Buod ng kumpanya

| GFX Securities Buod ng Pagsusuri | |

| Itinatag | 2022 |

| Rehistradong Bansa/Rehiyon | Mauritius |

| Regulasyon | Walang regulasyon |

| Mga Kasangkapan sa Merkado | Forex, Metals, Indices, Energies, Shares CFDs, Cryptos |

| Demo Account | ❌ |

| Leberahe | Hanggang sa 1:500 |

| Spread | Mula sa 2.5 pips (Standard account) |

| Platform ng Paggagalaw | GFX APP |

| Minimum Deposit | / |

| Suporta sa Kustomer | Telepono: (+973) 17260190 |

| Email: info@gfxsecurities.com | |

| Facebook, YouTube, X, Instagram | |

| Address: 3rd Floor, Ebene Skies, Rue de I Institut, Ebene, Republic of Mauritius | |

| Regional na Mga Pagganid | US, Cuba, Myanmar, North Korea |

| Bonus | 20% deposit bonus |

Impormasyon Tungkol sa GFX Securities

Ang GFX Securities ay isang online na broker na itinatag noong 2022 na nag-aalok ng iba't ibang produkto sa pagtitingi tulad ng Forex, Metals, Indices, Energies, Shares CFDs at Cryptos. Nagbibigay ito ng tatlong uri ng live accounts at ang leberahe ay maaaring hanggang sa 1:500.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Iba't ibang mga kasangkapan sa pagtitingi | Walang regulasyon |

| Maraming uri ng account | Mga pagsalig sa rehiyon |

| Walang komisyon | Walang MT4 o MT5 |

| 20% bonus para sa deposito |

Tunay ba ang GFX Securities?

Hindi. Ang GFX Securities ay walang regulasyon sa kasalukuyan. Mangyaring maging maingat sa panganib!

Ano ang Maaari Kong I-trade sa GFX Securities?

GFX Securities nag-aalok ng mga instrumento sa kalakalan sa Forex, Metals, Indices, Energies, Shares CFDs, at Cryptos.

| Mga Tradable na Instrumento | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Shares CFDs | ✔ |

| Energies | ✔ |

| Cryptos | ✔ |

| Metals | ✔ |

| Options | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

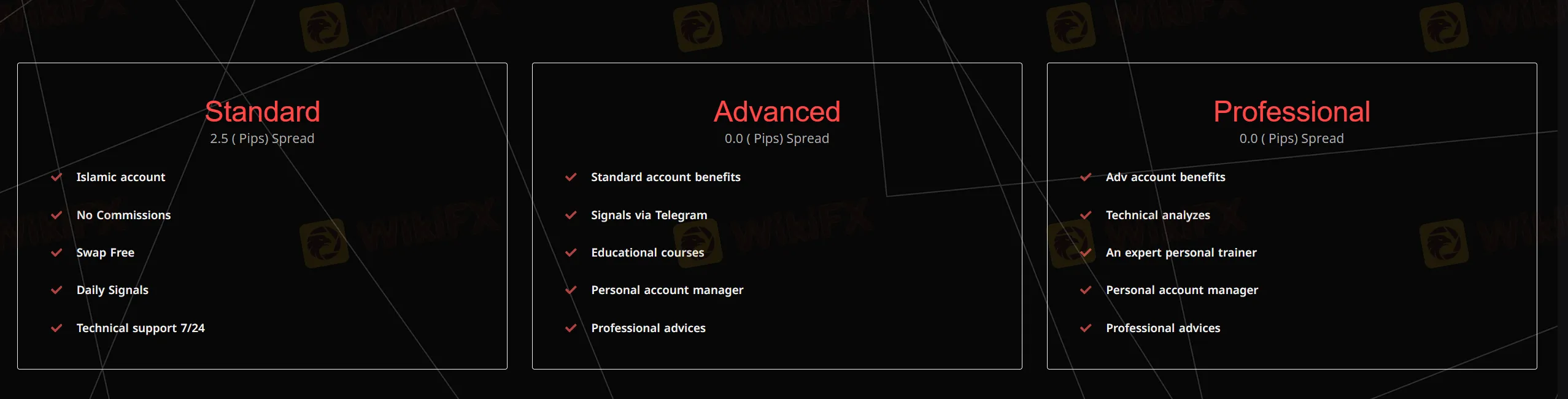

Uri ng Account at Mga Bayarin

May tatlong uri ng account sa website ng GFX Securities.

| Uri ng Account | Minimum Deposit | Spread | Komisyon |

| Standard | / | Mula 2.5 pips | 0 |

| Advanced | Mula 0 pips | ||

| Professional |

Leverage

Ang leverage ay maaaring hanggang sa 1:500. Dapat mag-ingat ang mga mamumuhunan bago mag-trade, dahil ang mataas na leverage ay maaaring magdala ng mataas na potensyal na panganib.

