Company Summary

| YLG Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Thailand |

| Regulation | No regulation |

| Trading Product | Gold bullion |

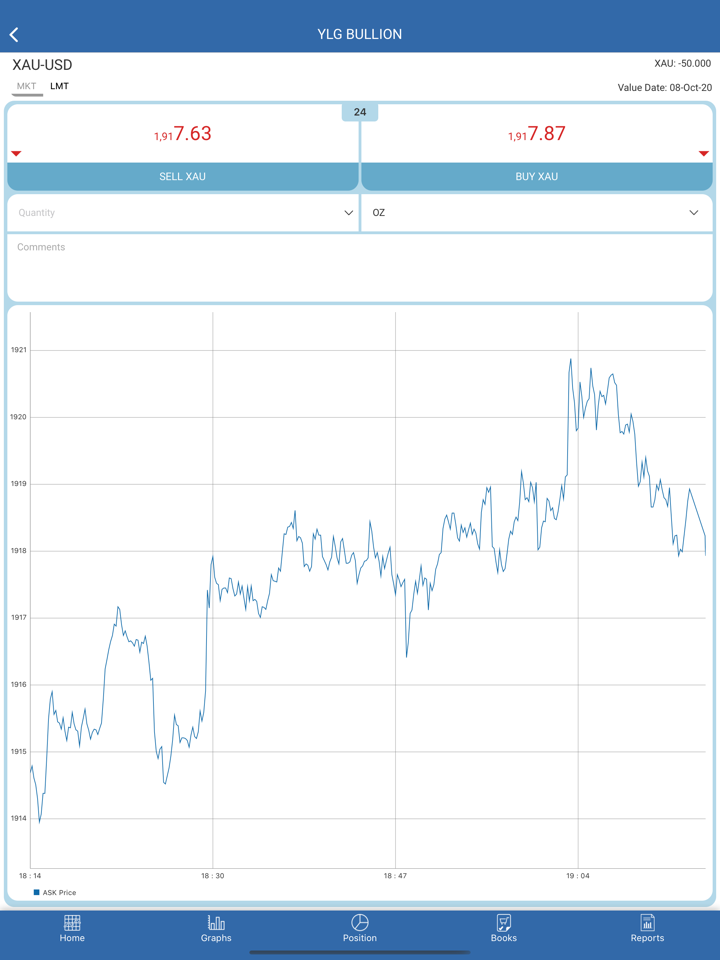

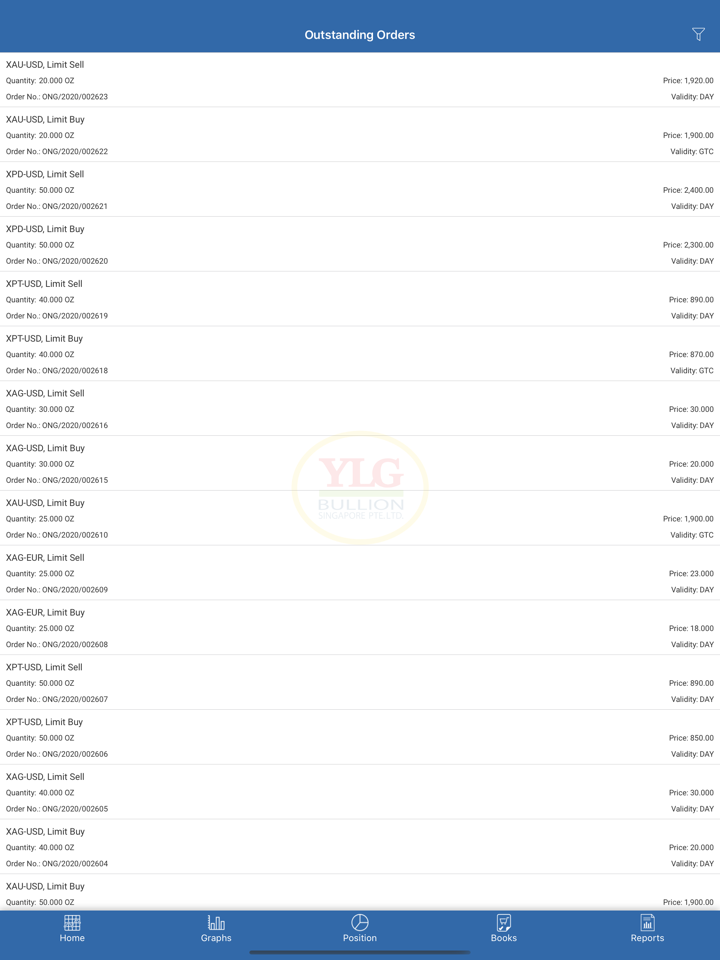

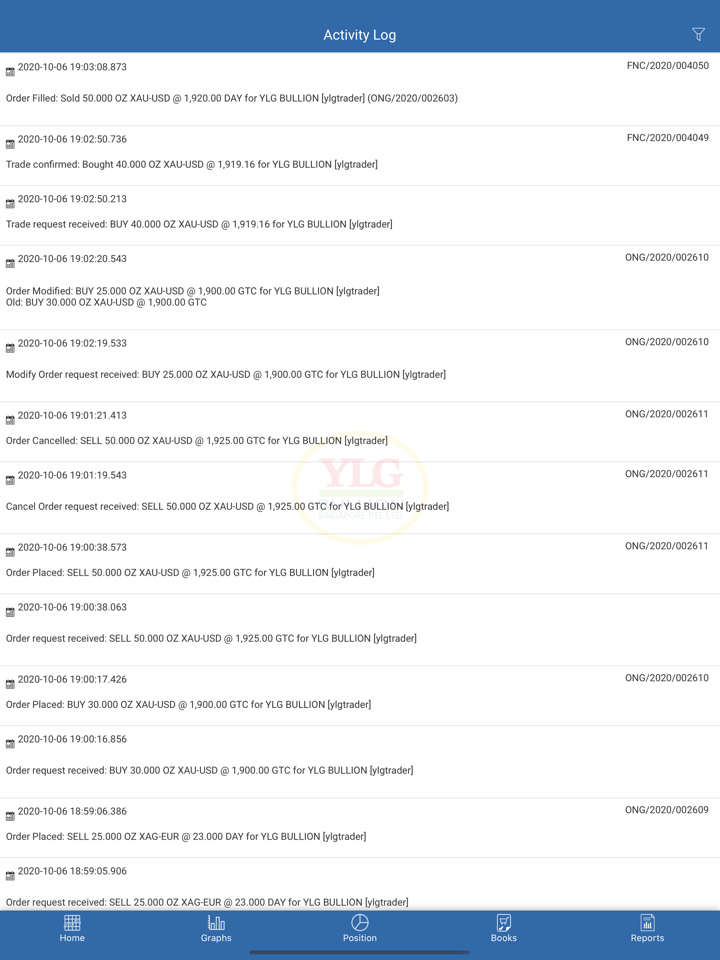

| Trading Platform | YLG Gold Trader Online |

| Customer Support | Tel: 02-687-9888, 02-106-5959; |

| Fax: 02-677-5586 | |

| Social platform: Facebook, YouTube, Instagram, LINE | |

| Address: 653/19 (between Soi Narathiwat 7-9), Thung Maha Mek, Sathorn, Bangkok 10120 | |

YLG Information

YLG is a Thailand-based financial services company established in 2022 and offers trading services in gold bullion.

