Resumo da empresa

| GFX Securities Resumo da Revisão | |

| Fundação | 2022 |

| País/Região Registrada | Maurício |

| Regulação | Sem regulação |

| Instrumentos de Mercado | Forex, Metais, Índices, Energias, Ações CFDs, Criptomoedas |

| Conta Demo | ❌ |

| Alavancagem | Até 1:500 |

| Spread | A partir de 2.5 pips (conta padrão) |

| Plataforma de Negociação | GFX APP |

| Depósito Mínimo | / |

| Suporte ao Cliente | Telefone: (+973) 17260190 |

| Email: info@gfxsecurities.com | |

| Facebook, YouTube, X, Instagram | |

| Endereço: 3rd Floor, Ebene Skies, Rue de I Institut, Ebene, República de Maurício | |

| Restrições Regionais | EUA, Cuba, Mianmar, Coreia do Norte |

| Bônus | Bônus de depósito de 20% |

Informações sobre GFX Securities

GFX Securities é uma corretora online fundada em 2022 que oferece uma variedade de produtos de negociação como Forex, Metais, Índices, Energias, Ações CFDs e Criptomoedas. Ela fornece três tipos de contas reais e a alavancagem pode chegar a 1:500.

Prós e Contras

| Prós | Contras |

| Vários instrumentos de negociação | Sem regulação |

| Múltiplos tipos de conta | Restrições regionais |

| Sem comissões | Sem MT4 ou MT5 |

| Bônus de 20% para depósito |

GFX Securities é Legítimo?

Não. GFX Securities não possui regulações atualmente. Esteja ciente do risco!

O Que Posso Negociar na GFX Securities?

GFX Securities oferece instrumentos de negociação em Forex, Metais, Índices, Energias, Ações CFDs e Criptomoedas.

| Instrumentos Negociáveis | Suportado |

| Forex | ✔ |

| Índices | ✔ |

| Ações CFDs | ✔ |

| Energias | ✔ |

| Criptomoedas | ✔ |

| Metais | ✔ |

| Opções | ❌ |

| Obrigações | ❌ |

| ETFs | ❌ |

Tipo de Conta e Taxas

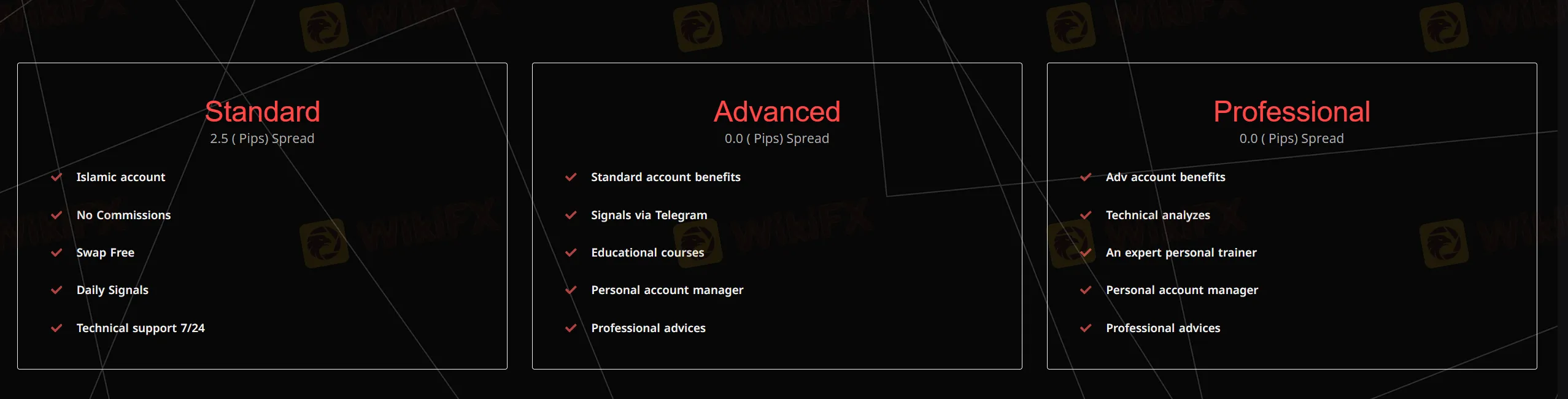

Existem três tipos de conta no site da GFX Securities.

| Tipo de Conta | Depósito Mínimo | Spread | Comissão |

| Padrão | / | A partir de 2.5 pips | 0 |

| Avançada | A partir de 0 pips | ||

| Profissional |

Alavancagem

A alavancagem pode chegar a 1:500. Os investidores precisam considerar cuidadosamente antes de negociar, pois a alta alavancagem pode trazer altos riscos potenciais.

