Puan

charles SCHWAB

Amerika Birleşik Devletleri | 5-10 yıl |

Amerika Birleşik Devletleri | 5-10 yıl |https://www.schwab.com/

Web Sitesi

Derecelendirme Endeksi

Etkilemek

Etkilemek

AAA

Etki endeksi NO.1

Amerika Birleşik Devletleri 9.97

Amerika Birleşik Devletleri 9.97 İletişim

Forex Lisansı

Forex Lisansı

Forex işlem lisansı bulunamadı. Lütfen risklerin farkında olun.

- Bu aracı kurumun geçerli bir forex düzenlemesi bulunmamaktadır. Lütfen riskin farkında olun!

Temel Bilgiler

Amerika Birleşik Devletleri

Amerika Birleşik Devletleri charles SCHWAB ürününü görüntüleyen kullanıcılar bunları da görüntüledi..

IC Markets Global

MiTRADE

TMGM

PU Prime

Arama Kaynağı

Dil

Pazar Analizi

Malzeme Teslimatı

Web sitesi

schwab.com

162.93.215.103schwab.com.hk

162.93.210.100tdameritrade.com

198.200.171.204tdameritrade.com.sg

198.200.171.26tdameritrade.com.hk

198.200.170.20

Şecere

İlgili Şirketler

Allen, Peter Blake

Yönetici Memur

Başlangıç tarihi

Durum

Çalışan

CHARLES SCHWAB & CO. INC.(District of Columbia (United States))

Allen, Peter Blake

Vali

Başlangıç tarihi

Durum

Çalışan

CHARLES SCHWAB & CO. INC.(District of Columbia (United States))

Beatty, Jonathan

Yönetici Memur

Başlangıç tarihi

Durum

Çalışan

CHARLES SCHWAB & CO. INC.(District of Columbia (United States))

Wiki Soru & Cevap

Does Charles Schwab have any cons?

As much as I appreciate the services offered by Charles Schwab, there are a few areas where I believe they could improve, especially when it comes to the Charles Schwab leverage options available. Schwab offers leverage of up to 2:1 for equities in margin accounts, meaning I can borrow up to 50% of the value of the securities I am trading. While this is typical for most brokers, some advanced traders, including myself, would appreciate a bit more flexibility, especially when trading higher-risk assets like options or futures. For someone like me who trades actively, this conservative approach can sometimes limit my ability to execute more aggressive strategies. Furthermore, Schwab is primarily focused on the U.S. market, and as such, investors looking for easy access to international markets may find this platform limiting. While Schwab does offer global accounts, their international trading options are somewhat restricted compared to brokers that are more focused on global diversification. Another drawback I encountered is that while Schwab offers great customer service, their thinkorswim® platform, which is geared toward advanced traders, can be quite complex for beginners. I recall feeling slightly overwhelmed by the sheer number of tools and features, which I didn’t initially know how to use effectively. For novice traders, this can be a bit intimidating and could potentially delay the learning curve. However, once I became familiar with it, thinkorswim® provided some of the most powerful trading tools I’ve ever used. In conclusion, while these cons are notable, I still find Schwab to be a great platform due to its overall reliability, excellent educational resources, and transparent fee structure.

Is Charles Schwab regulated? Is it safe and legit?

In my experience, Charles Schwab is a reliable and secure brokerage, despite its regulatory status with the SFC being revoked. Schwab operates under U.S. financial regulations, and it is a member of SIPC (Securities Investor Protection Corporation), which offers protection for customers' securities, up to $500,000, including $250,000 in cash. This SIPC protection gives me confidence that my assets are secure, and it provides peace of mind in case of unforeseen circumstances. Additionally, Schwab Bank is FDIC-insured, which means that any funds in my Schwab Bank accounts are covered up to $250,000 per depositor, further adding to the safety of my funds. Although the revocation of SFC regulation might seem concerning for non-U.S. investors, the extensive regulatory framework that Schwab adheres to within the United States ensures that I am well-protected as an investor. When I first registered and logged into my Charles Schwab account, I found that Schwab makes security a top priority, which reassured me. While the revoked status from SFC might limit Schwab's activities in some regions, its extensive regulatory background and customer protection mechanisms make it a trustworthy platform for me. Therefore, despite this revocation, I still feel comfortable with Schwab’s overall security and regulatory compliance.

Which payment methods does Charles Schwab support for deposits?

One of the reasons I continue using Charles Schwab is the variety of methods available for depositing funds. Schwab supports electronic funds transfers (EFT), which allow me to quickly transfer money from my bank account to Schwab. I also appreciate that Schwab accepts wire transfers and checks for deposits, giving me flexibility depending on my situation. I’ve personally used EFT for deposits, and it’s always been a smooth and fast process. Additionally, Schwab allows direct deposit, which is a great feature if I want to automate my contributions. Having the ability to easily deposit funds into my Schwab account ensures that I can invest whenever I want without worrying about the logistics of funding my account. Schwab’s deposit methods are reliable and easy to use, which is why I’ve never encountered any issues when adding funds to my account.