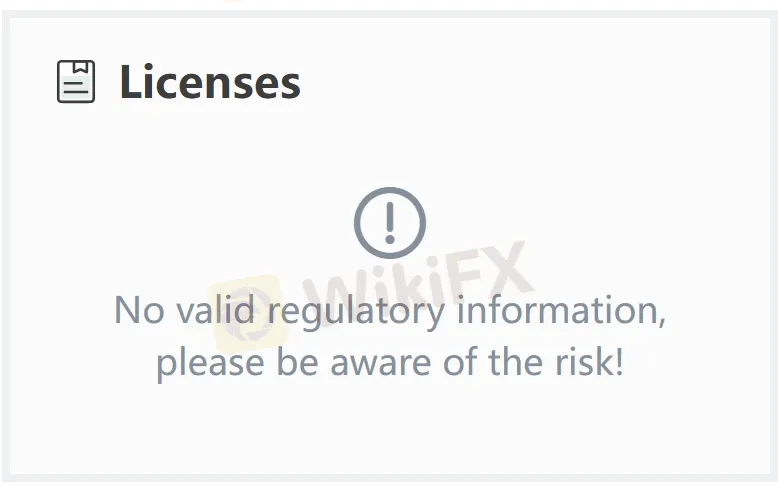

The company currently operates without valid regulation from any financial authorities, degrading its credibility and customer trust.

Pros and Cons

| Pros | Cons |

| / | No regulation |

| Unclear fee structure |

Is YLG Legit?

The most important factor in measuring the safety of a brokerage platform is whether it is formally regulated. YLG is an unregulated broker, which means that the safety of users' funds and trading activities are not effectively protected. Investors should choose Monix Limited with caution.

What Can I Trade on YLG?

