公司簡介

| YLG 評論摘要 | |

| 成立年份 | 2022 |

| 註冊國家/地區 | 泰國 |

| 監管 | 無監管 |

| 交易產品 | 黃金條 |

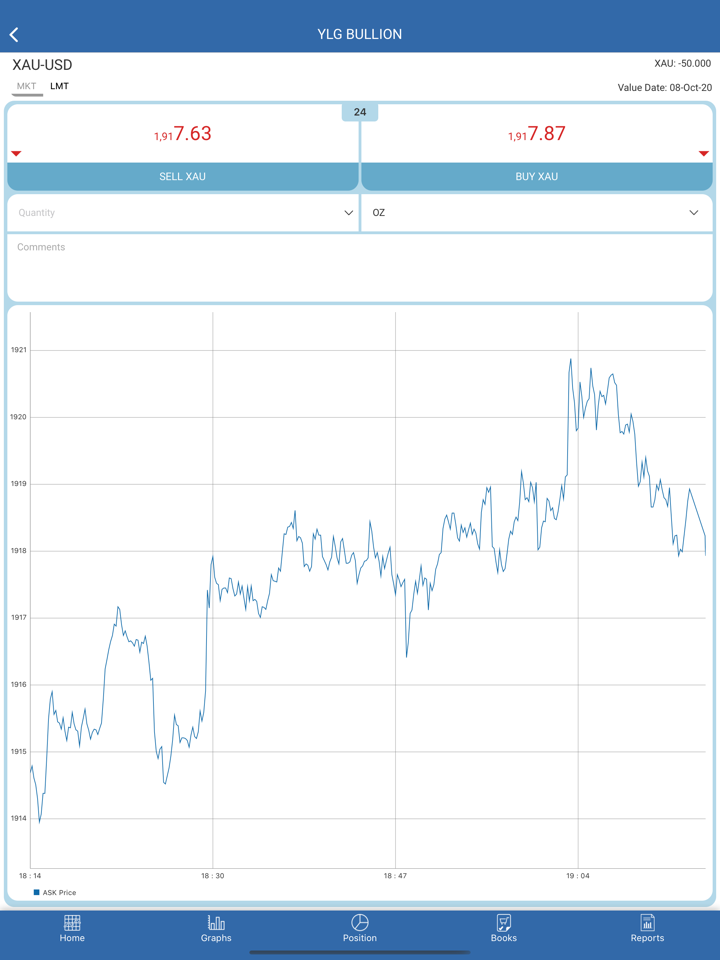

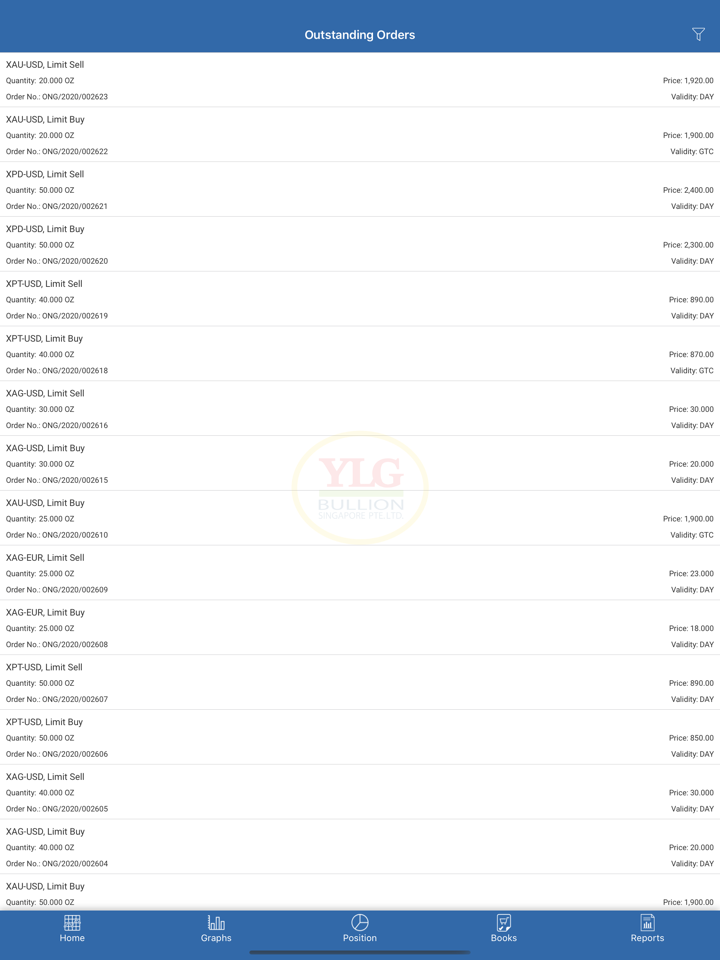

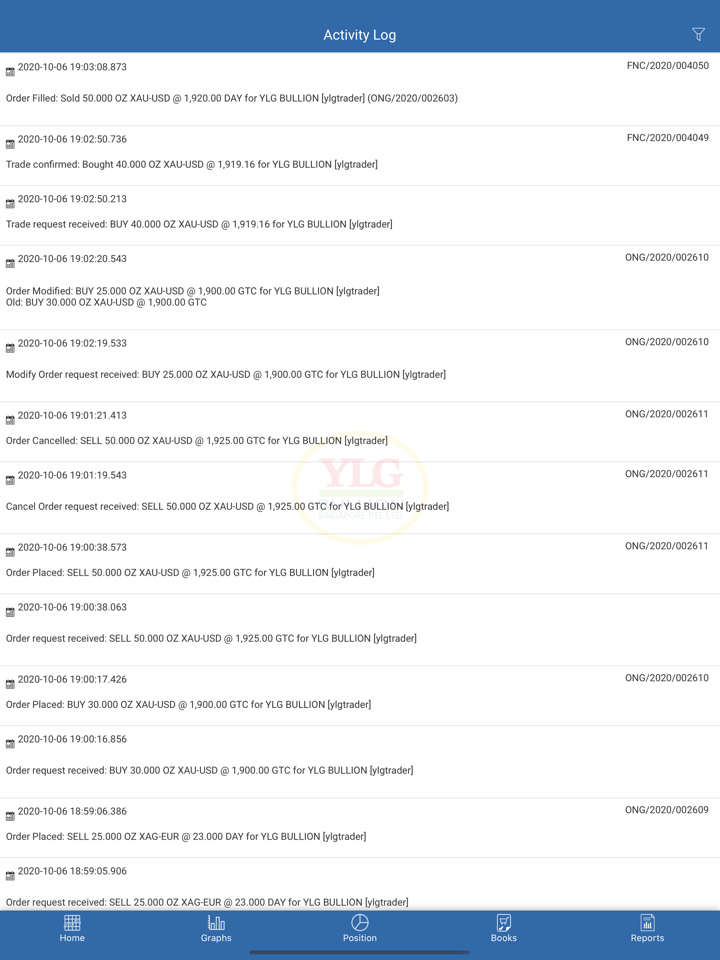

| 交易平台 | YLG 黃金交易在線 |

| 客戶支援 | 電話:02-687-9888、02-106-5959; |

| 傳真:02-677-5586 | |

| 社交平台:Facebook、YouTube、Instagram、LINE | |

