Profil perusahaan

| KCB Ringkasan Ulasan | |

| Dibentuk | 1896 |

| Negara/Daerah Terdaftar | Burundi |

| Regulasi | Tidak Ada Regulasi |

| Produk dan Layanan | Kartu, Pinjaman, Investasi, Forex |

| Akun Demo | ❌ |

| Deposit Minimum | / |

| Dukungan Pelanggan | Telepon: +25776522500 |

| Email: serviceclientele@bi.kcbbankgroup.com | |

| Formulir kontak, media sosial | |

Didirikan pada tahun 1896, KCB adalah perusahaan keuangan yang tidak diatur yang berbasis di Burundi. Itu menawarkan layanan untuk kartu, pinjaman, investasi, dan Forex.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Layanan Lengkap | Tidak Ada Regulasi |

| Jenis Akun yang Beragam | |

| Banyak Saluran Dukungan Pelanggan |

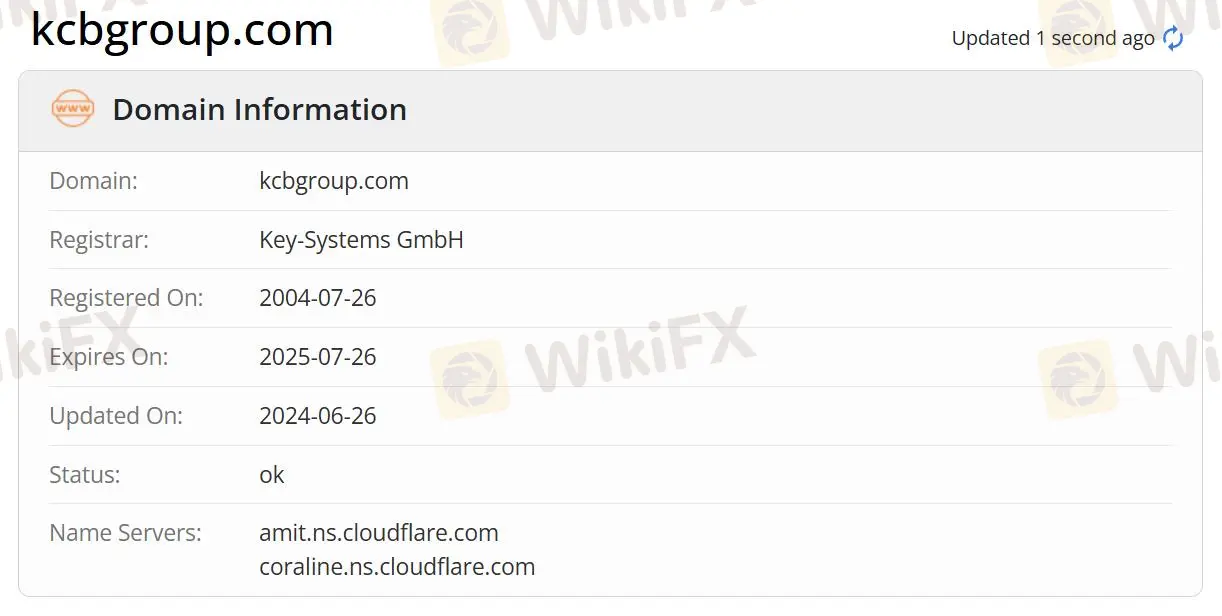

Apakah KCB Legal?

Saat ini, KCB tidak memiliki regulasi yang valid. Domainnya terdaftar pada 26 Juli 2004, dan status saat ini adalah "ok". Harap perhatikan keamanan dana Anda jika Anda memilih broker ini.

Produk dan Layanan

KCB menawarkan layanan dengan kartu, pinjaman, investasi, dan Forex.

Jenis Akun

KCB menyediakan dua jenis akun: Akun Transaksional dan Akun Tabungan. Akun Transaksional termasuk Akun Mahasiswa dan Akun Giro, dan Akun Tabungan termasuk Akun Simba Tabungan dan Akun Cub.

Cara Perbankan

KCB mendukung cara perbankan melalui CABANG, ATM, AGEN BANK KCB, PERBANKAN SELULER, PERBANKAN INTERNET, dan LAYANAN TRANSFER UANG.