Perfil de la compañía

| KnightsbridgeFX Resumen de la revisión | |

| Establecido | 2009 |

| País/Región Registrada | Canadá |

| Regulación | Sin regulación |

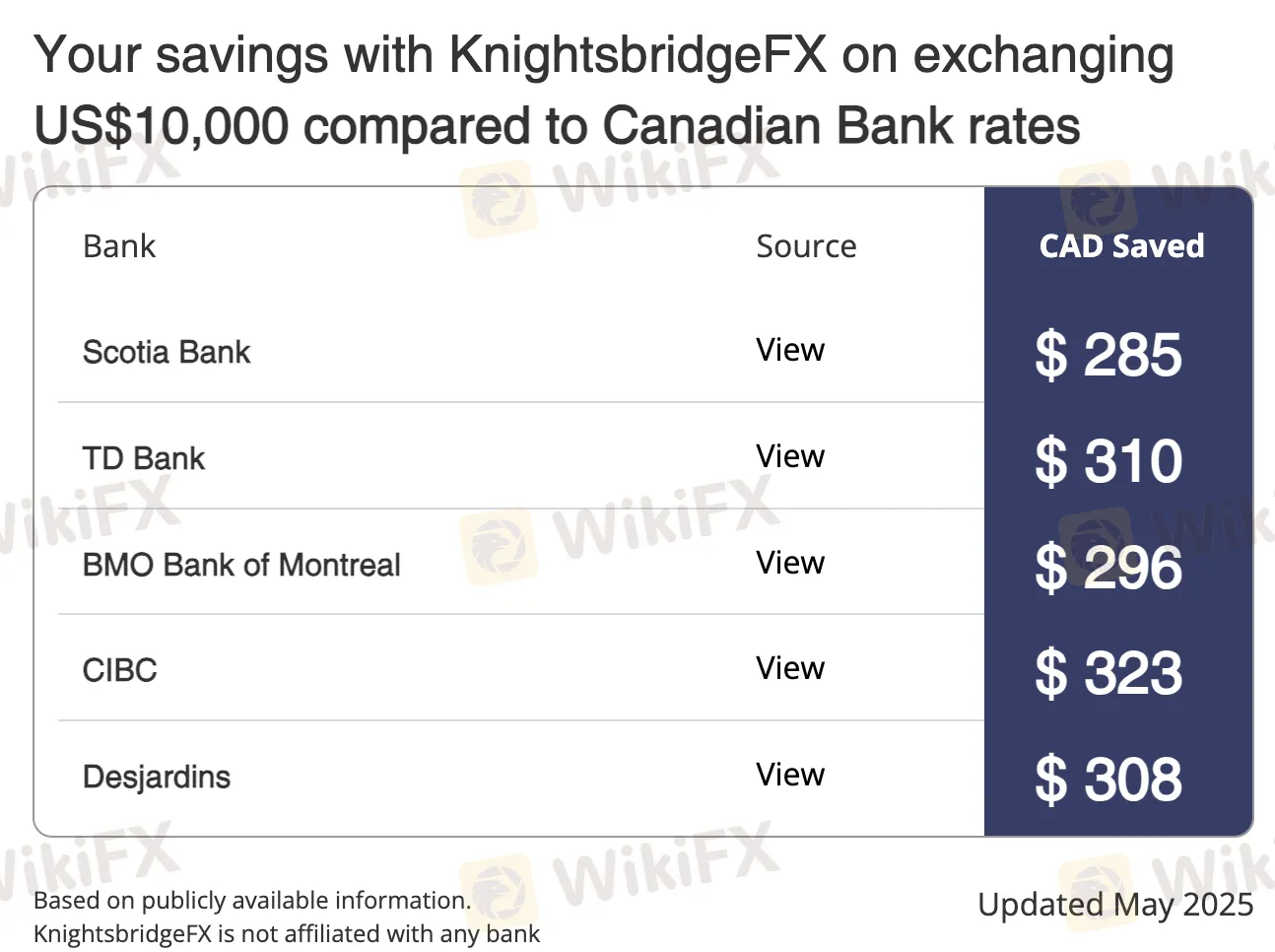

| Servicios | Intercambio de divisas extranjeras para individuos y empresas, tasas más competitivas que los bancos |

| Depósito Mínimo | $2,000 CAD |

| Soporte al Cliente | Llamada gratuita (Canadá/EE. UU.): (877)-355-KBFX (5239) ext. 1 |

| Local: (416) 800-5552 / (416) 479-0834 | |

| Correo electrónico: contact@knightsbridgefx.com | |

| Dirección: First Canadian Place, 100 King St W, Suite 5700, Toronto, ON, M5X 1C7 | |

