Profil perusahaan

| I-Access Ringkasan Ulasan | |

| Didirikan | 1999 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | Tidak diatur |

| Instrumen Pasar | Efek, Saham, Futures, Opsi |

| Akun Demo | ✅ |

| Platform Perdagangan | ISSNet |

| Dukungan Pelanggan | |

| Tel: 2890 8019 | |

| Fax: 2850 5786 | |

| Email: info@i-access.com | |

| Alamat: Tsim Sha Tsui Suite 801-3, Lantai 8, Ocean Centre, Harbour City | |

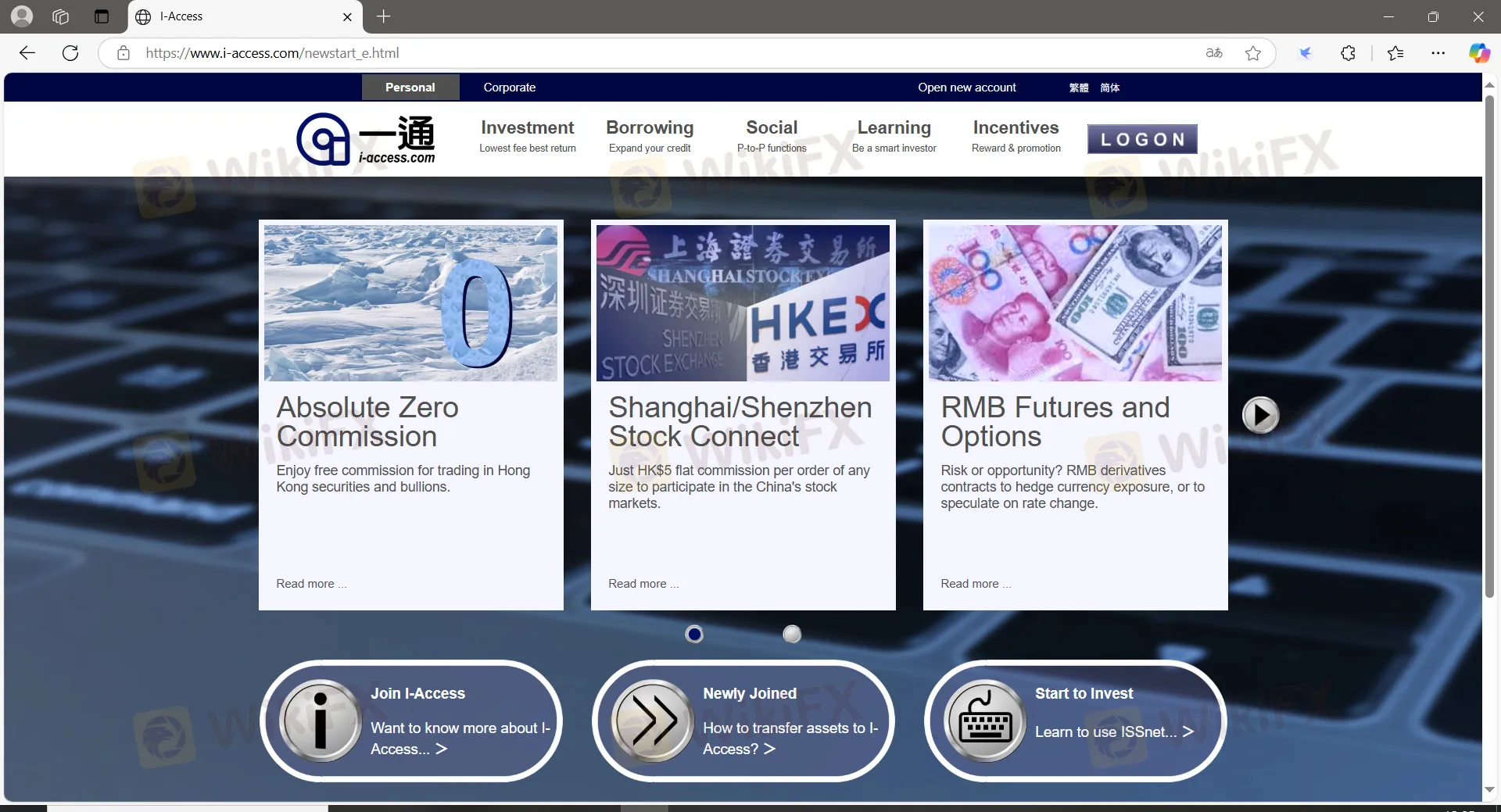

Informasi I-Access

I-Access adalah penyedia layanan pialang dan layanan keuangan unregulated terkemuka, yang didirikan di Hong Kong pada tahun 1999. Ini menawarkan produk dan layanan untuk Perdagangan Efek, Perdagangan Margin, Perdagangan Power, Perdagangan Saham Baru, Perdagangan Saham China A, Peminjaman & Peminjaman Saham, Jual Pendek, Perdagangan Futures, Perdagangan Opsi, Perdagangan Malam, Strategi Opsi, Hasil Tinggi, Rollover, Bullion, Perdagangan Lot Ganjil, Rencana Bulanan, eIPO, Langganan Obligasi Online, Kutipan Realtime, Layanan Counter, Dana Masuk/Keluar, dan Peminjaman.

Pro dan Kontra

| Pro | Kontra |

| Waktu operasi panjang | Kurangnya regulasi |

| Berbagai produk perdagangan | Biaya komisi dibebankan |

| Akun demo tersedia |

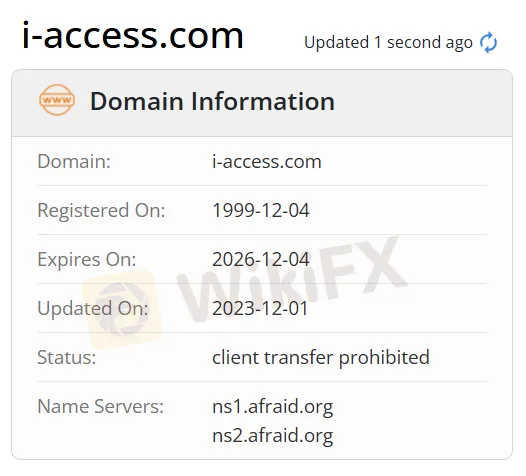

Apakah I-Access Legal?

Tidak. Saat ini I-Access tidak memiliki regulasi yang valid. Harap waspada terhadap risiko! Selain itu, status domainnya menunjukkan bahwa transfer klien dilarang.

Apa yang Bisa Saya Perdagangkan di I-Access?

