Présentation de l'entreprise

| KnightsbridgeFX Résumé de l'examen | |

| Fondé | 2009 |

| Pays/Région Enregistré | Canada |

| Régulation | Pas de régulation |

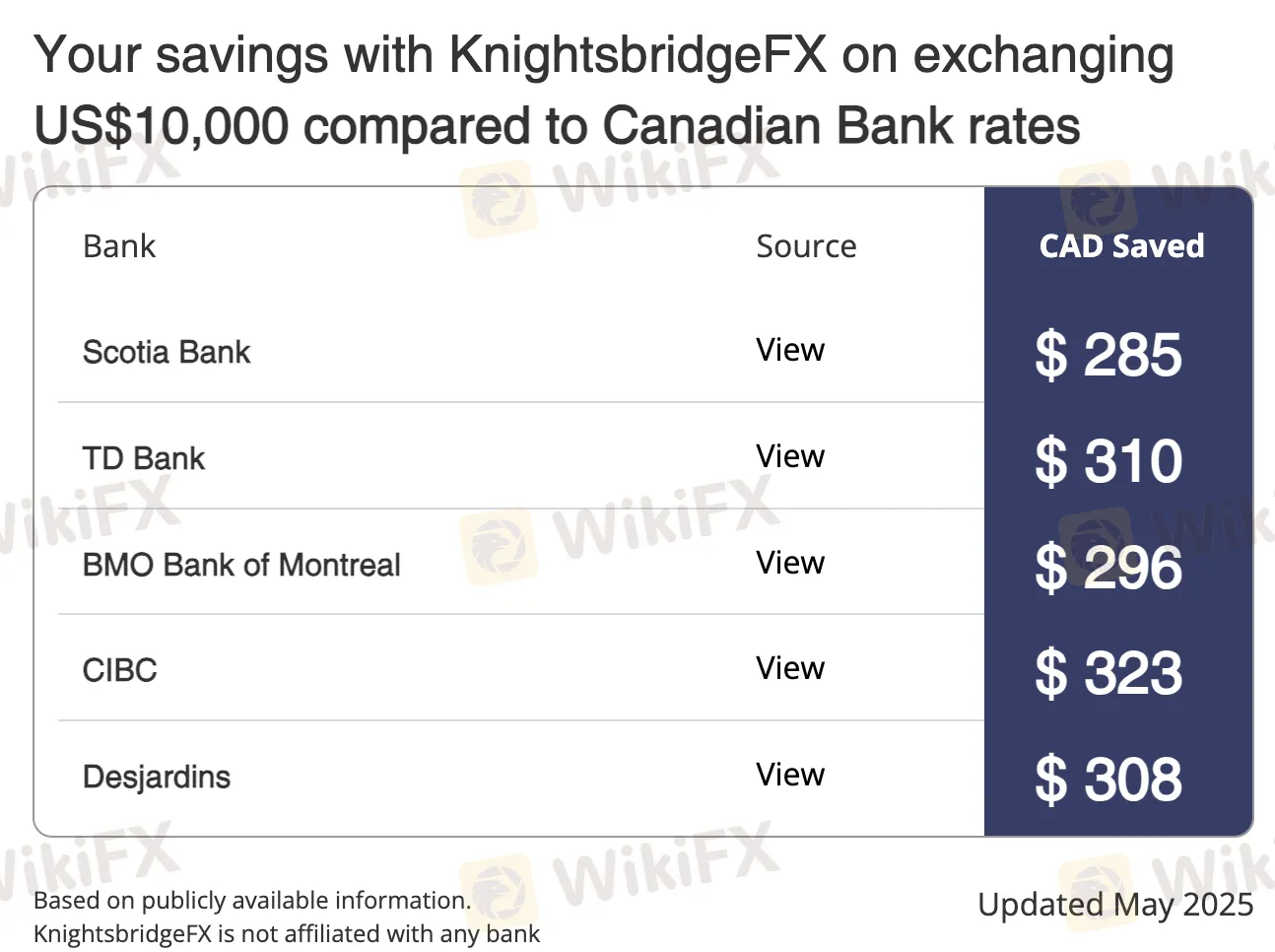

| Services | Échange de devises étrangères pour particuliers et entreprises, taux battant les banques |

| Dépôt Minimum | 2 000 $ CAD |

| Support Client | Numéro gratuit (Canada/USA) : (877)-355-KBFX (5239) poste 1 |

| Local : (416) 800-5552 / (416) 479-0834 | |

| Email : contact@knightsbridgefx.com | |

| Adresse : First Canadian Place, 100 King St W, Suite 5700, Toronto, ON, M5X 1C7 | |