Información de KnightsbridgeFX

KnightsbridgeFX no es una empresa de servicios financieros regulada en Canadá. No está autorizada por la IIROC ni por los reguladores provinciales. Aunque es un negocio legítimo de intercambio de divisas, no está regulado por agencias financieras establecidas.

Pros y Contras

| Pros | Contras |

| Ofrece mejores tasas de cambio que los principales bancos canadienses | Sin regulación |

| Transferencias del mismo día disponibles para la mayoría de las transacciones | |

| Sin tarifas de depósito/retiro |

¿Es KnightsbridgeFX Legítimo?

KnightsbridgeFX no es un proveedor de servicios financieros regulado. No posee licencias de la Organización Reguladora de la Industria de Inversiones de Canadá (IIROC) ni de ninguna autoridad provincial en Canadá, donde está registrada.

Según los registros WHOIS, el dominio knightsbridgefx.com se registró el 11 de junio de 2009, se actualizó por última vez el 7 de junio de 2023 y caducará el 11 de junio de 2029. Su estado es "clientTransferProhibited", lo que significa que el dominio está seguro y activo, protegido contra transferencias o modificaciones ilegales.

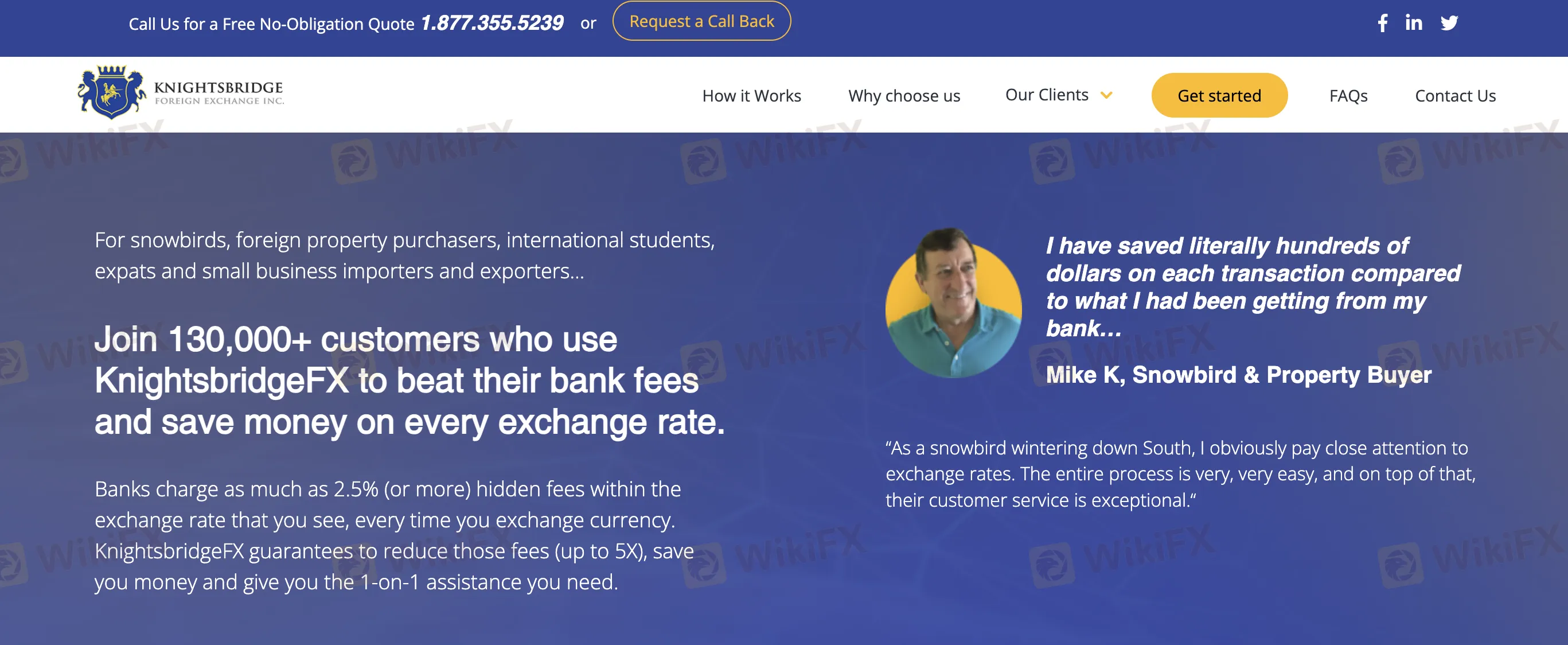

Servicios de KnightsbridgeFX

