Resumo da empresa

| YLG Resumo da Revisão | |

| Fundação | 2022 |

| País/Região Registrada | Tailândia |

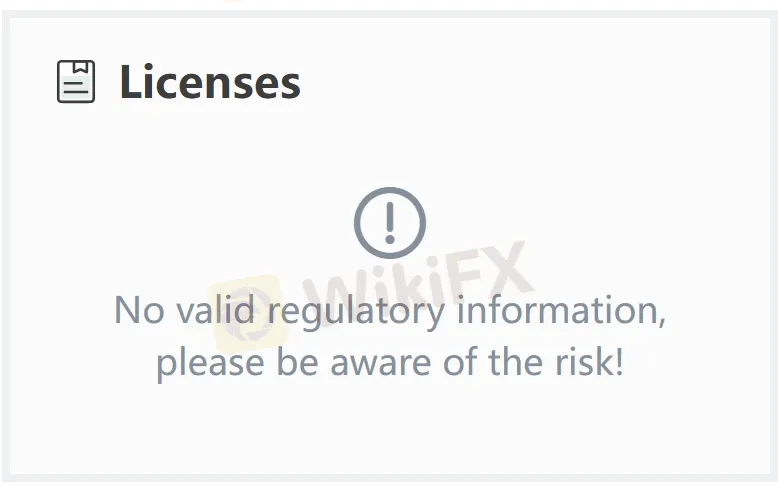

| Regulação | Sem regulação |

| Produto de Negociação | Ouro em barra |

| Plataforma de Negociação | YLG Gold Trader Online |

| Suporte ao Cliente | Tel: 02-687-9888, 02-106-5959; |

| Fax: 02-677-5586 | |

| Plataforma social: Facebook, YouTube, Instagram, LINE | |

| Endereço: 653/19 (entre Soi Narathiwat 7-9), Thung Maha Mek, Sathorn, Bangkok 10120 | |

Informações sobre YLG

YLG é uma empresa de serviços financeiros com base na Tailândia, estabelecida em 2022 e oferece serviços de negociação em ouro em barra.

A empresa atualmente opera sem regulação válida de quaisquer autoridades financeiras, o que prejudica sua credibilidade e confiança dos clientes.

Prós e Contras

| Prós | Contras |

| / | Sem regulação |

| Estrutura de taxas pouco clara |

YLG é Legítimo?

O fator mais importante na medição da segurança de uma plataforma de corretagem é se ela é formalmente regulamentada. YLG é um corretor não regulamentado, o que significa que a segurança dos fundos dos usuários e das atividades de negociação não são efetivamente protegidas. Investidores devem escolher a Monix Limited com cautela.

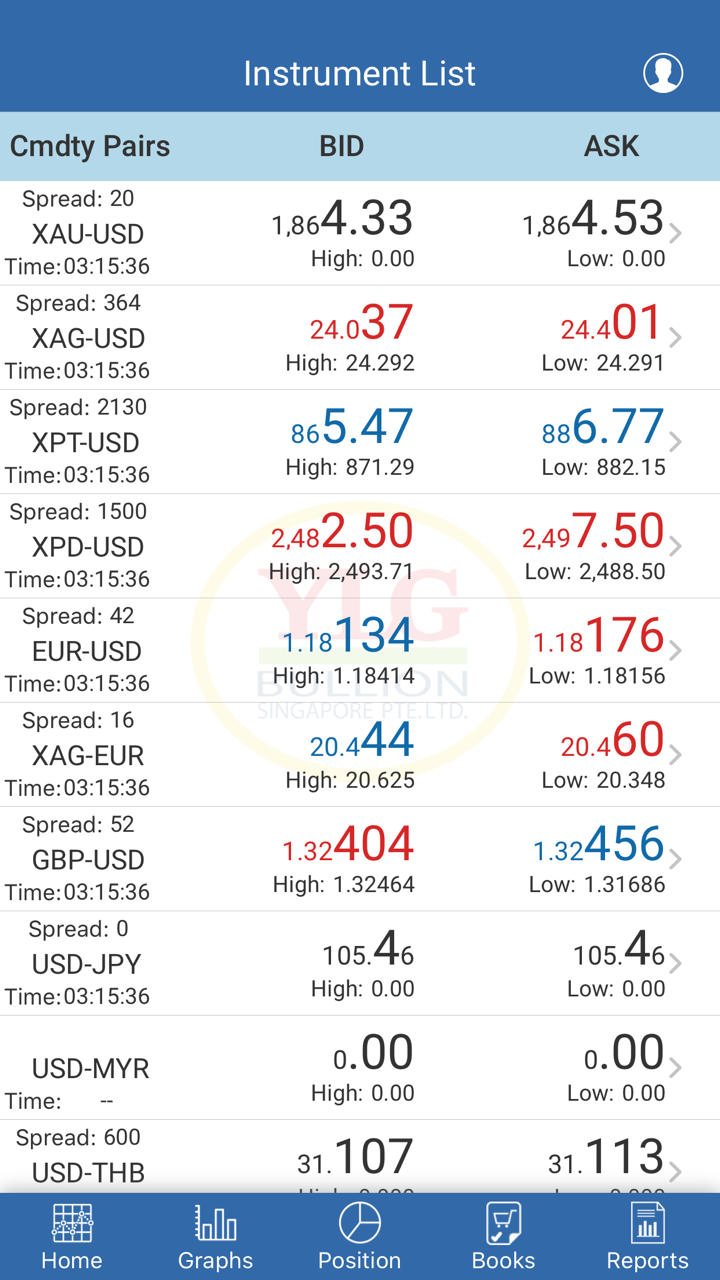

O Que Posso Negociar na YLG?

YLG oferece produtos de ouro em barra de 99,99% e 96,5% em uma ampla variedade de tamanhos, desde 0,1 gramas até 1 quilo.

