Unternehmensprofil

| KCB Überprüfungszusammenfassung | |

| Gegründet | 1896 |

| Registriertes Land/Region | Burundi |

| Regulierung | Keine Regulierung |

| Produkte und Dienstleistungen | Karte, Darlehen, Investitionen, Forex |

| Demo-Konto | ❌ |

| Mindesteinzahlung | / |

| Kundensupport | Telefon: +25776522500 |

| E-Mail: serviceclientele@bi.kcbbankgroup.com | |

| Kontaktformular, soziale Medien | |

Gegründet im Jahr 1896, ist KCB ein unreguliertes Finanzunternehmen mit Sitz in Burundi. Es bietet Dienstleistungen für Karten, Darlehen, Investitionen und Forex an.

Vor- und Nachteile

| Vorteile | Nachteile |

| Mehrere Dienstleistungen | Keine Regulierung |

| Verschiedene Kontotypen | |

| Mehrere Kundensupport-Kanäle |

Ist KCB seriös?

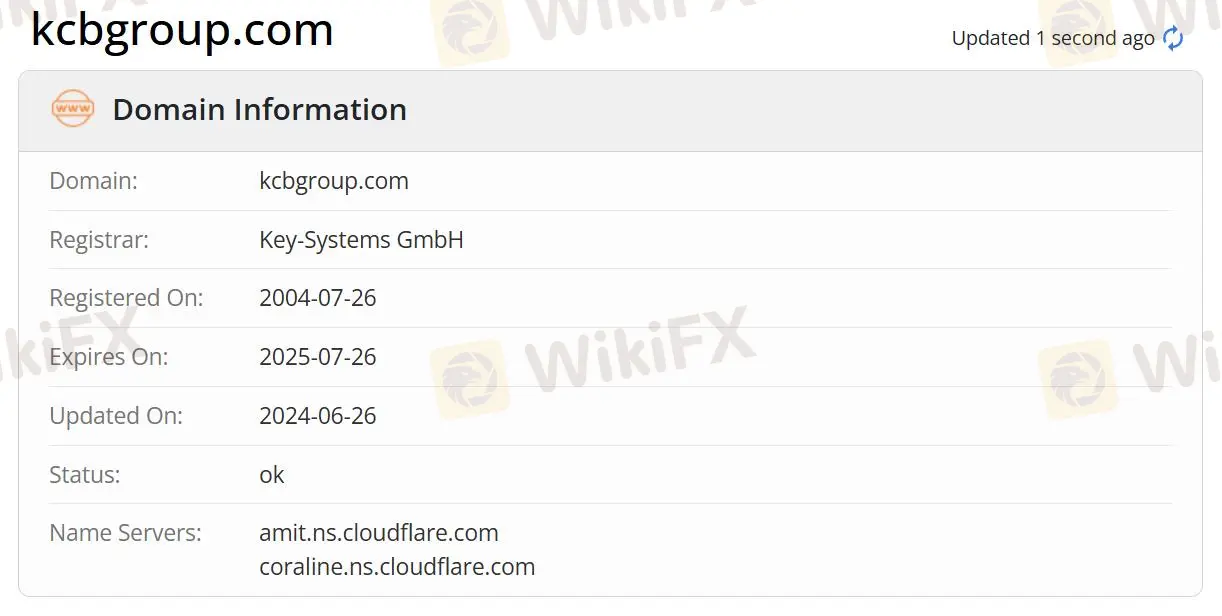

Derzeit fehlt es KCB an einer gültigen Regulierung. Die Domain wurde am 26. Juli 2004 registriert und der aktuelle Status ist "ok". Bitte achten Sie besonders auf die Sicherheit Ihrer Gelder, wenn Sie sich für diesen Broker entscheiden.

Produkte und Dienstleistungen

KCB bietet Dienstleistungen mit Karten, Darlehen, Investitionen und Forex an.

Kontotyp

KCB bietet zwei Arten von Konten an: Transaktionskonten und Sparkonto. Das Transaktionskonto umfasst Studentenkonto und Girokonto, und das Sparkonto umfasst Simba Sparkonto und Cub Konto.

Banking-Möglichkeiten

KCB unterstützt Bankgeschäfte über FILIALEN, GELDAUTOMATEN, KCB BANK AGENTS, MOBILE BANKING, INTERNET BANKING und GELDÜBERTRAGUNGSDIENSTE.