公司简介

| GFX Securities 评论摘要 | |

| 成立时间 | 2022 |

| 注册国家/地区 | 毛里求斯 |

| 监管 | 无监管 |

| 市场工具 | 外汇、金属、指数、能源、股票CFD、加密货币 |

| 模拟账户 | ❌ |

| 杠杆 | 最高可达1:500 |

| 点差 | 从2.5点起(标准账户) |

| 交易平台 | GFX APP |

| 最低存款 | / |

| 客服支持 | 电话:(+973) 17260190 |

| 邮箱:info@gfxsecurities.com | |

| Facebook、YouTube、X、Instagram | |

| 地址:毛里求斯共和国埃本市Ebene Skies三楼,Rue de I Institut | |

| 区域限制 | 美国、古巴、缅甸、朝鲜 |

| 奖金 | 20%存款奖金 |

GFX Securities 信息

GFX Securities 是一家成立于2022年的在线经纪商,提供外汇、金属、指数、能源、股票CFD和加密货币等多种交易产品。它提供三种实时交易账户,杠杆可达1:500。

优缺点

| 优点 | 缺点 |

| 多样的交易工具 | 无监管 |

| 多种账户类型 | 区域限制 |

| 无佣金 | 无MT4或MT5 |

| 存款享有20%奖金 |

GFX Securities 是否合法?

不。GFX Securities 目前没有监管。请注意风险!

我可以在GFX Securities上交易什么?