O ouro de 99,99% é reconhecido internacionalmente por sua pureza, enquanto o ouro de 96,5% é um padrão popular na Tailândia, negociado em unidades tradicionais de baht.

Os clientes podem comprar, vender ou acumular ouro com a YLG, seja para lucro a curto prazo ou investimento a longo prazo.

Plataforma de Negociação

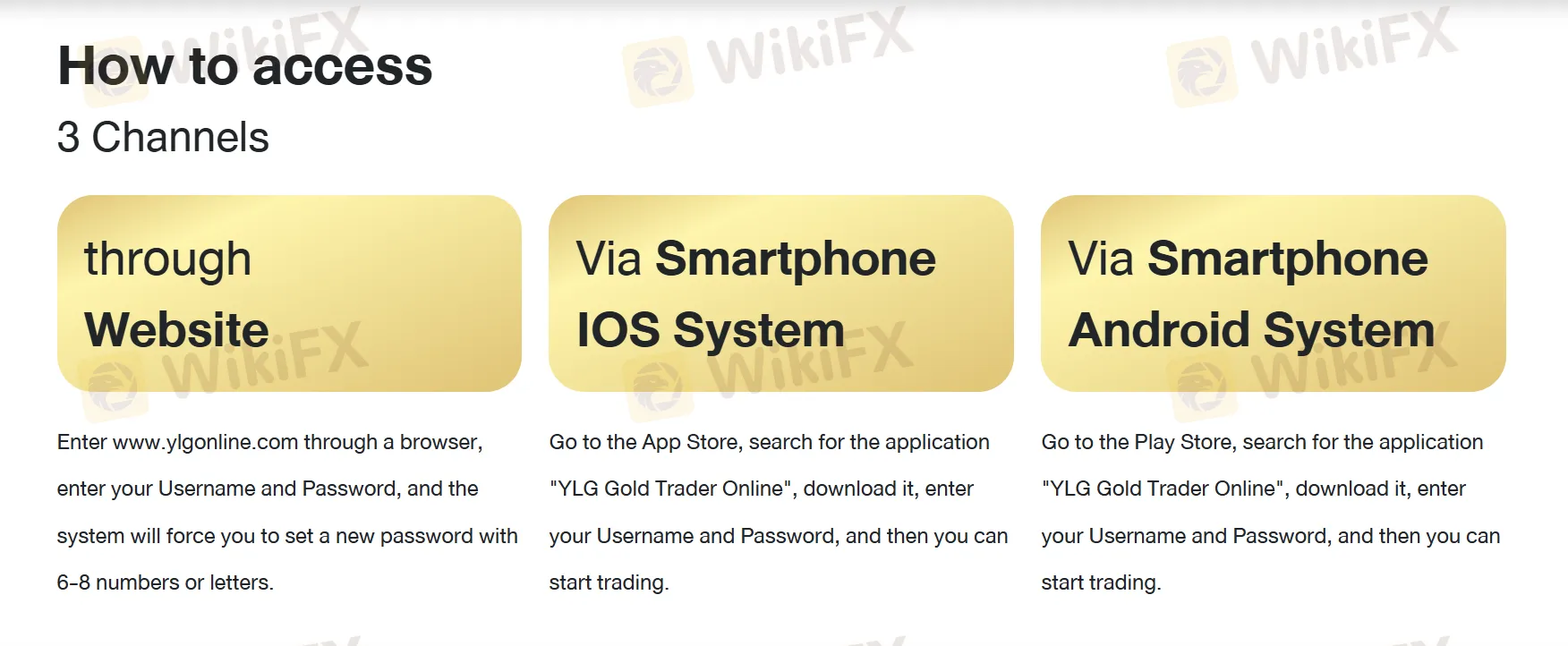