| 地址:10120 曼谷沙吞區通瑪哈湄區那拉提瓦七至九巷653/19號 | |

YLG 資訊

YLG 是一家總部位於泰國的金融服務公司,成立於2022年,提供黃金條交易服務。

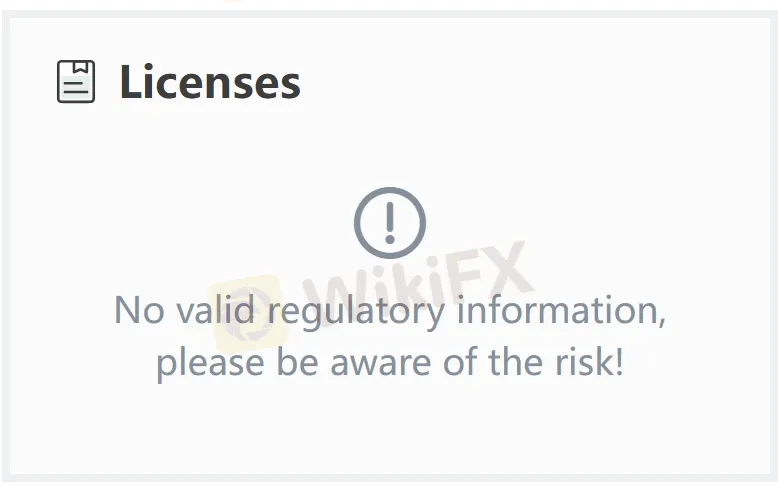

該公司目前沒有任何金融機構的有效監管,降低了其可信度和客戶信任。

優缺點

| 優點 | 缺點 |

| / | 無監管 |

| 費用結構不清晰 |

YLG 是否合法?

評估經紀平台安全性最重要的因素是它是否經過正式監管。YLG 是一家未受監管的經紀商,這意味著用戶資金的安全性和交易活動並未得到有效保護。投資者應謹慎選擇 Monix Limited。

我可以在 YLG 上交易什麼?

