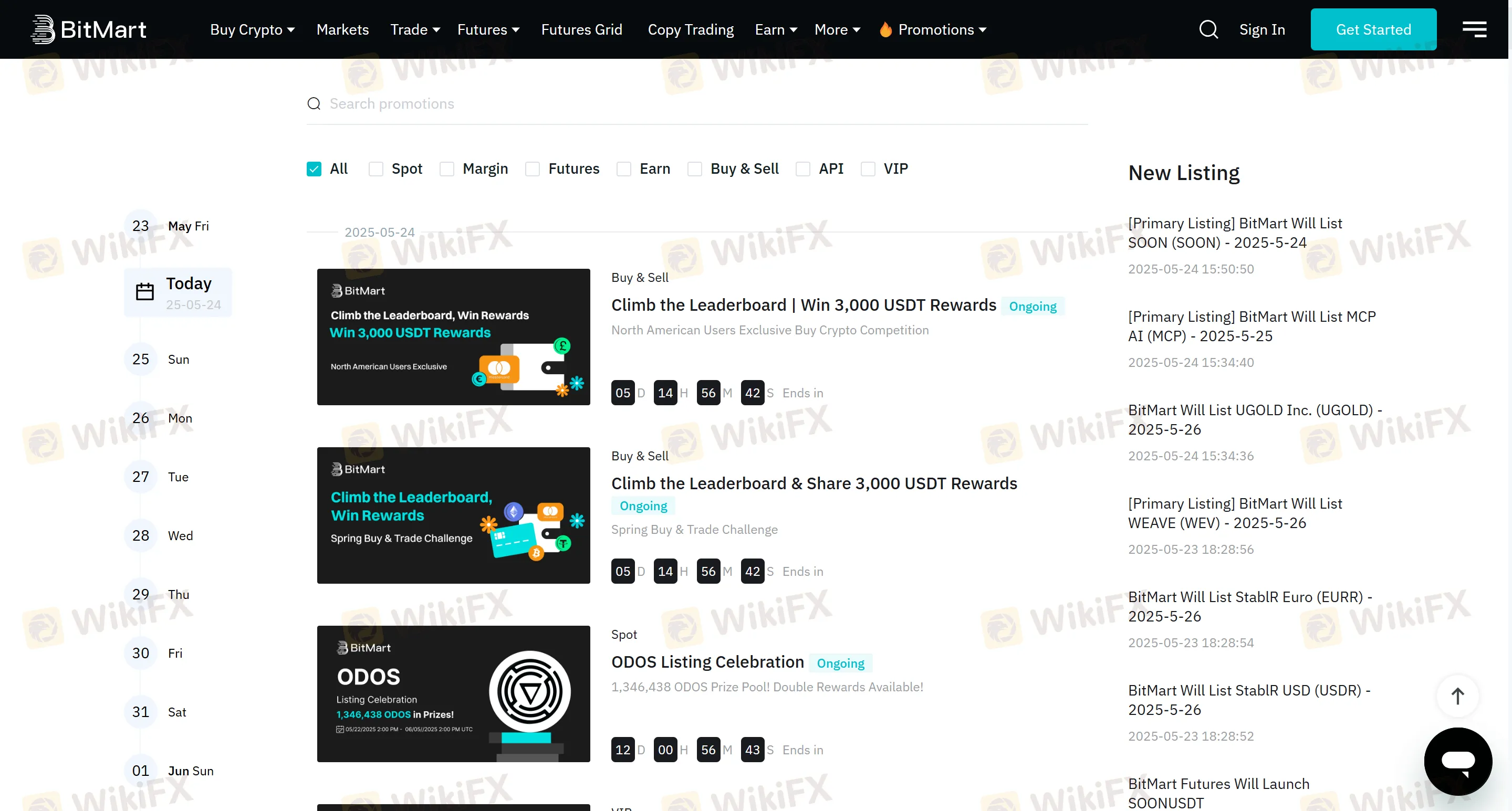

Bonus

Nag-aalok ang platform ng iba't ibang mga mapagkakaloob na aktibidad, at sa kasalukuyan, mayroong eksklusibong crypto buying contest para sa mga tagagamit mula sa Hilagang Amerika. Sa panahon mula 00:00:00 UTC noong Mayo 23, 2025, hanggang 23:59:59 UTC noong Mayo 29, 2025, ang top 100 North American users na bumili ng mga cryptocurrencies gamit ang fiat currencies tulad ng USD at CAD ay magbabahagi ng isang prize pool na nagkakahalaga ng 3,000 USDT.

| Pang-rangkahan | Kabuuang Gantimpala (USDT) |

| Top 1 | 288 |

| 2 - 10 | 792 |

| 11 - 30 | 870 |

| 31 - 100 | 1,050 |