Présentation de l'entreprise

| YLG Résumé de l'examen | |

| Fondé | 2022 |

| Pays/Région Enregistré | Thaïlande |

| Régulation | Pas de régulation |

| Produit de Trading | Lingots d'or |

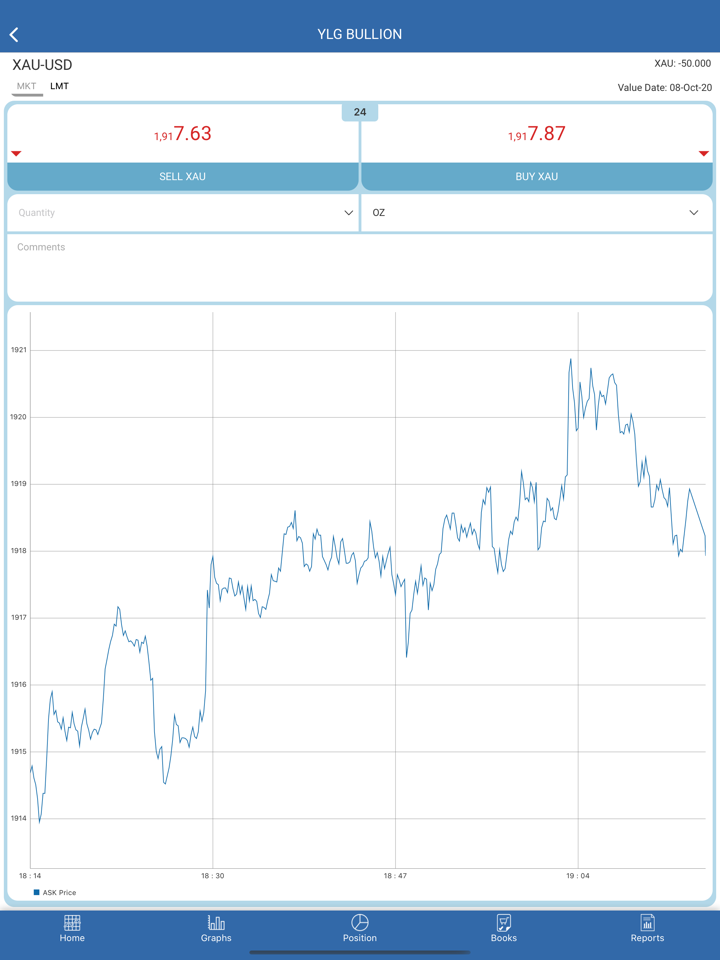

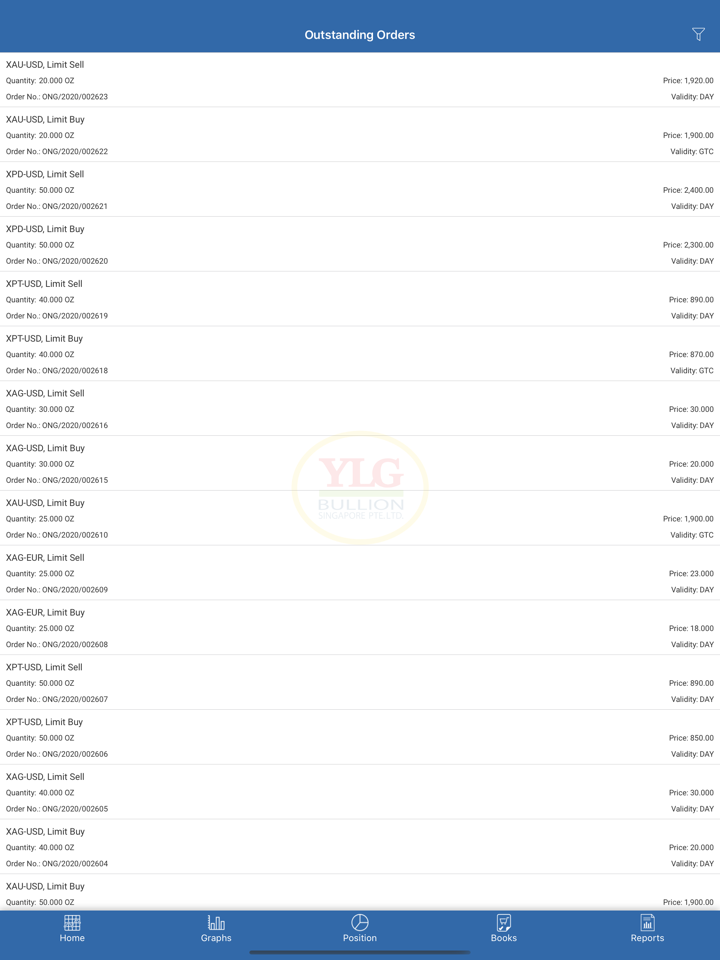

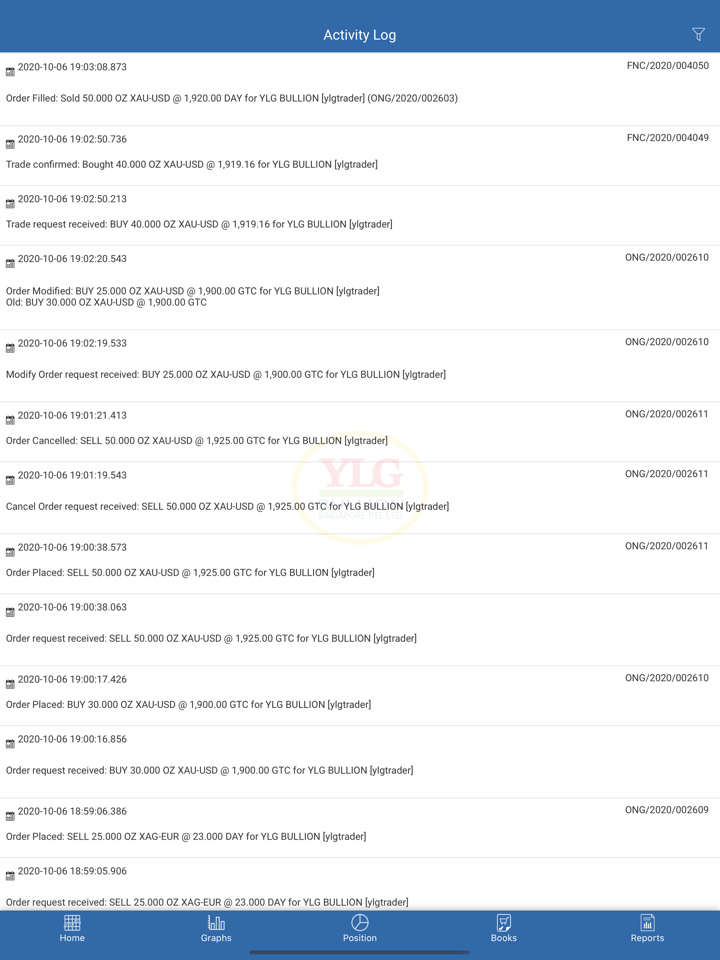

| Plateforme de Trading | YLG Gold Trader Online |

| Support Client | Tél : 02-687-9888, 02-106-5959; |

| Fax : 02-677-5586 | |

| Plateforme sociale : Facebook, YouTube, Instagram, LINE | |

| Adresse : 653/19 (entre Soi Narathiwat 7-9), Thung Maha Mek, Sathorn, Bangkok 10120 | |

Informations sur YLG

YLG est une société de services financiers basée en Thaïlande, fondée en 2022, et propose des services de trading de lingots d'or.

