회사 소개

| GFX Securities 리뷰 요약 | |

| 설립 연도 | 2022 |

| 등록 국가/지역 | 모리셔스 |

| 규제 | 규제 없음 |

| 시장 상품 | 외환, 금속, 지수, 에너지, 주식 CFD, 암호화폐 |

| 데모 계정 | ❌ |

| 레버리지 | 최대 1:500 |

| 스프레드 | 2.5 픽셀부터 (표준 계정) |

| 거래 플랫폼 | GFX APP |

| 최소 입금 | / |

| 고객 지원 | 전화: (+973) 17260190 |

| 이메일: info@gfxsecurities.com | |

| Facebook, YouTube, X, Instagram | |

| 주소: 모리셔스 공화국 에벤 스카이 3층, 루 드 I 인스티튜트, 에벤 | |

| 지역 제한 | 미국, 쿠바, 미얀마, 북한 |

| 보너스 | 20% 입금 보너스 |

GFX Securities 정보

GFX Securities는 2022년에 설립된 온라인 브로커로 외환, 금속, 지수, 에너지, 주식 CFD 및 암호화폐와 같은 다양한 거래 상품을 제공합니다. 세 가지 종류의 라이브 계정을 제공하며 레버리지는 최대 1:500까지 가능합니다.

장단점

| 장점 | 단점 |

| 다양한 거래 상품 | 규제 없음 |

| 다양한 계정 유형 | 지역 제한 |

| 수수료 없음 | MT4 또는 MT5 없음 |

| 입금 시 20% 보너스 |

GFX Securities이 신뢰할 만한가요?

아니요. GFX Securities은 현재 규제가 없습니다. 리스크를 인식해주시기 바랍니다!

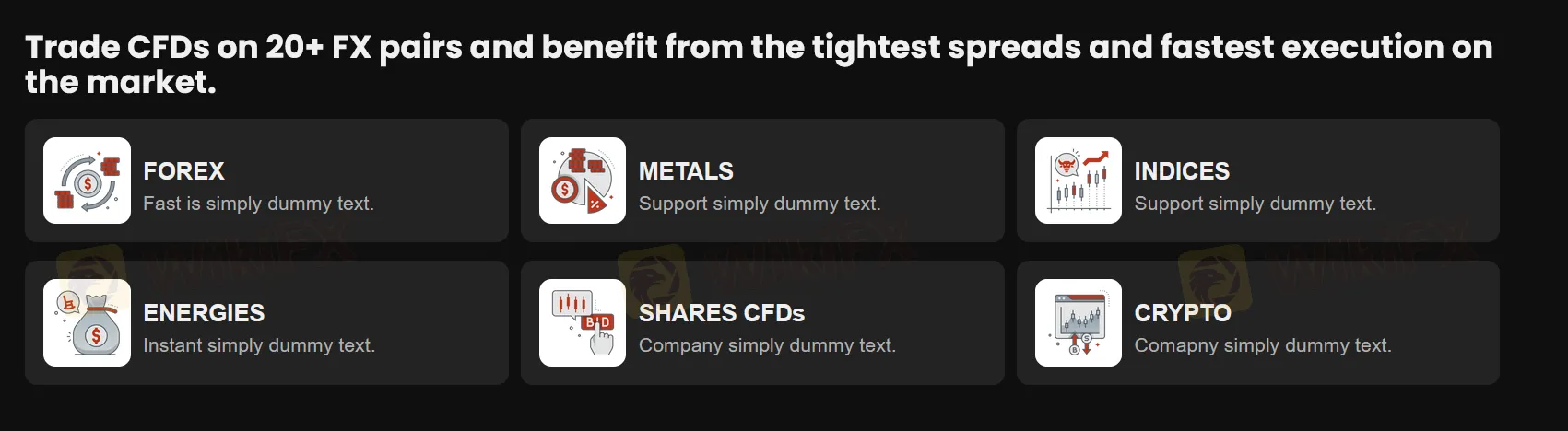

GFX Securities에서 무엇을 거래할 수 있나요?