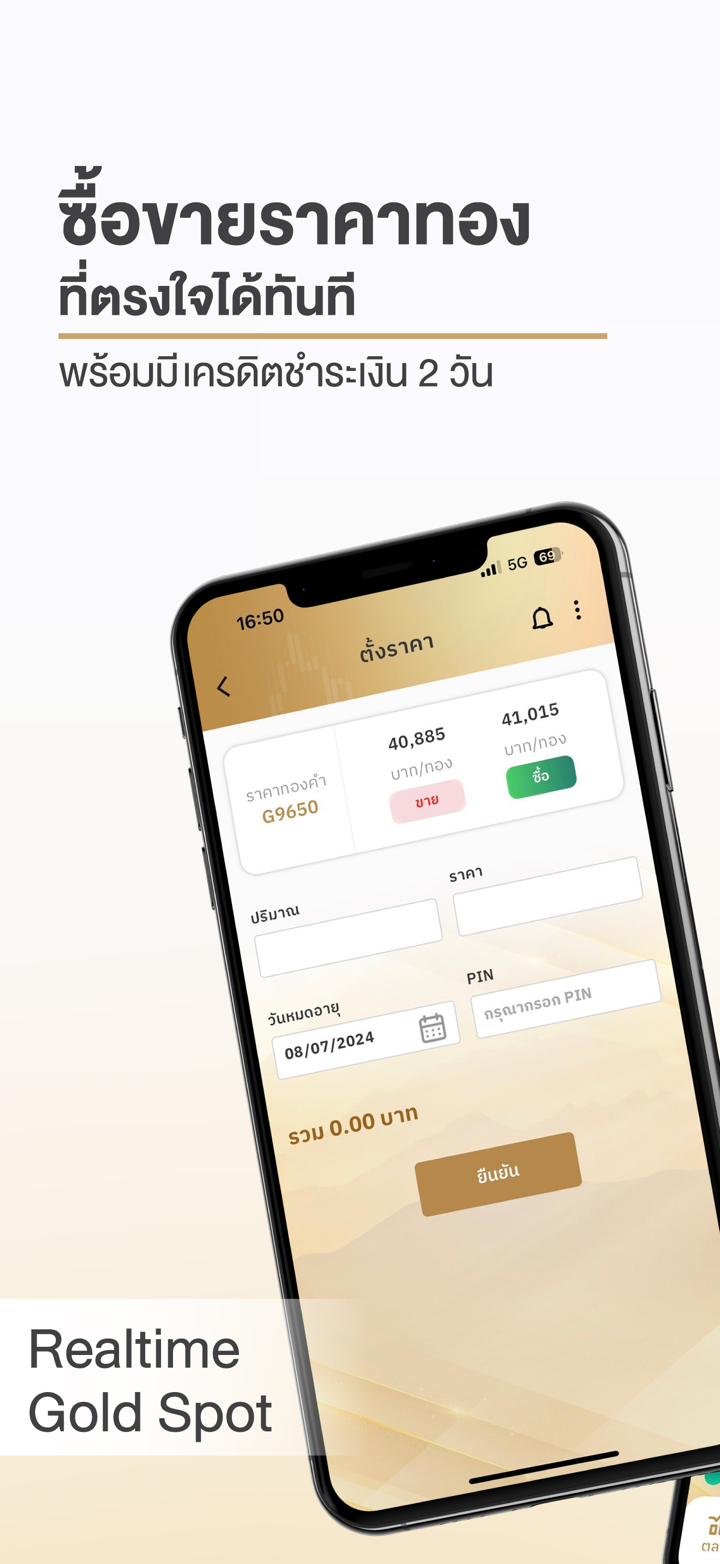

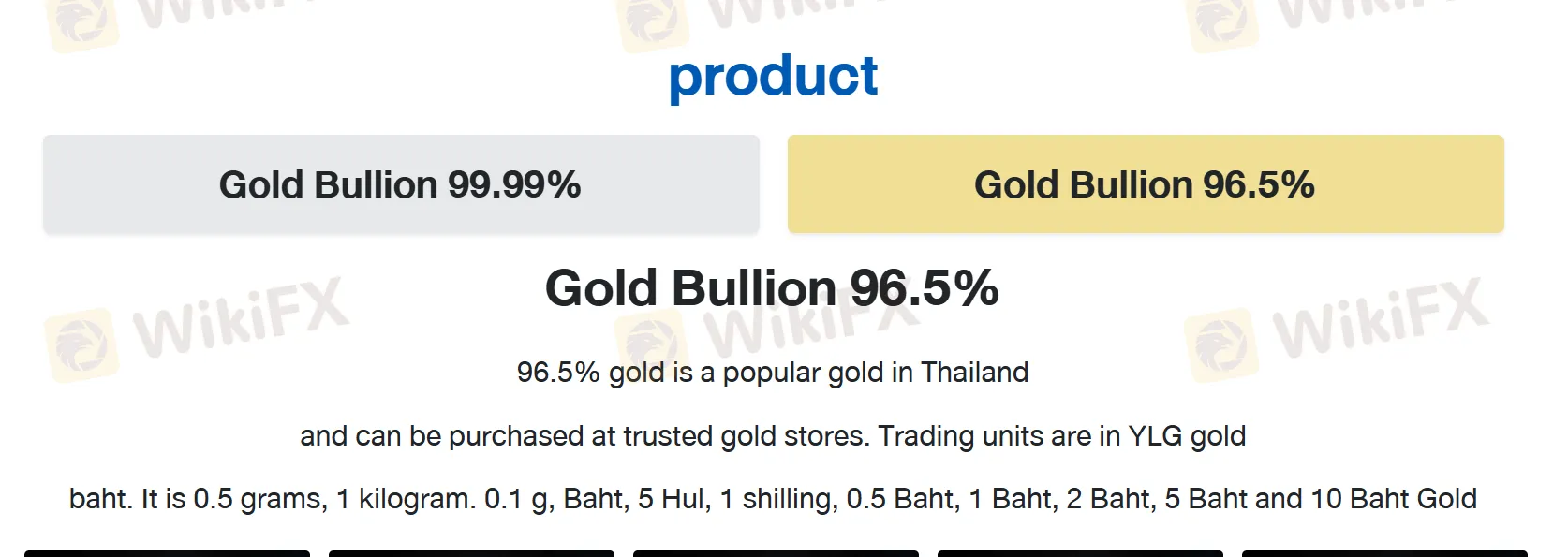

YLG offers both 99.99% and 96.5% gold bullion products in a wide range of sizes, from as small as 0.1 grams up to 1 kilogram.

99.99% gold is internationally recognized for its purity, while 96.5% gold is a popular standard in Thailand, traded in traditional baht units.