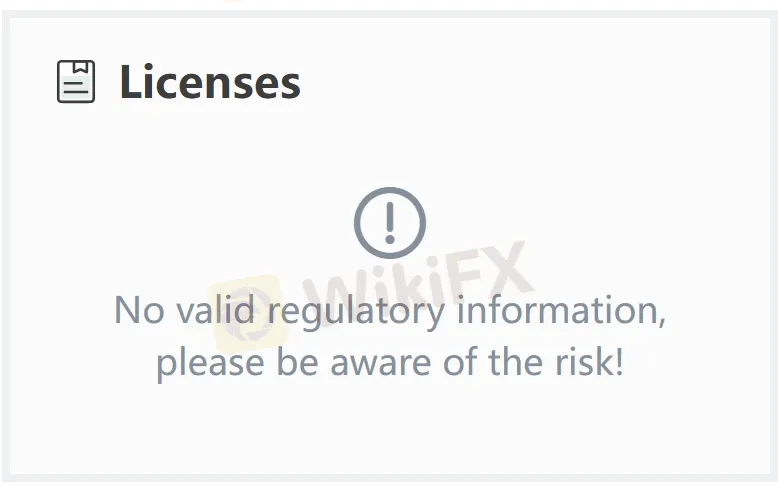

La société opère actuellement sans régulation valide de la part d'autorités financières, ce qui nuit à sa crédibilité et à la confiance des clients.

Avantages et Inconvénients

| Avantages | Inconvénients |

| / | Pas de régulation |

| Structure de frais peu claire |

YLG est-il Légitime ?

Le facteur le plus important pour mesurer la sécurité d'une plateforme de courtage est sa régulation formelle. YLG est un courtier non régulé, ce qui signifie que la sécurité des fonds des utilisateurs et de leurs activités de trading n'est pas efficacement protégée. Les investisseurs devraient choisir Monix Limited avec prudence.

Que Puis-je Trader sur YLG ?