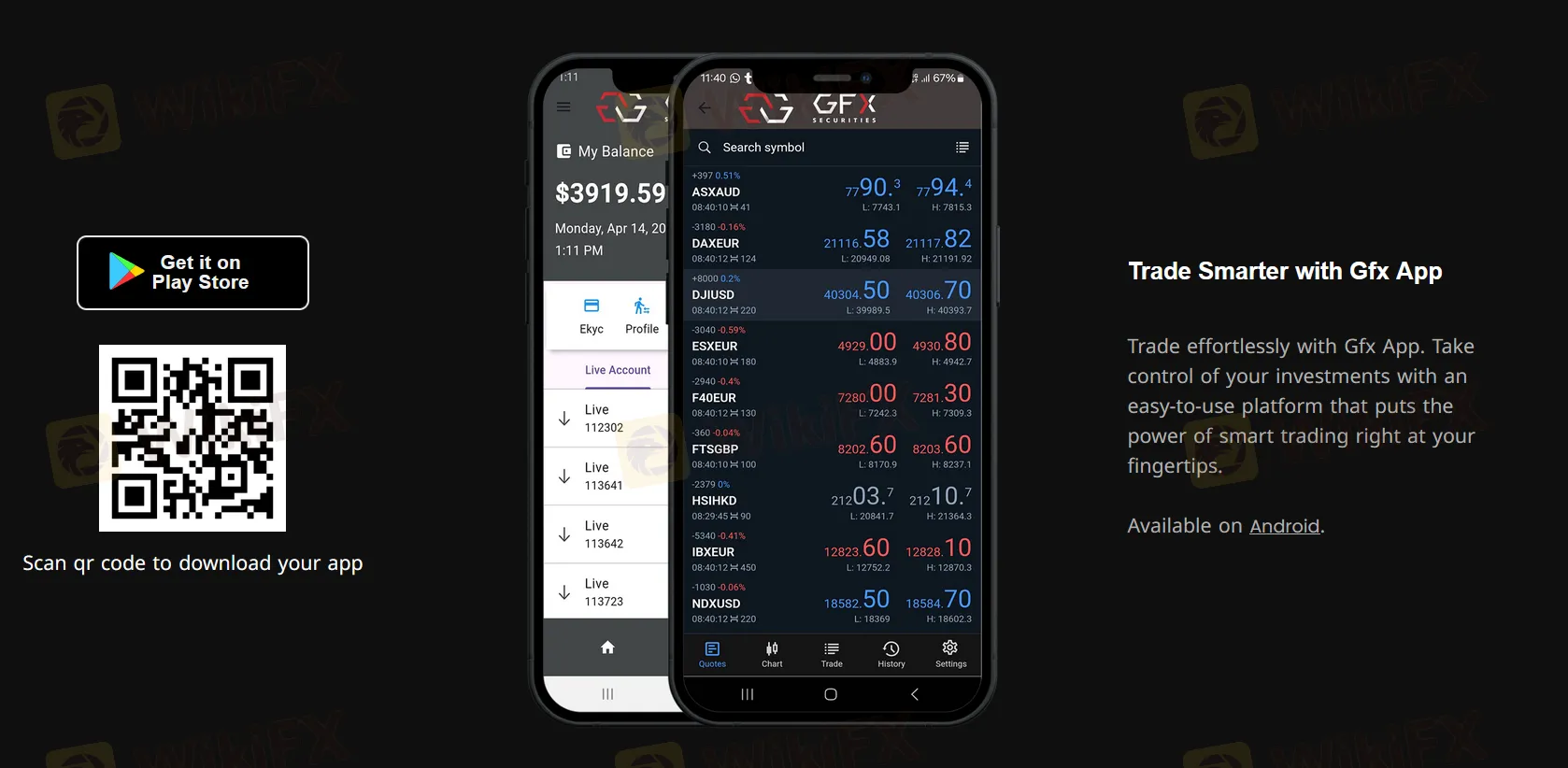

Plataporma ng Kalakalan

Nag-aalok ang GFX Securities ng kanilang sariling mobile APP at hindi sumusuporta sa karaniwang ginagamit na MT4 o MT5.

| Plataporma ng Kalakalan | Supported | Available Devices | Angkop para sa |

| GFX APP | ✔ | Mobile | / |

| MT5 | ❌ | / | Mga may karanasan na mangangalakal |

| MT4 | ❌ | / | Mga nagsisimula |

Deposito at Pag-Wiwithdraw

Maaaring mag-deposito at mag-withdraw ng pondo ang mga mangangalakal sa pamamagitan ng Mastercard, MoneyGram, Bank transfer at VISA.