Can I know the details about Charles Schwab's fees?

One of the things I value about Charles Schwab is their transparency regarding fees. As a regular user of their services, I was relieved to discover that they offer commission-free trading for most online stocks, ETFs, and options. This was particularly appealing to me as an active trader, because avoiding commissions means I can keep more of my investment returns. However, I did notice that for options trades, Schwab charges a $0.65 fee per contract, which is fairly typical across the industry. I also encountered some mutual fund transaction fees, particularly for those outside Schwab's OneSource® program, which can go up to $74.95 per trade. Despite these exceptions, I find Schwab’s overall fee structure to be highly competitive. Additionally, Schwab does not charge account maintenance or inactivity fees, and the Charles Schwab minimum deposit requirement for most accounts is $0, which makes it very accessible. I also appreciate that Schwab provides detailed information on all fees upfront, so there are no surprises. I was able to easily find all the pricing details on their website, which helped me make an informed decision. The absence of hidden fees and the simplicity of their pricing structure makes Schwab an appealing option for me. Overall, I feel that Schwab’s fees are reasonable for the value it provides, and I haven’t encountered any unexpected charges.

kullanıcı incelemesi6

Değerlendirmek istedikleriniz

Lütfen giriş yapın...

Yorum 6

TOP

TOP

Chrome

Chrome uzantısı

Küresel Forex Broker Düzenleyici Sorgulama

Forex brokerlerinin web sitelerine göz atın ve hangilerinin güvenilir hangilerinin dolandırıcı olduğunu doğru bir şekilde belirleyin

Şimdi Yükle

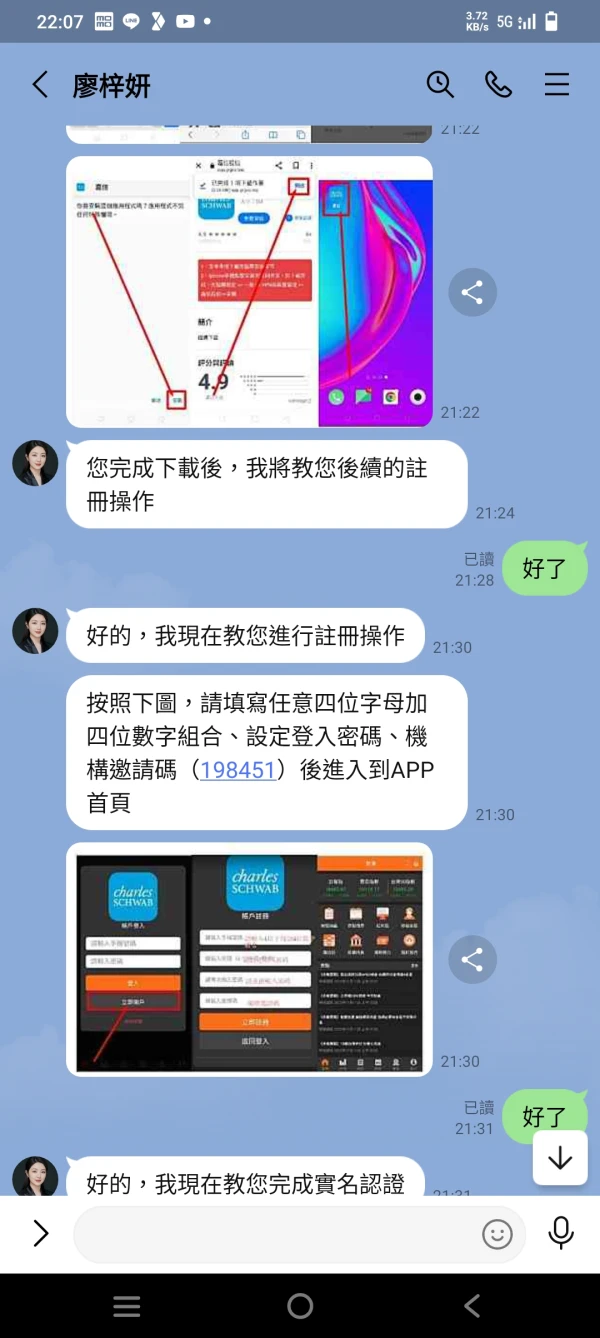

王爺爺

Tayvan

Bu Menkul Kıymet Yatırım Ortaklığı, HSBC ile tamamen aynı yöntemi kullanıyor. İlk önce size piyango yoluyla 20.000 yuan verecek ve ardından 100.000 yuan yatırım yapmanızı söyleyecektir. Yabancı yatırımcılar yatırımlarını 3 günde 150 bin artırıyor. Müdürünüzle bile operasyona ayak uydurabilecek 270.000 paranız var. Bu 3 günün kazancı size aittir. 3 gün sonra, yalnızca ana paranızı ve 3 günlük işletme kârınızı bırakarak 170.000 tutarındaki yatırımın tamamını yapacaksınız. İlk başta küçük bir miktar çekmenize izin verilecek, daha sonra yavaş yavaş para çekme işlemine izin verilmeyecektir. En sonunda sizinle anlaşıp önce kârın yarısını, sonra da anaparayı ve kârı size havale etmenizi istiyorlar. Yukarıdaki bu yeni dolandırıcılık yöntemidir. Umarım kimse benim gibi aldatılmaz.

