Unternehmensprofil

| KnightsbridgeFX Überprüfungszusammenfassung | |

| Gegründet | 2009 |

| Registriertes Land/Region | Kanada |

| Regulierung | Keine Regulierung |

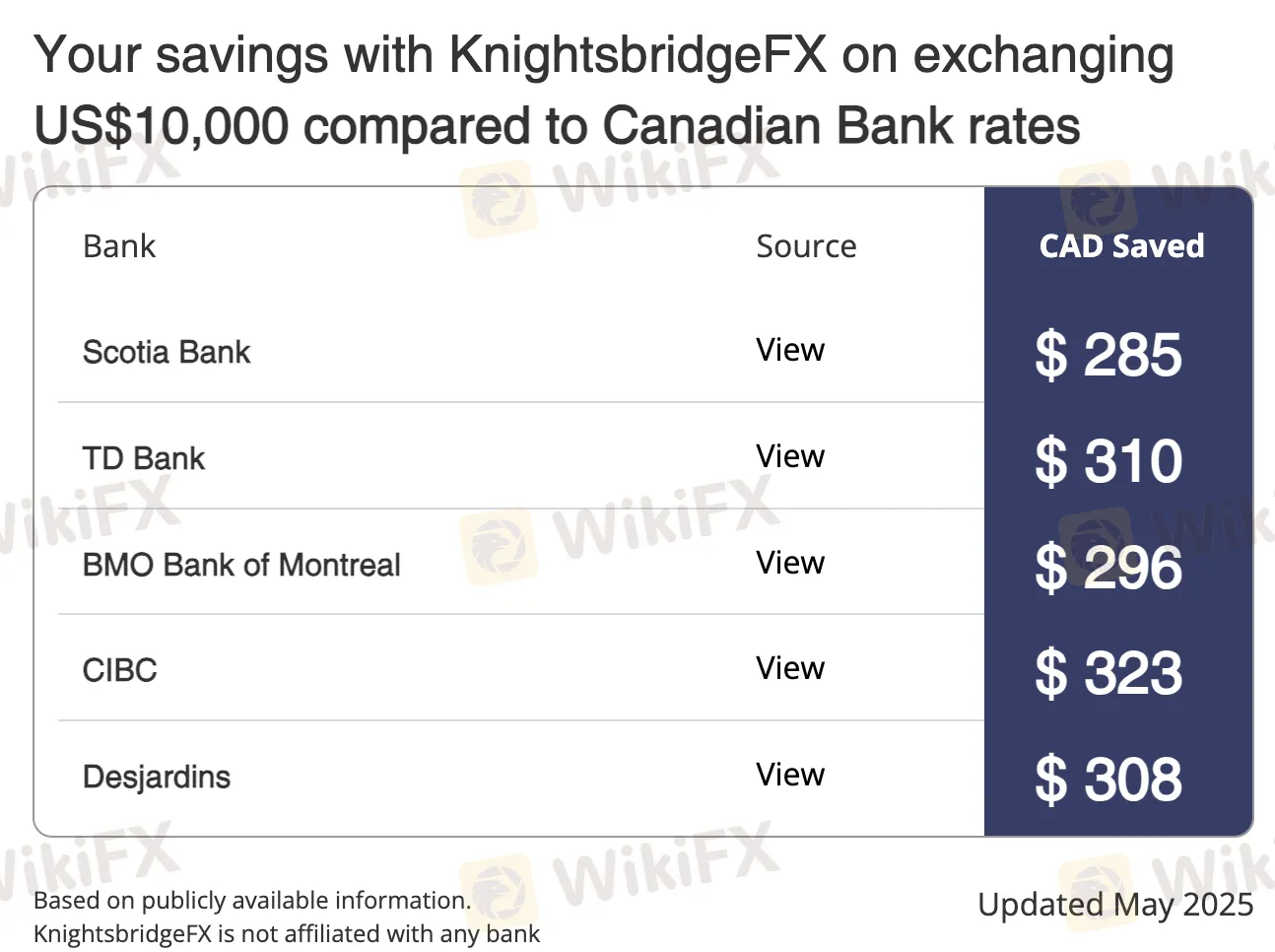

| Dienstleistungen | Devisenwechsel für Privatpersonen & Unternehmen, bessere Raten als Banken |

| Mindesteinlage | 2.000 CAD |

| Kundensupport | Kostenlose Rufnummer (Kanada/USA): (877)-355-KBFX (5239) Durchwahl 1 |

| Lokal: (416) 800-5552 / (416) 479-0834 | |

| E-Mail: contact@knightsbridgefx.com | |

| Adresse: First Canadian Place, 100 King St W, Suite 5700, Toronto, ON, M5X 1C7 | |