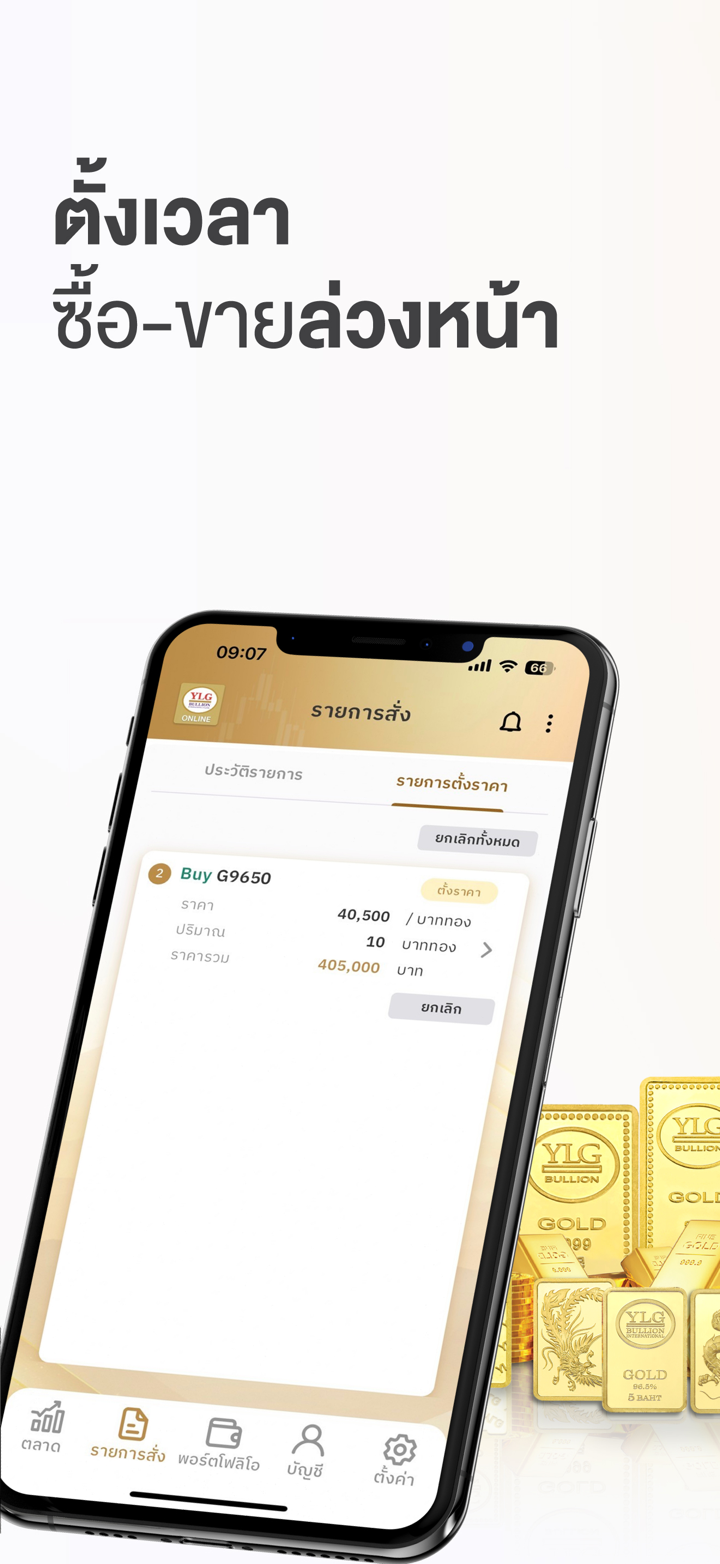

Customers can buy, sell, or accumulate gold with YLG, whether for short-term profit or long-term investment.