| Instrumen Perdagangan | Didukung |

| Efek | ✔ |

| Saham | ✔ |

| Futures | ✔ |

| Opsi | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kriptokurensi | ❌ |

| Obligasi | ❌ |

| ETF | ❌ |

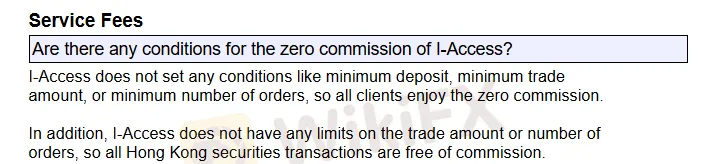

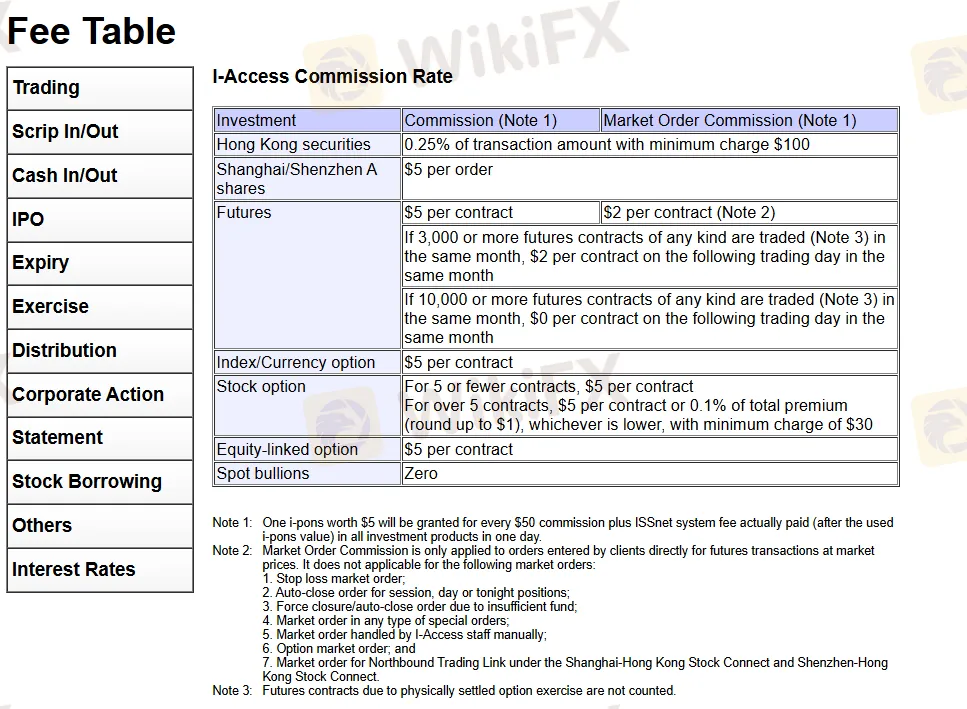

Biaya I-Access

| Investasi | Komisi | Komisi Pesanan Pasar |

| Sekuritas Hong Kong | 0,25% dari jumlah transaksi dengan biaya minimum $100 | |

| Saham Shanghai/Shenzhen A | $5 per pesanan | |

| Futures | $5 per kontrak | $2 per kontrak |

| Jika 3.000 atau lebih kontrak futures dari jenis apapun diperdagangkan dalam bulan yang sama, $2 per kontrak pada hari perdagangan berikutnya dalam bulan yang sama | ||

| Jika 10.000 atau lebih kontrak futures dari jenis apapun diperdagangkan dalam bulan yang sama, $0 per kontrak pada hari perdagangan berikutnya dalam bulan yang sama | ||

