Perfil de la compañía

| GFX Securities Resumen de la reseña | |

| Establecido | 2022 |

| País/Región Registrada | Mauricio |

| Regulación | Sin regulación |

| Instrumentos de Mercado | Forex, Metales, Índices, Energías, Acciones CFD, Criptomonedas |

| Cuenta Demo | ❌ |

| Apalancamiento | Hasta 1:500 |

| Spread | Desde 2.5 pips (cuenta estándar) |

| Plataforma de Trading | GFX APP |

| Depósito Mínimo | / |

| Soporte al Cliente | Teléfono: (+973) 17260190 |

| Email: info@gfxsecurities.com | |

| Facebook, YouTube, X, Instagram | |

| Dirección: 3rd Floor, Ebene Skies, Rue de I Institut, Ebene, República de Mauricio | |

| Restricciones Regionales | EE. UU., Cuba, Myanmar, Corea del Norte |

| Bono | Bono de depósito del 20% |

Información de GFX Securities

GFX Securities es un bróker en línea fundado en 2022 que ofrece una variedad de productos de trading como Forex, Metales, Índices, Energías, Acciones CFD y Criptomonedas. Proporciona tres tipos de cuentas en vivo y el apalancamiento puede ser de hasta 1:500.

Pros y Contras

| Pros | Contras |

| Varios instrumentos de trading | Sin regulación |

| Múltiples tipos de cuenta | Restricciones regionales |

| Sin comisiones | Sin MT4 o MT5 |

| Bono del 20% por depósito |

¿Es GFX Securities Legítimo?

No. GFX Securities actualmente no tiene regulaciones. ¡Por favor, tenga en cuenta el riesgo!

¿Qué puedo negociar en GFX Securities?

GFX Securities ofrece instrumentos de trading en Forex, Metales, Índices, Energías, Acciones CFD y Criptomonedas.

| Instrumentos Negociables | Soportados |

| Forex | ✔ |

| Índices | ✔ |

| Acciones CFD | ✔ |

| Energías | ✔ |

| Criptomonedas | ✔ |

| Metales | ✔ |

| Opciones | ❌ |

| Bonos | ❌ |

| ETFs | ❌ |

Tipo de Cuenta y Tarifas

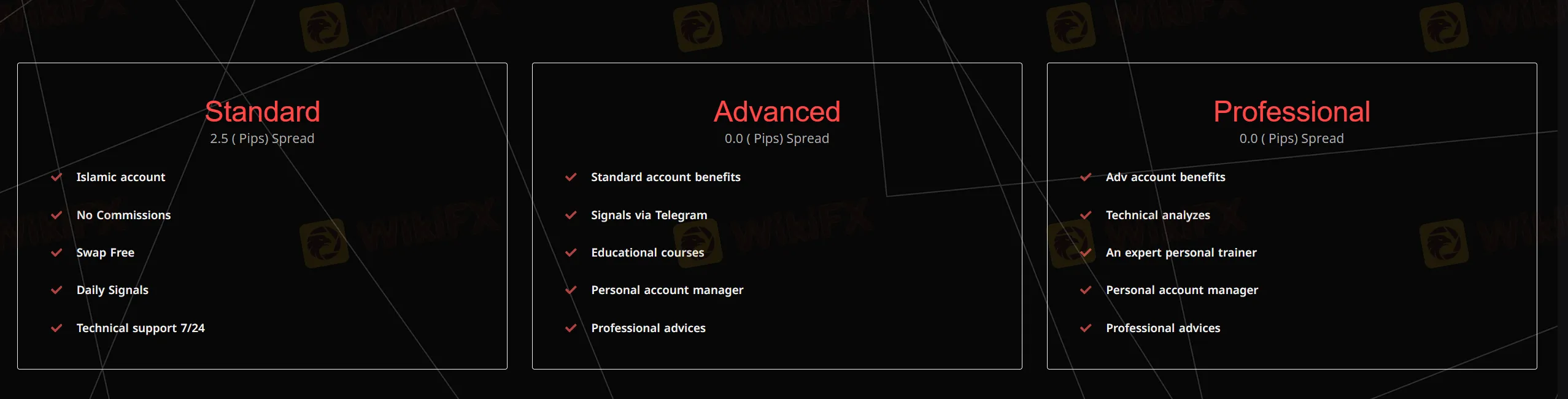

Hay tres tipos de cuenta en el sitio web de GFX Securities.

| Tipo de Cuenta | Depósito Mínimo | Spread | Comisión |

| Estándar | / | Desde 2.5 pips | 0 |

| Avanzada | Desde 0 pips | ||

| Profesional |

Apalancamiento

El apalancamiento puede ser de hasta 1:500. Los inversores deben considerar cuidadosamente antes de operar, ya que un alto apalancamiento puede traer altos riesgos potenciales.