Trading Platform

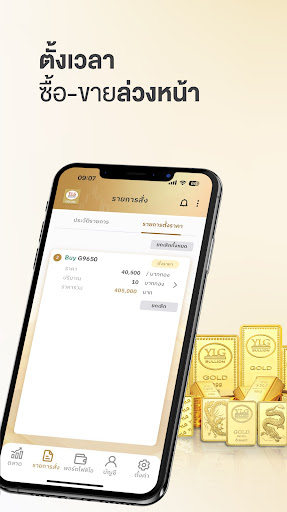

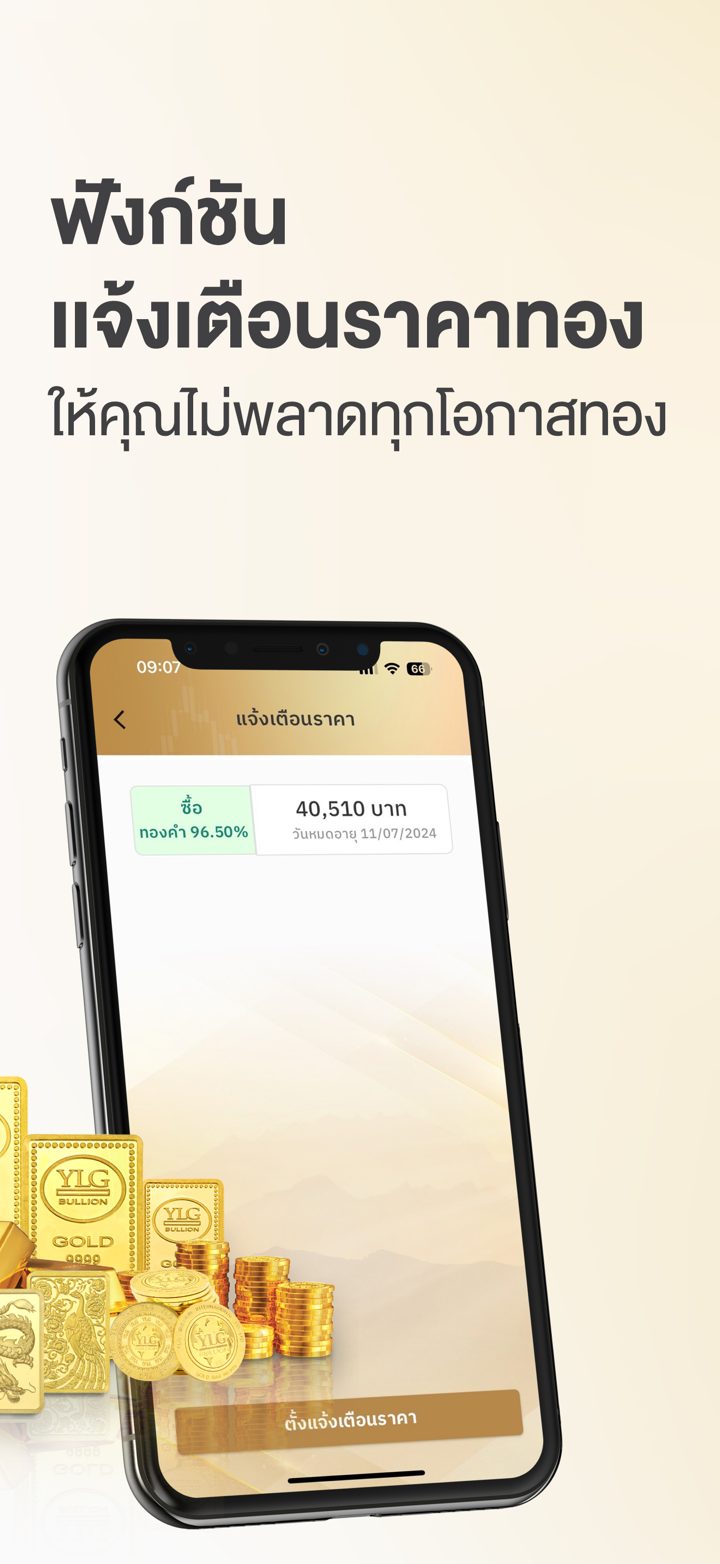

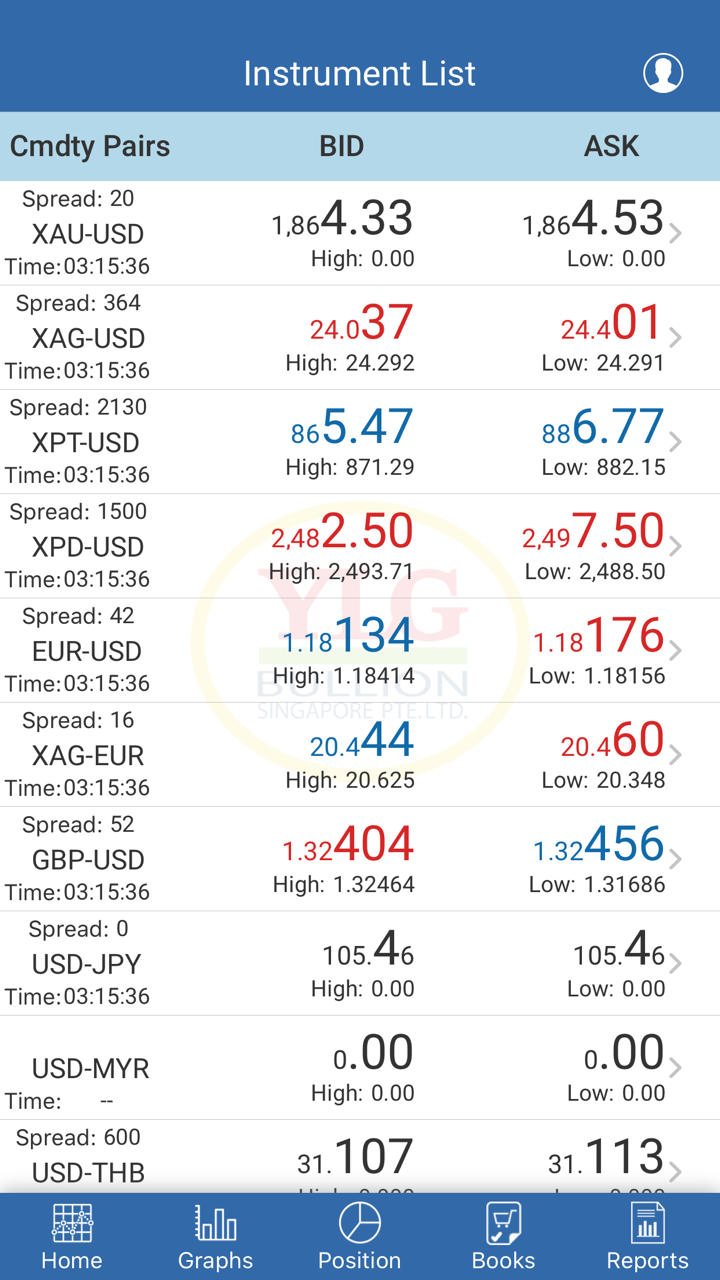

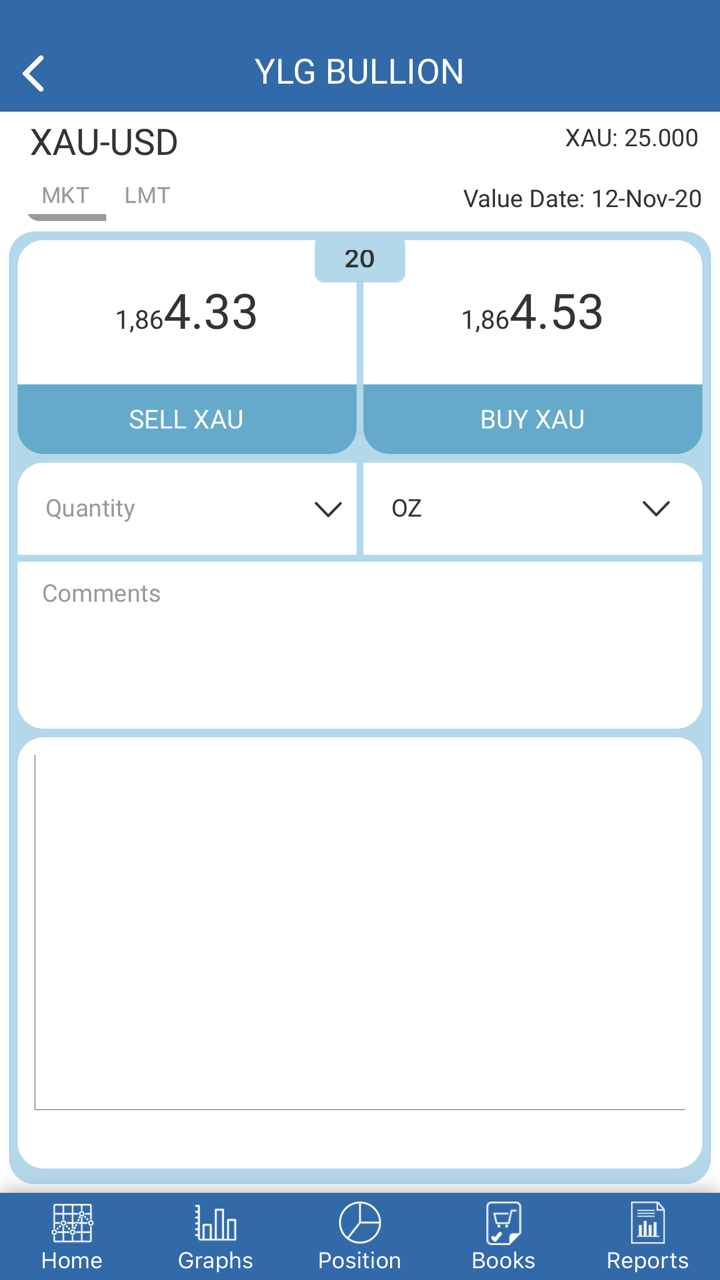