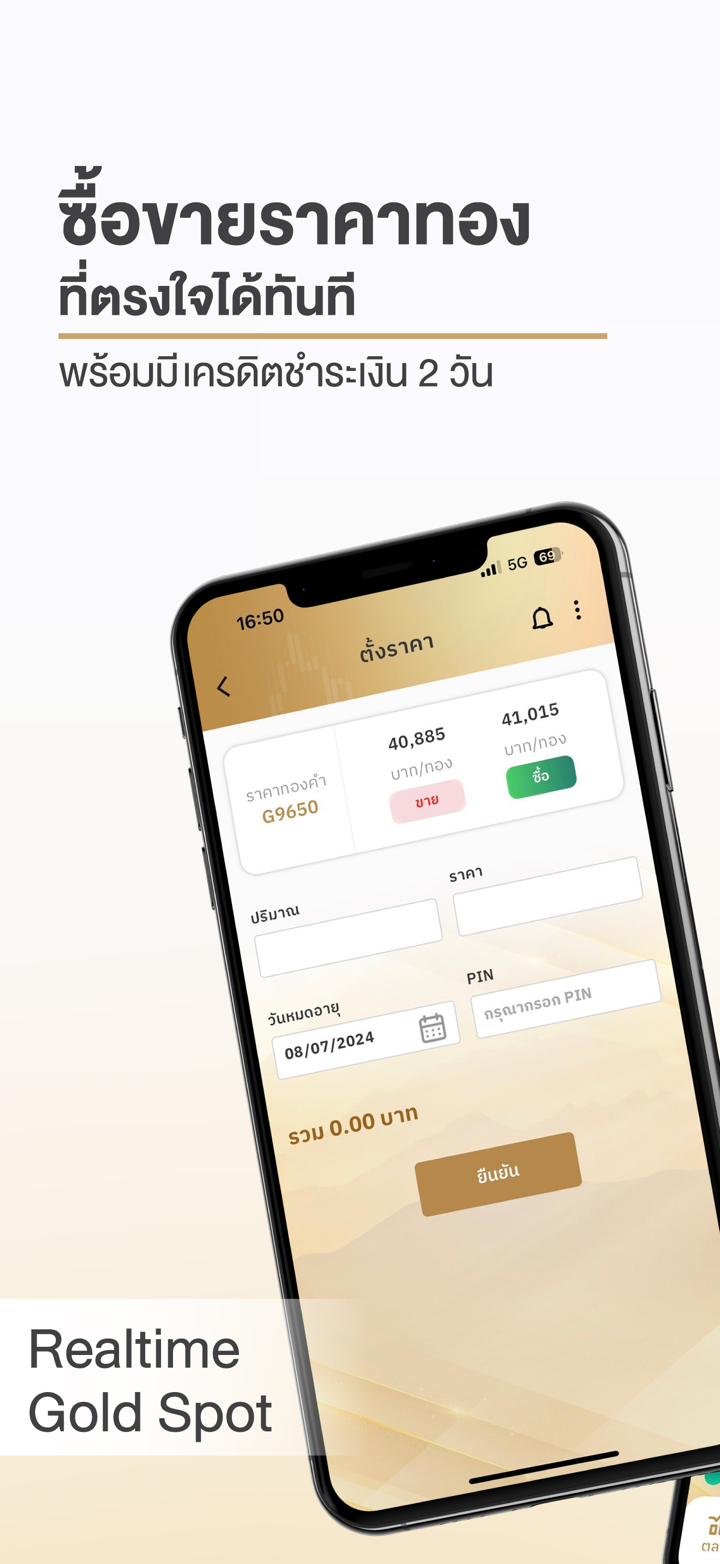

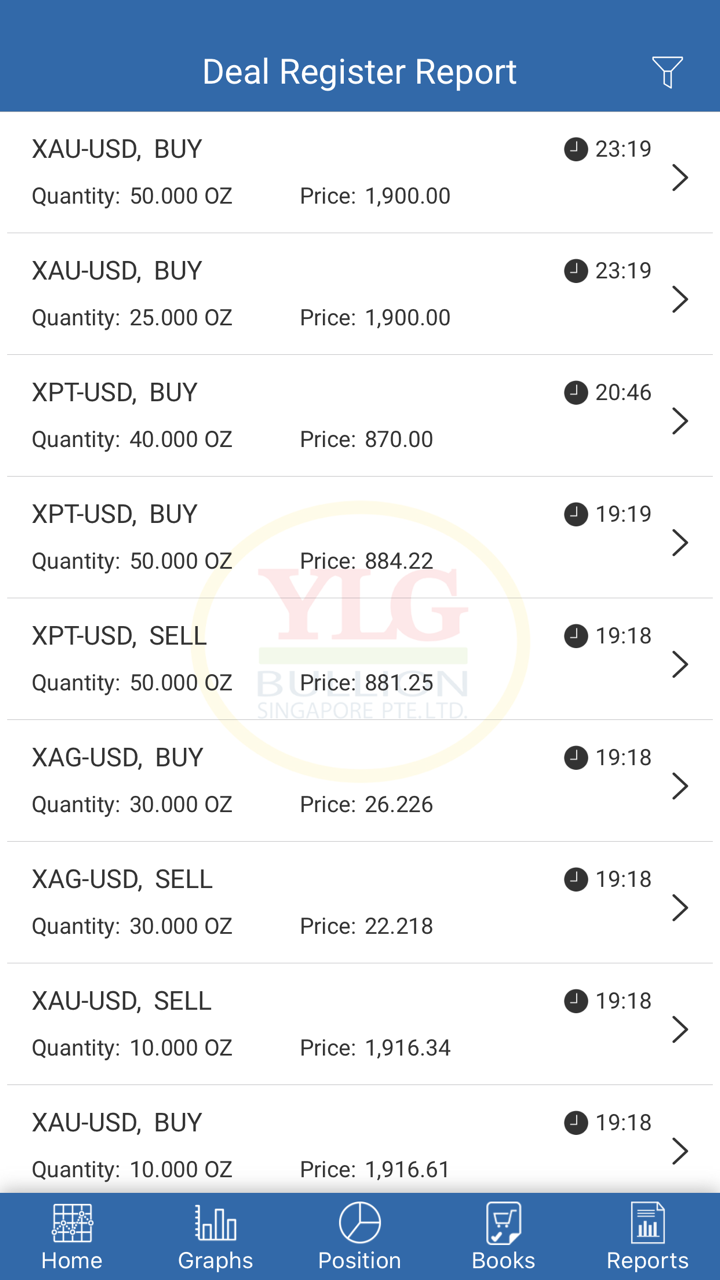

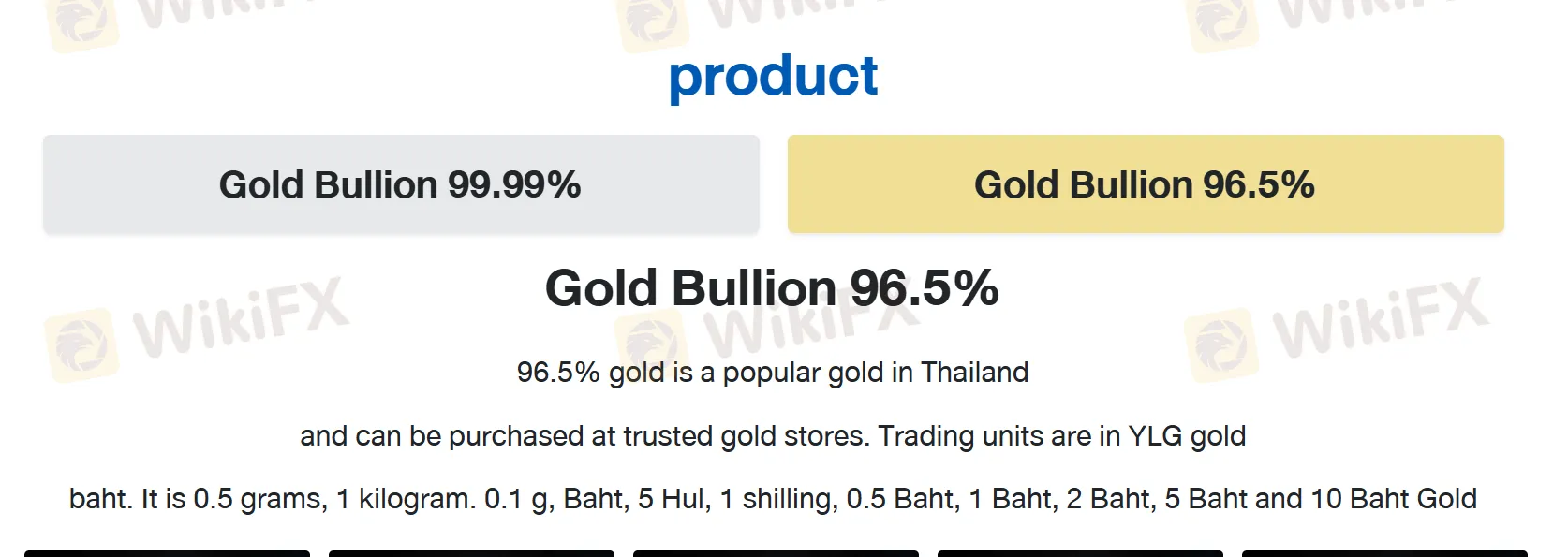

YLG propose à la fois des produits de lingots d'or 99,99% et 96,5% dans une large gamme de tailles, allant de 0,1 gramme à 1 kilogramme.

L'or à 99,99% est reconnu internationalement pour sa pureté, tandis que l'or à 96,5% est une norme populaire en Thaïlande, échangée en unités traditionnelles de baht.