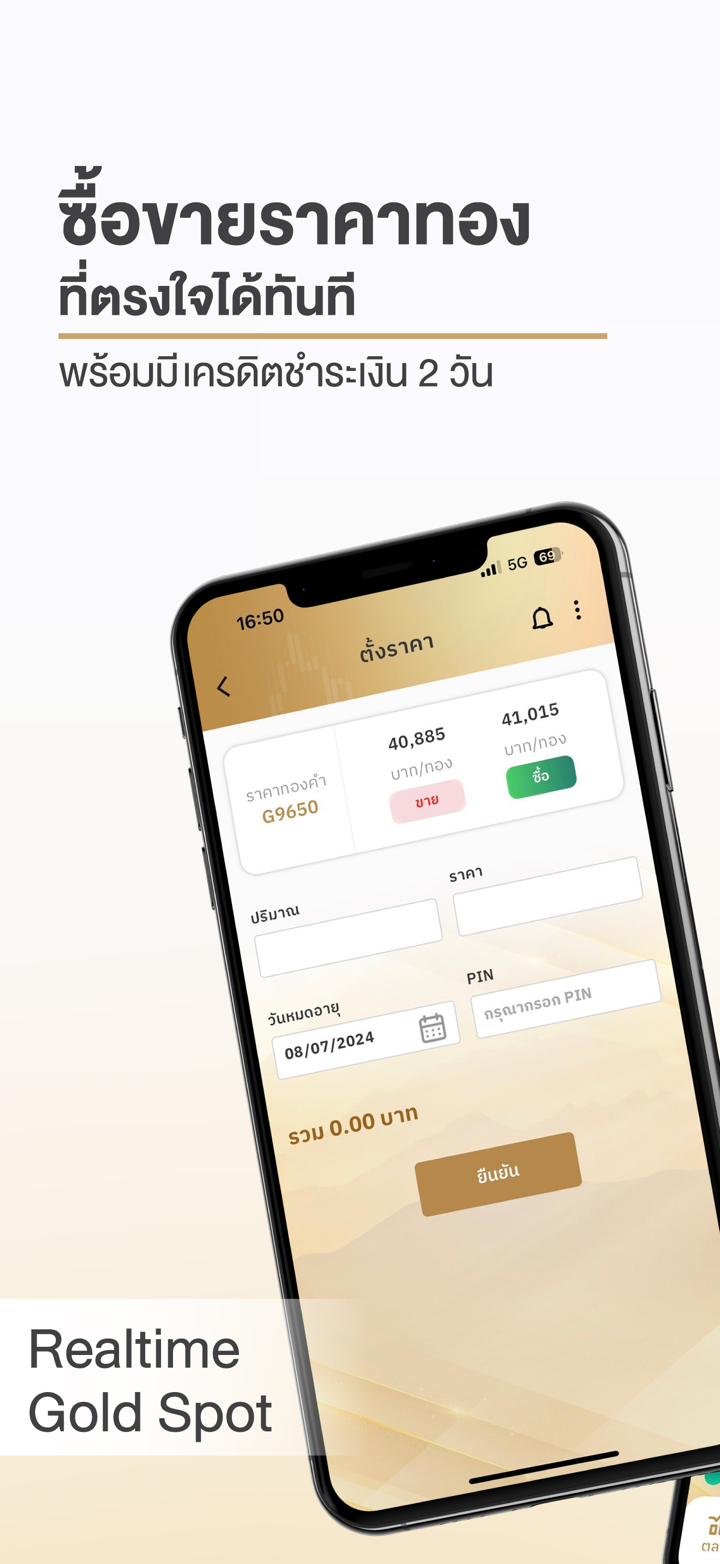

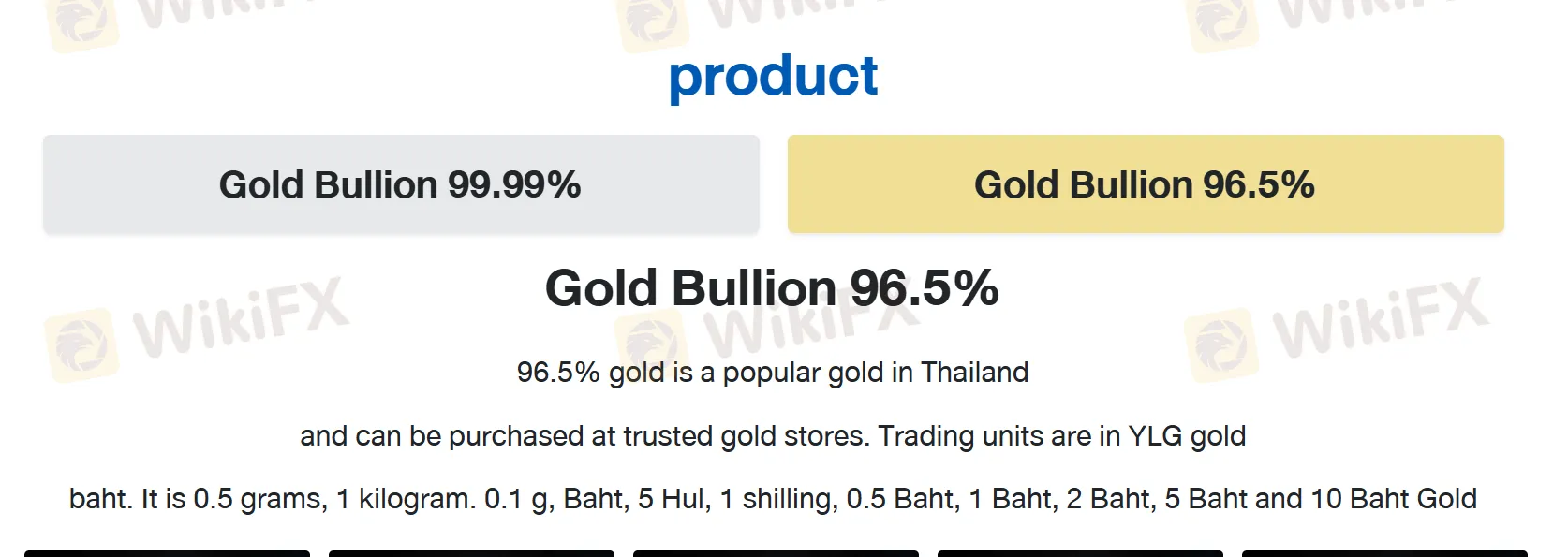

YLG 提供99.99% 和96.5% 黃金條產品,尺寸範圍廣泛,從0.1克到1公斤不等。