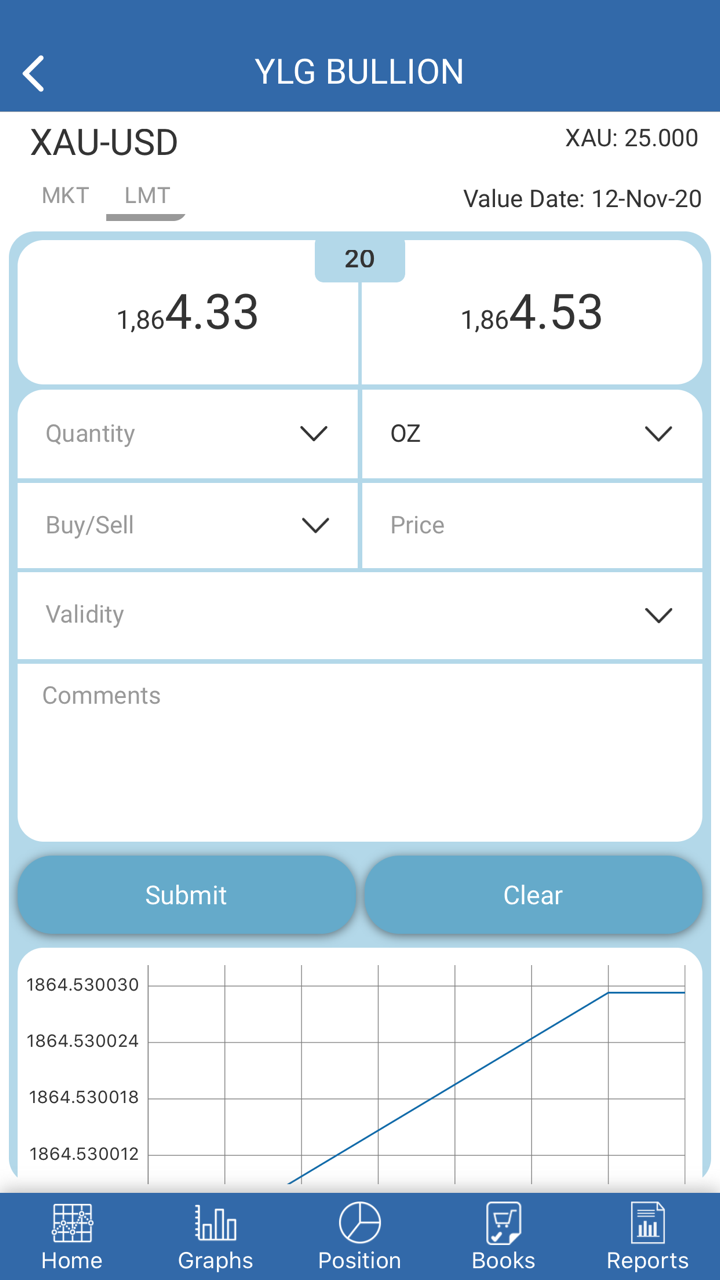

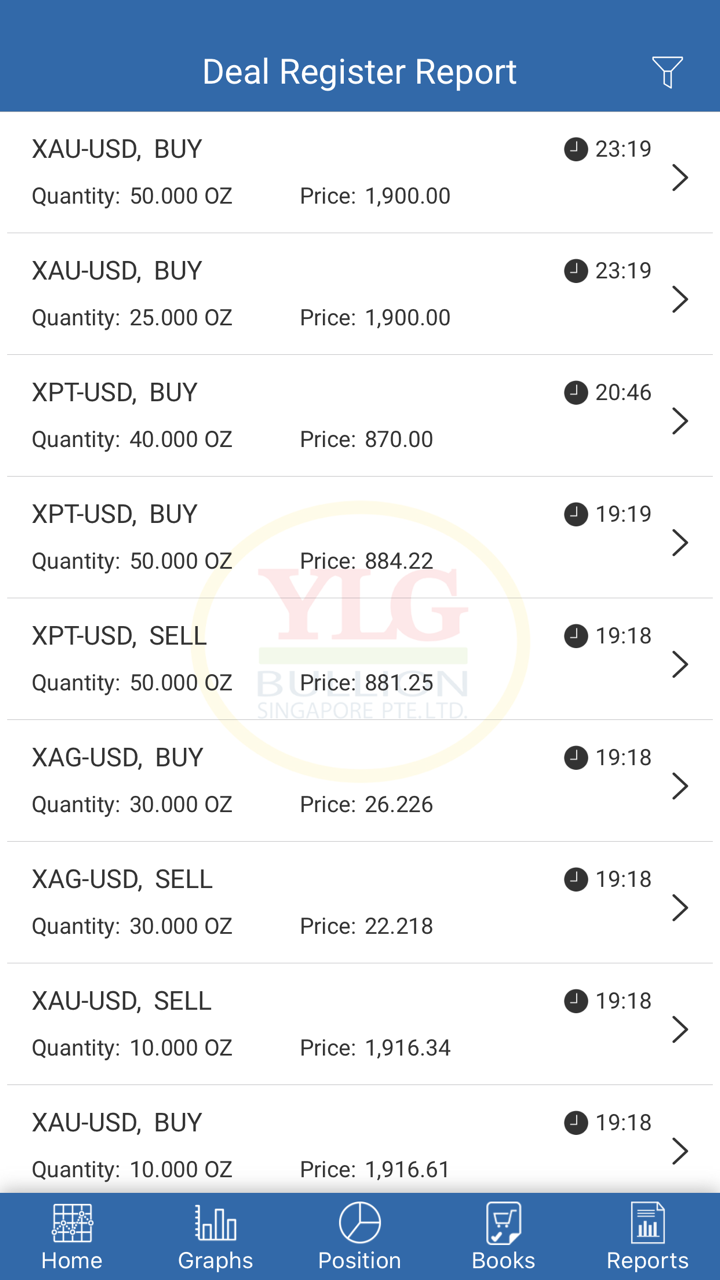

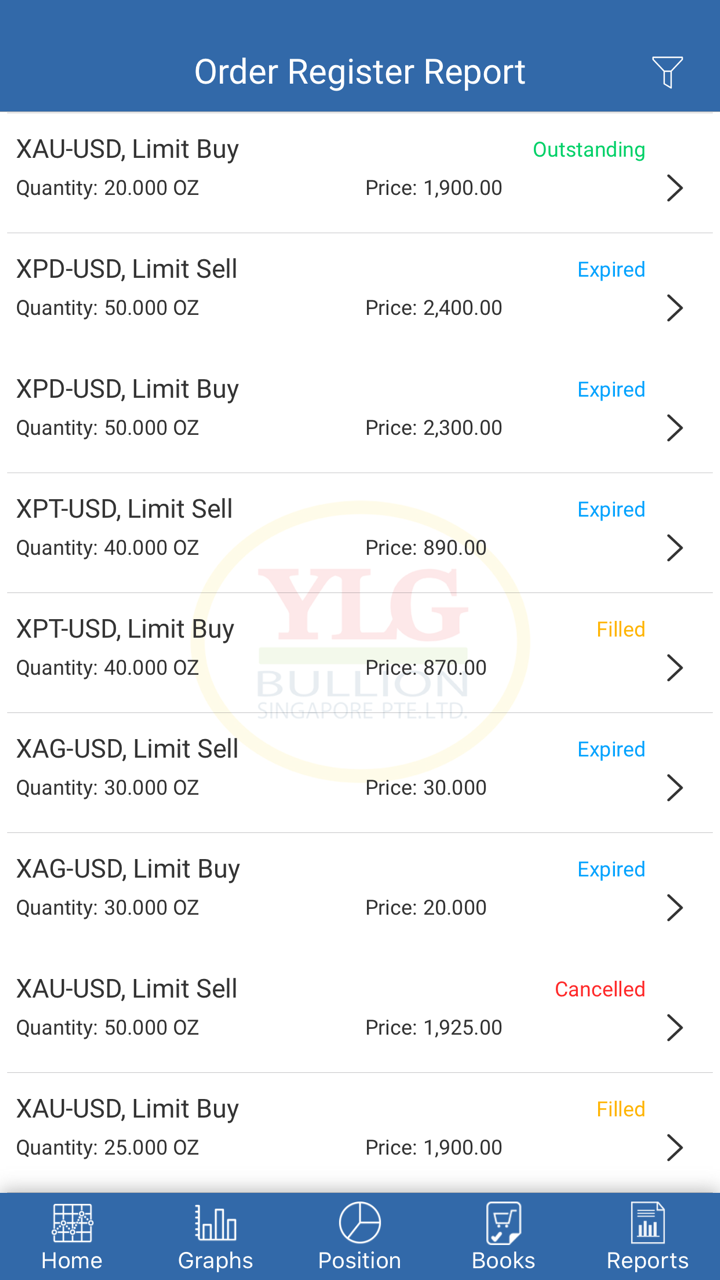