Informations sur KnightsbridgeFX

KnightsbridgeFX n'est pas une entreprise de services financiers réglementée au Canada. Elle n'est pas autorisée par l'OCRCVM ou les régulateurs provinciaux. Bien qu'il s'agisse d'une véritable entreprise d'échange de devises, elle n'est pas réglementée par des organismes financiers établis.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Offre de meilleurs taux de change que les grandes banques canadiennes | Pas de régulation |

| Transferts le jour même disponibles pour la plupart des transactions | |

| Pas de frais de dépôt/retrait |

KnightsbridgeFX Est-il Légitime ?

KnightsbridgeFX n'est pas un fournisseur de services financiers réglementé. Il ne détient aucune licence de l'Organisme canadien de réglementation du commerce des valeurs mobilières (OCRCVM) ou d'autorités provinciales au Canada, où il est enregistré.

Selon les enregistrements WHOIS, le domaine knightsbridgefx.com a été enregistré le 11 juin 2009, mis à jour pour la dernière fois le 7 juin 2023 et expirera le 11 juin 2029. Son statut est "clientTransferProhibited", ce qui signifie que le domaine est sécurisé et actif, protégé contre les transferts ou modifications illégaux.

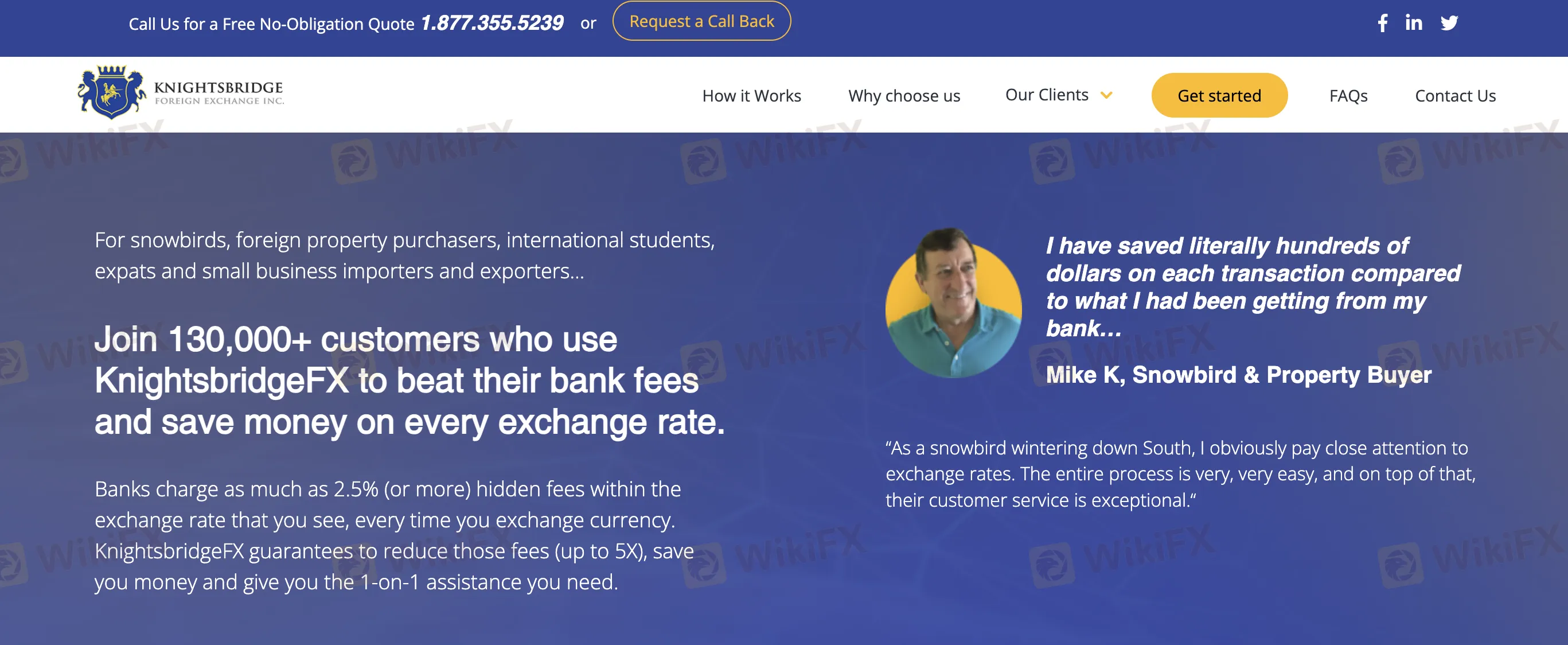

Services de KnightsbridgeFX

