Présentation de l'entreprise

| Alfa Capital Résumé de l'examen | |

| Fondé | / |

| Pays/Région Enregistré | Chypre |

| Régulation | CYSEC/FCA (Révoqué) |

| Instruments de Marché | FX, métaux, options, contrats à terme |

| Compte de Démo | / |

| Effet de Levier | / |

| Spread | / |

| Plateforme de Trading | / |

| Dépôt Minimum | / |

| Support Client | Tél : +357 22 470900 |

| Fax : +357 22 681505 | |

| Email : info@alfacapital.com.cy | |

| Adresse : 3, rue Themistocles Dervis, Julia House, 4ème étage, 1066 Nicosie, Chypre | |

| Restriction Régionale | États-Unis |

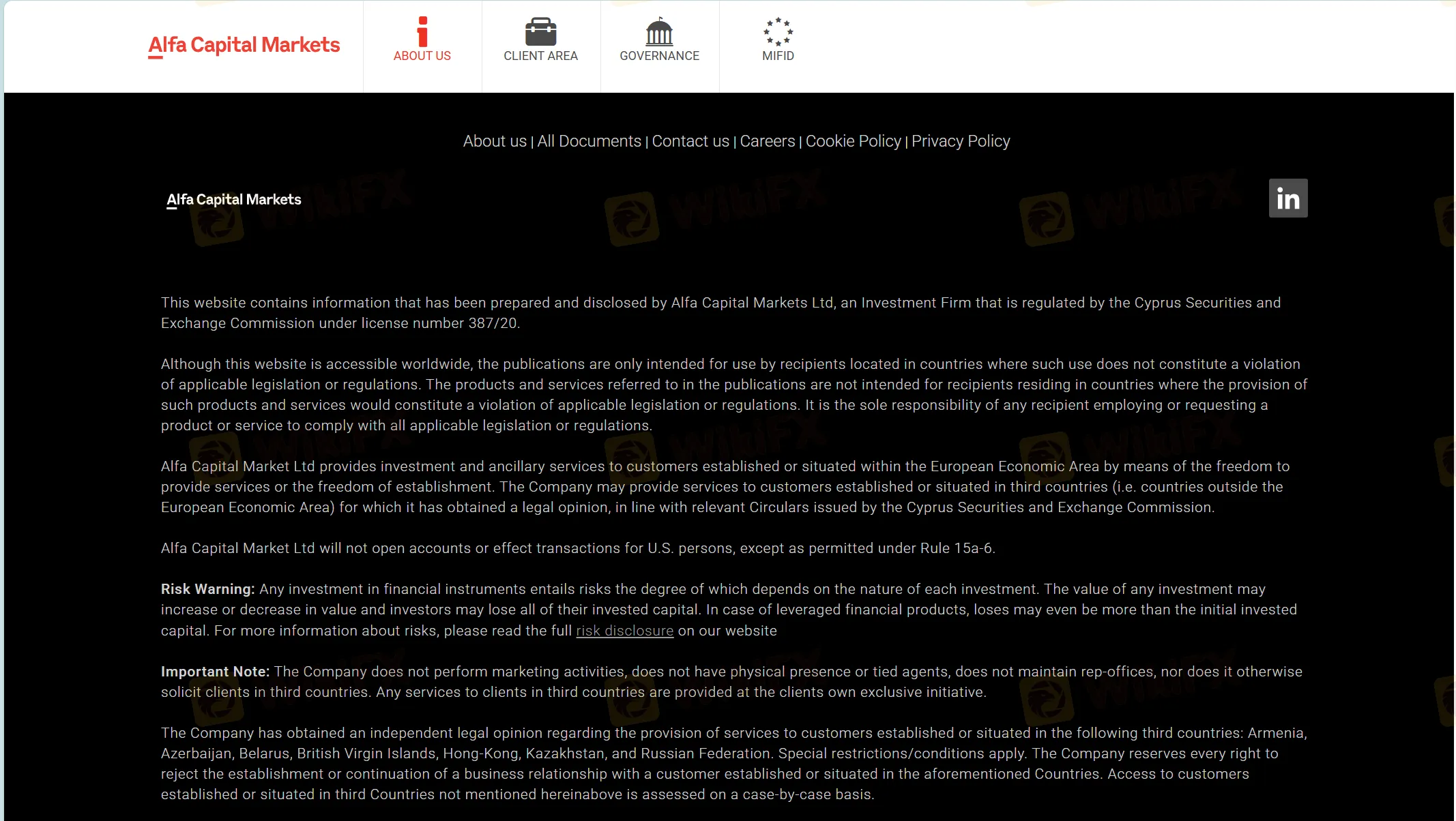

Alfa Capital est une entreprise enregistrée à Chypre. Elle propose divers instruments de marché pour le trading ainsi que des services d'investissement et auxiliaires. Cependant, ses licences ont été révoquées. Il existe également des restrictions régionales, les États-Unis étant exclus de ses services, et son site web est invalide, ce qui en fait un courtier risqué.