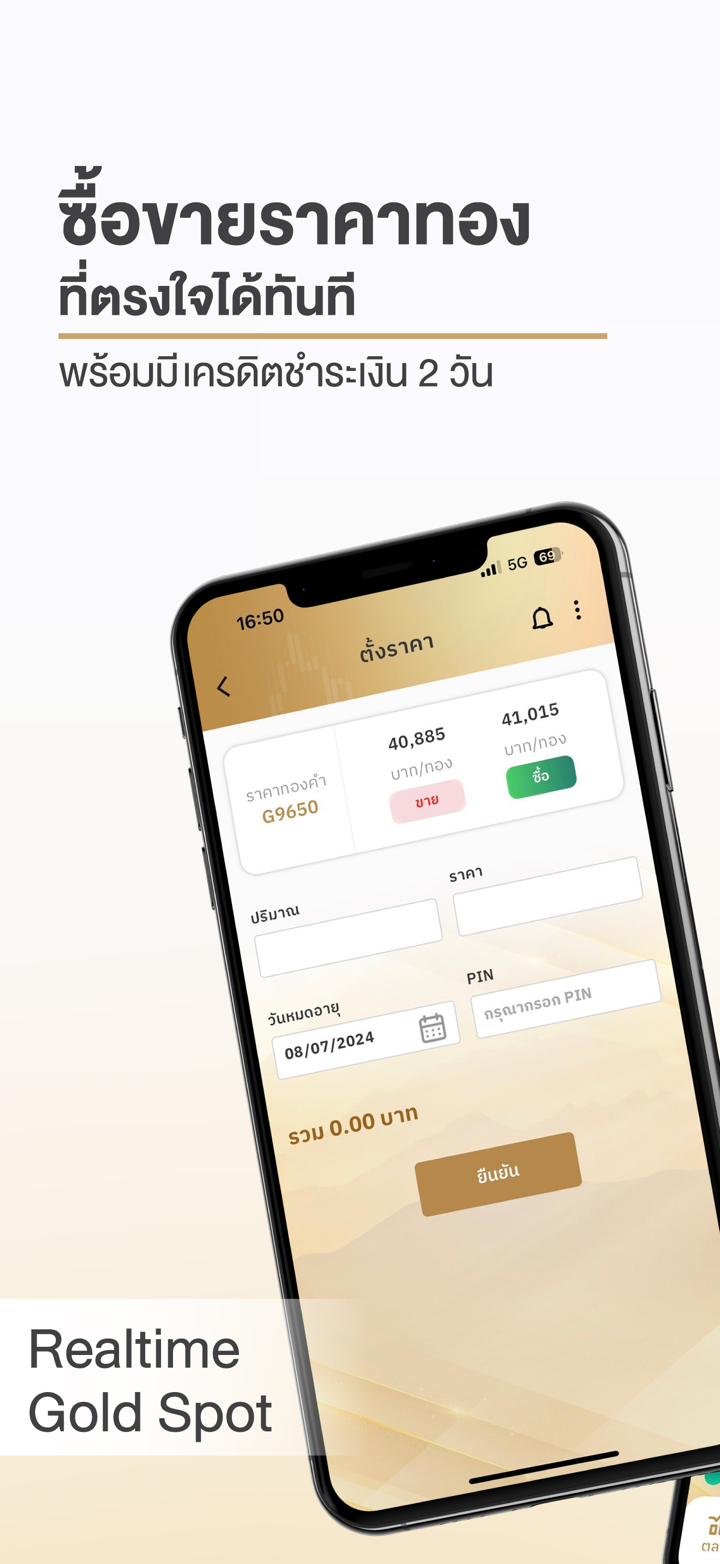

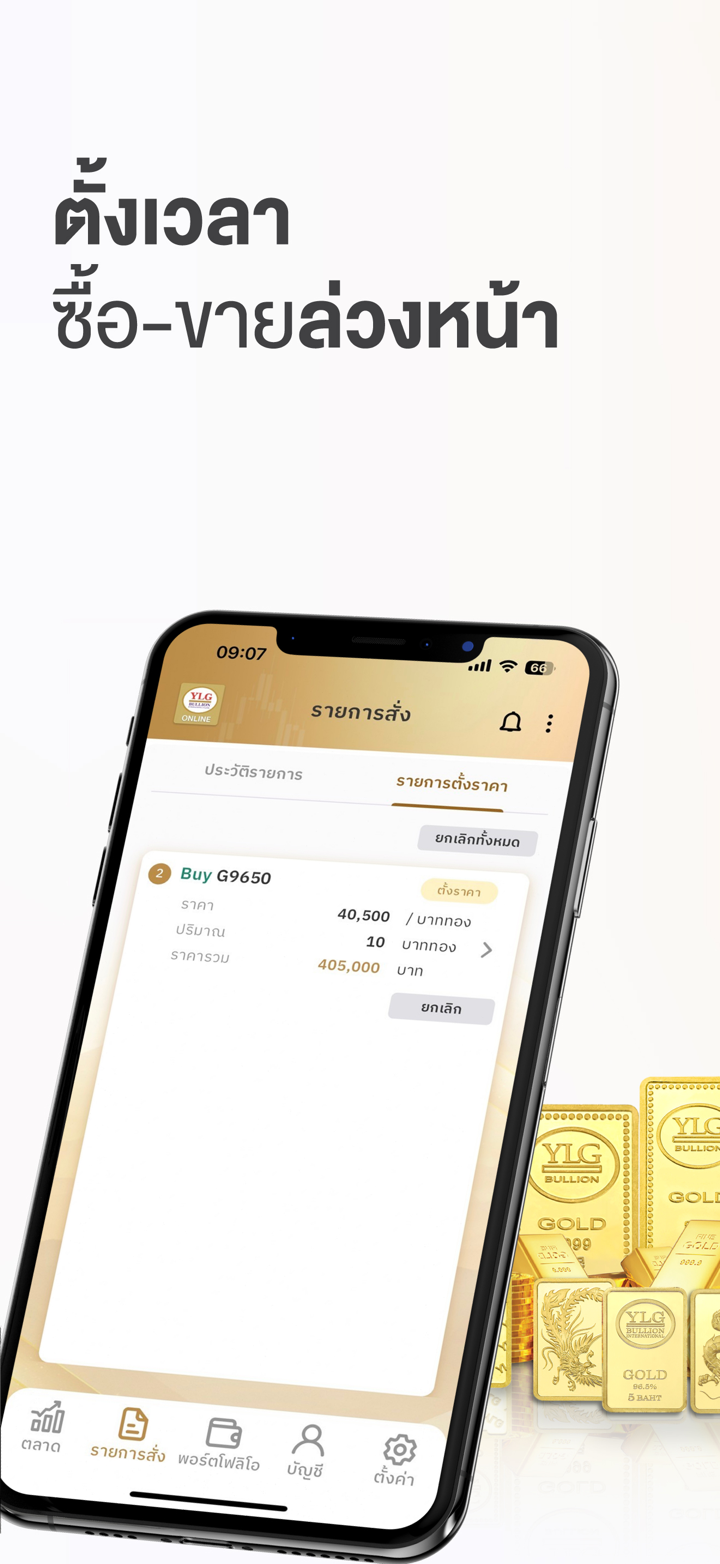

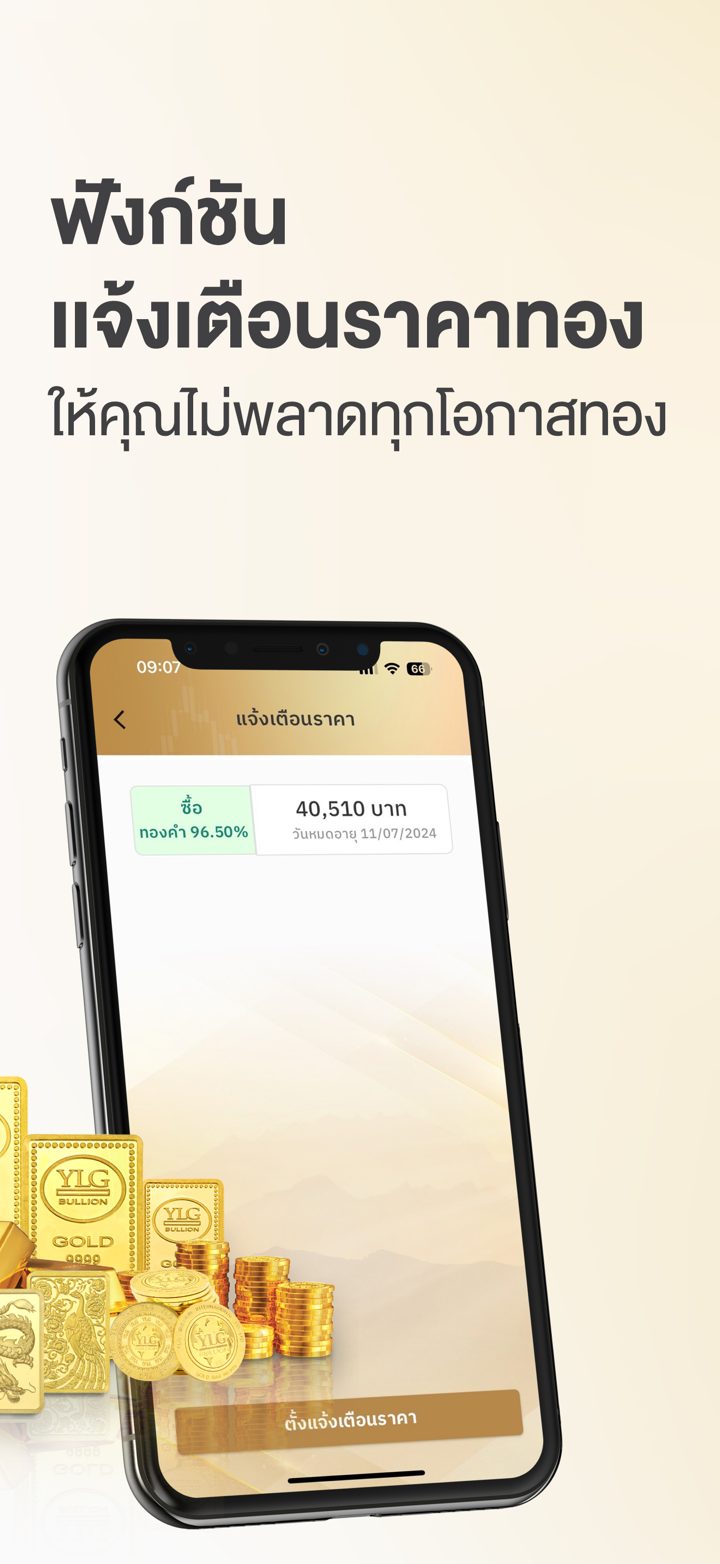

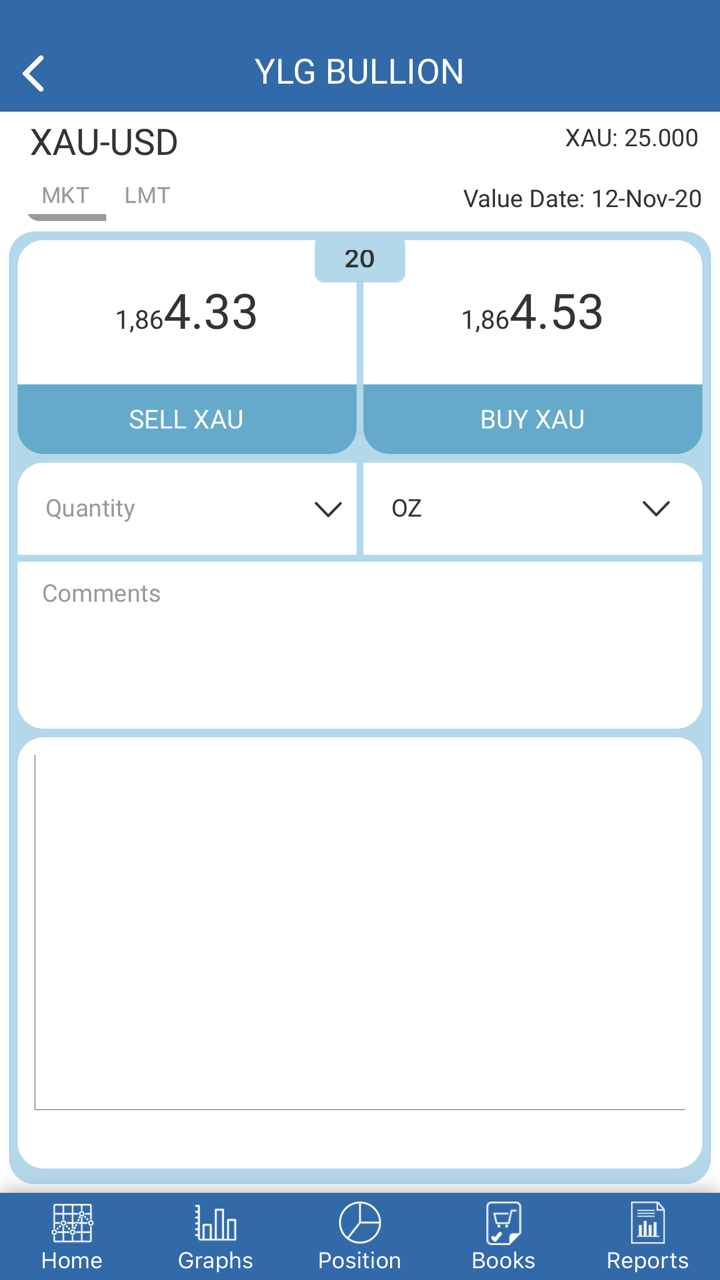

