Company Summary

| KCB Review Summary | |

| Founded | 1896 |

| Registered Country/Region | Burundi |

| Regulation | No Regulation |

| Products and Services | Card, Loan, Investments, Forex |

| Demo Account | ❌ |

| Minimum Deposit | / |

| Customer Support | Phone: +25776522500 |

| Email: serviceclientele@bi.kcbbankgroup.com | |

| Contact form, social media | |

Founded in 1896, KCB is an unregulated financial company based in Burundi. It offers services for cards, loans, investments, and Forex.

Pros and Cons

| Pros | Cons |

| Multiple Services | No Regulation |

| Diverse Account Types | |

| Multiple Customer Support Channels |

Is KCB Legit?

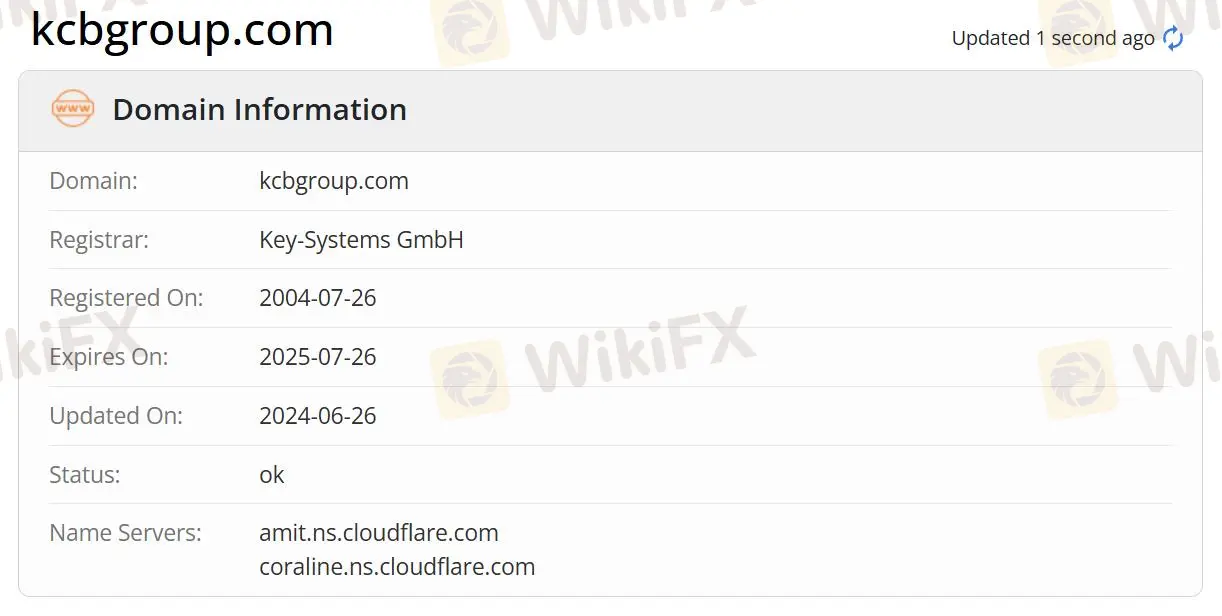

At present, KCB lacks valid regulation. Its domain was registered on July 26, 2004, and the current status is “ok”. Please pay high attention to the safety of your funds if you choose this broker.

Products and Services

KCB offers services with cards, loans, investments, and Forex.

Account Type

KCB provides two types of accounts: Transactional Accounts and Savings Account. Transactional Account includes Student Account and Current Account, andSavings Account includes Simba Savings Account and Cub Account.

Ways of Banking

KCB supports ways of banking through BRANCHES, ATMS, KCB BANK AGENTS, MOBILE BANKING, INTERNET BANKING, and MONEY TRANSFER SERVICES.