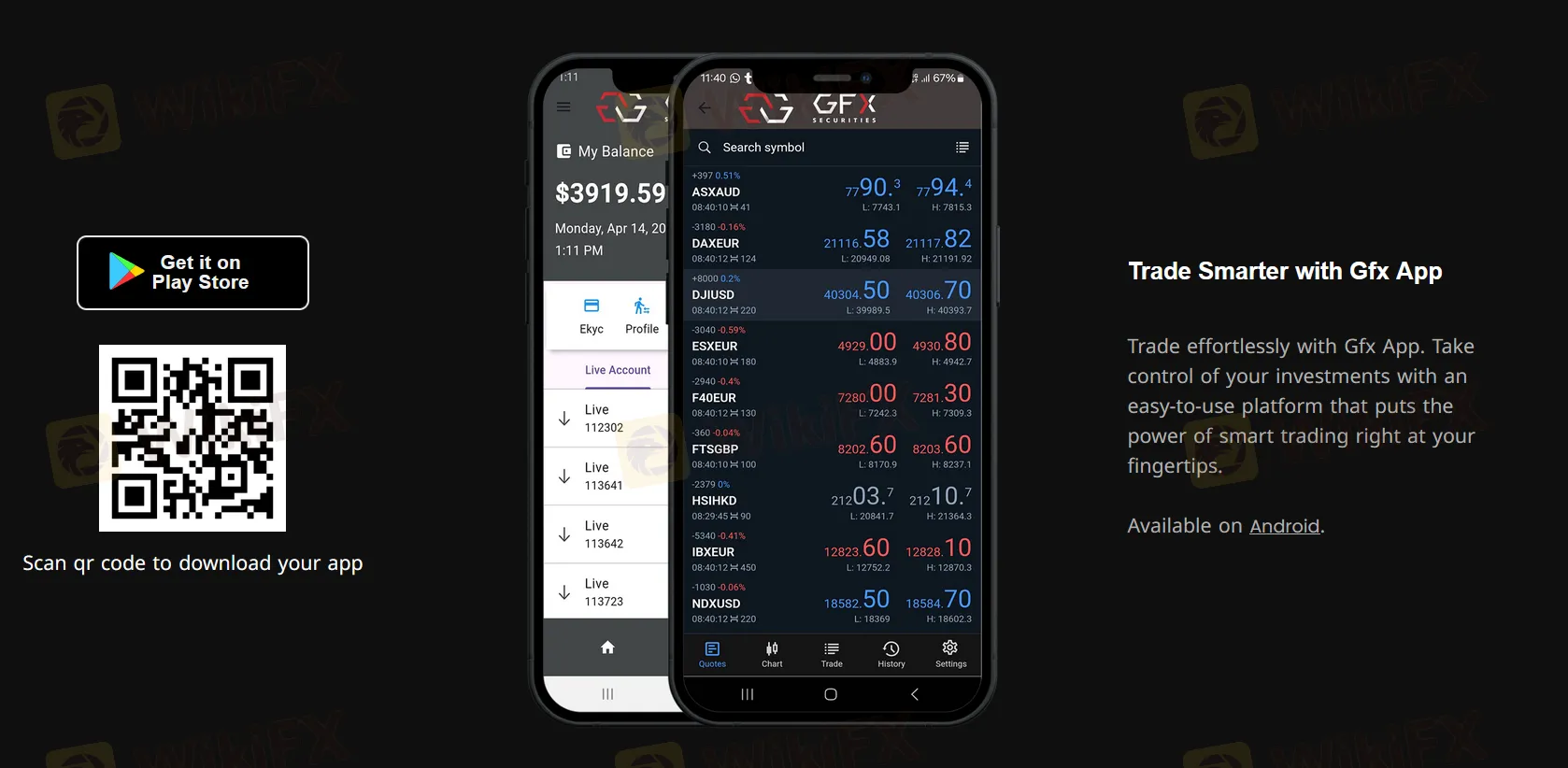

Plataforma de Negociação

GFX Securities oferece seu próprio aplicativo móvel e não suporta o MT4 ou MT5 comumente usados.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| APP GFX | ✔ | Móvel | / |

| MT5 | ❌ | / | Traders experientes |

| MT4 | ❌ | / | Iniciantes |

Depósito e Saque

Os traders podem depositar e sacar fundos via Mastercard, MoneyGram, Transferência Bancária e VISA.