Unternehmensprofil

| GFX Securities Überprüfungszusammenfassung | |

| Gegründet | 2022 |

| Registriertes Land/Region | Mauritius |

| Regulierung | Keine Regulierung |

| Handelsinstrumente | Forex, Metalle, Indizes, Energien, Aktien-CFDs, Kryptowährungen |

| Demo-Konto | ❌ |

| Hebel | Bis zu 1:500 |

| Spread | Ab 2,5 Pips (Standardkonto) |

| Handelsplattform | GFX APP |

| Mindesteinzahlung | / |

| Kundensupport | Telefon: (+973) 17260190 |

| E-Mail: info@gfxsecurities.com | |

| Facebook, YouTube, X, Instagram | |

| Adresse: 3. Stock, Ebene Skies, Rue de I Institut, Ebene, Republik Mauritius | |

| Regionale Beschränkungen | USA, Kuba, Myanmar, Nordkorea |

| Bonus | 20% Einzahlungsbonus |

GFX Securities Informationen

GFX Securities ist ein Online-Broker, der 2022 gegründet wurde und eine Vielzahl von Handelsprodukten wie Forex, Metalle, Indizes, Energien, Aktien-CFDs und Kryptowährungen anbietet. Es bietet drei Arten von Live-Konten und der Hebel kann bis zu 1:500 betragen.

Vor- und Nachteile

| Vorteile | Nachteile |

| Verschiedene Handelsinstrumente | Keine Regulierung |

| Mehrere Kontotypen | Regionale Beschränkungen |

| Keine Provisionen | Kein MT4 oder MT5 |

| 20% Bonus für Einzahlung |

Ist GFX Securities seriös?

Nein. GFX Securities hat derzeit keine Regulierung. Bitte beachten Sie das Risiko!

Was kann ich bei GFX Securities handeln?

GFX Securities bietet Handelsinstrumente für Forex, Metalle, Indizes, Energien, Aktien-CFDs und Kryptowährungen an.

| Handelsinstrumente | Unterstützt |

| Forex | ✔ |

| Indizes | ✔ |

| Aktien-CFDs | ✔ |

| Energien | ✔ |

| Kryptowährungen | ✔ |

| Metalle | ✔ |

| Optionen | ❌ |

| Anleihen | ❌ |

| ETFs | ❌ |

Kontotypen & Gebühren

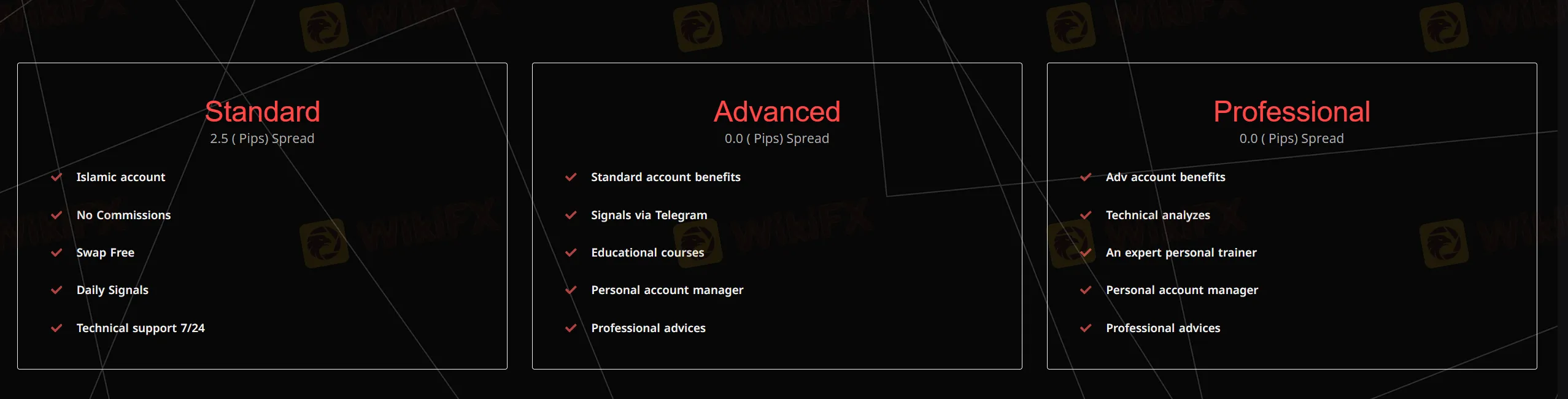

Auf der Website von GFX Securities gibt es drei Kontotypen.

| Kontotyp | Mindesteinzahlung | Spread | Kommission |

| Standard | / | Ab 2,5 Pips | 0 |

| Advanced | Ab 0 Pips | ||

| Professional |

Hebelwirkung

Die Hebelwirkung kann bis zu 1:500 betragen. Anleger sollten vor dem Handel sorgfältig überlegen, da eine hohe Hebelwirkung hohe potenzielle Risiken mit sich bringen kann.

