Temel Bilgiler

Mauritius

MauritiusPuan

Mauritius

|

5-10 yıl

|

Mauritius

|

5-10 yıl

| https://www.gfxsecurities.com

Web Sitesi

Derecelendirme Endeksi

MT4/5

Tam Lisans

GFXSecurities-GFXSECURITIES

Etkilemek

C

Etki endeksi NO.1

Suudi Arabistan 3.03

Suudi Arabistan 3.03

MT4/5 Tanımlaması

Tam Lisans

Amerika Birleşik Devletleri

Amerika Birleşik DevletleriEtkilemek

C

Etki endeksi NO.1

Suudi Arabistan 3.03

Suudi Arabistan 3.03 Lisans

LisansLisanslı Kuruluş:Gilgamesh Financial Services

Lisans Türü:GB210270733

Tek Çekirdekli

1G

40G

1M*ADSL

Mauritius

Mauritius

Resmi ana MT4/5 yatırımcıları sağlam sistem hizmetlerine ve takip teknik desteğine sahip olacaktır. Genel olarak, işleri ve teknolojileri nispeten olgunlaşmıştır ve risk kontrol yetenekleri güçlüdür

gfxsecurities.com

gfxsecurities.com Singapur

Singapur

| GFX Securities İnceleme Özeti | |

| Kuruluş | 2022 |

| Kayıtlı Ülke/Bölge | Mauritius |

| Düzenleme | Düzenleme yok |

| Piyasa Enstrümanları | Forex, Metaller, Endeksler, Enerjiler, Hisse Senedi CFD'leri, Kriptolar |

| Demo Hesap | ❌ |

| Kaldıraç | 1:500'e kadar |

| Spread | 2.5 pip'ten başlayan (Standart hesap) |

| İşlem Platformu | GFX APP |

| Minimum Yatırım | / |

| Müşteri Desteği | Telefon: (+973) 17260190 |

| E-posta: info@gfxsecurities.com | |

| Facebook, YouTube, X, Instagram | |

| Adres: 3. Kat, Ebene Skies, Rue de I Institut, Ebene, Mauritius Cumhuriyeti | |

| Bölgesel Kısıtlamalar | ABD, Küba, Myanmar, Kuzey Kore |

| Bonus | %20 depozito bonusu |

GFX Securities, 2022 yılında kurulmuş çeşitli işlem ürünleri sunan bir çevrimiçi aracı kurumdur. Forex, Metaller, Endeksler, Enerjiler, Hisse Senedi CFD'leri ve Kriptolar gibi çeşitli işlem ürünleri sunmaktadır. Üç çeşit canlı hesap sunmakta olup kaldıraç 1:500'e kadar çıkabilmektedir.

| Artılar | Eksiler |

| Çeşitli işlem enstrümanları | Düzenleme yok |

| Birden fazla hesap türü | Bölgesel kısıtlamalar |

| Komisyon yok | MT4 veya MT5 yok |

| Depozito için %20 bonus |

Hayır. GFX Securities şu anda herhangi bir düzenlemeye sahip değil. Lütfen riskin farkında olun!

GFX Securities Forex, Metaller, Endeksler, Enerjiler, Hisse Senetleri CFD'leri ve Kriptolar üzerinde işlem enstrümanları sunmaktadır.