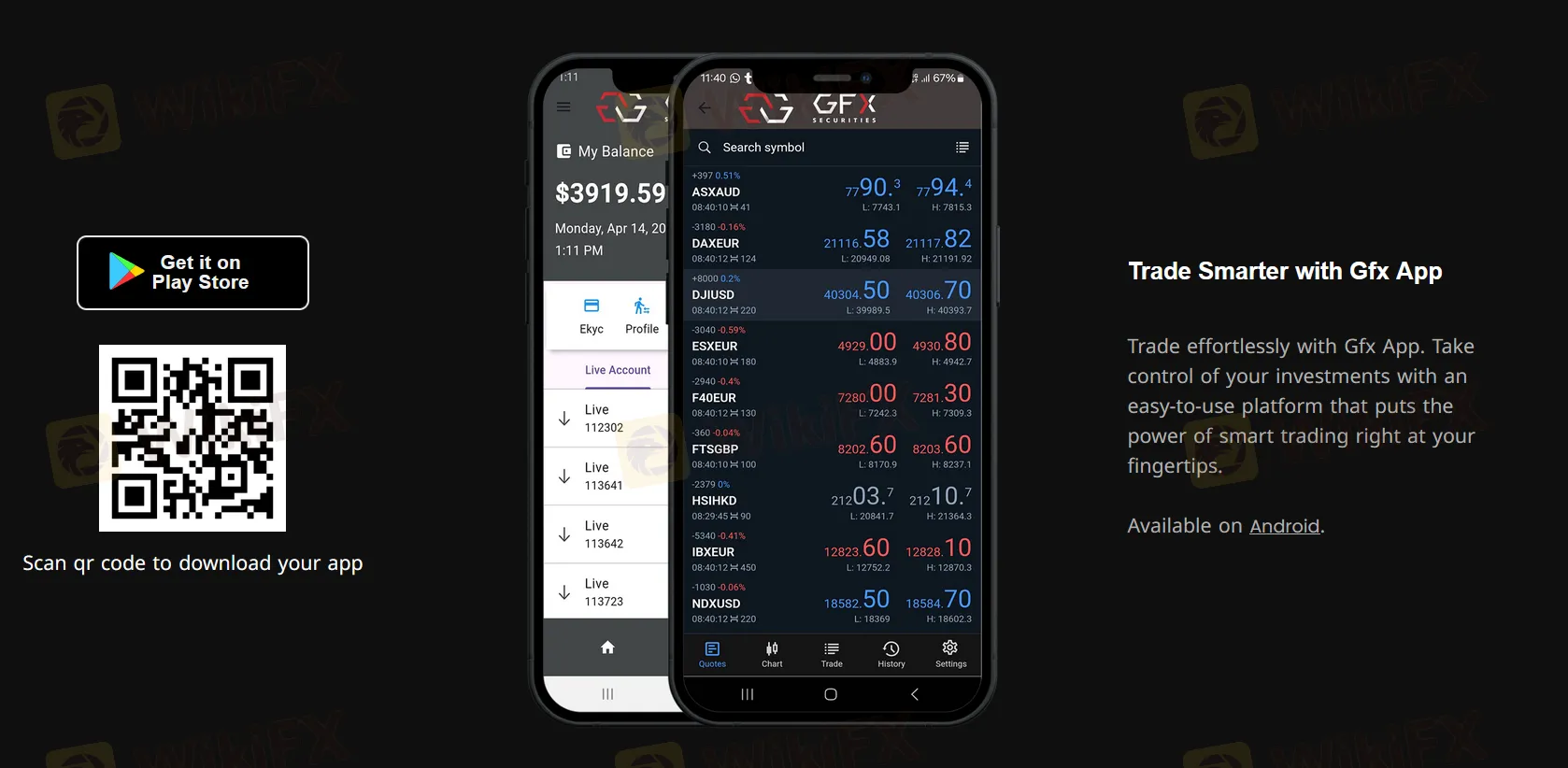

Plataforma de Trading

GFX Securities ofrece su propia aplicación móvil y no es compatible con las comúnmente utilizadas MT4 o MT5.

| Plataforma de Trading | Soportada | Dispositivos Disponibles | Adecuado para |

| APP GFX | ✔ | Móvil | / |

| MT5 | ❌ | / | Traders experimentados |

| MT4 | ❌ | / | Principiantes |

Depósito y Retiro

Los traders pueden depositar y retirar fondos a través de Mastercard, MoneyGram, Transferencia bancaria y VISA.