Unternehmensprofil

| Carlyle Überprüfungszusammenfassung | |

| Gegründet | 1987 |

| Registriertes Land/Region | Vereinigte Staaten |

| Regulierung | Keine Regulierung |

| Produkte und Dienstleistungen | Global Private Equity, Global Credit, Investment Solutions |

| Demokonto | / |

| Hebel | / |

| Spread | / |

| Handelsplattform | / |

| Mindesteinzahlung | / |

| Kundensupport | Telefon: +1 212 813 4504 |

| E-Mail: media@carlyle.com | |

| Soziale Medien: X, YouTube, LinkedIn, Instagram | |

| Adresse: 799 9th Street, NW, Suite 200, Washington, DC 20001 | |

Carlyle Informationen

Carlyle ist eine weltweite Investmentfirma mit Hauptsitz in den Vereinigten Staaten und wurde 1987 gegründet. Sie unterliegt keiner Regulierung als Einzelhandelsmakler und bietet keine Handelskonten an. Das Unternehmen ist auf institutionelles Asset Management für Private Equity, Kredite und Investmentlösungen spezialisiert und verwaltet etwa 453 Milliarden US-Dollar an Vermögenswerten.

Vor- und Nachteile

| Vorteile | Nachteile |

| Langjährige globale Investmentfirma | Nicht reguliert |

| Verschiedene Kontaktmöglichkeiten | Keine Informationen zu Handelsbedingungen |

| Mehrere globale Niederlassungen |

Ist Carlyle legitim?

Carlyle hat seinen Sitz in den USA, wird jedoch von keiner Finanzbehörde dort überwacht. Es besitzt auch keine Lizenzen von den wichtigsten internationalen Regulierungsbehörden wie der FCA (UK), ASIC (Australien) oder CySEC (Zypern).

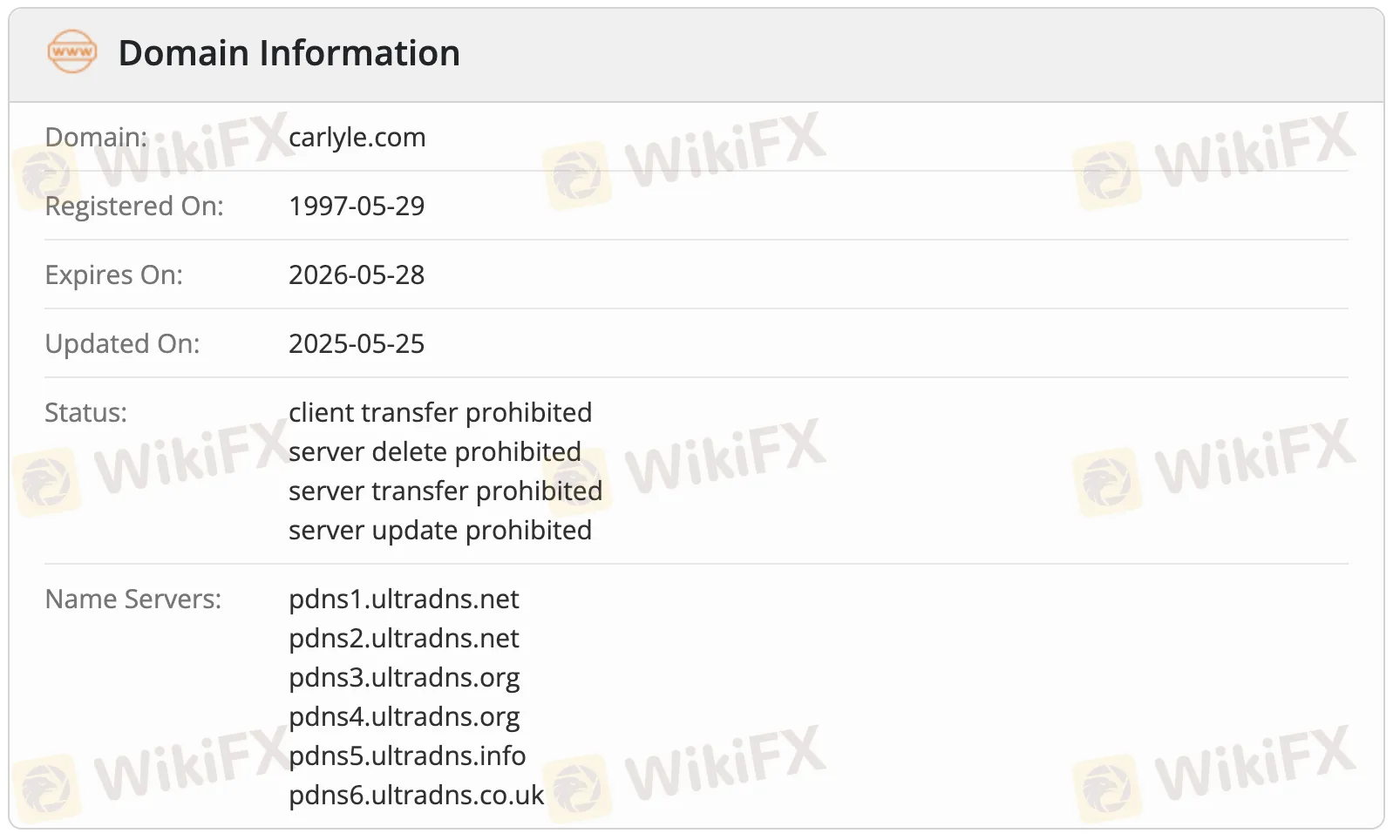

Eine WHOIS-Suche für die Domain carlyle.com zeigt, dass sie erstmals am 29. Mai 1997 registriert wurde. Die Domain ist immer noch aktiv, und ihre Registrierung läuft bis zum 28. Mai 2026. Das letzte Änderungsdatum war der 25. Mai 2025. Es gelten einige Regeln für die Domain, z. B. dass es den Kunden nicht gestattet ist, Server zu verschieben, zu bearbeiten, zu entfernen oder zu übertragen.

Produkte und Dienstleistungen

Carlyle bietet globale Investmentmanagement-Dienstleistungen an, insbesondere im Bereich Private Equity, Kredite und Investmentlösungen. Es verwaltet mehr als 453 Milliarden US-Dollar an Vermögenswerten in verschiedenen Segmenten und Fahrzeugen weltweit.

| Produkte & Service | Unterstützt |

| Global Private Equity | ✔ |

| Global Credit | ✔ |

| Investment Solutions | ✔ |