مقدمة عن الشركة

| KnightsbridgeFX ملخص المراجعة | |

| تأسست | 2009 |

| البلد/المنطقة المسجلة | كندا |

| التنظيم | لا يوجد تنظيم |

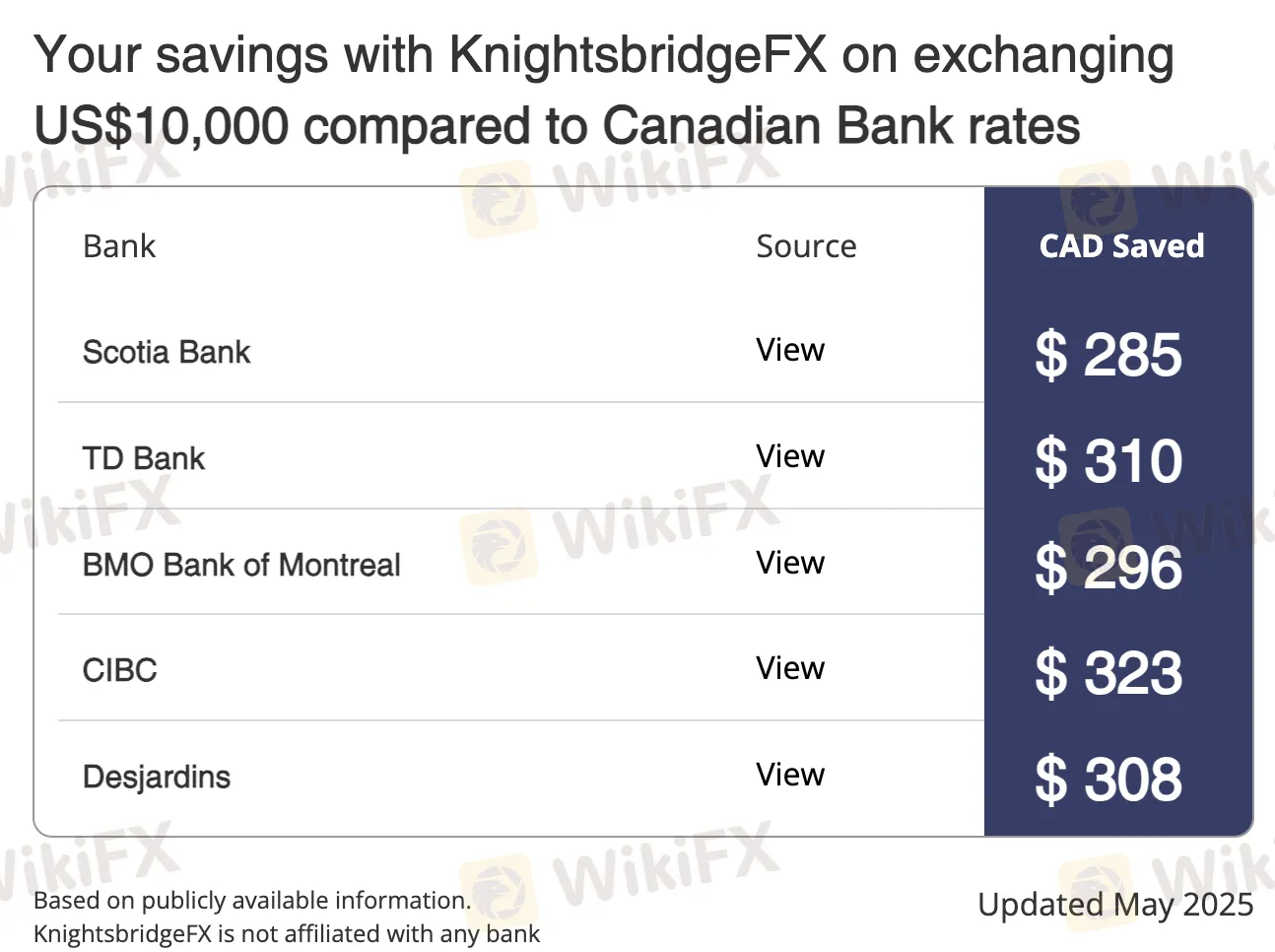

| الخدمات | صرف العملات الأجنبية للأفراد والشركات، بأسعار تفوق تلك المصرفية |

| الحد الأدنى للإيداع | $2,000 CAD |

| دعم العملاء | رقم مجاني (كندا/الولايات المتحدة): (877)-355-KBFX (5239) تحويلة 1 |

| محلي: (416) 800-5552 / (416) 479-0834 | |

| البريد الإلكتروني: contact@knightsbridgefx.com | |

| العنوان: First Canadian Place، 100 King St W، Suite 5700، Toronto، ON، M5X 1C7 | |