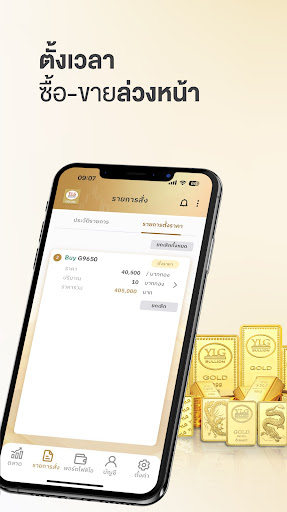

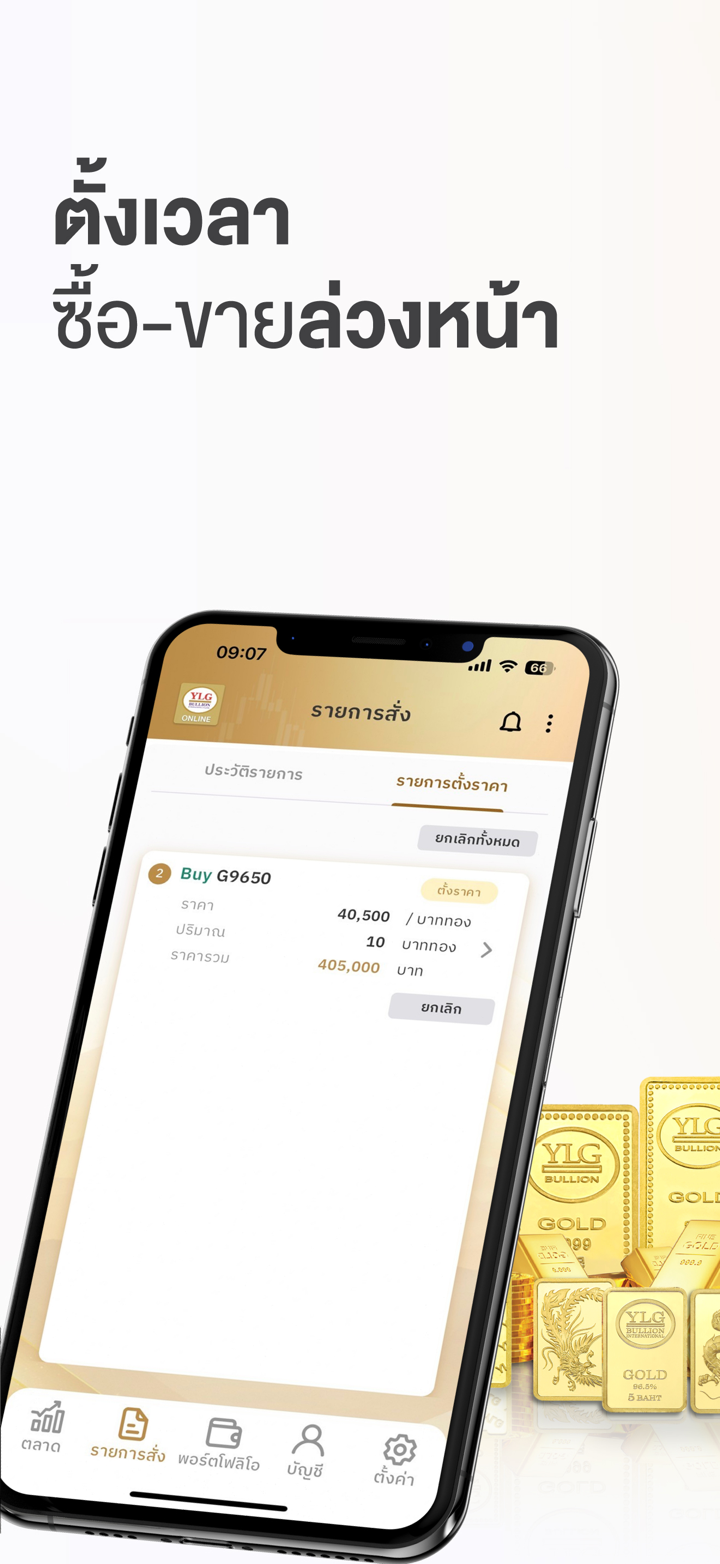

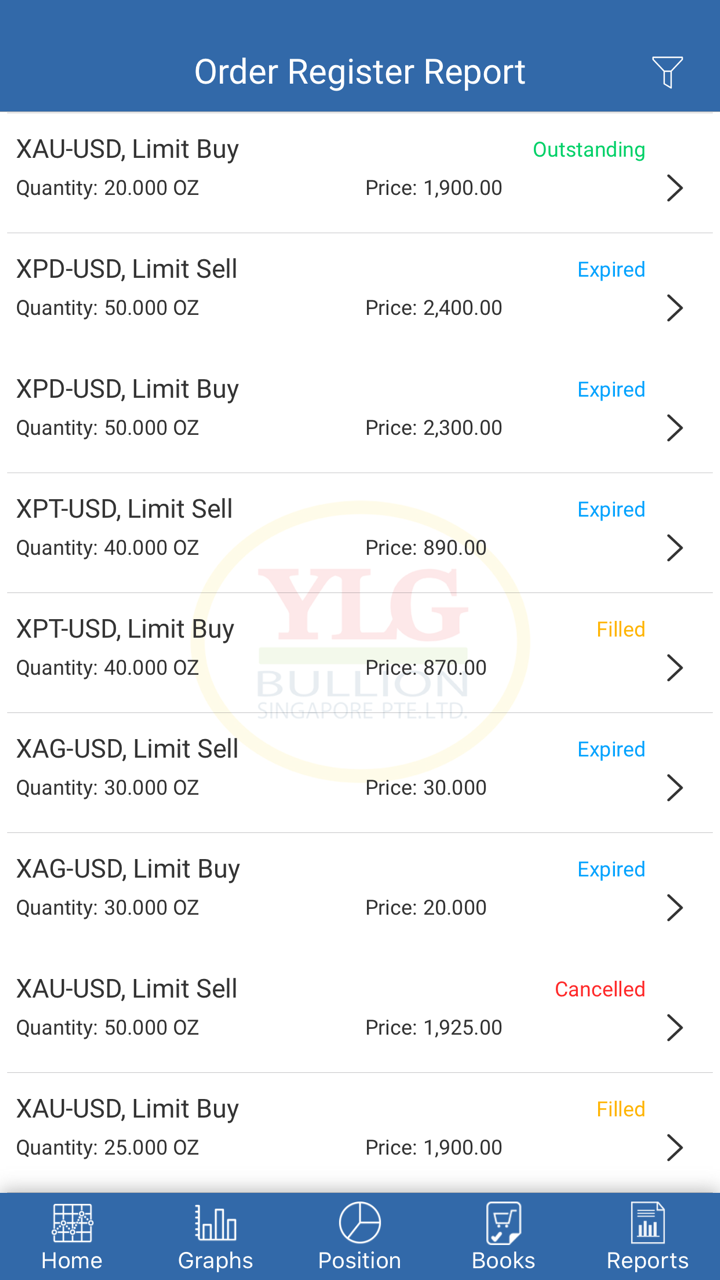

Les clients peuvent acheter, vendre ou accumuler de l'or avec YLG, que ce soit pour un profit à court terme ou un investissement à long terme.