| Opsi Indeks/Mata Uang | $5 per kontrak | |

| Opsi Saham | Untuk 5 atau kurang kontrak, $5 per kontrak. Untuk lebih dari 5 kontrak, $5 per kontrak atau 0,1% dari total premi (dibulatkan ke $1), mana yang lebih rendah, dengan biaya minimum $30 | |

| Opsi Terkait Ekuitas | $5 per kontrak | |

| Bullion Spot | ❌ | |

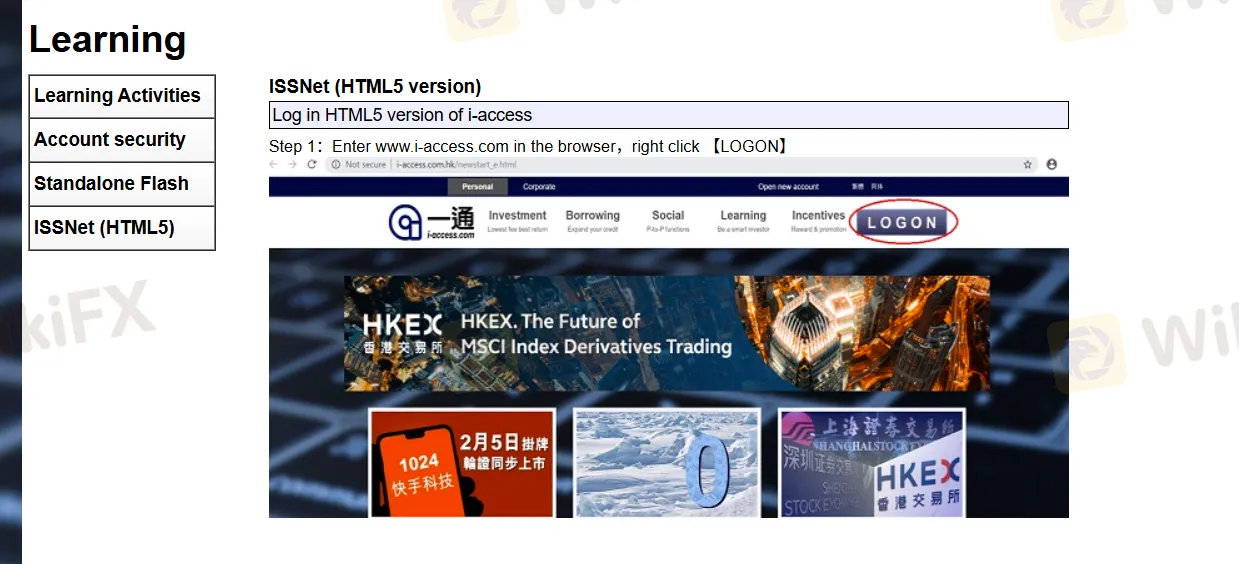

Platform Perdagangan

| Platform Perdagangan | Dukungan | Perangkat Tersedia |

| Aplikasi ISSNet | ✔ | Mobile |

| Web ISSNet | ✔ | PC, laptop, tablet |

Deposit dan Penarikan

Terkait deposit minimum, I-Access tidak menetapkan kondisi apapun. Selain itu, detail lain seperti waktu pemrosesan, opsi pembayaran, dan mata uang yang diterima, tidak jelas.