Handelsplattform

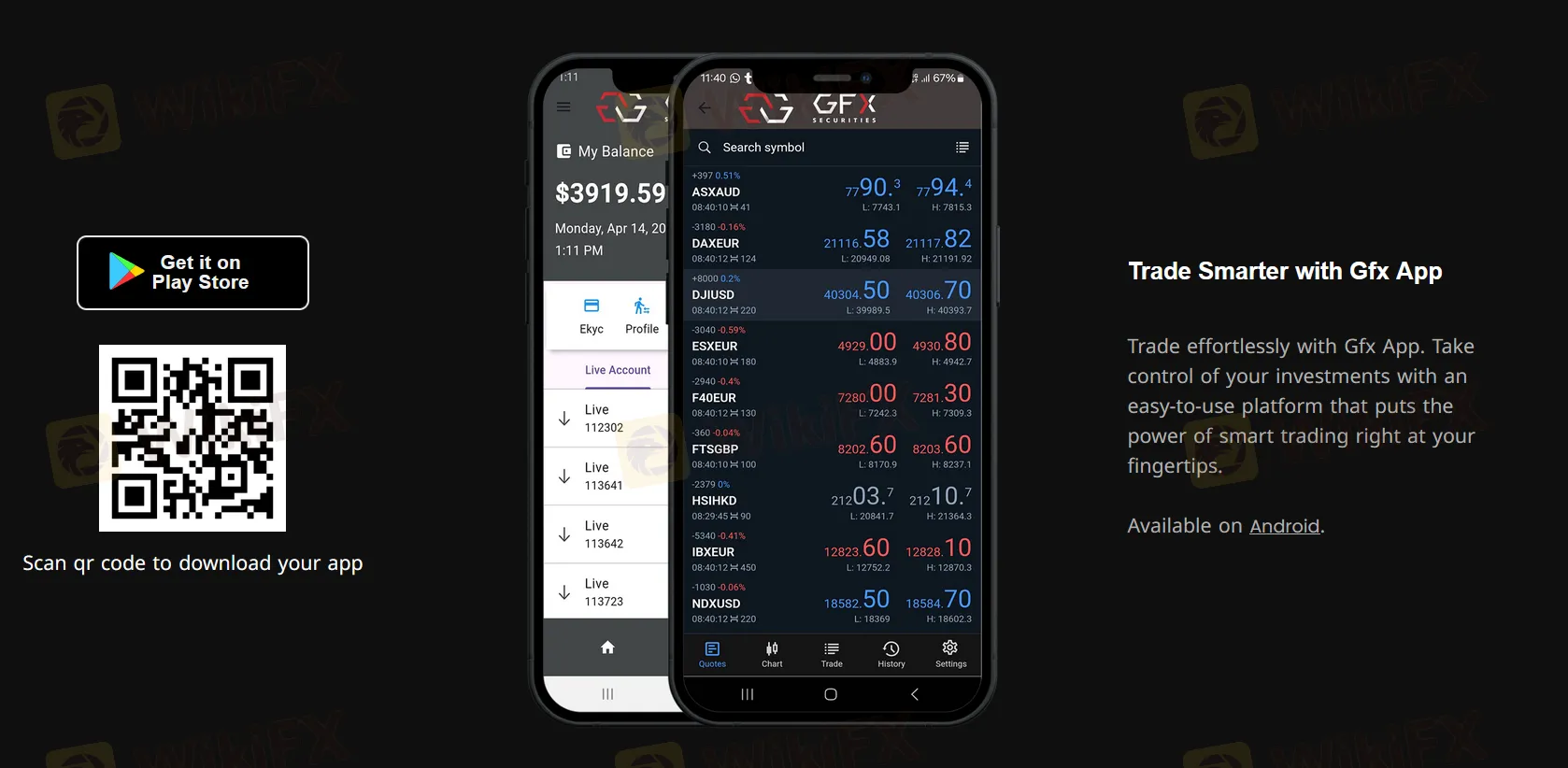

GFX Securities bietet ihre eigene mobile APP an und unterstützt nicht die häufig verwendeten MT4 oder MT5.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| GFX APP | ✔ | Mobile | / |

| MT5 | ❌ | / | Erfahrene Händler |

| MT4 | ❌ | / | Anfänger |

Einzahlung und Auszahlung

Händler können Gelder über Mastercard, MoneyGram, Banküberweisung und VISA einzahlen und abheben.