معلومات KnightsbridgeFX

KnightsbridgeFX ليست شركة خدمات مالية منظمة في كندا. ليس لديها تراخيص من منظمة تنظيم الصناعة الاستثمارية في كندا (IIROC) أو أي سلطات إقليمية في كندا، حيث تم تسجيلها. على الرغم من أنها شركة صرف عملات حقيقية، إلا أنها غير مُنظمة من قبل الوكالات المالية المعتمدة.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| يقدم أسعار صرف أفضل من البنوك الكندية الكبرى | لا يوجد تنظيم |

| تحويلات في نفس اليوم متاحة لمعظم المعاملات | |

| لا توجد رسوم إيداع/سحب |

هل KnightsbridgeFX شرعية؟

KnightsbridgeFX ليست مزود خدمات مالية مُنظم. لا تحمل أي تراخيص من منظمة تنظيم الصناعة الاستثمارية في كندا (IIROC) أو أي سلطات إقليمية في كندا، حيث تم تسجيلها.

وفقًا لسجلات WHOIS، تم تسجيل نطاق knightsbridgefx.com في 11 يونيو 2009، تم تحديثه في 7 يونيو 2023، وسينتهي في 11 يونيو 2029. حالته هي "clientTransferProhibited"، مما يعني أن النطاق آمن وحيٌّ، محمي من التحويلات أو التعديلات غير القانونية.

خدمات KnightsbridgeFX

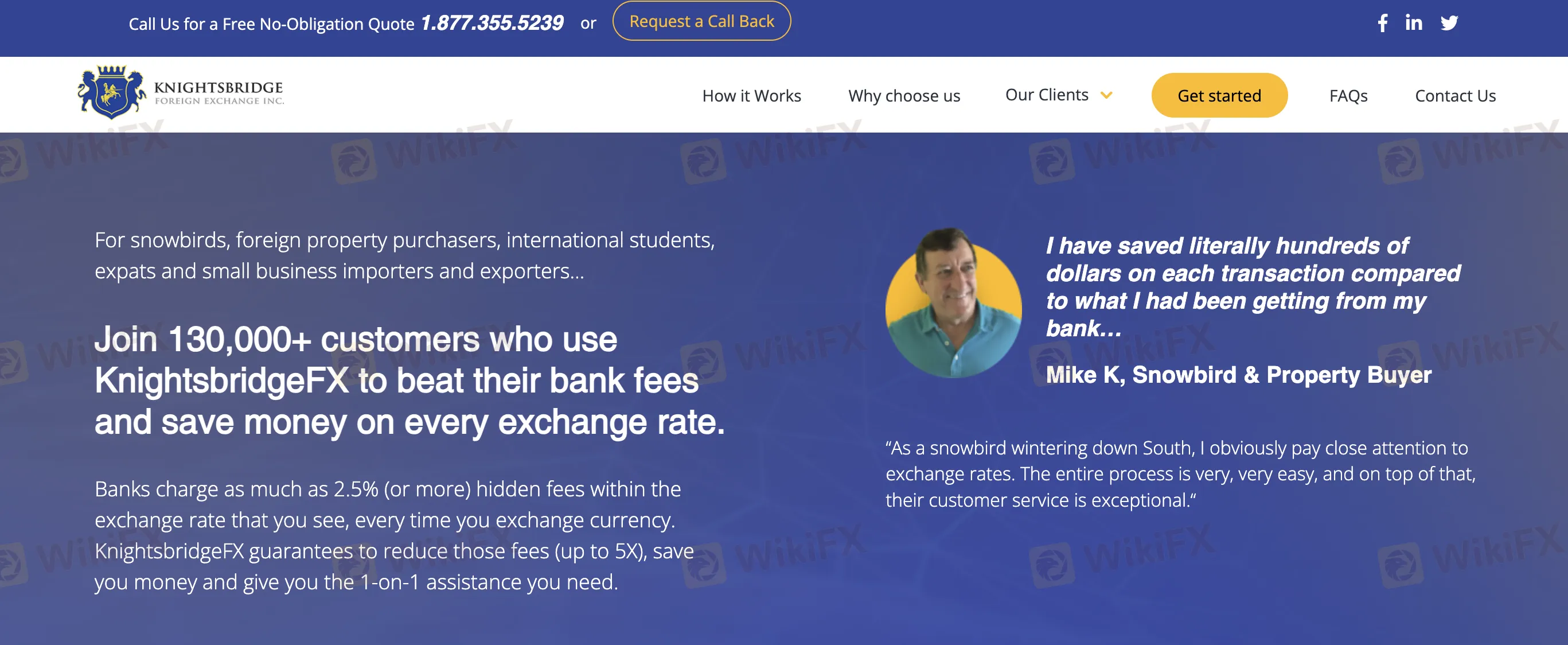

KnightsbridgeFX هي شركة كندية لصرف العملات تقدم خدمات صرف العملات الأجنبية للأفراد والشركات الصغيرة، مع التركيز على أسعار صرف أفضل من البنوك. تخدم الثلجيون، ومشترو العقارات، والمغتربين، والطلاب الدوليين، وشركات الاستيراد/التصدير، وتقدم خدمة بدون رسوم خفية، وتحويلات في نفس اليوم، وخدمة شخصية.

| الخدمات | مدعوم |

| صرف العملات (CAD/USD وعملات أجنبية أخرى) | ✔ |

| تحويلات العملات العقارية | ✔ |

| الدفع للدراسة والطلاب الدوليين | ✔ |

| صرف العملات للأعمال للاستيراد/التصدير | ✔ |

الحد الأدنى لمبلغ الصرف

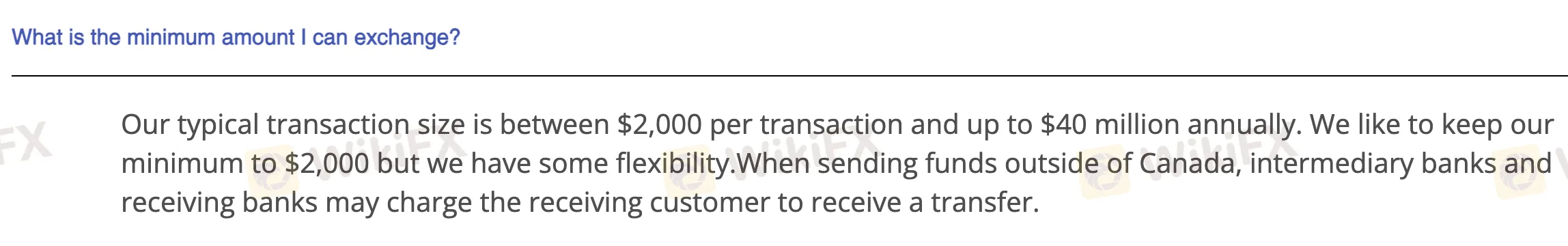

الحد الأدنى للمبلغ الذي يمكن تبادله مع KnightsbridgeFX عادةً $2,000 CAD لكل عملية. على الرغم من أن هذا هو مستوى القاعدة الخاص بهم، إلا أنهم يعترفون بوجود بعض المرونة استنادًا إلى الظروف.

الإيداع والسحب

KnightsbridgeFX لا تفرض رسومًا على الإيداعات أو السحوبات. قد تتم فرض رسوم من قبل البنوك الوسيطة والمستلمة عند إرسال المدفوعات دوليًا. الحد الأدنى للإيداع (مبلغ التبادل) عادةً ما يكون $2,000 CAD، ولكن قد يتم تقديم بعض المرونة.

| طريقة الدفع | الحد الأدنى للمبلغ | الرسوم | وقت المعالجة |

| دفع الفاتورة | $2,000 CAD | 0 | نفس اليوم (عادةً) |

| تحويل بنكي | نفس اليوم أو يوم عمل واحد | ||

| تحويل الأموال الإلكتروني (EFT) | نفس اليوم (عادةً) |