KnightsbridgeFX Informationen

KnightsbridgeFX ist kein reguliertes Finanzdienstleistungsunternehmen in Kanada. Es ist nicht von der IIROC oder den Provinzregulierungsbehörden lizenziert. Obwohl es sich um ein echtes Devisenwechselgeschäft handelt, wird es nicht von etablierten Finanzbehörden reguliert.

Vor- und Nachteile

| Vorteile | Nachteile |

| Bietet bessere Wechselkurse als große kanadische Banken | Keine Regulierung |

| Sofortige Überweisungen für die meisten Transaktionen verfügbar | |

| Keine Einzahlungs-/Abhebungsgebühren |

Ist KnightsbridgeFX legitim?

KnightsbridgeFX ist kein regulierter Finanzdienstleister. Es besitzt keine Lizenzen von der Investment Industry Regulatory Organization of Canada (IIROC) oder von Provinzbehörden in Kanada, wo es registriert ist.

Laut WHOIS-Einträgen wurde die Domain knightsbridgefx.com am 11. Juni 2009 registriert, zuletzt am 7. Juni 2023 aktualisiert und läuft am 11. Juni 2029 ab. Ihr Status ist "clientTransferProhibited", was bedeutet, dass die Domain sicher und aktiv ist, vor illegalen Übertragungen oder Änderungen geschützt ist.

