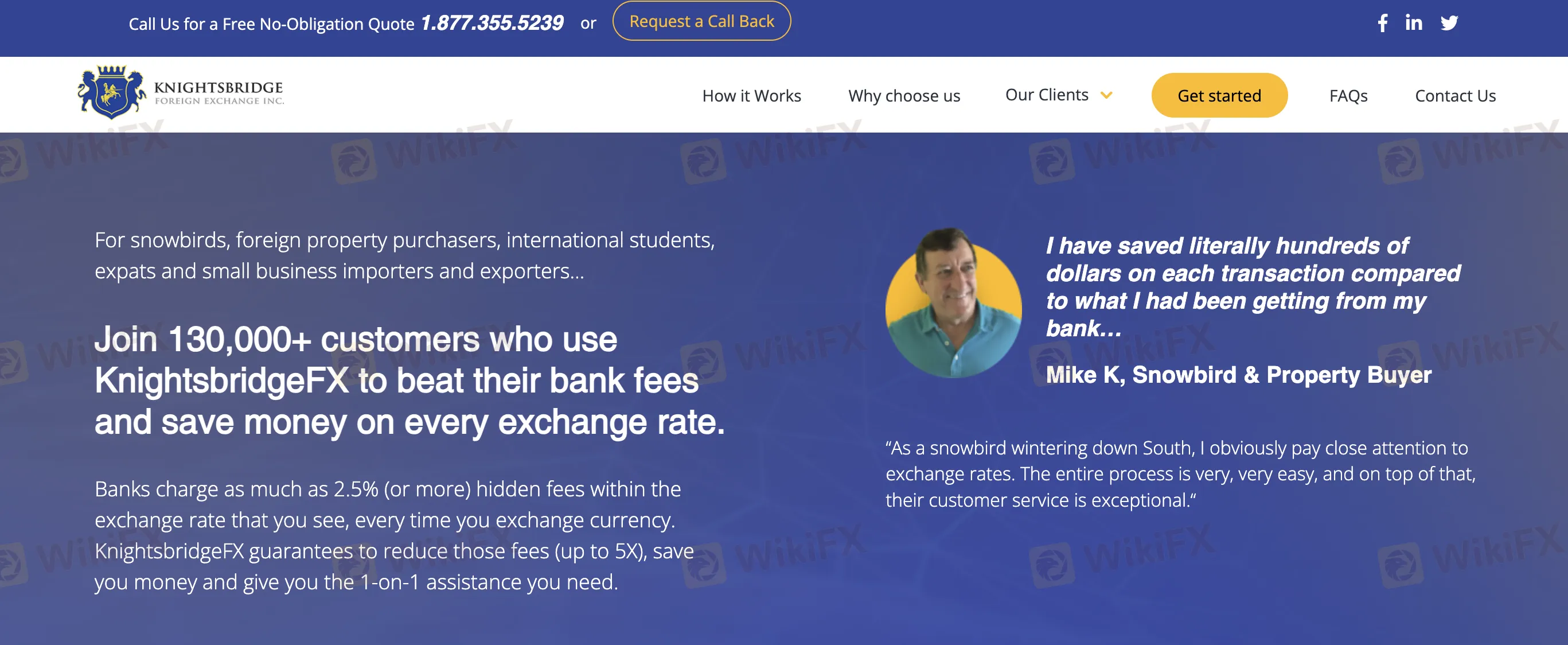

회사 소개

| KnightsbridgeFX 리뷰 요약 | |

| 설립 연도 | 2009 |

| 등록 국가/지역 | 캐나다 |

| 규제 | 규제 없음 |

| 서비스 | 개인 및 기업을 위한 외환 거래, 은행보다 우수한 환율 |

| 최소 입금액 | $2,000 캐나다 달러 |

| 고객 지원 | 무료 전화 (캐나다/미국): (877)-355-KBFX (5239) 내선 1 |

| 지역 전화: (416) 800-5552 / (416) 479-0834 | |

| 이메일: contact@knightsbridgefx.com | |

| 주소: First Canadian Place, 100 King St W, Suite 5700, Toronto, ON, M5X 1C7 | |

KnightsbridgeFX 정보

KnightsbridgeFX은 캐나다에서 규제되지 않은 금융 서비스 회사입니다. IIROC나 캐나다의 지방 규제 기관에서 라이선스를 받지 않았습니다. 실제 환전 사업체이지만 기존 금융 기관에 의해 규제되지 않습니다.