| İşlem Yapılabilir Enstrümanlar | Desteklenen |

| Forex | ✔ |

| Endeksler | ✔ |

| Hisse Senetleri CFD'leri | ✔ |

| Enerjiler | ✔ |

| Kriptolar | ✔ |

| Metaller | ✔ |

| Opsiyonlar | ❌ |

| Bono | ❌ |

| ETF'ler | ❌ |

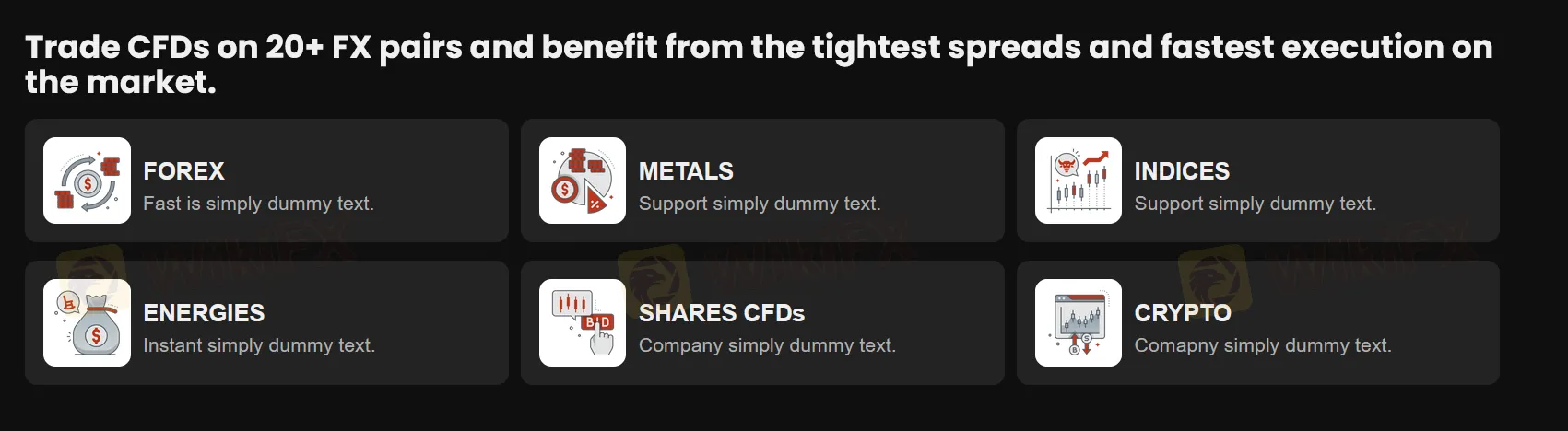

GFX Securities'nın web sitesinde üç hesap türü bulunmaktadır.

| Hesap Türü | Minimum Depozito | Spread | Komisyon |

| Standart | / | 2.5 pip'ten | 0 |

| Gelişmiş | 0 pip'ten | ||

| Profesyonel |

Kaldıraç oranı 1:500'e kadar çıkabilir. Yatırımcılar, yüksek kaldıraçın yüksek potansiyel riskler getirebileceğini dikkate almalıdır.

