Resumo da empresa

| Invesco Resumo da Revisão | |

| Fundado | 1995 |

| País/Região Registrado | Estados Unidos |

| Regulação | FSA |

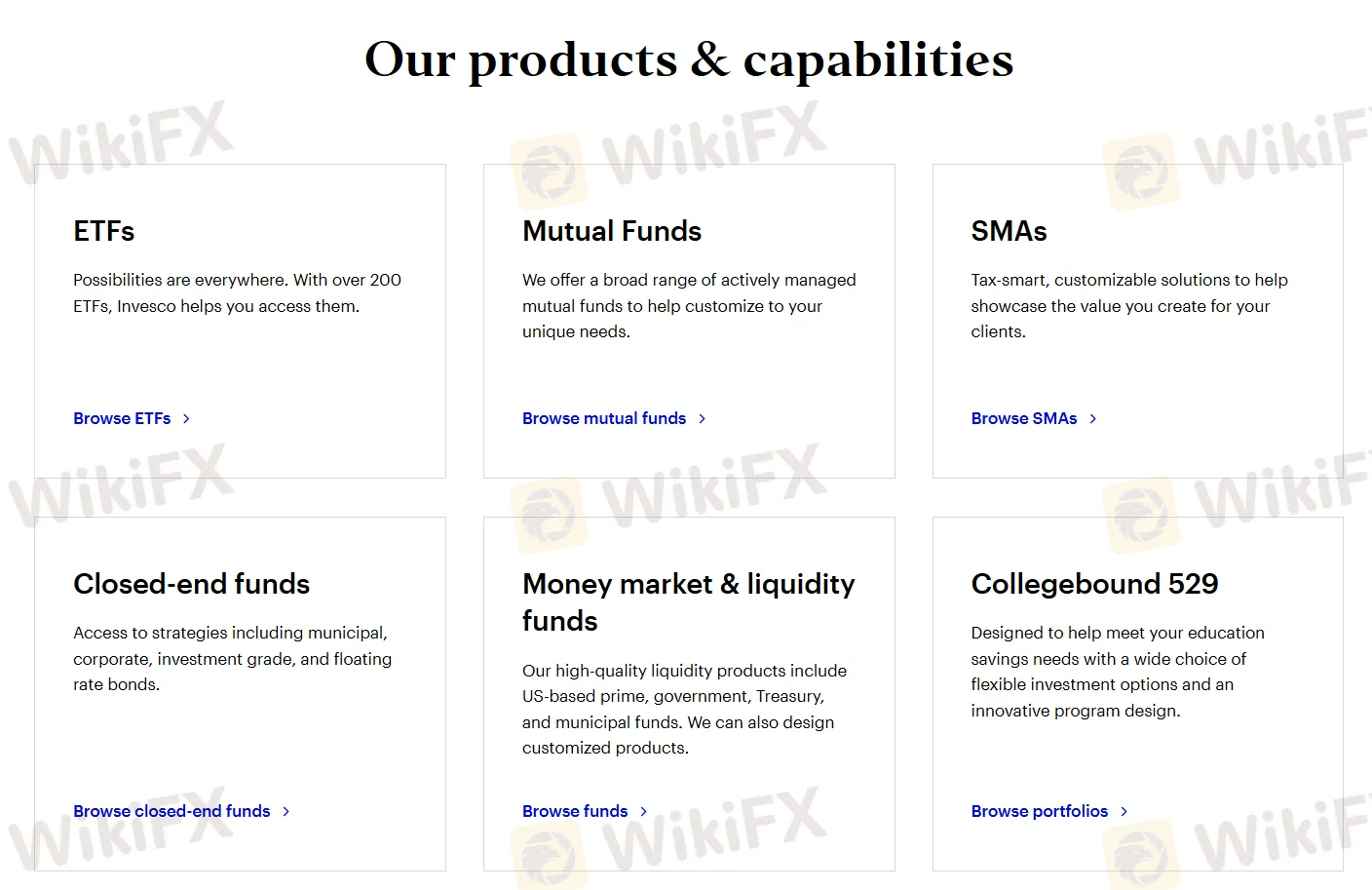

| Produtos e Serviços | ETFs, fundos mútuos geridos ativamente, SMAs, fundos de fechamento, fundos de mercado monetário e liquidez, e planos Collegebound 529 |

| Suporte ao Cliente | EUA (800) 959-4246Fora dos EUA (713) 626-1919Linha de investidores Invesco (800) 246-5463Fundos de fechamento (800) 341-2929Segunda-feira - Sexta-feira, 7:00 am-6:00 pm, CT |

Invesco Informação

Invesco é uma empresa de gestão de investimentos global bem estabelecida regulada pela FSA. A empresa oferece diversos produtos e serviços financeiros, incluindo ETFs, fundos mútuos, SMAs, fundos de fechamento, fundos de mercado monetário e 529 planos, fornecendo soluções de investimento padrão e personalizadas com ferramentas convenientes de gerenciamento de contas.

