회사 소개

| T&D리뷰 요약 | |

| 설립 | 1980 |

| 등록 국가/지역 | 일본 |

| 규제 | FSA |

| 서비스 | AXIA (Value), SOPHIA (Core-Growth) 및 ESG 전략 |

| 고객 지원 | 이메일: mkt_offshore@tdasset.co.jp |

| 주소: T&D 자산 관리 주식회사. 미타 벨주 빌딩, 5-36-7, 시바, 미나토-쿠, 도쿄, 108-0014, 일본 | |

1980년에 설립되고 일본에 등록된 T&D은 FSA의 승인을 받아 AXIA (Value), SOPHIA (Core-Growth) 및 ESG 전략을 포함한 다양한 투자 관리 서비스를 제공하는 투자 관리 회사입니다.

장단점

| 장점 | 단점 |

| 다년간의 산업 경험 | 이메일 지원만 가능 |

| FSA 규제 | |

| 다양한 투자 관리 서비스 |

T&D이 신뢰할 만한가요?

네, T&D은 금융 서비스 기관 (FSA)에 의해 승인되고 규제를 받고 있습니다. 라이선스 유형은 소매 외환 라이선스이며 라이선스 번호는 関東財務局長(金商)第357号입니다.

| 규제 국가 | 규제 기관 | 현재 상태 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| 금융 서비스 기관 (FSA) | 규제됨 | T&Dアセットマネジメント株式会社 | 소매 외환 라이선스 | 関東財務局長(金商)第357号 |

서비스

T&D은 AXIA (Value), SOPHIA (Core-Growth) 및 ESG 전략을 포함한 다양한 투자 관리 서비스를 제공합니다.

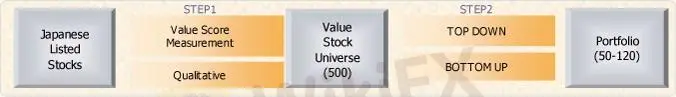

AXIA (Value): AXIA는 아직 가치가 평가되지 않았지만 비즈니스를 재구성하거나 새로운 비즈니스로 확장하거나 수익성을 높이기 위해 설득력 있는 노력을 하는 기업에 투자합니다.

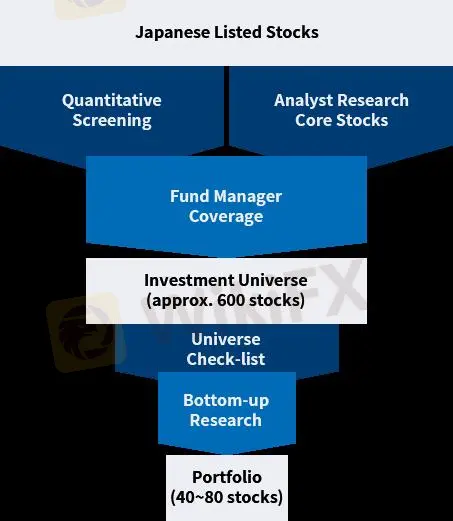

SOPHIA (Core-Growth): SOPHIA는 ROE 성장 동력에 의해 식별된 수익성이 향상되거나 재평가될 가능성이 있는 기업에 투자합니다. 이 전략은 ROE 성장으로부터 알파를 포착하기 위해 목표를 합니다.

ESG 전략: ESG는 장기적인 관점에서 높은 ESG 프로필을 가진 기업에 투자합니다.