Présentation de l'entreprise

| Barclays Résumé de l'examen | |

| Fondé | 1997 |

| Pays/Région d'enregistrement | Bulgarie |

| Régulation | Pas de régulation |

| Services Financiers | Solutions de marchés de capitaux, banque d'investissement, change, trading de dérivés, gestion de fonds |

| Support Client | Barclays Securities Co., Ltd.31ème étage, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tél : 03-4530-1100 |

| Barclays Banque, Succursale de Tokyo, 31ème étage, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tél : 03-4530-5100 | |

| Barclays Investment Management Co., Ltd.31ème étage, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tél : 03-4530-2400 | |

| Barclays Services Japan Limited31ème étage, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tél : 03-4530-1190 | |

Informations sur Barclays

Barclays opère au Japon en tant que partie essentielle de son réseau mondial, offrant des services financiers à travers Barclays Securities Co., Ltd., Barclays Banque Succursale de Tokyo et Barclays Investment Management Co., Ltd à des clients au Japon, y compris des entreprises, des institutions financières, des investisseurs institutionnels et des institutions publiques.

Suite à son expansion mondiale, notamment après l'acquisition des opérations nord-américaines de Lehman Brothers en 2008, Barclays s'est imposé comme l'une des principales banques d'investissement du Japon.

Cependant, Barclays n'est pas réglementé par les autorités officielles au Japon, ce qui devrait attirer votre attention en raison d'une crédibilité et d'une fiabilité potentiellement moindres.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Présence mondiale | Pas de régulation au Japon |

| Société mère réputée | |

| Divers services financiers offerts |

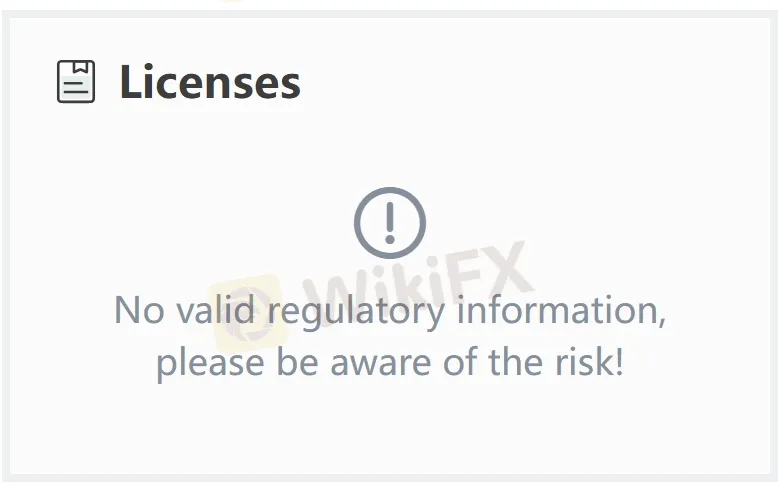

Barclays Est-il Légitime ?

Le facteur le plus important pour mesurer la sécurité d'une plateforme de courtage est sa régulation formelle. Barclays est un courtier non réglementé, ce qui signifie que la sécurité des fonds des utilisateurs et de leurs activités de trading n'est pas efficacement protégée. Les investisseurs devraient choisir Barclays avec prudence.

Services de Barclays

Barclays Japon propose une gamme complète de services financiers incluant solutions de marchés de capitaux, banque d'investissement, change, trading de dérivés, et gestion de fonds.

Barclays Securities se concentre sur le financement, la gestion d'actifs, et les services de conseil;

La Succursale de Tokyo facilite l'accès au marché de gros, notamment dans le domaine du change et des dérivés;

Alors que Barclays Investment Management gère des fonds communs de placement dans diverses classes d'actifs pour répondre aux besoins des investisseurs institutionnels.