GFX Securities 提供外汇、金属、指数、能源、股票差价合约和加密货币等交易工具。

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 指数 | ✔ |

| 股票差价合约 | ✔ |

| 能源 | ✔ |

| 加密货币 | ✔ |

| 金属 | ✔ |

| 期权 | ❌ |

| 债券 | ❌ |

| 交易所交易基金 | ❌ |

账户类型和费用

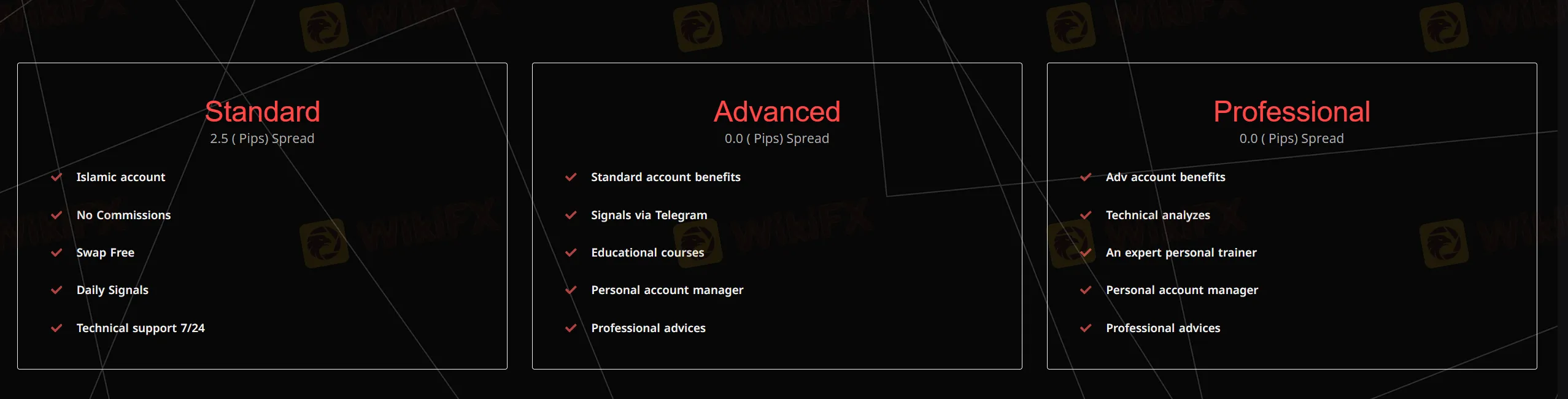

GFX Securities 网站上有三种账户类型。

| 账户类型 | 最低存款 | 点差 | 佣金 |

| 标准 | / | 从2.5点 | 0 |

| 高级 | 从0点 | ||

| 专业 |

杠杆

杠杆可以高达1:500。投资者在交易前需要仔细考虑,因为高杠杆可能带来高潜在风险。

交易平台

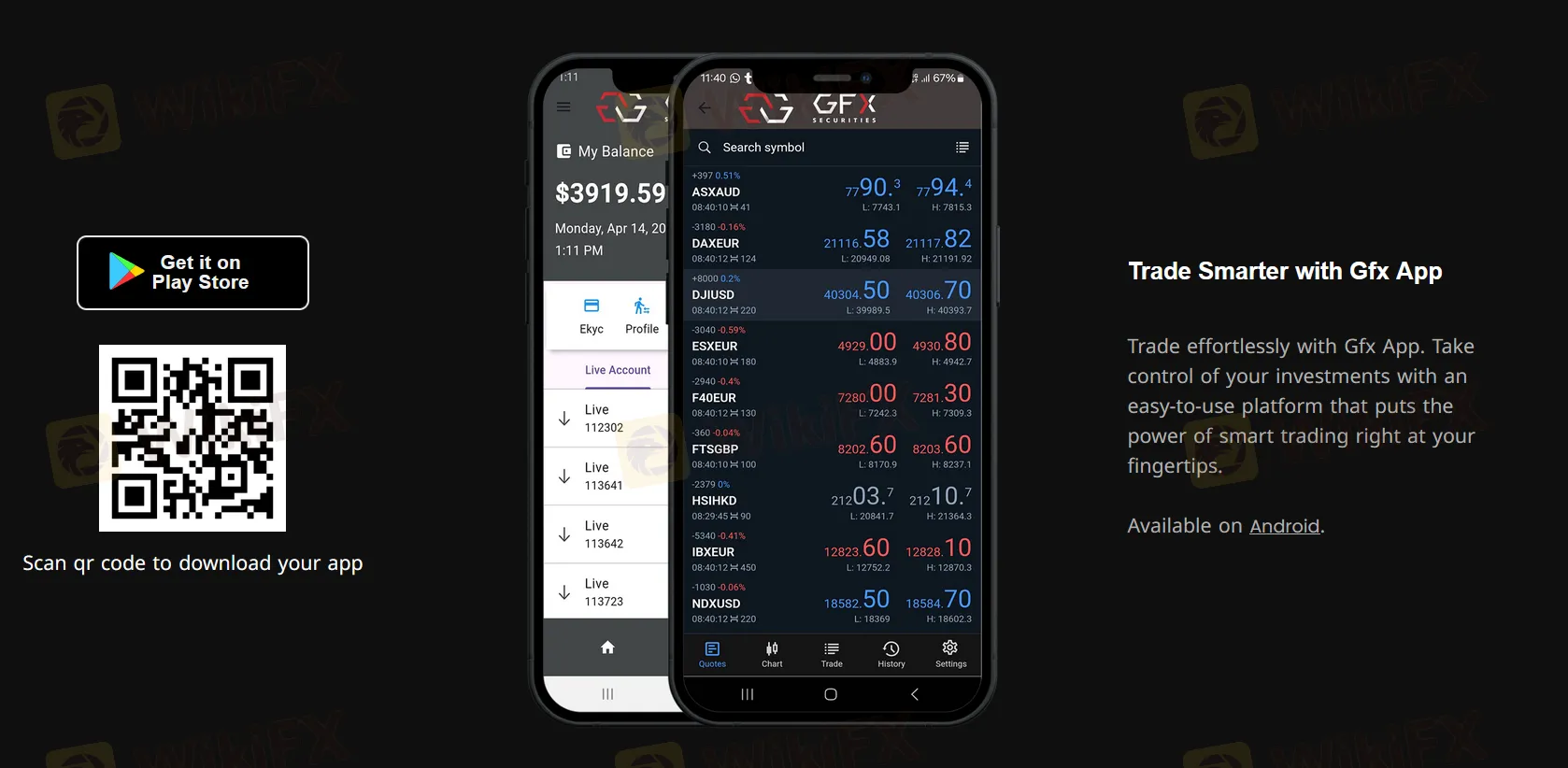

GFX Securities 提供自己的移动应用程序,不支持常用的MT4或MT5。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| GFX APP | ✔ | 移动设备 | / |

| MT5 | ❌ | / | 经验丰富的交易者 |

| MT4 | ❌ | / | 初学者 |

存款和取款

交易者可以通过万事达卡、MoneyGram、银行转账和VISA存款和取款。