GFX Securities은 외환, 금속, 지수, 에너지, 주식 CFD 및 암호화폐에 대한 거래 도구를 제공합니다.

| 거래 가능한 도구 | 지원 |

| 외환 | ✔ |

| 지수 | ✔ |

| 주식 CFD | ✔ |

| 에너지 | ✔ |

| 암호화폐 | ✔ |

| 금속 | ✔ |

| 옵션 | ❌ |

| 채권 | ❌ |

| ETFs | ❌ |

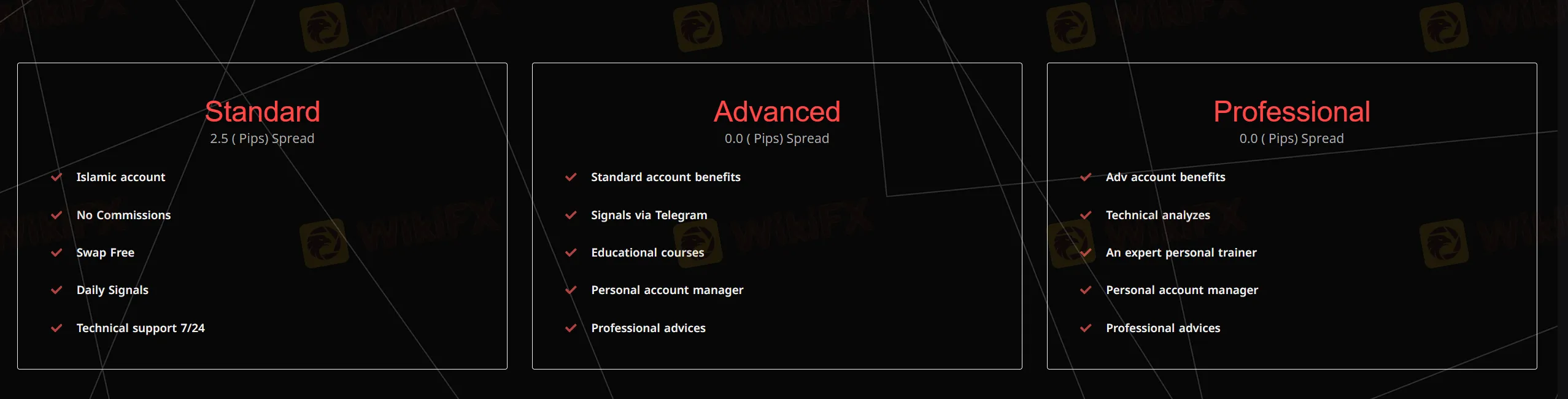

계정 유형 및 수수료

GFX Securities 웹사이트에는 세 가지 계정 유형이 있습니다.

| 계정 유형 | 최소 입금 | 스프레드 | 수수료 |

| 표준 | / | 2.5 픽스부터 | 0 |

| 고급 | 0 픽스부터 | ||

| 전문가 |

레버리지

레버리지는 최대 1:500까지 가능합니다. 투자자는 높은 레버리지가 높은 잠재적 위험을 가져올 수 있으므로 신중히 고려해야 합니다.