Prós e Contras

| Prós | Contras |

|

|

|

|

Invesco é Legítimo?

Invesco possui uma Licença de Forex de Varejo regulada pela Agência de Serviços Financeiros (FSA) no Japão com o número de licença 関東財務局長(金商)第306号.

Produtos e Serviços

Invesco oferece diversos produtos e capacidades financeiras, incluindo ETFs, fundos mútuos geridos ativamente, SMAs, fundos de fechamento, fundos de mercado monetário e liquidez, e planos Collegebound 529, satisfazendo diversas necessidades de investimento e tipos de clientes. A empresa oferece soluções prontas e personalizáveis.

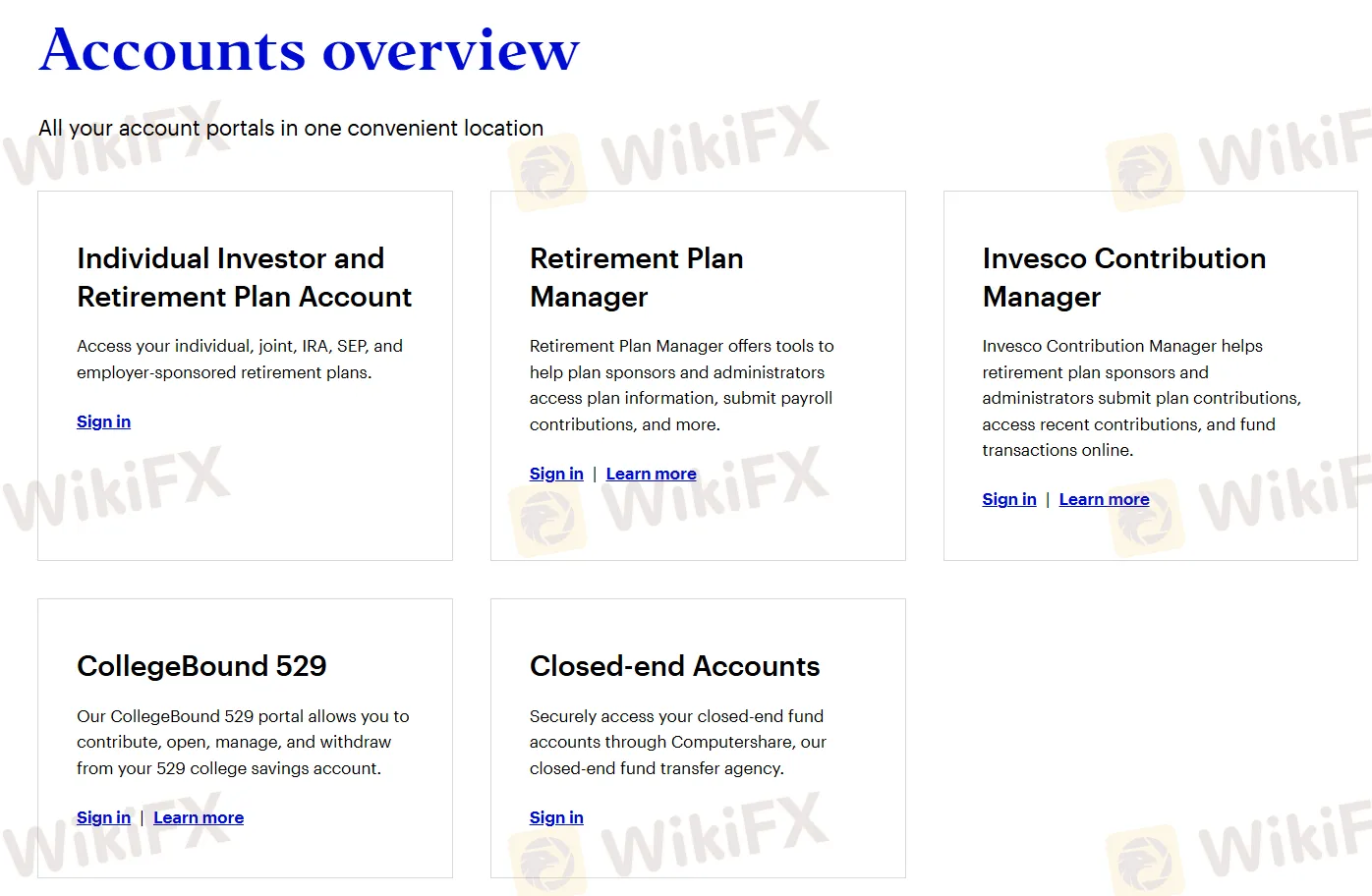

Visão Geral das Contas

Invesco oferece acesso a investidores individuais e contas de planos de aposentadoria, ferramentas para patrocinadores e administradores de planos de aposentadoria, uma plataforma para gerenciar contribuições Invesco, acesso a contas CollegeBound 529 e acesso seguro a contas de fechamento.