KnightsbridgeFX Dienstleistungen

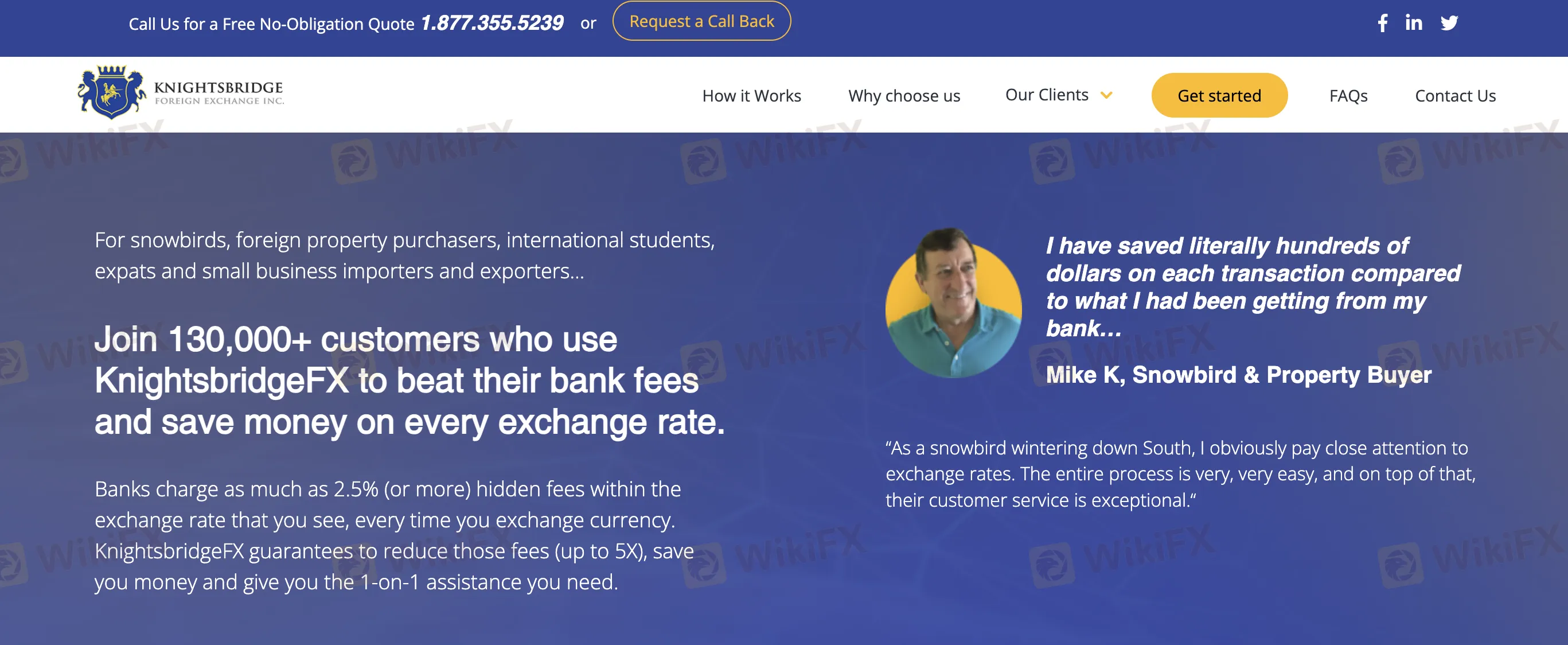

KnightsbridgeFX ist ein kanadisches Devisenwechselunternehmen, das Devisendienstleistungen für Privatpersonen und kleine Unternehmen anbietet und sich auf bessere Wechselkurse als Banken konzentriert. Es richtet sich an Schneevögel, Immobilienkäufer, Expats, internationale Studenten und Import-/Exportunternehmen und bietet keine versteckten Gebühren, sofortige Überweisungen und persönlichen Service.

| Dienstleistungen | Unterstützt |

| Devisenwechsel (CAD/USD & andere Devisen) | ✔ |

| Devisentransfers für Immobilien | ✔ |

| Tuition & Internationale Studentenzahlungen | ✔ |

| Unternehmens-FX für Import/Export | ✔ |

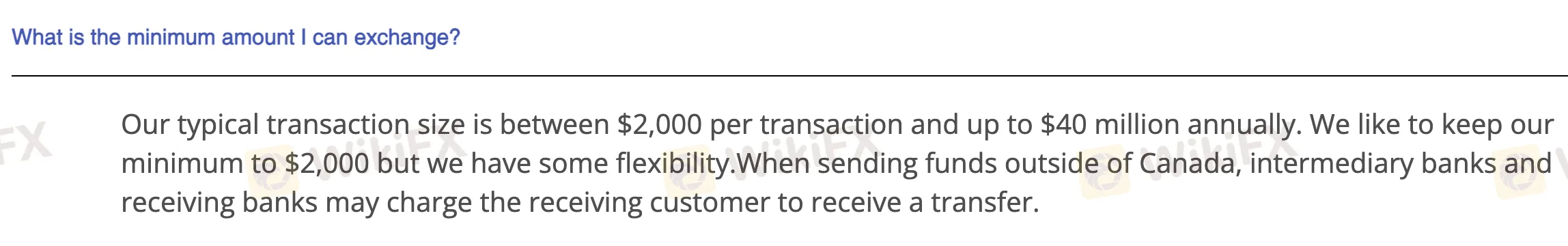

Mindestumtauschbetrag

Der Mindestbetrag, der mit KnightsbridgeFX normalerweise pro Transaktion umgetauscht werden kann, beträgt 2.000 CAD. Obwohl dies ihr Grundniveau ist, geben sie zu, dass es je nach den Umständen einige Flexibilität gibt.

Ein- und Auszahlung

KnightsbridgeFX erhebt keine Gebühren für Einzahlungen oder Auszahlungen. Gebühren können von Zwischen- und Empfangsbanken erhoben werden, wenn Zahlungen international gesendet werden. Die Mindesteinzahlung (Umtauschbetrag) beträgt normalerweise 2.000 CAD, aber sie können etwas Spielraum bieten.

| Zahlungsmethode | Mindestbetrag | Gebühren | Bearbeitungszeit |

| Rechnungszahlung | 2.000 CAD | 0 | Am selben Tag (in der Regel) |

| Überweisung | Am selben Tag oder 1 Werktag | ||

| EFT (elektronische Überweisung) | Am selben Tag (in der Regel) |