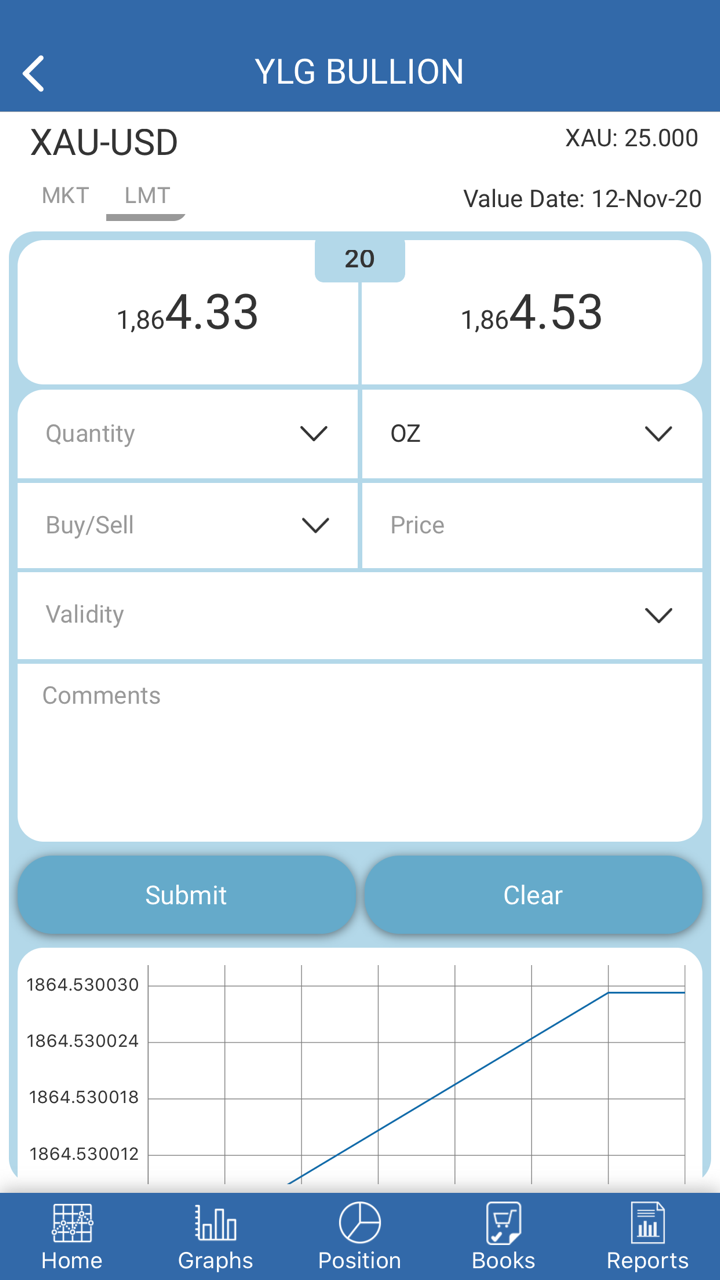

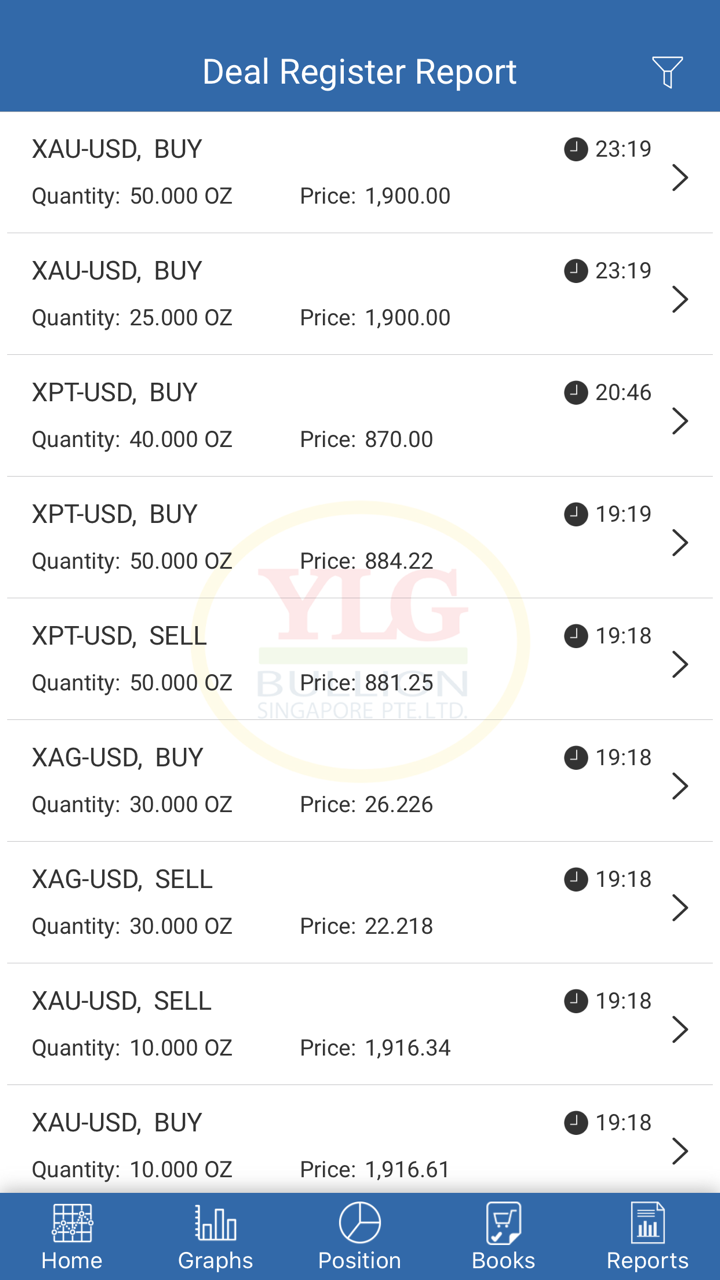

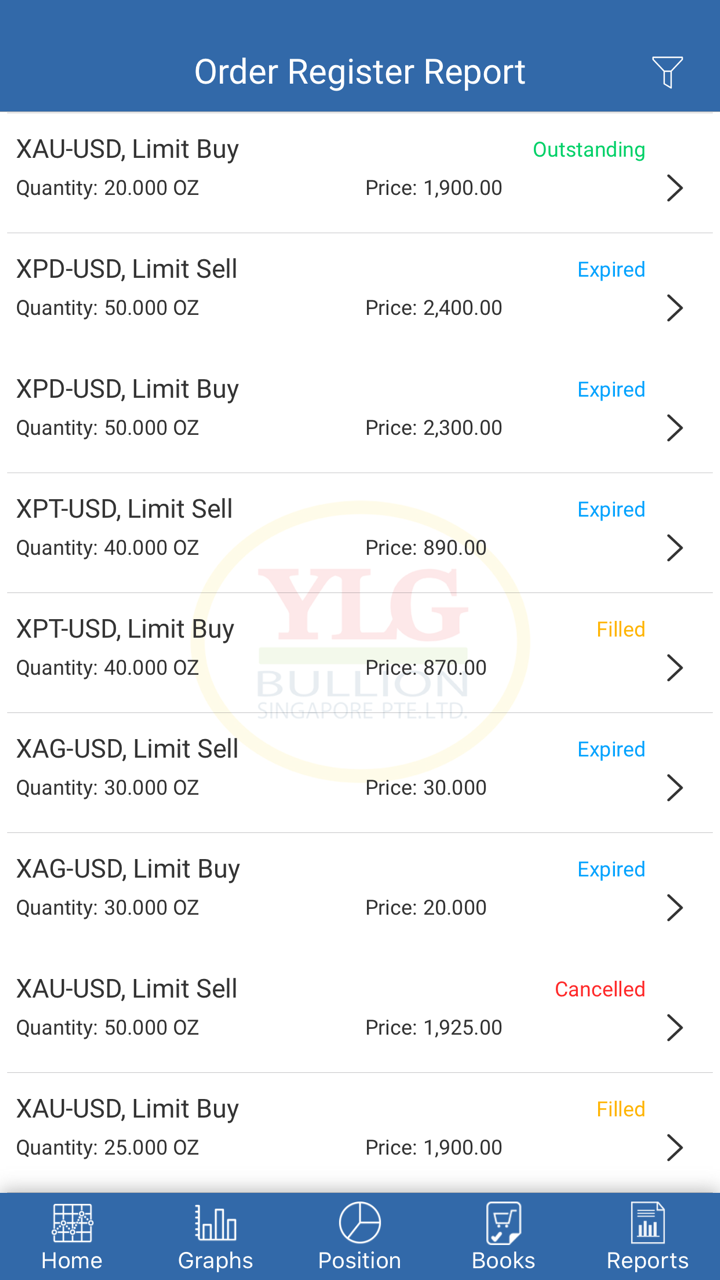

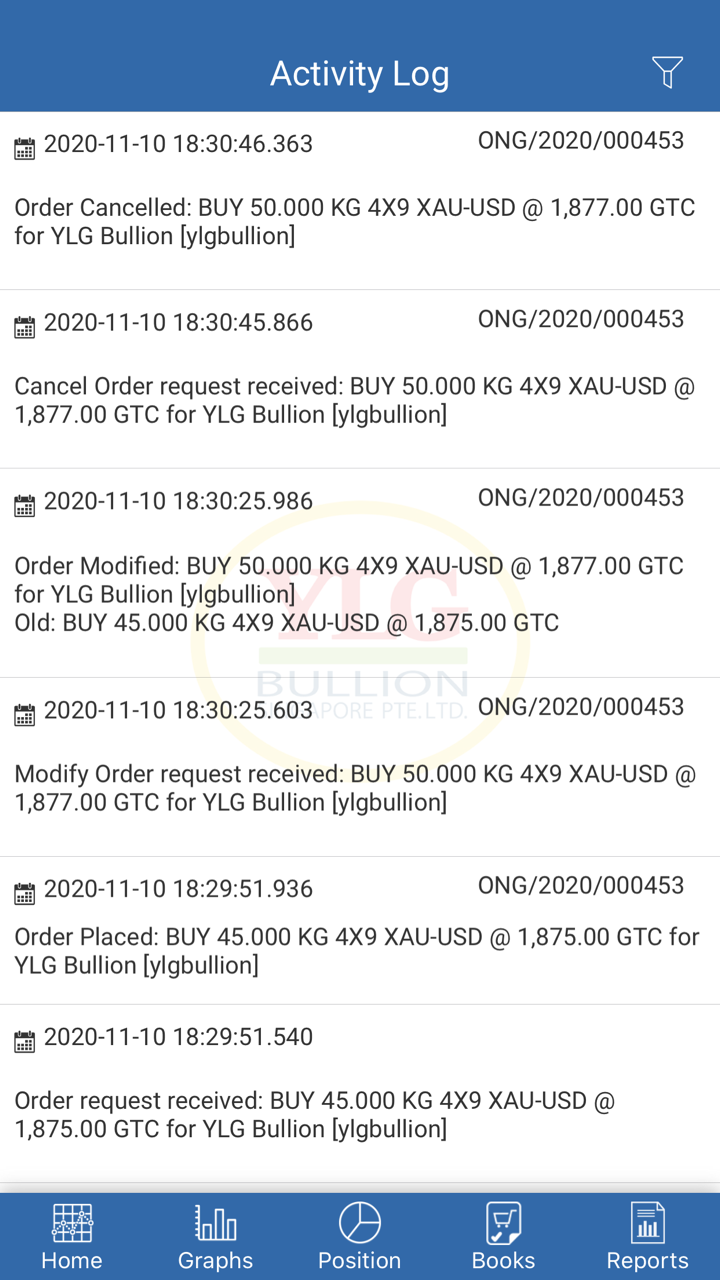