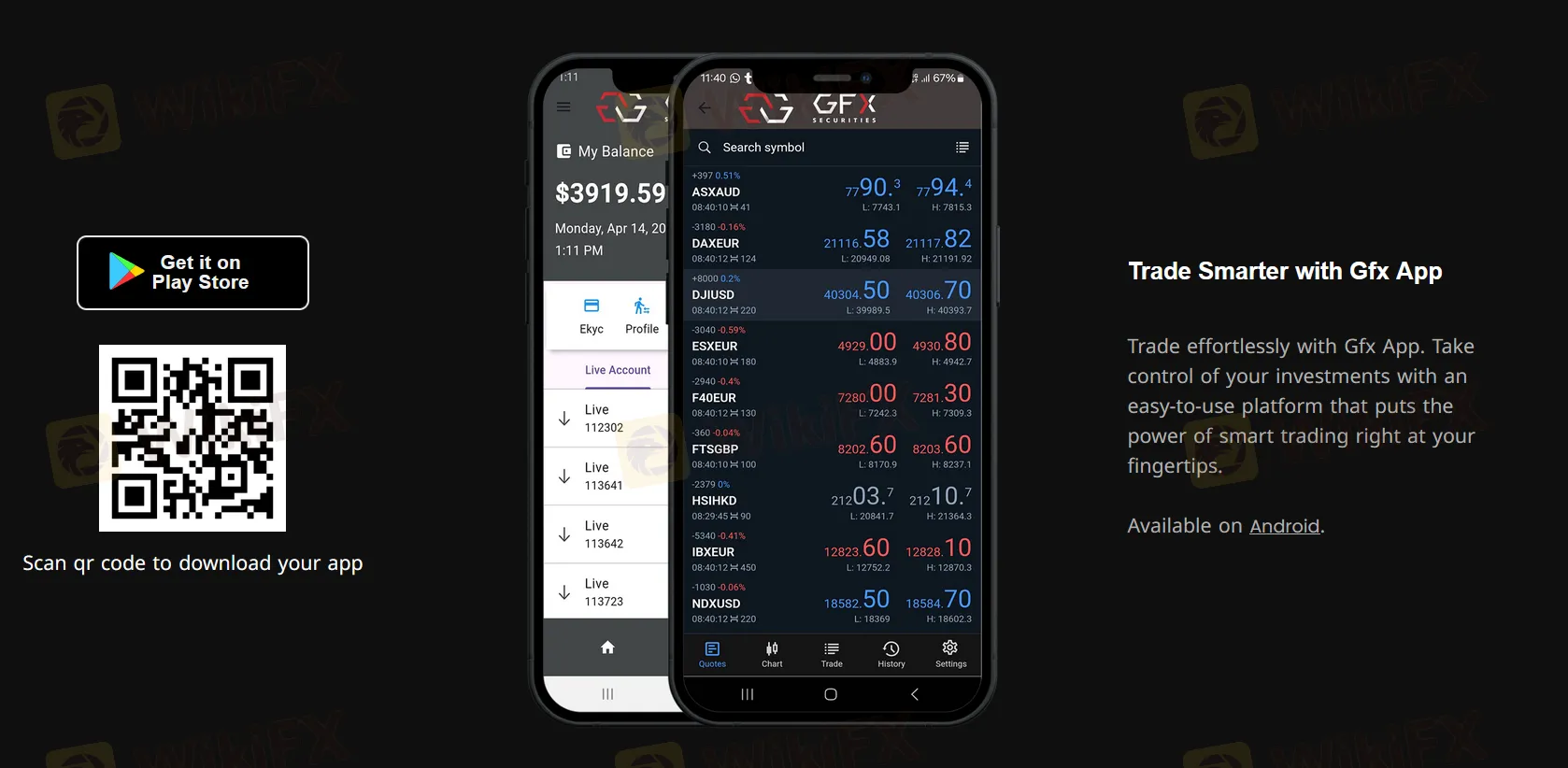

GFX Securities kendi mobil uygulamasını sunmaktadır ve genellikle kullanılan MT4 veya MT5'i desteklememektedir.

| İşlem Platformu | Desteklenen | Mevcut Cihazlar | Uygun |

| GFX Uygulaması | ✔ | Mobil | / |

| MT5 | ❌ | / | Deneyimli yatırımcılar |

| MT4 | ❌ | / | Yeni başlayanlar |

Yatırımcılar, Mastercard, MoneyGram, Banka transferi ve VISA aracılığıyla fon yatırabilir ve çekebilirler.

In my experience as an independent forex trader evaluating brokers, regulatory oversight is one of the most critical factors I assess before entrusting any company with my funds. After a careful review of all available information about GFX Securities, I discovered that the company is registered in Mauritius and is associated with entities claiming a retail forex license and regional offshore status. However, when I look deeper into the actual regulatory situation, the most significant concern for me is that GFX Securities currently lacks any formal or recognized regulation. This means there is no credible financial authority directly supervising their operations, client fund protection, or dispute resolution process. They operate under the name Gilgamesh Financial Services and reference offshore regulation, but, in my judgment, offshore regulation of this nature offers far lower levels of protection than what is provided under stringent financial regulators like ASIC, FCA, or CySEC. For traders like me who value transparency and capital safety, the absence of recognized regulatory oversight immediately increases the risk profile of this broker. The broker may offer a range of trading instruments and attractive account features, but personally, I would always approach unregulated entities with extreme caution. Without trusted regulatory safeguards, I find it very difficult to place full confidence in GFX Securities’ ability to act in the best interests of traders or provide the same recourse if issues arise.