Voici la page d'accueil du site officiel de ce courtier :

Avantages et Inconvénients

| Avantages | Inconvénients |

| / | Licences CYSEC/FCA révoquées |

| Les clients américains ne sont pas acceptés | |

| Informations limitées sur les conditions de trading |

Alfa Capital est-il Légitime ?

Les licences de Alfa Capital de la Commission des Valeurs Mobilières de Chypre (CySEC) et de l'Autorité de Conduite Financière (FCA) ont été révoquées.

| Pays Réglementé | Autorité de Régulation | Statut Actuel | Entité Réglementée | Type de Licence | Numéro de Licence |

| Chypre | La Commission des Valeurs Mobilières de Chypre (CySEC) | Révoqué | Alfa Capital Holdings (Chypre) Ltd | Teneur de Marché (MM) | 025/04 |

| États-Unis | L'Autorité de Conduite Financière (FCA) | Révoqué | Alfa Capital Holdings (Chypre) Ltd | Représentant Autorisé Européen (EEA) | 416251 |

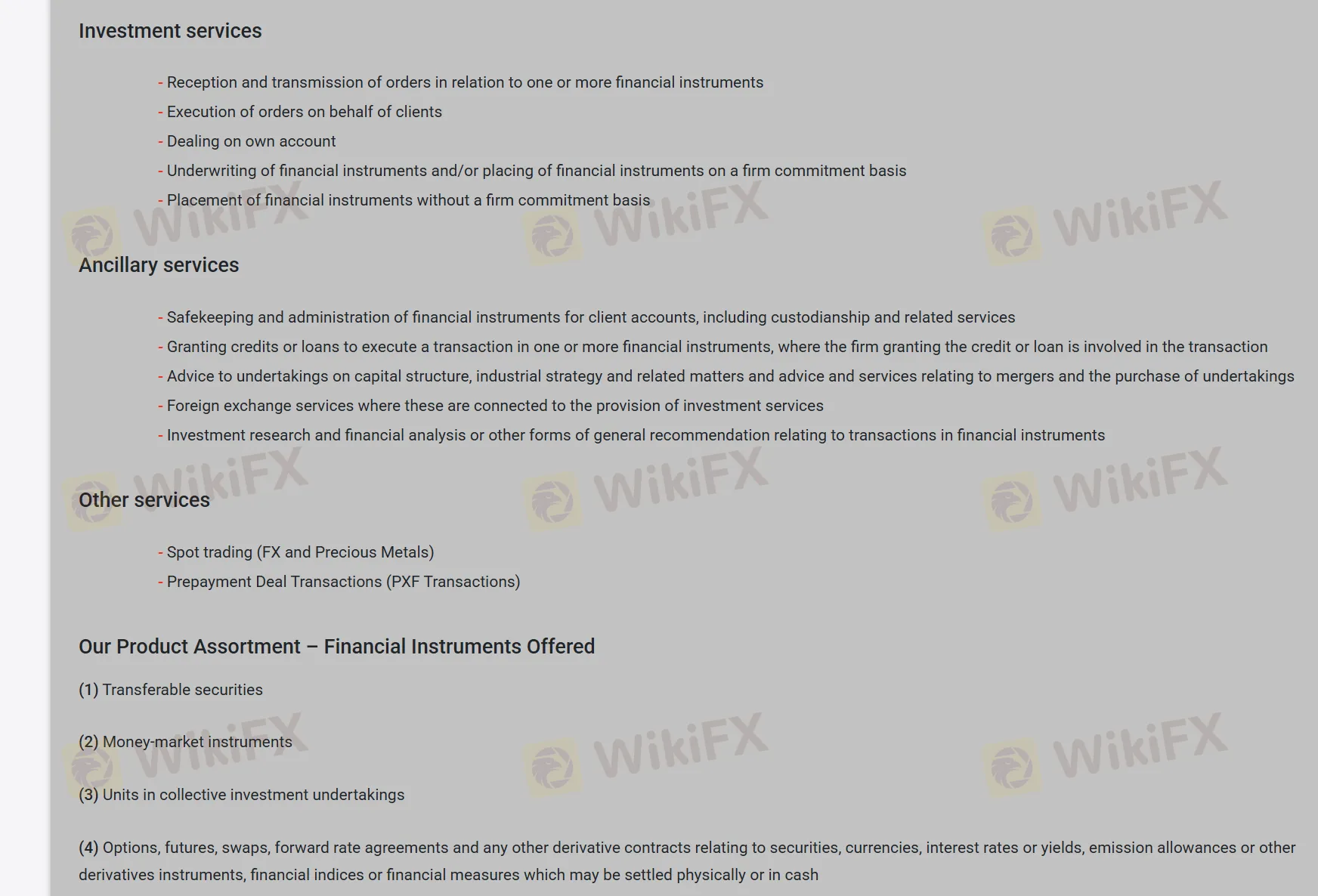

Que Puis-je Trader sur Alfa Capital ?

Alfa Capital propose des services d'investissement et auxiliaires. Il propose également des opérations au comptant pour FX, métaux, options et contrats à terme.

| Instruments de trading | Pris en charge |

| FX | ✔ |

| Métaux | ✔ |

| Options | ✔ |

| Contrats à terme | ✔ |

| Matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| ETFs | ❌ |