KnightsbridgeFX es una empresa canadiense de intercambio de divisas que ofrece servicios de cambio de divisas a individuos y pequeñas empresas, con un enfoque en tasas de cambio mejores que los bancos. Atiende a "snowbirds", compradores de bienes raíces, expatriados, estudiantes internacionales y empresas de importación/exportación, ofreciendo sin tarifas ocultas, transferencias del mismo día y servicio personalizado.

| Servicios | Soportados |

| Intercambio de Divisas (CAD/USD y otras divisas) | ✔ |

| Transferencias de Divisas para Bienes Raíces | ✔ |

| Pagos de Matrícula y Estudiantes Internacionales | ✔ |

| Intercambio de Divisas Comerciales para Importación/Exportación | ✔ |

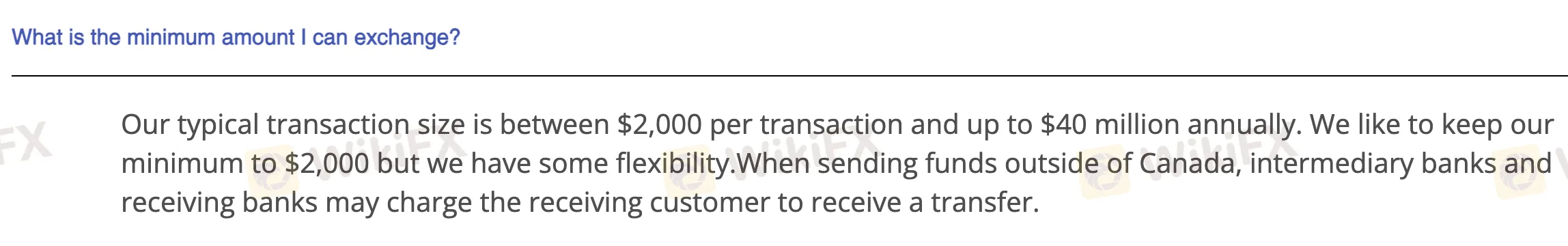

Monto Mínimo de Intercambio

El monto mínimo que se puede intercambiar con KnightsbridgeFX es normalmente de $2,000 CAD por transacción. Aunque ese es su nivel base, admiten que hay cierta flexibilidad según las circunstancias.

Depósito y Retiro

KnightsbridgeFX no cobra tarifas por depósitos o retiros. Pueden aplicarse tarifas por parte de bancos intermedios y receptores al enviar pagos internacionalmente. El depósito mínimo (monto de intercambio) suele ser de $2,000 CAD, pero pueden ofrecer cierta flexibilidad.

| Método de Pago | Monto Mínimo | Tarifas | Tiempo de Procesamiento |

| Pago de Facturas | $2,000 CAD | 0 | Mismo día (normalmente) |

| Transferencia Bancaria | Mismo día o 1 día hábil | ||

| Transferencia Electrónica de Fondos (EFT) | Mismo día (normalmente) |