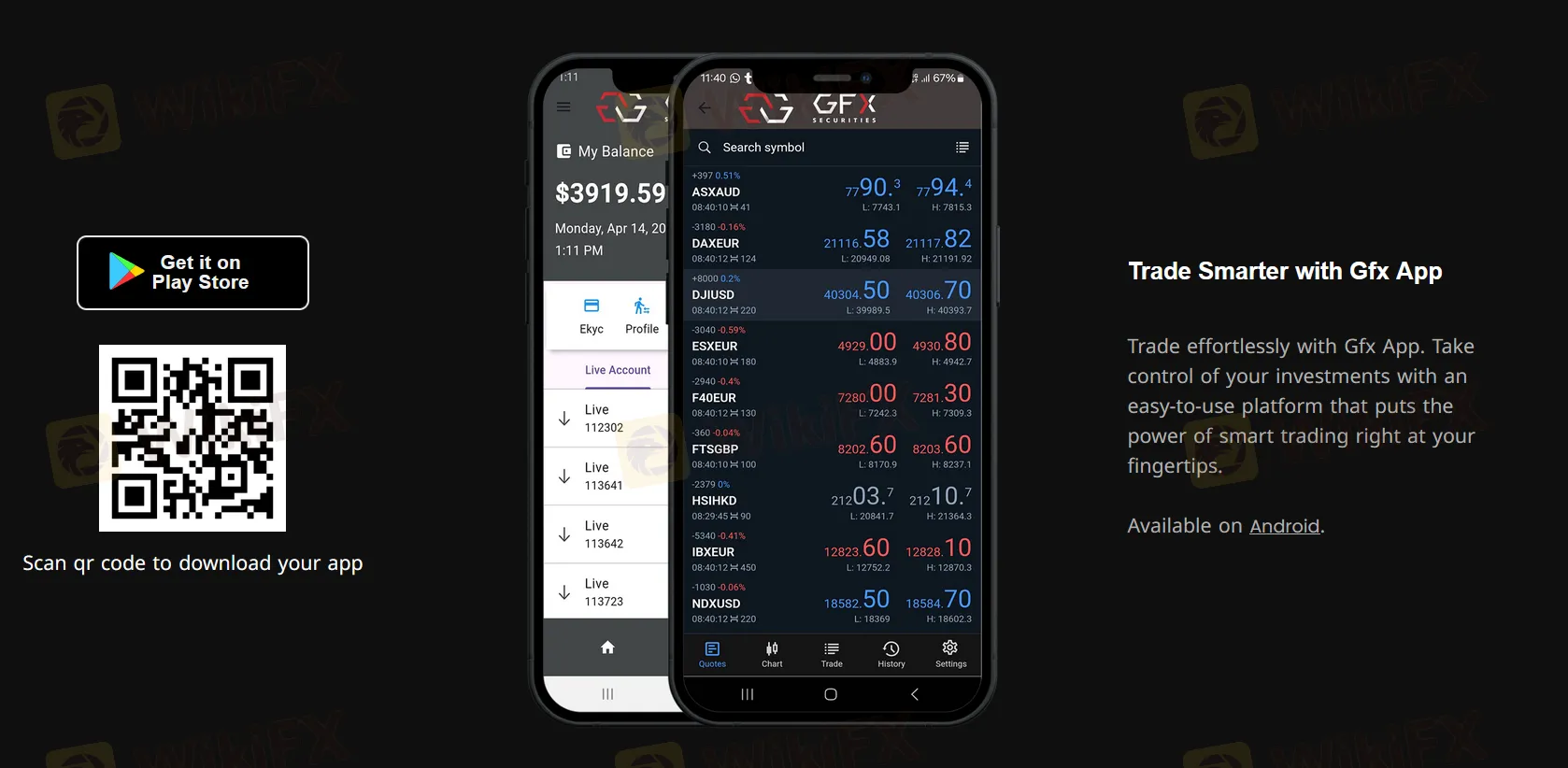

거래 플랫폼

GFX Securities은 자체 모바일 앱을 제공하며 일반적으로 사용되는 MT4 또는 MT5를 지원하지 않습니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합한 대상 |

| GFX 앱 | ✔ | 모바일 | / |

| MT5 | ❌ | / | 경험 있는 트레이더 |

| MT4 | ❌ | / | 초보자 |

입출금

거래자는 Mastercard, MoneyGram, 은행 송금 및 VISA를 통해 자금을 입출금할 수 있습니다.