Teşhir

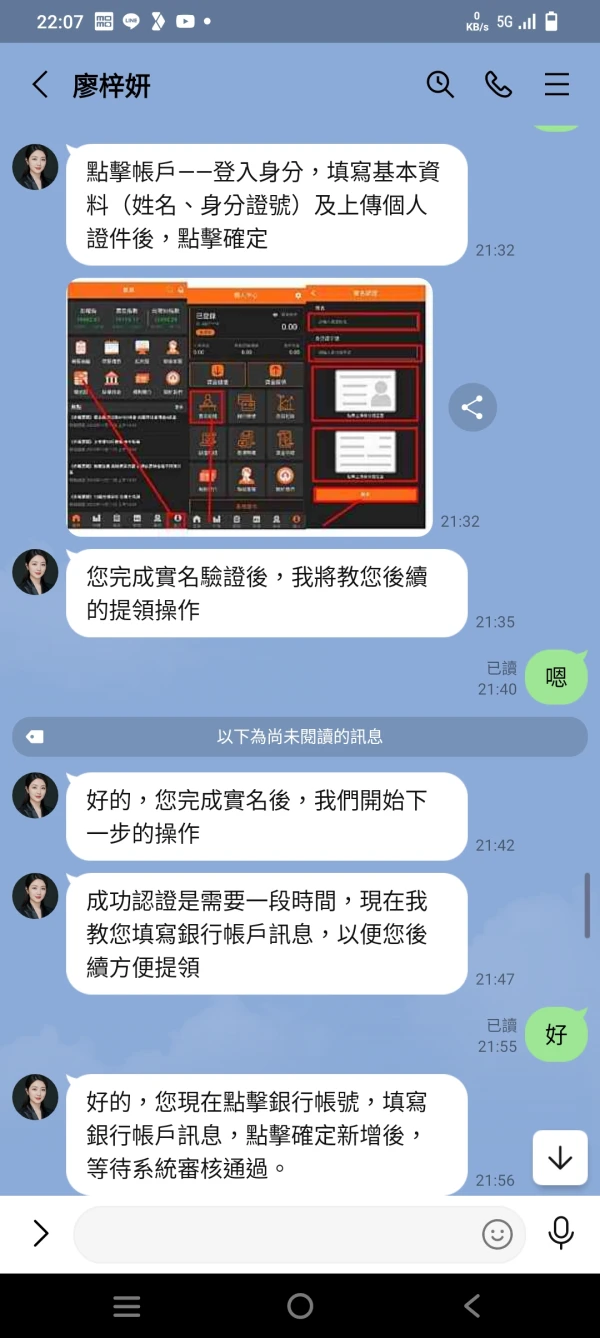

kang Rona

Endonezya

Para çekme konusunda yardımcı olabilecek var mı? Bir dolandırıcılık olduğundan ve CE'den çok fazla para yatırıldığından endişeleniyorum. Para çekme değeri üzerinden yüzde 15 vergi ödemem gerekiyor...

Teşhir

Gerhard Van Wyk

Güney Afrika

i joined on May the 4th. everytime they ask for a fee and everytime they lie about payout. They are very slick with the words.

Teşhir

Đỗ Văn Ngọc

Avustralya

TD Ameritrade'in web sitesi çok profesyonel görünüyor, ancak tüm web sitesini aradım ve düzenleyici lisanslar hakkında hiçbir bilgi bulamadım. Bir şirket sıkı bir şekilde düzenlenmişse, müşterilerin güvenini kazanmak için yüksek sesle söylemeli, değil mi?

Pozitif

♔

Hong Kong

TD Ameritrade'de hesap açmanın maliyeti 25.000$'dır... Dürüst olmak gerekirse eşik benim için biraz yüksek! O yüzden şimdilik takas düşünmüyorum. Öyle oluyor ki, bu şirketin nasıl olduğunu görmek için bekleyip tekrar görebilirim.

Doğal

墨香

Arjantin

Aslında, TD A ile ticaret deneyimini seviyorum. Yaklaşık iki yıldır forex ticareti yapıyorum, ancak sürekli veya yoğun bir şekilde değil, çünkü çok fazla deneyimim olduğunu söyleyemem, ancak TDA'daki koşullar ve hizmetler iyileştirildi. benim için tatmin edici Wikifx'in neden burada düzenlemeye tabi olmadığını söylediğini anlamıyorum, çünkü hala normal şekilde geri çekilebiliyorum.

Pozitif