From my personal experience evaluating GFX Securities, I found that the typical spreads for a standard account start from 2.5 pips. For a frequently traded pair like EUR/USD, this is considerably higher than what I've seen at many established brokers. In my years of trading, I have found that lower spreads are crucial for keeping costs down—especially for active strategies or those trading major pairs like EUR/USD. Higher spreads, like those at GFX Securities, can quickly eat into potential profits, so I have to be particularly careful with position sizing and overall trade frequency. Additionally, GFX Securities does not charge commissions on standard accounts, so the spread effectively represents the main trading cost. However, I always remind myself and others that even with zero commission, a wider spread can make break-even—and profitable—trading more challenging. Weighing this factor is especially important because GFX Securities lacks recognized regulation, which adds a layer of risk that responsible traders should consider. In summary, for my style and needs, a 2.5 pip spread for EUR/USD is on the high side, and I suggest prospective clients analyze whether this fits their risk and cost tolerance.

From my thorough experience evaluating forex brokers for my own trading needs, I place high value on access to free, unrestricted demo accounts, as they offer a safe environment to familiarize oneself with platforms and risk controls before committing real funds. With GFX Securities, I found a notable point of caution: they do not provide a demo account option at all. This absence is significant for me, as I believe that practicing strategies and exploring platform functions with virtual funds is fundamental to prudent risk management, especially with new or lesser-known brokers. The lack of a demo account may indicate a gap in user support for beginners and those wanting to assess platform features without financial exposure. This is particularly important because, as highlighted in the available information, GFX Securities operates without formal regulation and only supports trading on their proprietary app rather than industry-standard platforms like MT4 or MT5. In my opinion, this combination—offshore registration, absence of a demo account, and reliance on an in-house mobile app—makes it even more important for traders to proceed cautiously. For me, the absence of this critical practice environment would prevent me from opening a live trading account, as my approach always prioritizes risk reduction and a clear understanding of a broker’s systems before investing real capital.

As an experienced forex trader, assessing a broker’s overnight financing fees—also called swap charges—is a key part of my decision-making process. With GFX Securities, concrete information about their swap charges is notably absent from their available materials. This lack of transparency immediately gives me pause because it makes it difficult to compare their costs directly with other brokers I’ve used, many of whom publish clear, instrument-specific swap rates on their platforms. Most established brokers offer detailed breakdowns of overnight financing fees, often accessible before opening a live account, so that I can precisely calculate the impact of holding positions overnight. With GFX Securities, the fact that such data isn’t readily available means I’d need to contact support directly or open an account simply to access these crucial trading costs. This additional step is inconvenient and, more importantly, does not build trust. Furthermore, GFX Securities operates without recognized regulatory oversight at present, which raises my standards for fee transparency even higher. When considering offshore brokers, opaque fee structures represent an added risk, as there’s little third-party review or protection against unfavorable or unannounced changes in costs. For my approach, I only trade with brokers that are upfront and specific about swap rates, as these charges can materially erode profits on longer-term trades. Until GFX Securities provides explicit, public information on their overnight fees, I find it impossible to view them as competitive or reliable in this regard compared to the major, regulated providers in the industry.

Lütfen giriş yapın...

TOP

TOP

Chrome

Chrome uzantısı

Küresel Forex Broker Düzenleyici Sorgulama

Forex brokerlerinin web sitelerine göz atın ve hangilerinin güvenilir hangilerinin dolandırıcı olduğunu doğru bir şekilde belirleyin

Şimdi Yükle