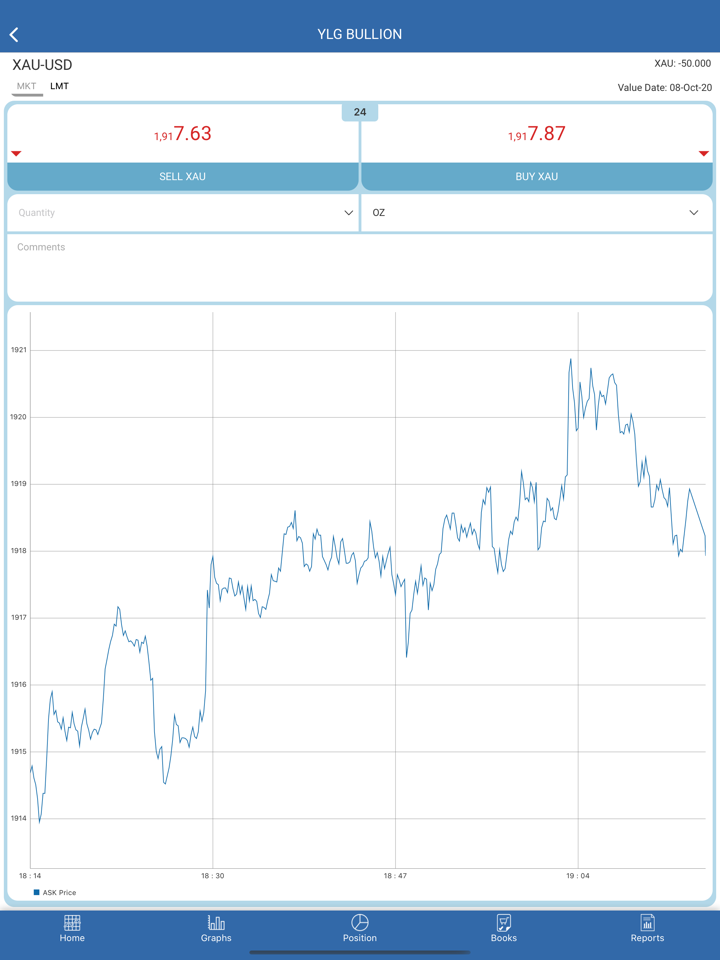

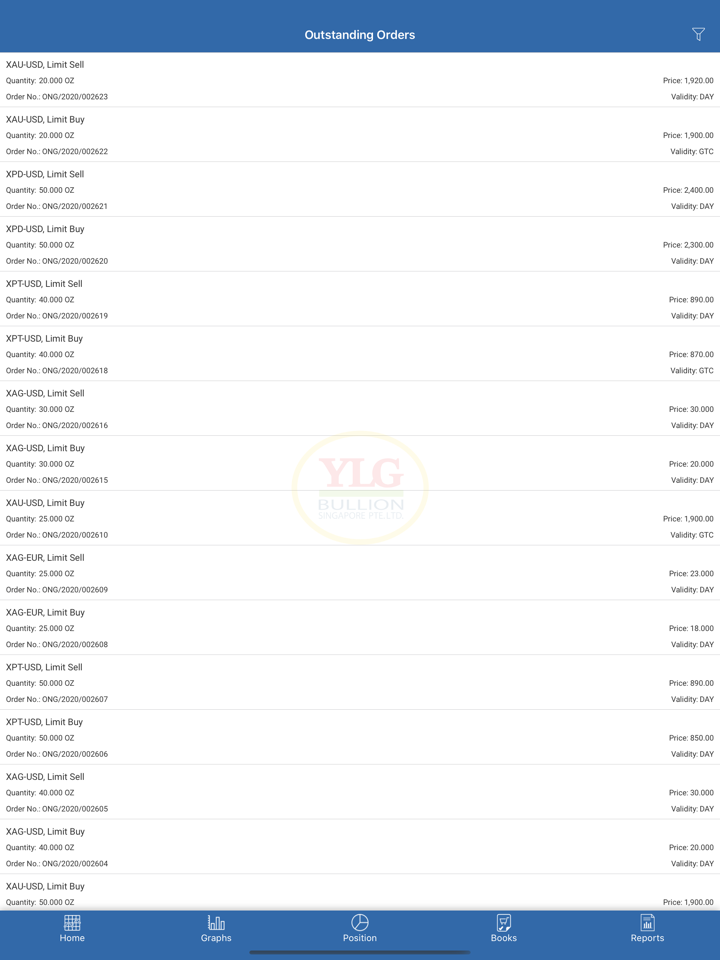

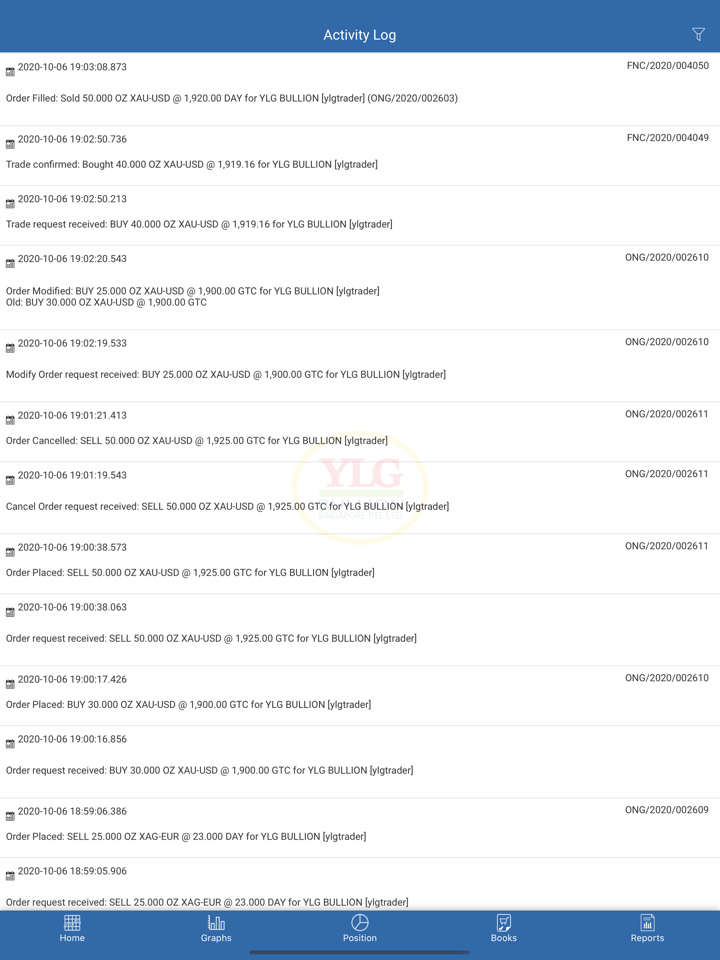

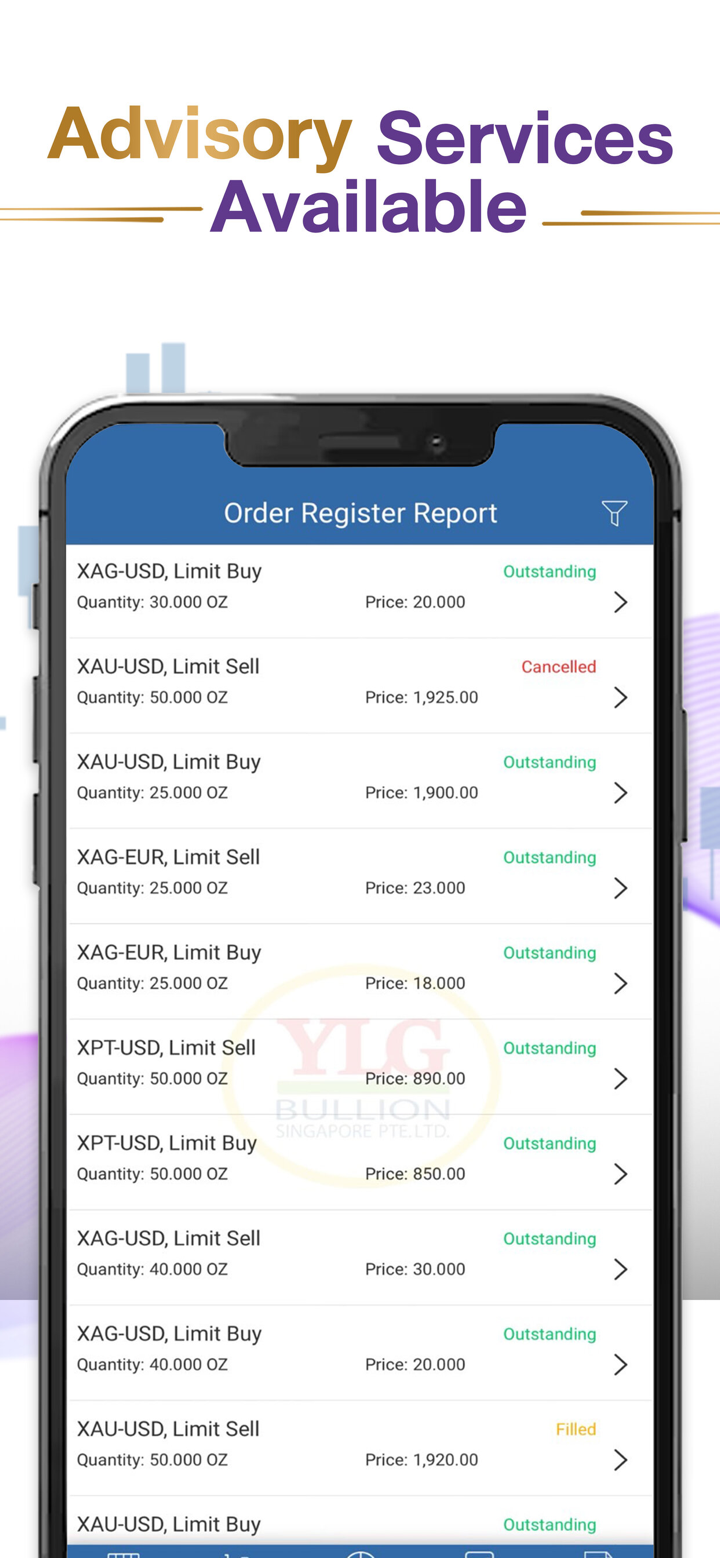

YLG oferece uma plataforma de negociação proprietária, nomeadamente o “YLG Gold Trader Online”, que pode ser acessada via web, iOS e plataformas Android.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| YLG Gold Trader Online | ✔ | Web/Telefones móveis | / |

| MT4 | ❌ | / | Iniciantes |

| MT5 | ❌ | / | Traders experientes |