KnightsbridgeFX est une entreprise canadienne d'échange de devises qui propose des services de change pour les particuliers et les petites entreprises, en mettant l'accent sur des taux de change plus avantageux que les banques. Elle s'adresse aux snowbirds, aux acheteurs immobiliers, aux expatriés, aux étudiants internationaux et aux entreprises d'import/export, offrant des transferts le jour même, un service personnalisé et sans frais cachés.

| Services | Pris en Charge |

| Échange de devises (CAD/USD et autres devises étrangères) | ✔ |

| Transferts de devises immobilières | ✔ |

| Frais de scolarité et paiements d'étudiants internationaux | ✔ |

| FX professionnel pour l'import/export | ✔ |

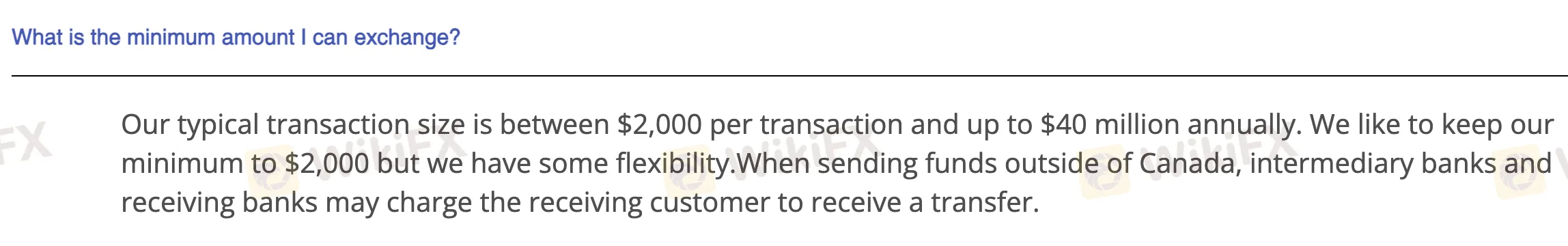

Montant Minimum d'Échange

Le montant minimum pouvant être échangé avec KnightsbridgeFX est normalement de 2 000 $ CAD par transaction. Bien que ce soit leur niveau de base, ils reconnaissent qu'il y a une certaine flexibilité en fonction des circonstances.

Dépôt et Retrait

KnightsbridgeFX ne facture pas de frais pour les dépôts ou les retraits. Des frais peuvent être facturés par les banques intermédiaires et réceptrices lors de l'envoi de paiements à l'international. Le dépôt minimum (montant d'échange) est généralement de 2 000 $ CAD, mais ils peuvent offrir une certaine marge de manœuvre.

| Méthode de paiement | Montant minimum | Frais | Délai de traitement |

| Paiement de facture | 2 000 $ CAD | 0 | Le jour même (généralement) |

| Virement bancaire | Le jour même ou 1 jour ouvrable | ||

| Virement électronique (EFT) | Le jour même (généralement) |