Plateforme de Trading

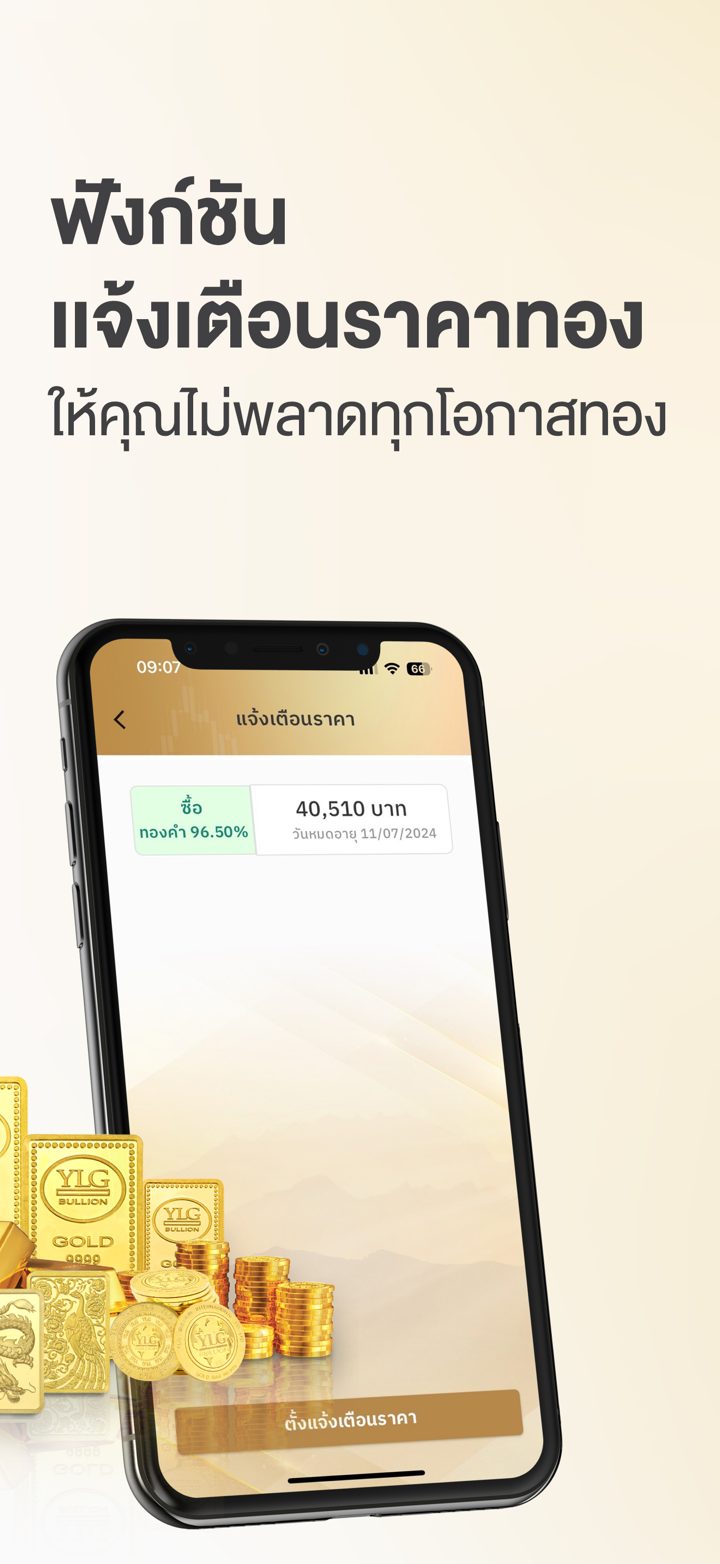

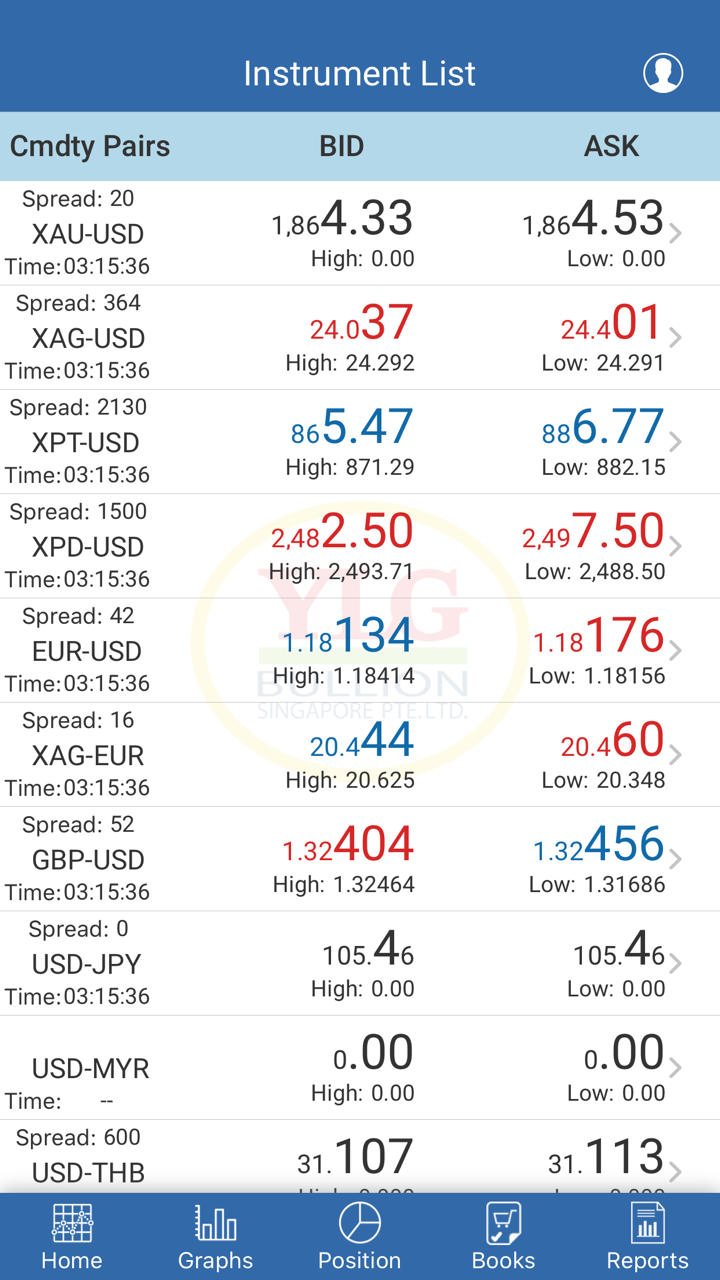

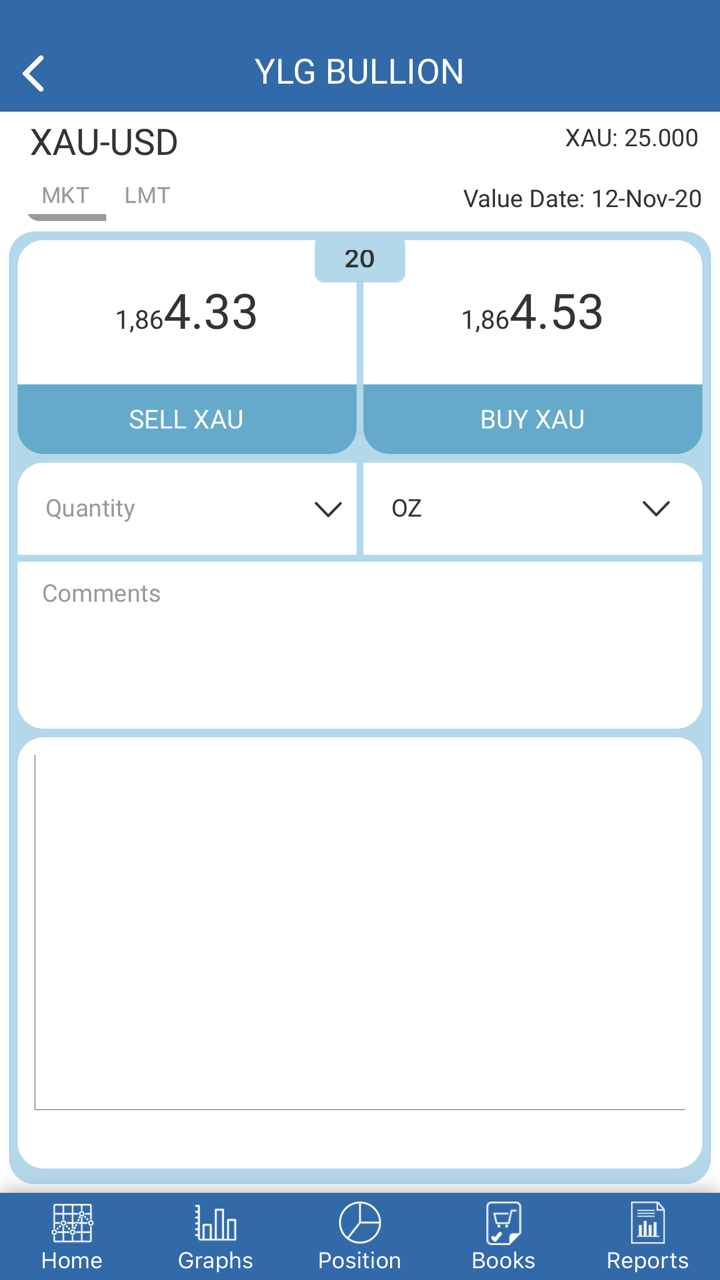

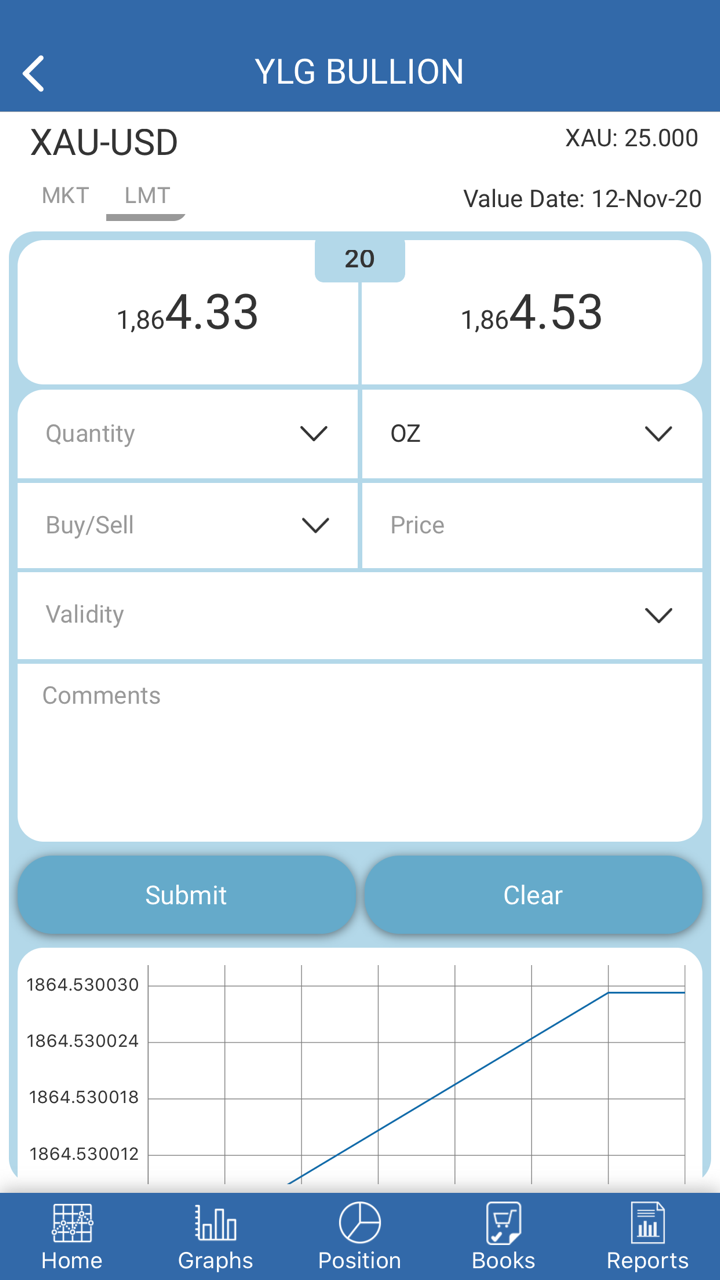