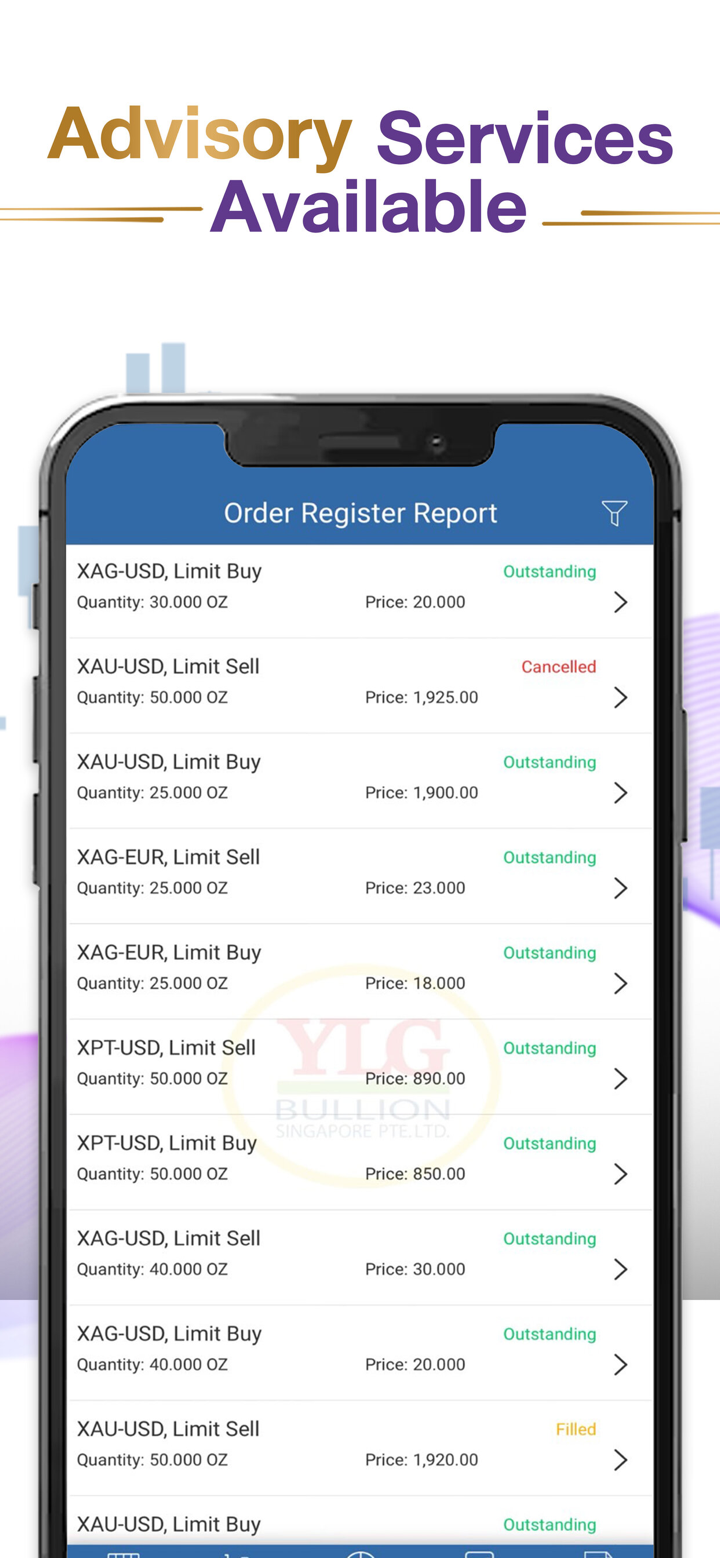

YLG offers a proprietary trading platform, namely “YLG Gold Trader Online”, which can be accessed via web, iOS and Android platforms.

| Trading Platform | Supported | Available Devices | Suitable for |

| YLG Gold Trader Online | ✔ | Web/Mobile phones | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |