Şirket özeti

| Carlyle İnceleme Özeti | |

| Kuruluş Yılı | 1987 |

| Kayıtlı Ülke/Bölge | Amerika Birleşik Devletleri |

| Regülasyon | Herhangi bir regülasyon bulunmamaktadır |

| Ürünler ve Hizmetler | Global Özel Sermaye, Küresel Kredi, Yatırım Çözümleri |

| Deneme Hesabı | / |

| Kaldıraç | / |

| Spread | / |

| İşlem Platformu | / |

| Minimum Yatırım | / |

| Müşteri Desteği | Telefon: +1 212 813 4504 |

| E-posta: media@carlyle.com | |

| Sosyal Medya: X, YouTube, LinkedIn, Instagram | |

| Adres: 799 9th Street, NW, Suite 200, Washington, DC 20001 | |

Carlyle Bilgileri

Carlyle, 1987 yılında kurulmuş ve merkezi Amerika Birleşik Devletleri'nde bulunan küresel bir yatırım firmasıdır. Perakende aracı olarak düzenlenmemekte ve işlem hesapları sunmamaktadır. Şirket, özel sermaye, kredi ve yatırım çözümleri için kurumsal varlık yönetiminde uzmanlaşmış olup yaklaşık olarak 453 milyar dolarlık varlığı yönetmektedir.

Artıları ve Eksileri

| Artılar | Eksiler |

| Köklü küresel yatırım firması | Düzenlenmemiş |

| Çeşitli iletişim kanalları | İşlem koşulları hakkında bilgi yok |

| Birçok küresel şubesi bulunmaktadır |

Carlyle Güvenilir mi?

Carlyle, ABD'de merkezli olup ancak oradaki herhangi bir finansal kurum tarafından denetlenmemektedir. Ayrıca, FCA (İngiltere), ASIC (Avustralya) veya CySEC (Kıbrıs) gibi önemli uluslararası düzenleyici otoritelerden herhangi bir lisansa sahip değildir.

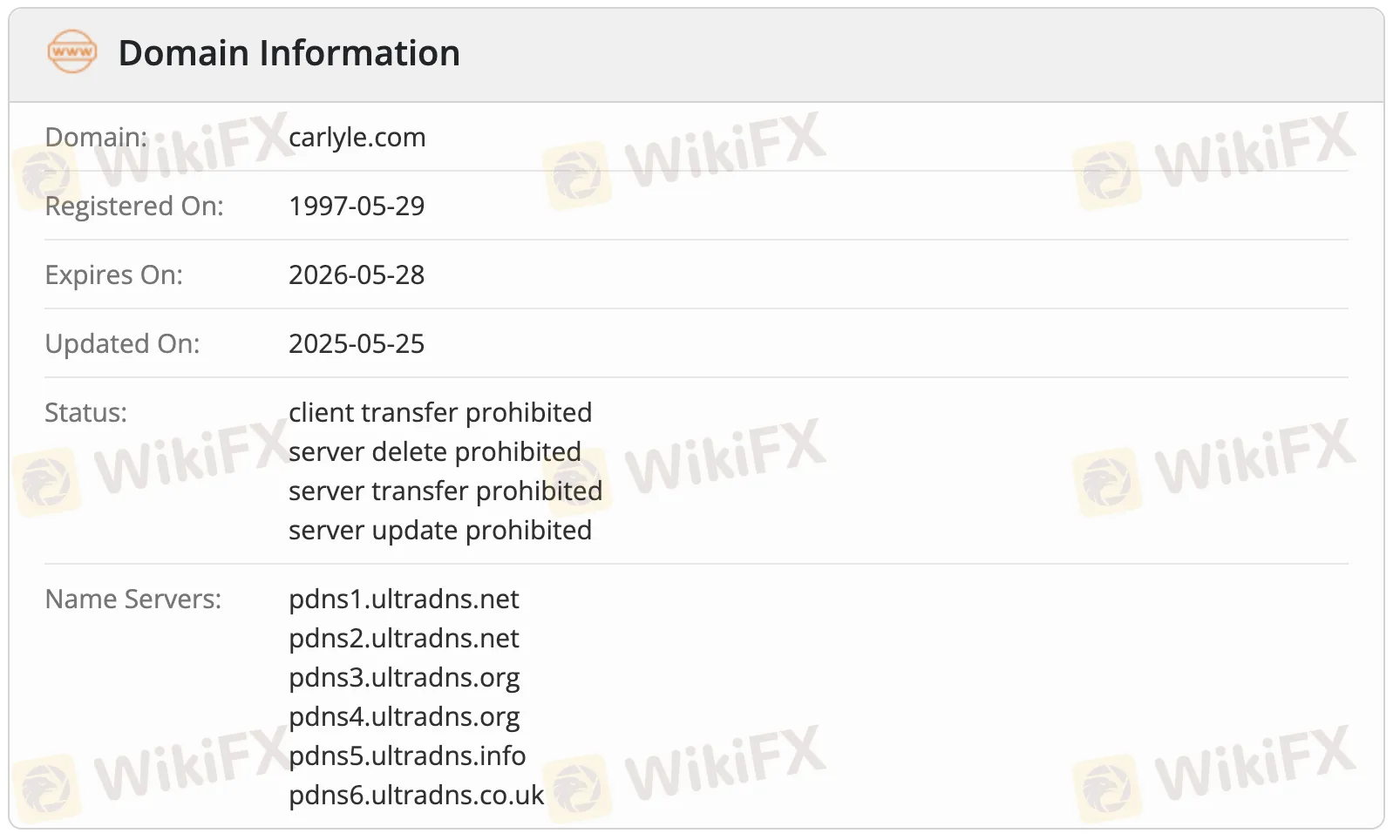

carlyle.com alan adı için yapılan WHOIS araması, alan adının ilk kez 29 Mayıs 1997'de kaydedildiğini göstermektedir. Alan adı hala aktiftir ve kaydı 28 Mayıs 2026'ya kadar geçerlidir. Son değişiklik ise 25 Mayıs 2025 tarihinde yapılmıştır. Alan adı için bazı kurallar bulunmakta olup, müşterilerin sunucuları taşımalarına, düzenlemelerine, kaldırmalarına veya transfer etmelerine izin verilmemektedir.

Ürünler ve Hizmetler

Carlyle, özellikle özel sermaye, kredi ve yatırım çözümleri alanında küresel yatırım yönetimi hizmetleri sunmaktadır. Farklı segmentler ve araçlar üzerinde dünya çapında 453 milyar doların üzerinde varlığı yönetmektedir.

| Ürünler & Hizmet | Desteklenen |

| Global Özel Sermaye | ✔ |

| Küresel Kredi | ✔ |

| Yatırım Çözümleri | ✔ |