99.99% 黃金在國際上以其純度而聞名,而96.5% 黃金是泰國的流行標準,以傳統的泰銖單位交易。

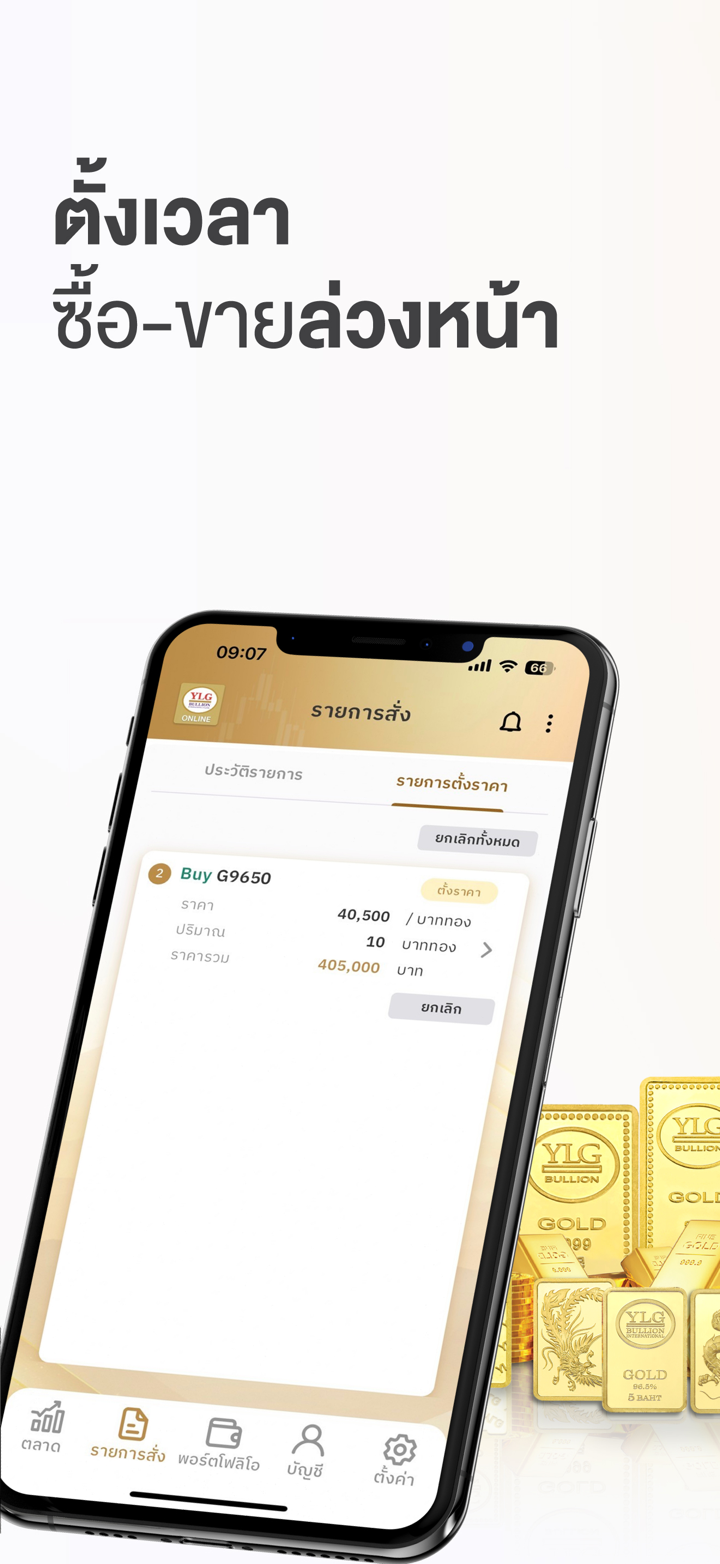

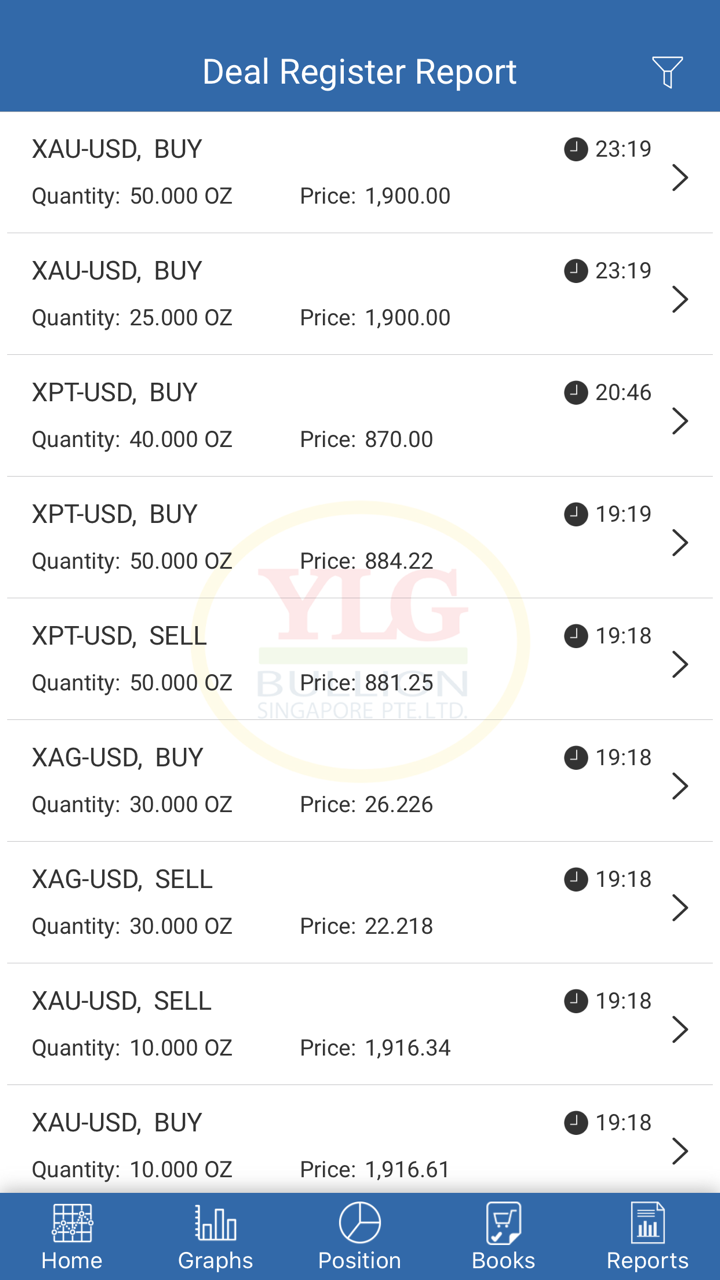

