Présentation de l'entreprise

| Carlyle Résumé de l'examen | |

| Fondé | 1987 |

| Pays/Région Enregistré | États-Unis |

| Régulation | Pas de régulation |

| Produits et Services | Private Equity Mondial, Crédit Mondial, Solutions d'Investissement |

| Compte de Démo | / |

| Effet de Levier | / |

| Spread | / |

| Plateforme de Trading | / |

| Dépôt Minimum | / |

| Support Client | Téléphone : +1 212 813 4504 |

| Email : media@carlyle.com | |

| Réseaux Sociaux : X, YouTube, LinkedIn, Instagram | |

| Adresse : 799 9th Street, NW, Suite 200, Washington, DC 20001 | |

Carlyle Informations

Carlyle est une société d'investissement mondiale basée aux États-Unis et fondée en 1987. Elle n'est pas réglementée en tant que courtier de détail et ne propose pas de comptes de trading. La société est spécialisée dans la gestion d'actifs institutionnels pour le private equity, le crédit et les solutions d'investissement, gérant environ 453 milliards de dollars d'actifs.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Société d'investissement mondiale bien établie | Non réglementée |

| Divers canaux de contact | Pas d'informations sur les conditions de trading |

| Plusieurs succursales mondiales |

Carlyle Est-il Légitime ?

Carlyle est basé aux États-Unis, bien qu'aucun organisme financier là-bas ne le surveille. Il ne possède pas non plus de licences délivrées par les principales autorités de régulation internationales, telles que la FCA (Royaume-Uni), l'ASIC (Australie) ou la CySEC (Chypre).

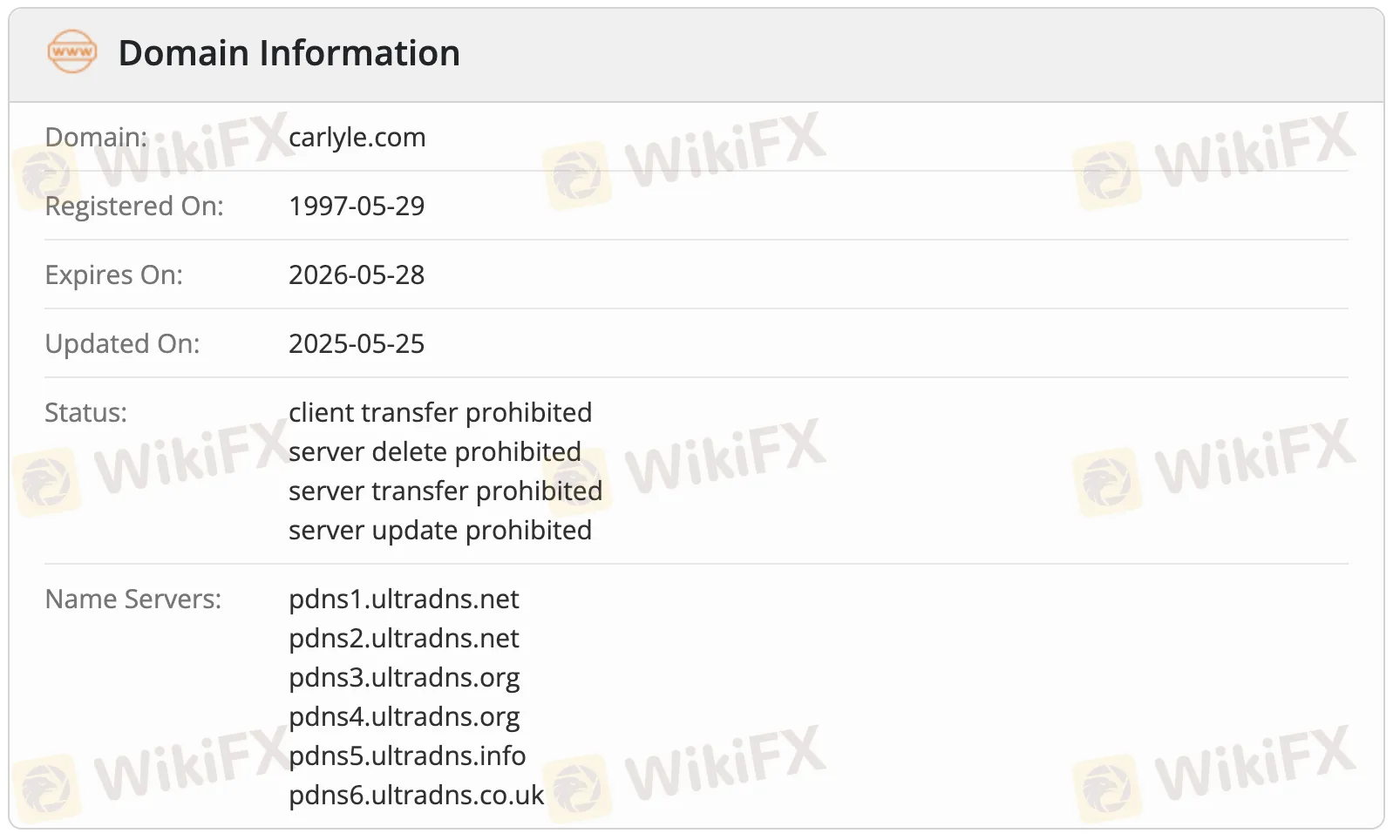

Une recherche WHOIS pour le domaine carlyle.com montre qu'il a été enregistré pour la première fois le 29 mai 1997. Le domaine est toujours actif et son enregistrement est valable jusqu'au 28 mai 2026. La dernière modification a eu lieu le 25 mai 2025. Certaines règles sont en place pour le domaine, telles que l'interdiction aux clients de déplacer, éditer, supprimer ou transférer des serveurs.

Produits et Services

Carlyle propose des services mondiaux de gestion d'investissement, notamment dans le private equity, le crédit et les solutions d'investissement. Il gère plus de 453 milliards de dollars d'actifs dans différents segments et véhicules à travers le monde.

| Produits & Service | Pris en Charge |

| Private Equity Mondial | ✔ |

| Crédit Mondial | ✔ |

| Solutions d'Investissement | ✔ |