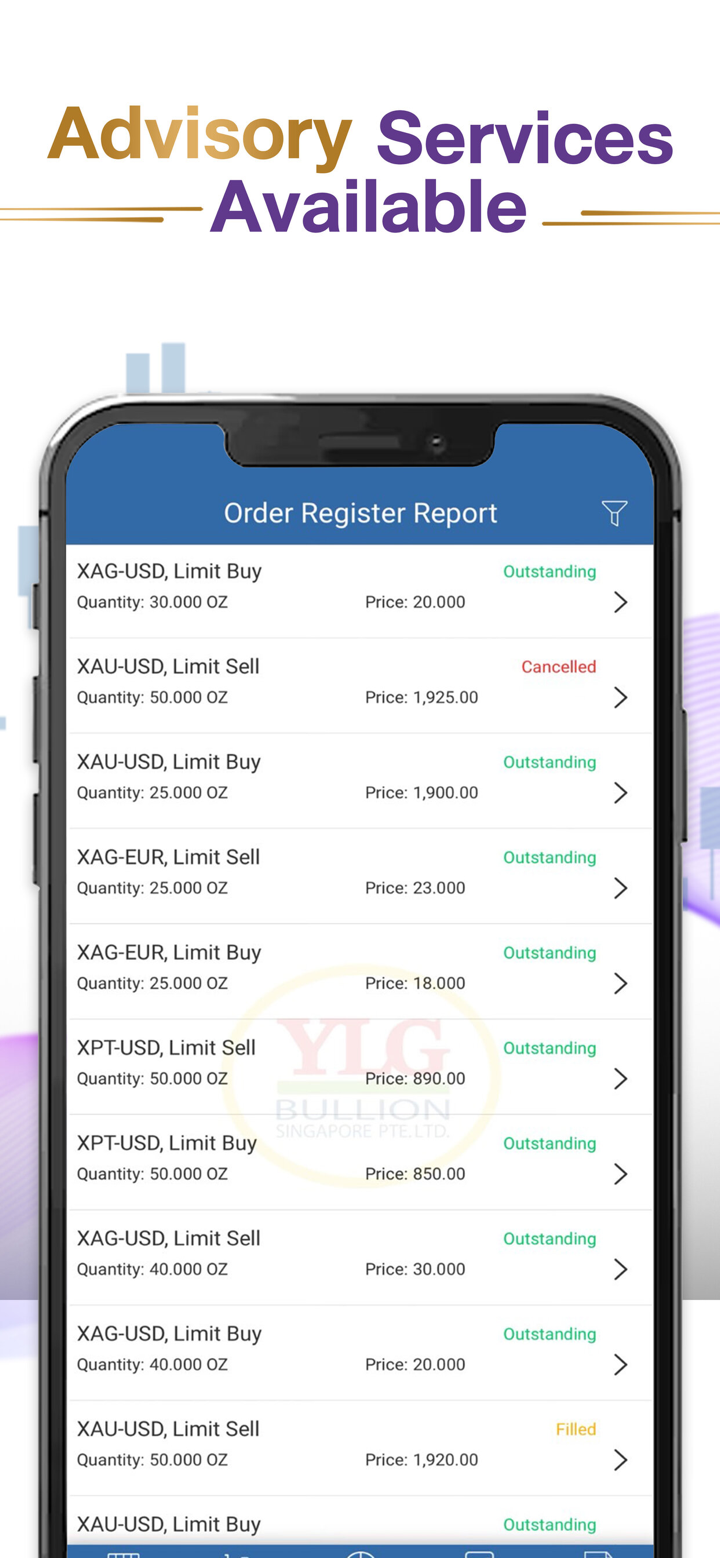

YLG propose une plateforme de trading propriétaire, nommée "YLG Gold Trader Online", qui peut être accessible via les plateformes web, iOS et Android.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| YLG Gold Trader Online | ✔ | Web/Téléphones mobiles | / |

| MT4 | ❌ | / | Débutants |

| MT5 | ❌ | / | Traders expérimentés |