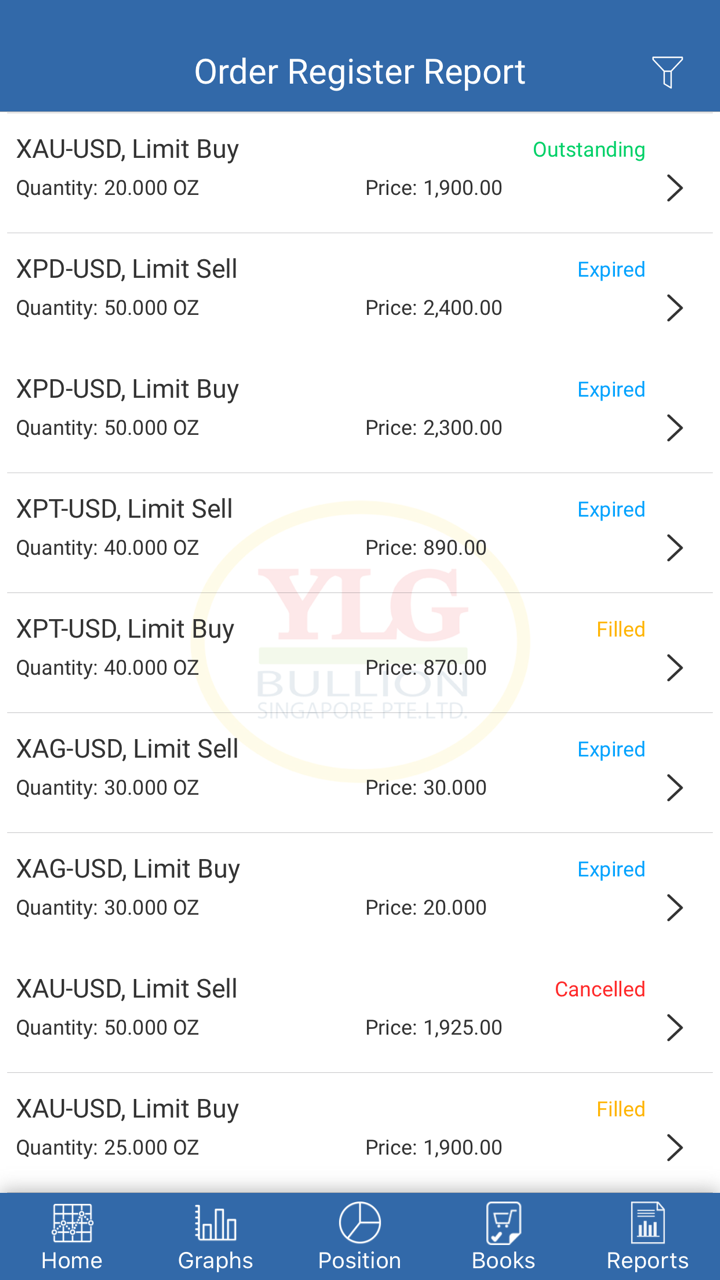

客戶可以在 YLG 購買、出售或積累黃金,無論是為了短期利潤還是長期投資。

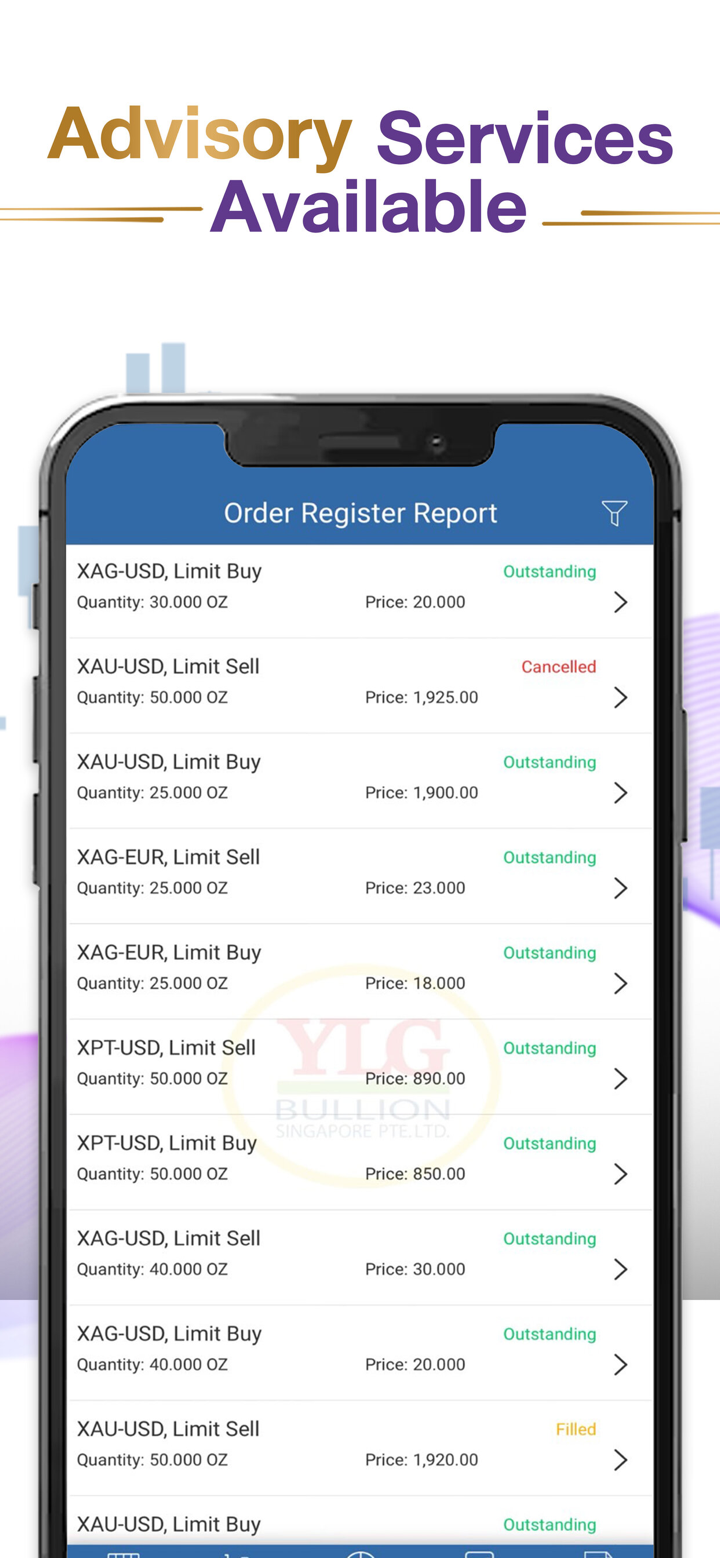

交易平台