장단점

| 장점 | 단점 |

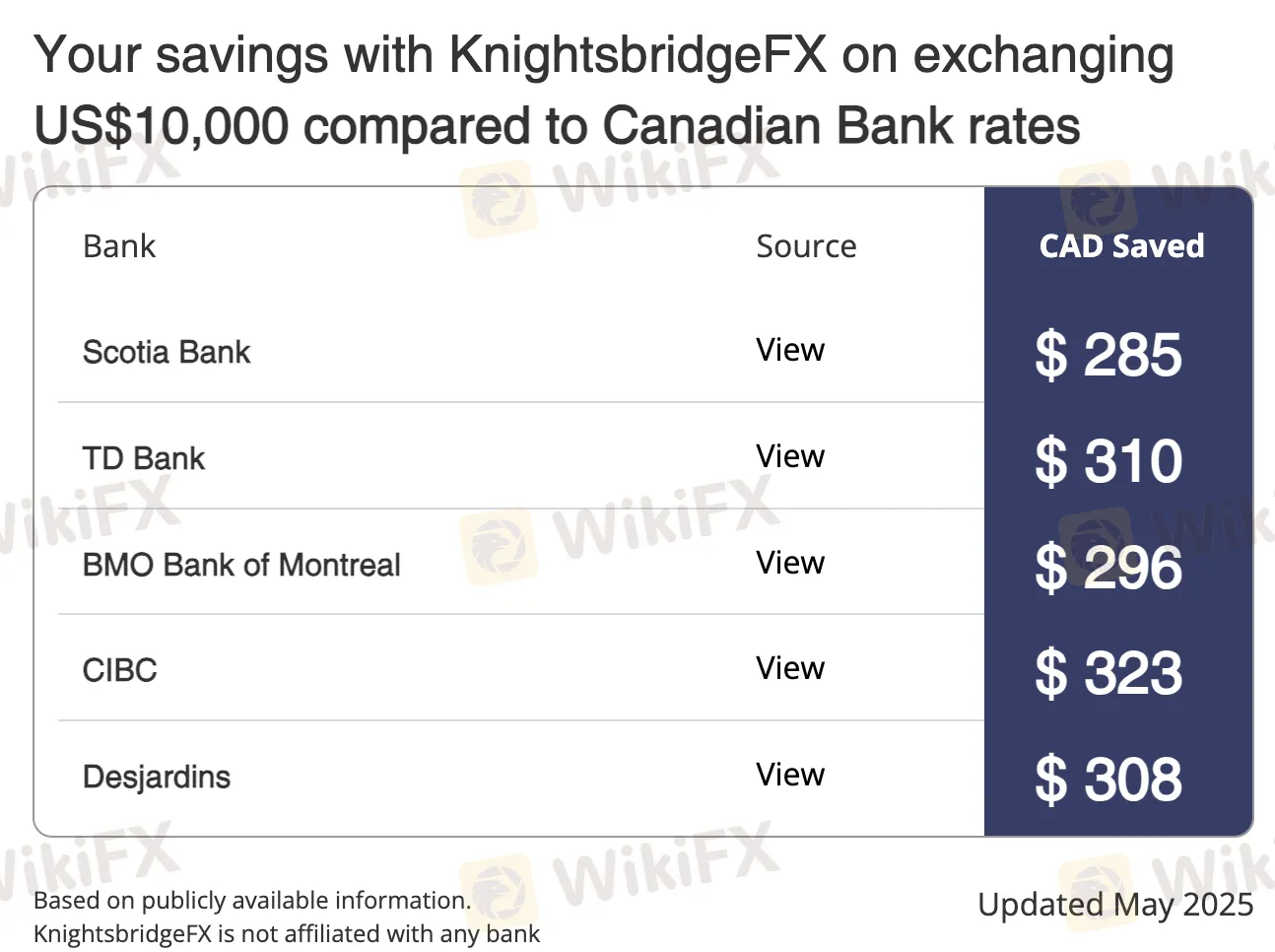

| 주요 캐나다 은행보다 더 좋은 환율 제공 | 규제 없음 |

| 대부분 거래에 대한 당일 이체 가능 | |

| 입금/출금 수수료 없음 |

KnightsbridgeFX 합법성

KnightsbridgeFX은 캐나다에서 규제되지 않은 금융 서비스 제공업체입니다. 캐나다의 투자 산업 규제 기구 (IIROC)나 지방 당국으로부터 라이선스를 받지 않았습니다.

WHOIS 레코드에 따르면, 도메인 knightsbridgefx.com은 2009년 6월 11일에 등록되었으며, 2023년 6월 7일에 마지막으로 업데이트되었으며, 2029년 6월 11일에 만료될 예정입니다. 상태는 "clientTransferProhibited"로, 도메인이 안전하고 불법적인 이전이나 수정으로부터 보호됩니다.

KnightsbridgeFX 서비스

KnightsbridgeFX은 캐나다의 환전 회사로, 은행보다 더 좋은 환율에 중점을 둔 개인 및 소기업을 대상으로 외환 서비스를 제공합니다. 스노우버드, 부동산 구매자, 국제 학생, 수출입 기업 등을 대상으로 하며, 숨겨진 수수료 없이 당일 이체와 맞춤형 서비스를 제공합니다.

| 서비스 | 지원 |

| 통화 환전 (CAD/USD 및 기타 외환) | ✔ |

| 부동산 환전 | ✔ |

| 등록금 및 국제 학생 결제 | ✔ |

| 수출입을 위한 비즈니스 외환 | ✔ |

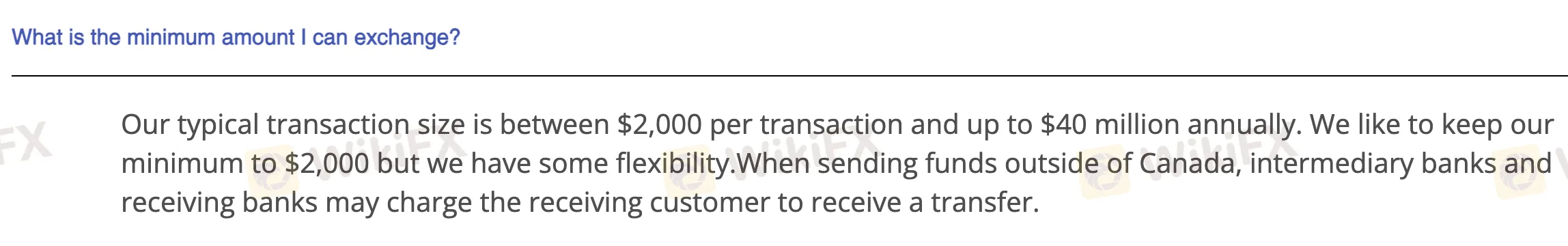

최소 환전 금액

KnightsbridgeFX과(와)의 최소 환전 금액은 일반적으로 거래 당 $2,000 CAD입니다. 이는 그들의 기본 수준이지만, 상황에 따라 유연성이 있다고 인정합니다.

입금 및 출금

KnightsbridgeFX은(는) 입금 또는 출금에 대한 수수료를 부과하지 않습니다. 국제 송금 시 중간 및 수취 은행에서 수수료가 부과될 수 있습니다. 최소 입금(환전 금액)은 일반적으로 $2,000 CAD이지만, 약간의 유연성을 제공할 수 있습니다.

| 결제 방법 | 최소 금액 | 수수료 | 처리 시간 |

| 계산서 결제 | $2,000 CAD | 0 | 당일 (일반적으로) |

| 전신 송금 | 당일 또는 1 영업일 | ||

| EFT (전자 자금 이체) | 당일 (일반적으로) |