회사 소개

| KCB 리뷰 요약 | |

| 설립 | 1896 |

| 등록 국가/지역 | 부룬디 |

| 규제 | 규제 없음 |

| 제품 및 서비스 | 카드, 대출, 투자, 외환 |

| 데모 계정 | ❌ |

| 최소 입금액 | / |

| 고객 지원 | 전화: +25776522500 |

| 이메일: serviceclientele@bi.kcbbankgroup.com | |

| 문의 양식, 소셜 미디어 | |

KCB은 1896년에 설립된 부룬디에 본사를 둔 규제되지 않은 금융 회사입니다. 카드, 대출, 투자 및 외환 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| 다양한 서비스 | 규제 없음 |

| 다양한 계정 유형 | |

| 다양한 고객 지원 채널 |

KCB이 신뢰할 수 있는가?

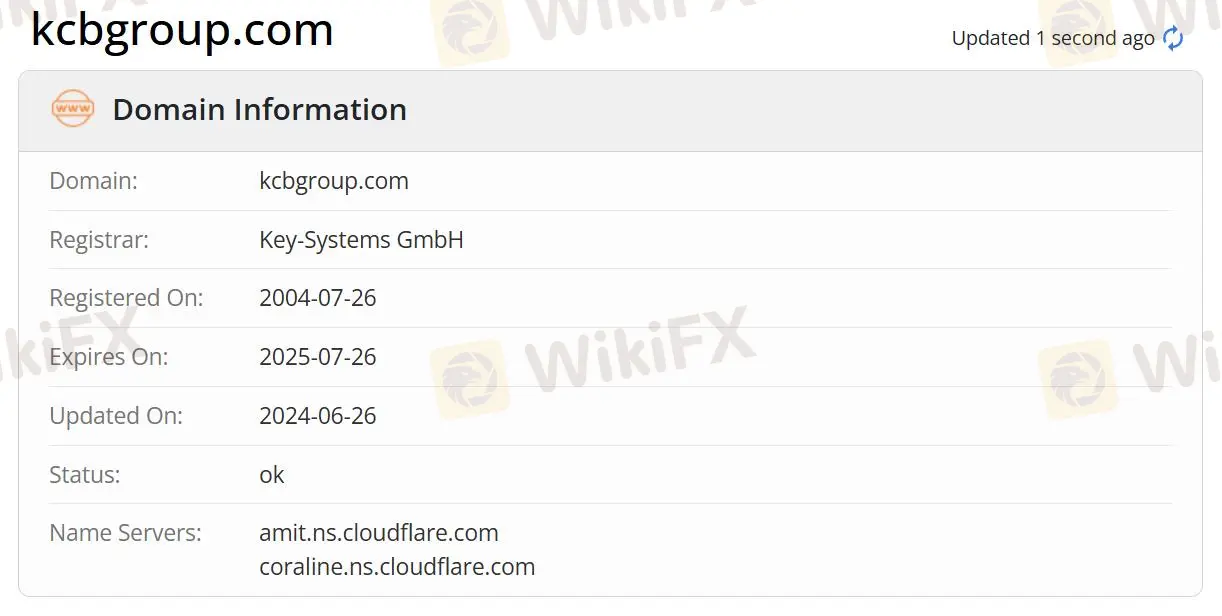

현재, KCB은 유효한 규제가 없습니다. 해당 도메인은 2004년 7월 26일에 등록되었으며 현재 상태는 "정상"입니다. 이 브로커를 선택한다면 자금의 안전에 매우 주의하십시오.

제품 및 서비스

KCB은 카드, 대출, 투자 및 외환 서비스를 제공합니다.

계정 유형

KCB은 거래 계정과 저축 계정 두 가지 유형의 계정을 제공합니다. 거래 계정에는 학생 계정과 당좌 계정이 포함되며, 저축 계정에는 심바 저축 계정과 커브 계정이 포함됩니다.

은행 업무 방식

KCB은 지점, ATM, KCB 은행 대리점, 모바일 뱅킹, 인터넷 뱅킹 및 송금 서비스를 통해 은행 업무 방식을 지원합니다.