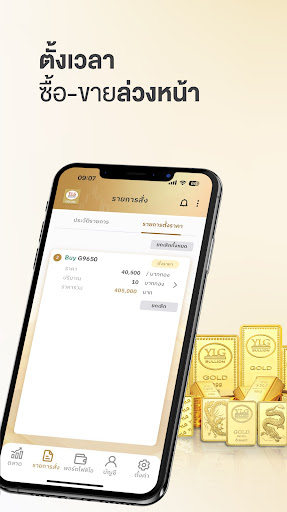

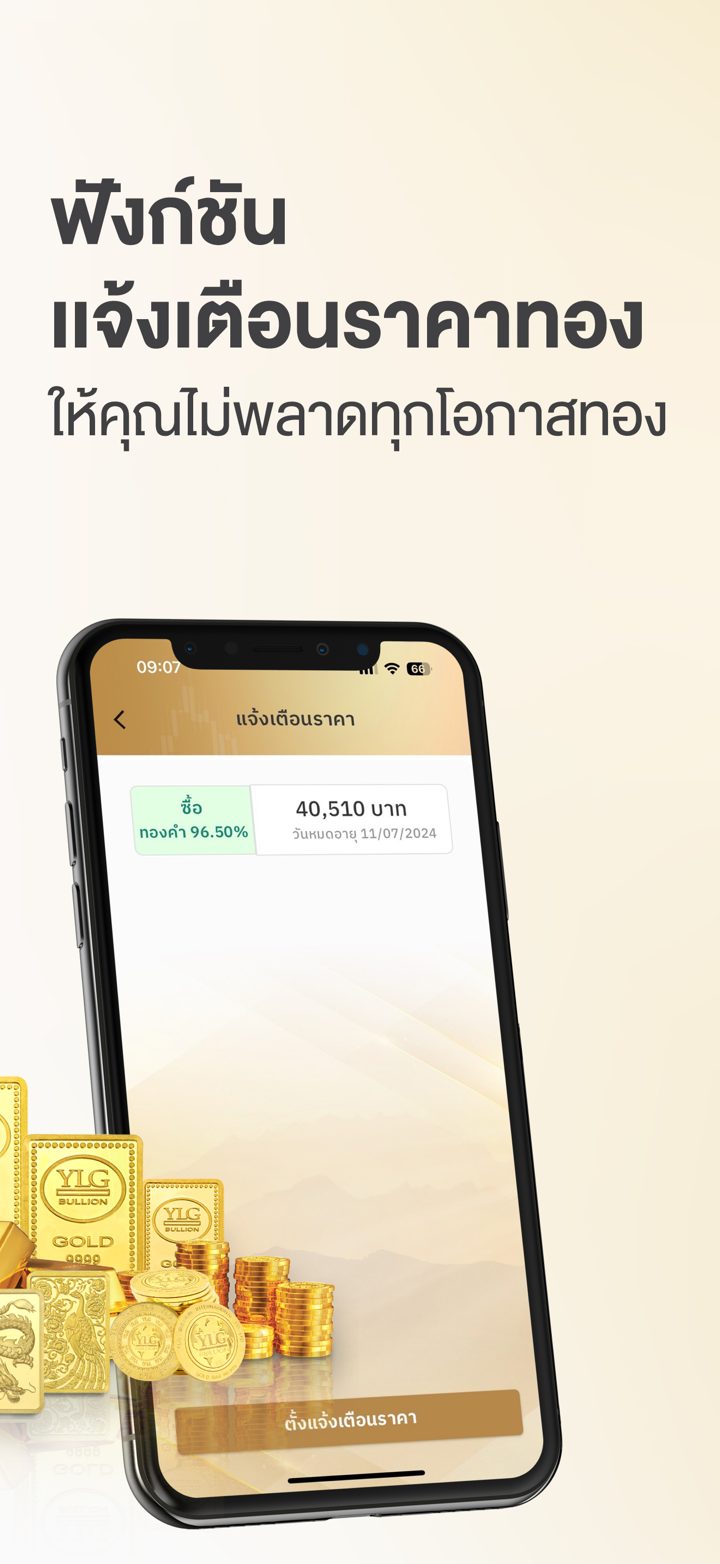

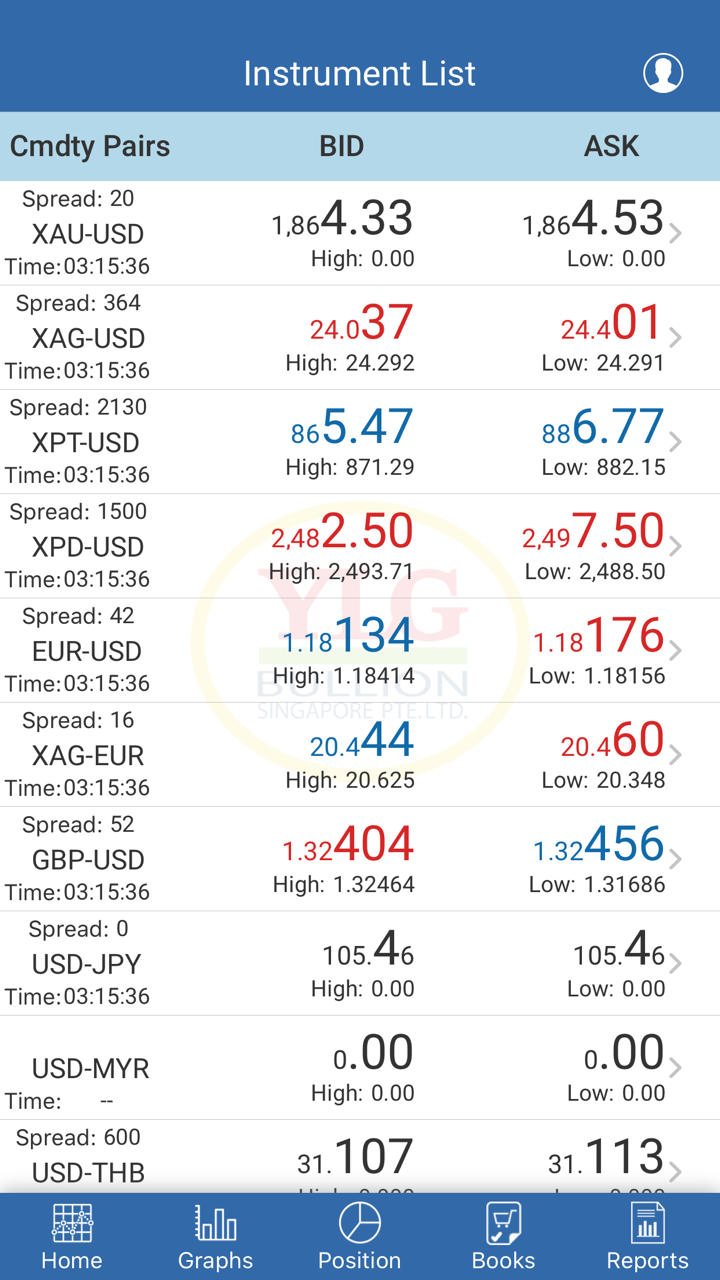

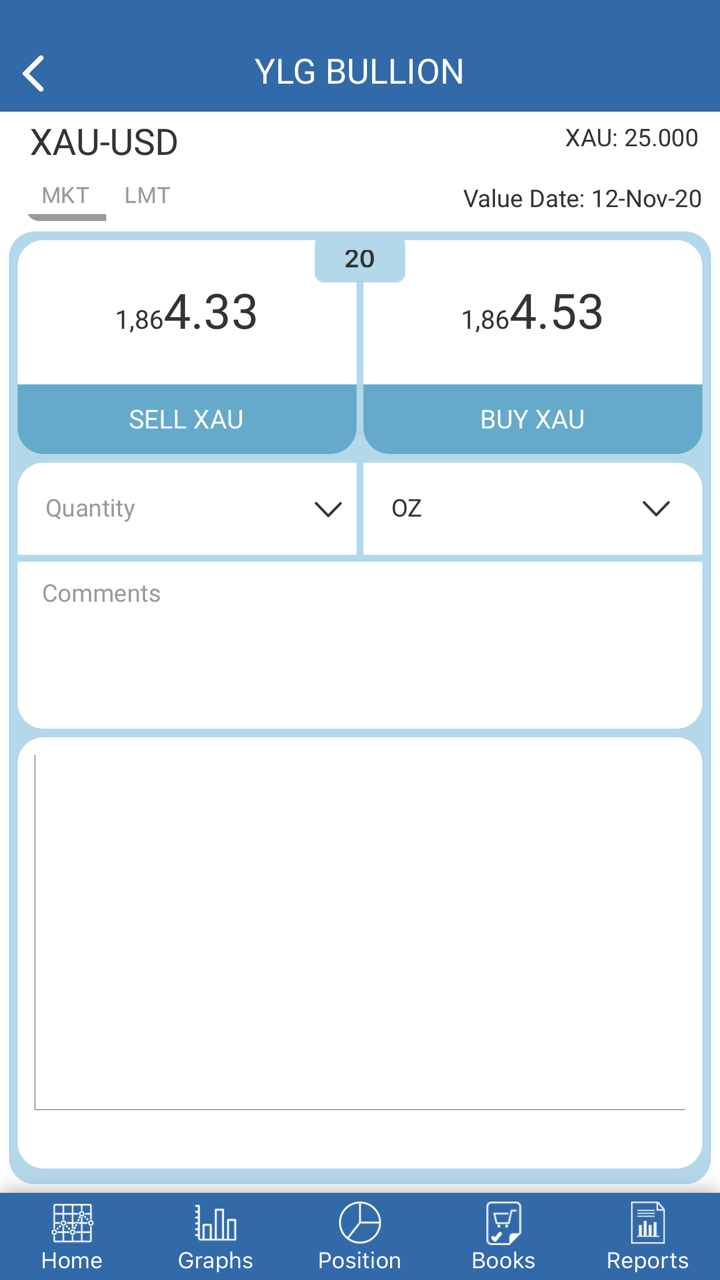

