회사 소개

| TD 리뷰 요약 | |

| 설립 연도 | 1998 |

| 등록 국가/지역 | 캐나다 |

| 규제 | 규제 없음 |

| 제품 및 서비스 | 당좌 및 저축 계좌, 신용카드, 모기지 옵션, 개인 투자, 대출, 온라인 투자 및 거래, 맞춤형 자산 상담 |

| 플랫폼/앱 | TD 앱 |

| 고객 지원 | 영어: 1-800-983-8472, 프랑스어: 1-800-983-8472, 중국어: 1-877-233-5844 |

TD 정보

TD은 종합적인 개인 뱅킹 서비스를 제공하는 온라인 거래 회사로, 신용카드, 모기지, 다양한 투자 옵션 등을 TD 앱을 통해 손쉽게 이용할 수 있습니다. 그러나 현재 어떤 금융 당국에도 규제되지 않았습니다.

장단점

| 장점 | 단점 |

| 다양한 개인 뱅킹 서비스 | 규제되지 않은 플랫폼 |

| 수수료 구조 불명확 |

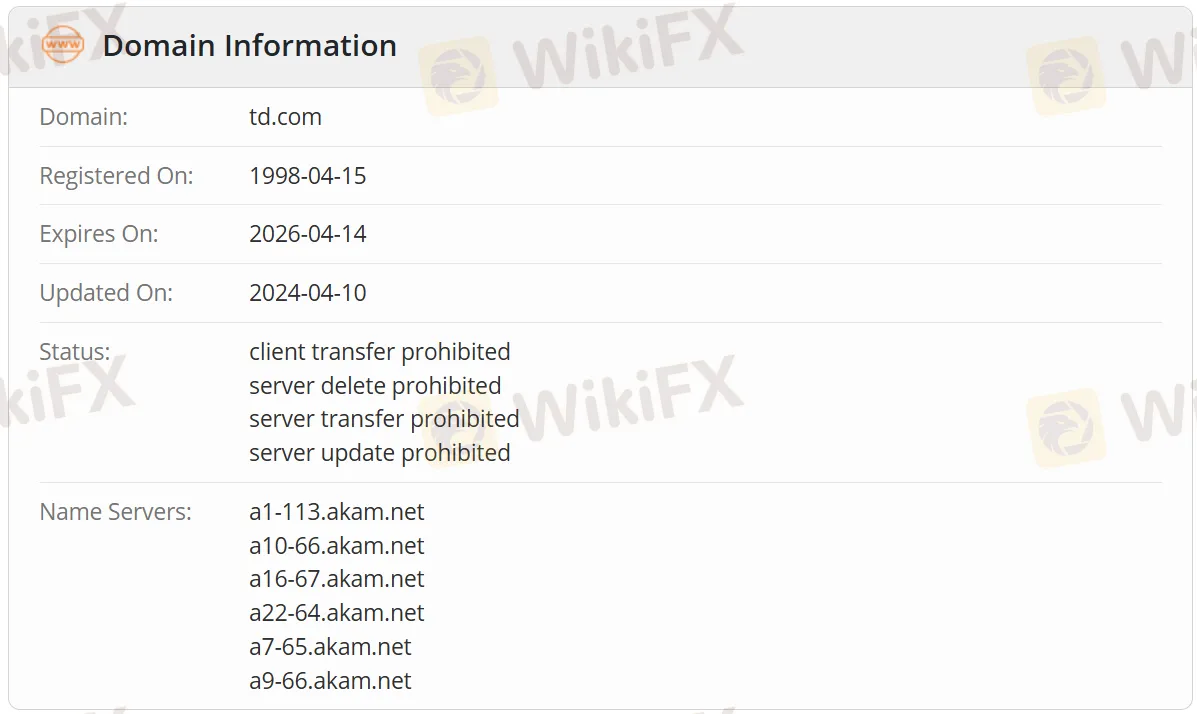

TD 합법 여부

아니요. TD은 규제되지 않은 플랫폼입니다. 도메인 이름 td.com은 1998년 4월 15일에 WHOIS에 등록되었으며, 2026년 4월 14일에 만료됩니다. 현재 상태는 "클라이언트 이전 금지, 서버 삭제/이전/업데이트 금지"입니다.

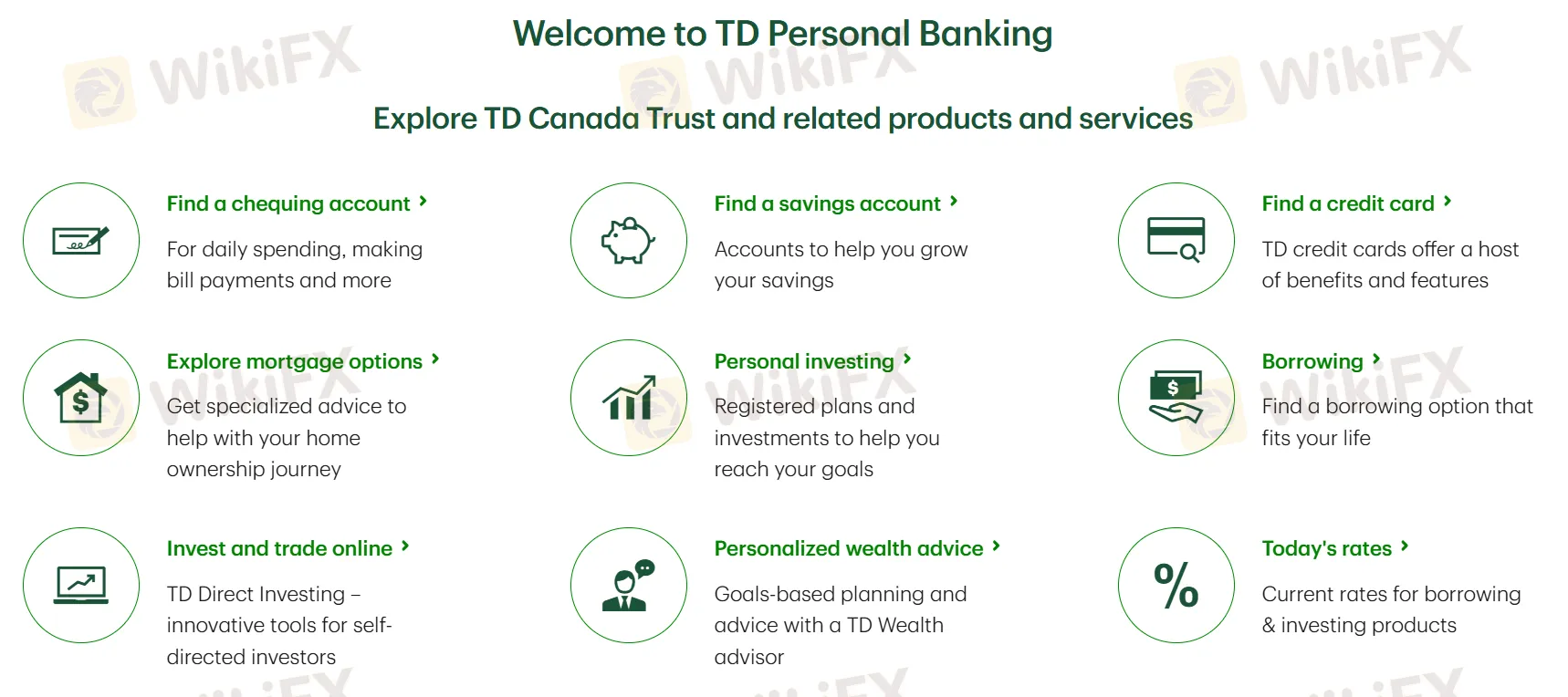

제품 및 서비스

TD은 당좌 및 저축 계좌, 신용카드, 모기지 옵션, 개인 투자, 대출, 온라인 투자 및 거래, 맞춤형 자산 상담 등의 제품 및 서비스를 제공합니다.

플랫폼/앱

| 플랫폼/앱 | 지원 | 사용 가능한 장치 |

| TD 앱 | ✔ | 애플, 안드로이드 |