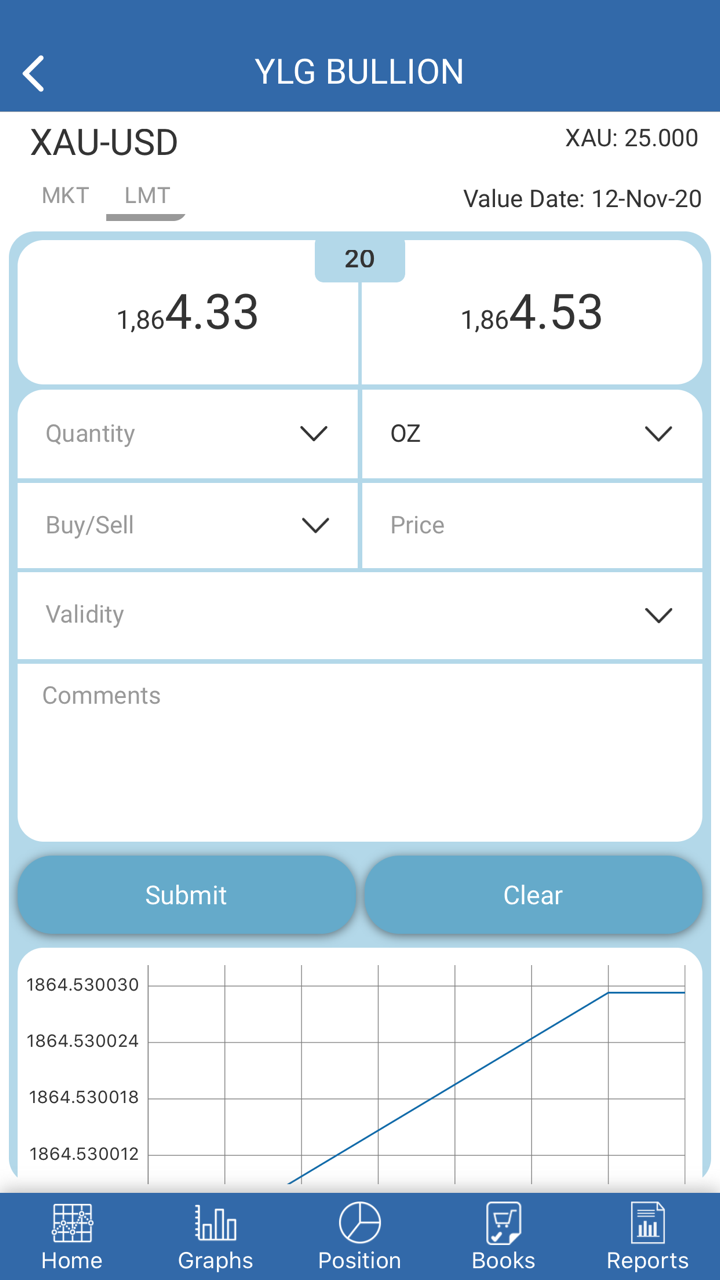

YLG 提供了一個專有的交易平台,名為“YLG Gold Trader Online”,可透過網頁、iOS和Android平台進行訪問。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| YLG Gold Trader Online | ✔ | 網頁/手機 | / |

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |